"Last week we talked about all of the storms on the horizon. Now we see that currency war discussions have broken out again. Abe, the Japanese Prime Minister, is doing everything he can to suppress the value of the yen, and therefore he’s going to have Japan print unlimited amounts of money.

Of course the President of the Bundesbank, Weidmann, has now begun criticizing Japan about starting currency wars. He also said its monetary policy was totally unacceptable. Many others have joined in this criticism. We have the UBS Chairman, who was the former President of the Bundesbank, and Mervyn King from the Bank of England also did the same thing.

They all say we can’t have a deliberate policy to destroy a nation’s economy through currency debasement. But that’s exactly what every country is doing. This is just posturing by politicians because the game is to destroy the currencies....

Debt in most countries has been growing exponentially. Last year in Europe almost every single country grew its debt. If they don’t grow the debt the political leaders will be thrown out of office. Rajoy, the Prime Minister of Spain, had a landslide victory a year ago. Now with austerity his approval rating is down to 15%. So we know austerity will not work.

As long as these countries continue to run deficits, it’s guaranteed the currencies will continue to decline in real terms, which is against gold. In 1965, Charles De Gaulle gave a superb speech in which he said most countries accepted that the dollar was as good as gold. He said that will lead to the US going massively into debt.

De Gaulle, stated that “A currency system must be based on an indisputable money base that doesn’t bear the mark of one country.” He said that “There is only one standard that meets those criteria and that must be gold.” That was back in 1965.

A few years later De Gaulle demanded the US pay all of their debts to France in gold. Of course as we all know that forced Nixon to close the gold window in 1971. That was the start of the monetary experiment and explosion in money printing in the world, and this is only going to accelerate in the next few years.

I’ve included the gold chart below which shows that gold is up almost 7-fold since 1999. During the last 13 years gold has reached overbought situations a few times. We saw it in 2006, 2008, and again in 2011. Every time gold has reached those overbought situations we’ve seen a consolidation.

Compared to the previous rises this has been a relatively mild consolidation. This last consolidation has finished in my view. All of the major moving averages have caught up nicely to the price of gold and it is now preparing for liftoff.

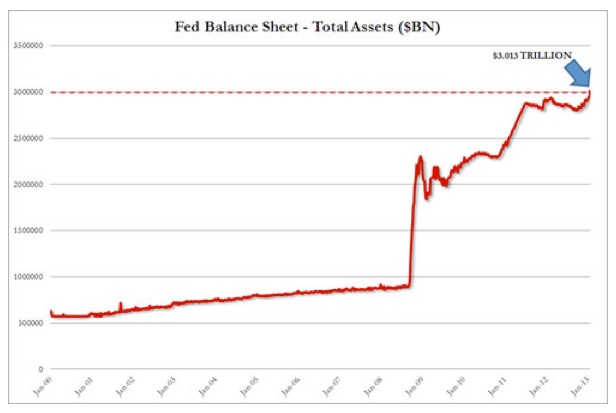

The balance sheets of all central banks are continuing to grow and I’ve included a chart of the Fed’s balance sheet (see chart below). The Fed’s balance sheet has now gone over $3 trillion. $3 trillion is an absolutely massive amount. The total borrowings are now actually over $3.1 trillion.

So the Fed continues to print money to finance the deficits. They are also there to finance and backstop the precarious nature of the banking system. We’ve seen the balance sheet of the Fed consolidating in the last year, just like gold. But now as you can see on the chart above that it’s breaking out again and I think we are ready for the next move higher in the Fed’s balance sheet.

What we are witnessing right now is a perfect Ponzi scheme with the central banks buying up the government debt. But like all Ponzi schemes it will fail and it will fail badly. They will be constantly printing up new money to finance the debt and as this accelerates we will see the hyperinflation I have been predicting for quite some time.”

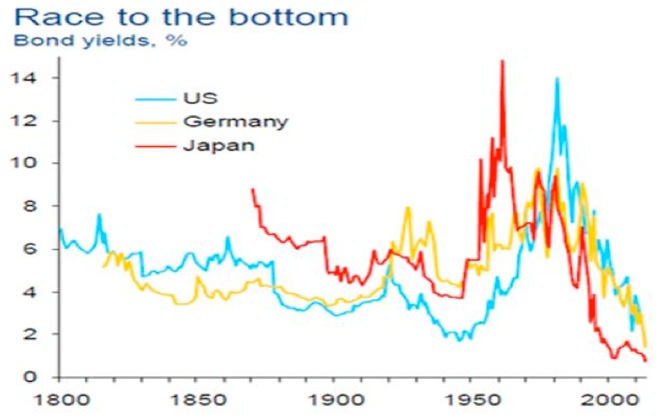

Not only are currencies racing to the bottom, but so are rates. I’ve included another very interesting chart that shows bond yields for the US, Germany and Japan. This is a 200 year chart and it shows that rates are now at an all-time low (see chart below).

This breaks every single economic law there is. You can’t have unlimited credit expansion and record low rates. This is totally unreal and unsustainable. When borrowings are high, the rates must be high as well. This the law of supply and demand.

But governments and central banks have temporarily suspended economic laws by artificially manipulating rates. This will not last, that much is absolutely guaranteed. Since governments can’t repay their debts in today’s money, bond prices will fall dramatically.

So yields will go higher and they will go a lot higher than what we see on the above chart, even at the peak where interest rates were in the mid teens.”

Greyerz had this to say regarding gold: “Looking at gold and silver we are seeing another small pullback as both of these metals prepare to launch. So the manipulation short-term continues. But the continued rise of both of these metals is inevitable.

Everyone who deals in the physical market sees strong demand whether it’s in coins or bars. I have mentioned previously that the next target for gold will be $4,500 for gold and $150 for silver. Eventually there will be many zeros in the price due to the hyperinflation we will see.

So investors are buying gold and silver to protect themselves against the destruction of paper money. By now investors should know they must buy physical gold and silver and they must store it outside the banking system.”

Original source: Kingworldnews

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.