In another post, we saw that mining shares, being shares mainly (with high volatility and the risk of losing 100%), cannot be put on the same level as physical gold. Is it also the case with “paper gold”?

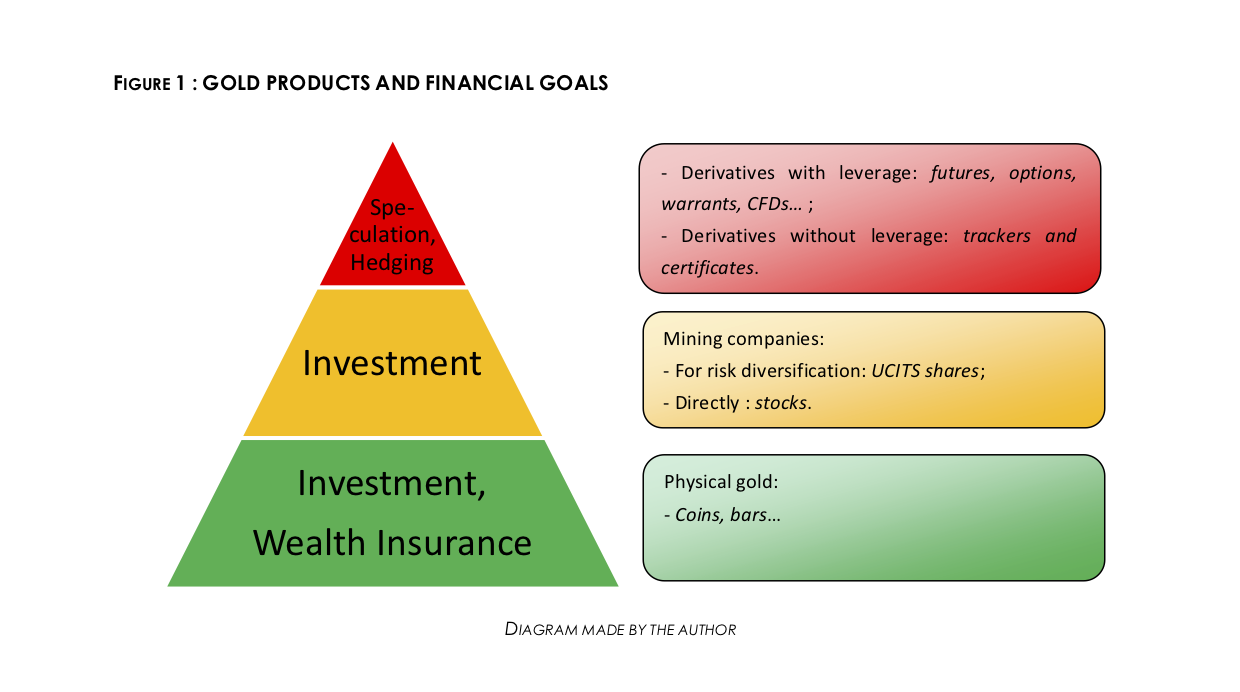

Gold products and wealth objectives

Gold is a financial asset that can be broken down in three families, so to speak: physical gold, gold mining shares and what is called “paper gold”. Each family of products differs in terms of financial properties (level of risk, yield expectations, level of liquidity and security); one must take a position on the product that is the better suited to one’s wealth objectives.

When one wishes to protect wealth against the risks of conjectural and – a fortiori – structural instability, one has to go with physical gold. As a wealth management advisor, substituting the easy solution of acquiring shares in a gold tracker – whether within a life insurance policy or an ordinary account – would be a mistake.

Of course, you don’t have to take my word for it. So I shall try to prove it to you.

Gold trackers or ETFs: What of them?

There is a plethora of paper investment vehicles allowing one to invest in the yellow metal. Among those products derived from physical gold, trackers and ETFs are the most used by wealth management advisors to protect the wealth of their clients against a catastrophe.

Morningstar financial analysts define ETFs as follows: “ETFs are not funds, strictly speaking. They are hybrid financial instruments that have some of the funds characteristics and some of the shares characteristics, since they are traded on the stock exchange. They replicate stock indices and are passively managed, like index funds. Since the price of ETFs fluctuates throughout the day – as opposed to funds which only have a daily or weekly liquidity value – investors can choose the moment and price of the transaction.”

In this particular case, the index used to replicate gold’s performance is the price of gold in a defined currency that, in most cases, uses the London fix as a benchmark.

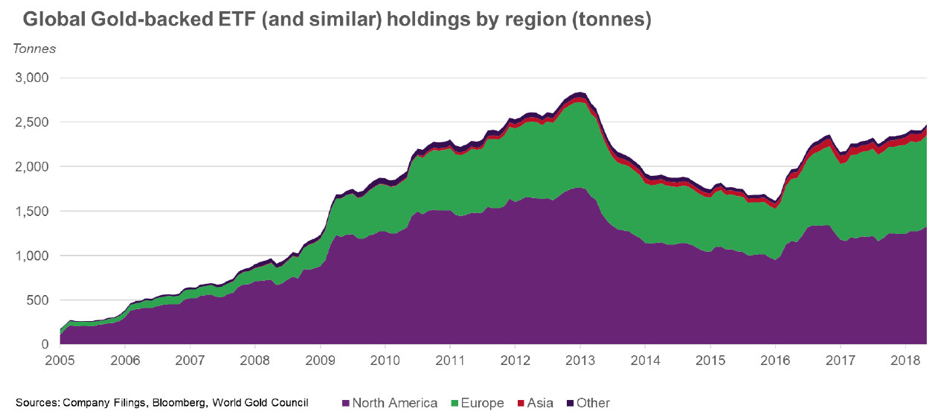

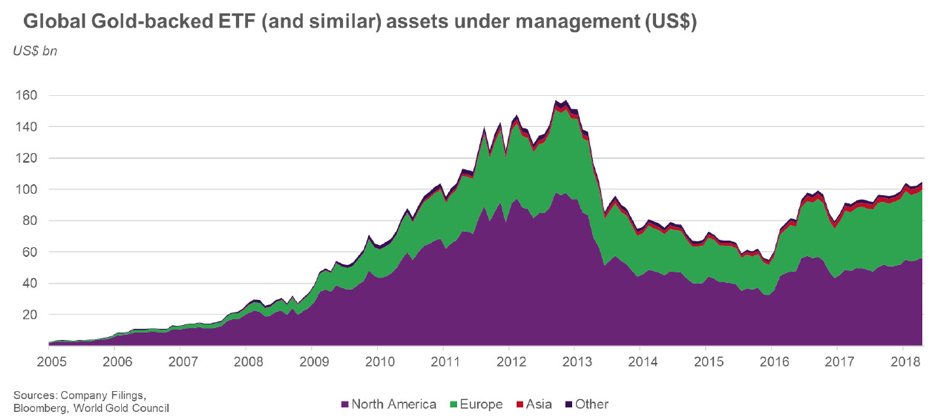

Gold ETFs have been traded since 2003. According to the World Gold Council, these investment vehicles are backed by a little less than 2,500 tons of physical gold as of May 2018, or the equivalent of Banque de France’s reserves (2,435 tons).

At around $1,300 per ounce, this represents about $100 billion of investments in this type of product.

You will notice that Western investors make up for most of the demand for gold trackers. Gold is, of course, cherished by Asian investors (notably Chinese and Indian), but, however, when it comes to precious metals, they much prefer the real, physical thing.

In his "Guide d’investissement sur le marché de l’or", Yannick Colleu explains how trackers work: "An issuer proposes to accredited sellers/distributors lots of trackers corresponding to some shares and backed by some fine gold kept in a depository bank. The existence of the gold is attested by a trusted third party who manages the buy/sell operations on the market. Accredited sellers (“market makers”) must use an order book to insure the trackers’ liquidity for potential buyers or sellers. Regularly, depending on the amount of gold acquired, the issuer may issue more trackers. (...) This, in turn, creates charges – commissions, brokerage, caretaking, audit etc. These charges are paid regularly to the tracker managing sponsor by selling – via the third party – a certain amount of gold held in the bank. Said sales thusly affect the amount of gold held and the quantity corresponding to a tracker”.

Advantages of gold trackers over physical gold

As I wrote in my book, “Buying gold tracker shares is the simplest way to go if your motivation is a bet on the evolution of the price. Since this type of product is easily accessible, liquid (in a “normal” situation – we’ll get back to it) and affordable (annual management fees are low, due to its passive management nature), the gold tracker is a privileged instrument with which one can go back and forth with short- and mid-term profit taking”.

Gold trackers, in principle (not all of them), give one ownership of some physical metal, or more exactly are a promise of ownership should one require delivery. As I was writing in my book, with this characteristic, “they thus differ from gold certificates, a category of bank-issued derivatives with or without any expiration date that aim to replicate the evolution of the price of gold, having no underlying counterparty whatsoever. Should the issuing bank go bankrupt, assets held in gold certificates might very well just disappear”.

However, gold trackers do expose investors to several risks that can be avoided with physical gold, as we shall see in the next article.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.