Before I go into the five reasons to buy gold in 2015, let me go through four hypotheses for the future price of gold and silver.

Hypothesis for 2015

The first hypothesis is that the present bear market is not finished and it would have another one or two legs down all the way to where it started at $300. On a technical basis, it can be defended if you believe $1,900 was the end of a bubble started in 2000. I don’t. Many other technical, but also fundamental, factors make me give this scenario a very low probability.

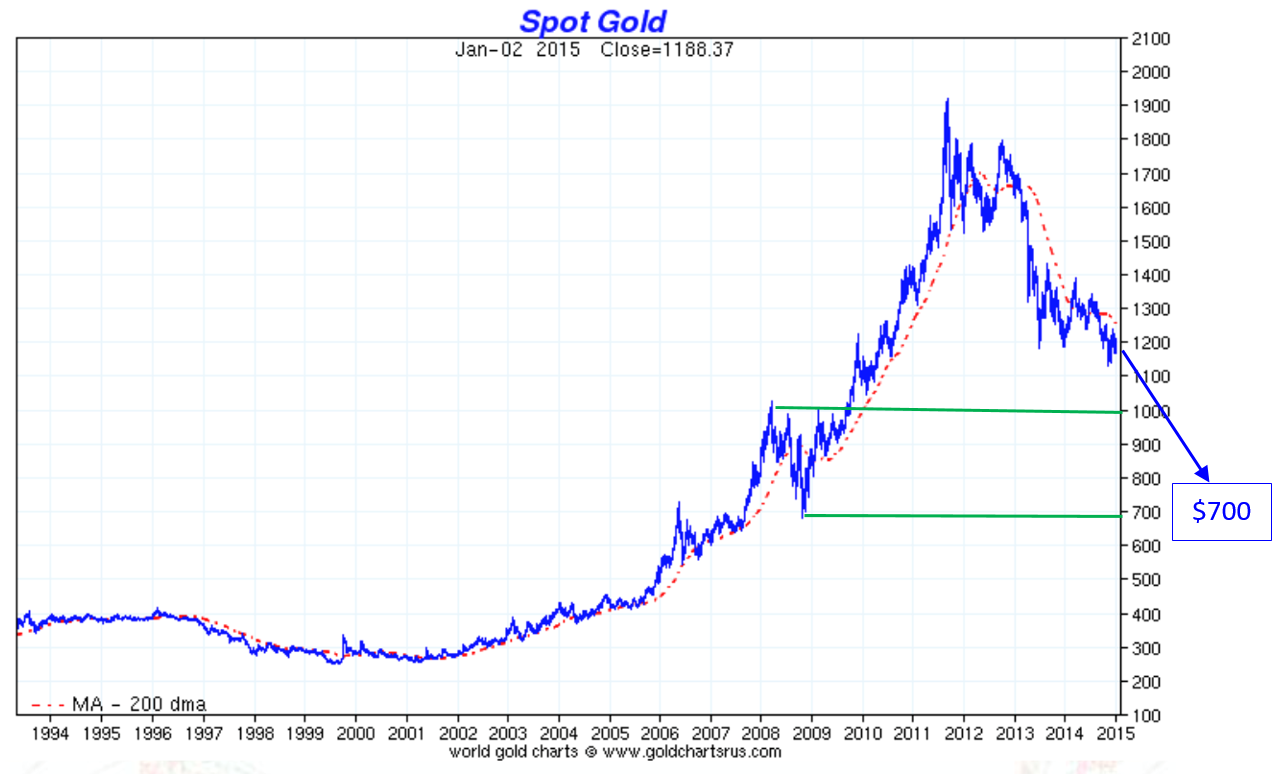

The second hypothesis is that we will retrace down to the area of $1000 to $700. This scenario is more probable but, in my view, it should have happened by now and sentiment indicators are so bearish that I don’t see a move to $700, which would be a total retracement of the bull leg started in 2009. A short spike to $1000 is more possible, which would be approximately a 50% retracement from the top, but I think it should have happened by now.

The third hypothesis would be a continuation of the sideways pattern with price oscillating between $1100 and $1400 before a move in either direction happens in 2016. This is a good possibility if central banks manage to avoid a collapse of the international monetary system. Recent events make me believe some “black swan” event or a combination of them will end this sideways movement sooner.

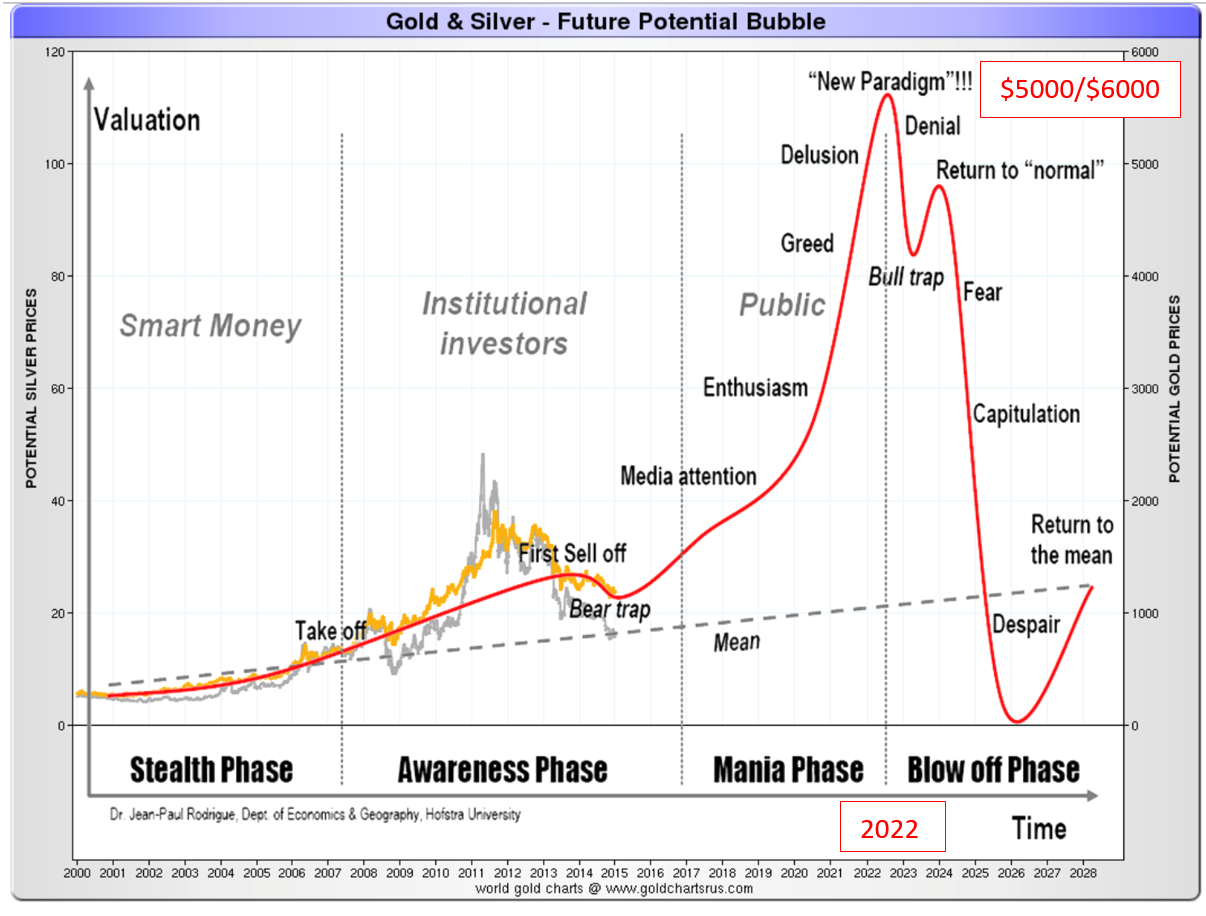

The fourth hypothesis, and the one I prefer, is the beginning of the mania phase described by the bubble model below. I still believe the most probable path is that the next bubble phase of this major secular bull market in gold and silver would begin in 2015 to 2017 and would end at the latest by 2022. Those dates are approximations with a big margin of error. I don’t expect a progressive move but a quantum leap with at least $500/day moves, as we have seen in the ‘70s when gold moved from $100 to $850. We have been, in my opinion, in a bear trap similar to the one shown in the graph below. The main cause of this mania phase is the collapse of the present dollar-based international monetary system, which will end also the present currency wars with a reset.

The year 2015 has started with several conflicts, which all are bullish for gold, and all can degenerate in a major crisis, pushing gold well above $2,000.

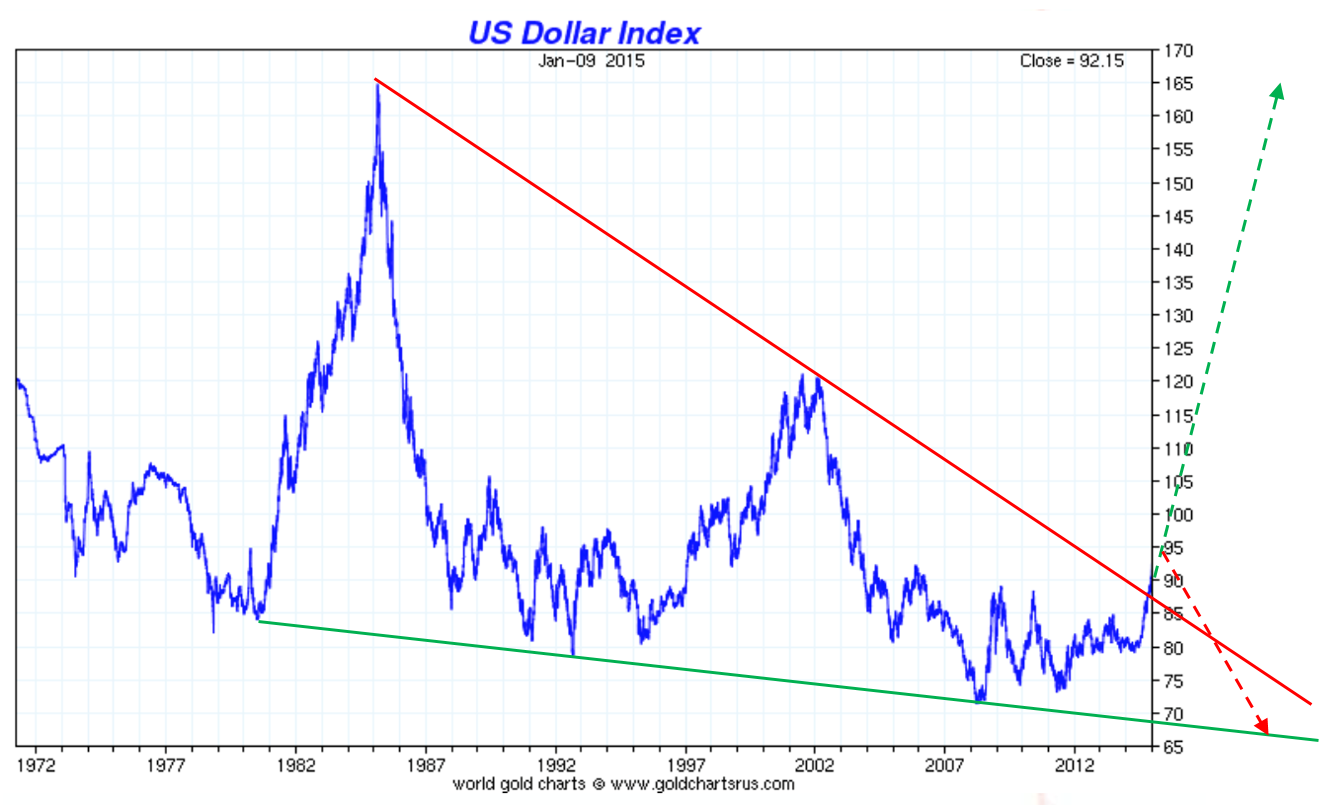

I do believe we are very close to the end of this Fed-created bull market in U.S. stocks and I don’t believe the US dollar is on its way to a major bull run like in the ‘80s. I also believe the U.S. Treasuries are in a historical bubble and that the currency wars will end it. The petrodollar system is on its way out and all those dollars circulating outside the U.S. will come home, creating a run on the dollar and hyperinflation in the U.S. Tensions are growing between the U.S. and its adversaries, Russia and China. U.S. relations with the European Union are also tense.

Five Reasons to Buy Gold in 2015

1. The most important reason to buy gold in 2015 or any time, for that matter, is diversification and as an insurance against uncertainty. I was always told to have 5% to 10% in gold and pray I will never need it. In these dangerous times we live in and with the risk of a major event like a war, revolution or financial collapse, it is wise and prudent to have some of the gold and silver outside of the banking system.

2. Gold is now at a very low level and oversold. I don’t expect gold to go below $1,000. In the case of a sideways market, gold will move between $1,100 and $1,500. If gold doesn’t explode in 2015 it will still move slightly up.

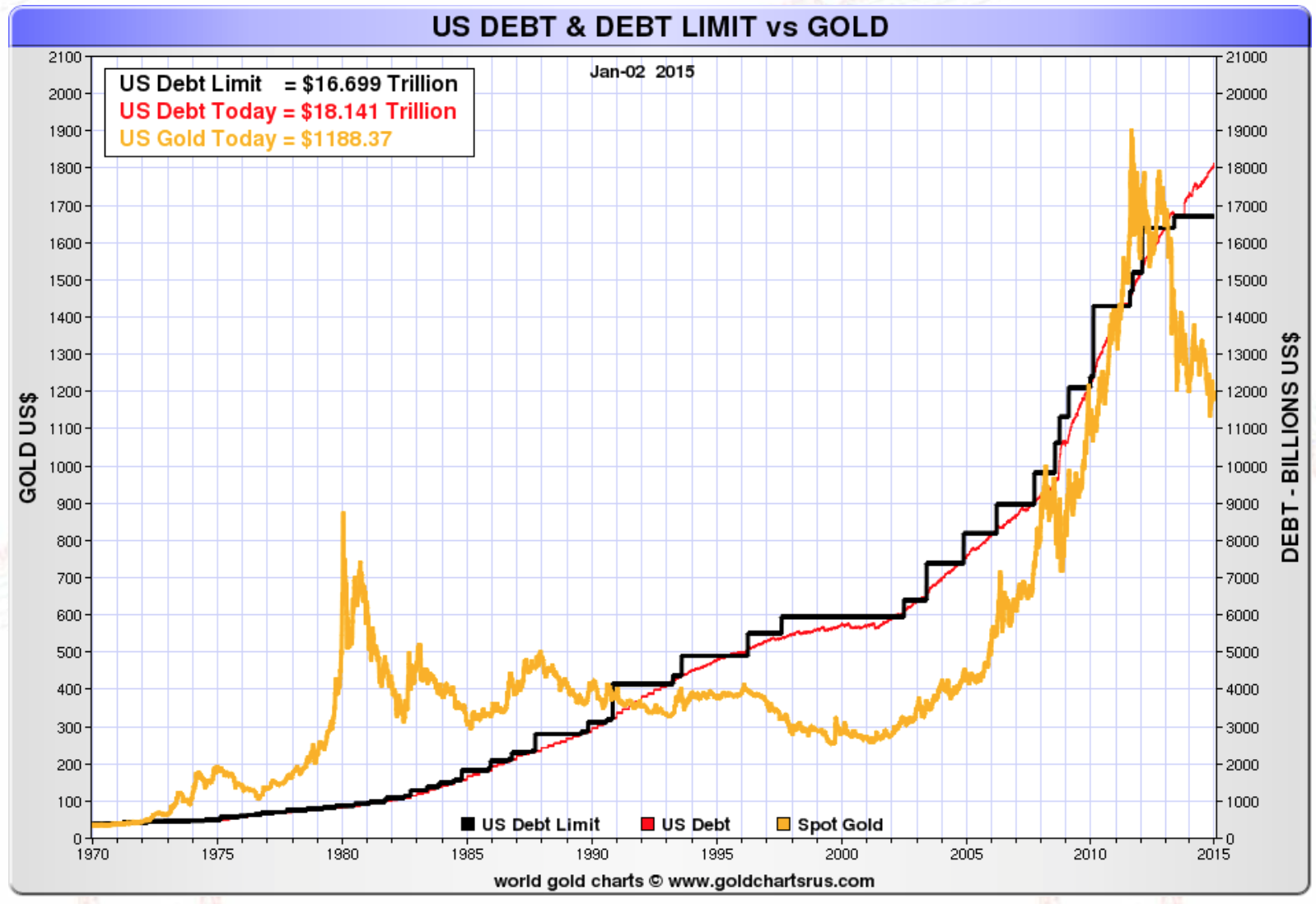

3. Central banks are and will continue to buy gold and I even expect them to accelerate their buying, competing for a limited amount of gold and pushing the price up. Silver will follow gold as poor man’s gold. Central banks have been in currency wars since 2008 and they will end badly. Both Russia and China are using gold in their currency wars. A reset of the current monetary system will push gold easily to $5,000. An announcement by China of its gold reserves could get gold to test $1,900, and even $2,000, in 2015.

4. I often hear that there is no risk of hyperinflation but of deflation, therefore a negative for gold. What people ignore is that a deflationary environment is catastrophic to the banking system and excellent for gold. In a collapse of the banks, gold and silver will circulate since they are the most marketable real assets.

5. In the case of hyperinflation, which is also a high probability and can come after a short period of deflation, gold will outperform or, at least, maintain its value in real terms. In this case, $10,000 in nominal US dollars is not absurd.

All these reasons are in some way connected to the collapse of the present monetary system due to an exorbitant global debt, but especially of the United States and the European Union. Will it start this year or next? It is difficult to predict, but the recent events make me doubt the central bankers know what they are doing. We have seen this week (mid-January) that central banks don’t necessarily coordinate and don’t know what they are doing. The Swiss National Bank reversed the peg of the Swiss franc to the euro after strongly defending it not long ago in a fight against the supporters of the Swiss gold initiative. The Swiss didn’t consult nor took into consideration other countries no more than the Fed did in its QEs. The unpegging of the franc was a cataclysmic event that caught everyone by surprise. It was, in my opinion, the first of a series of black swans of 2015. Statements as “we are in unchartered territory” and “we learn by doing” make me take precautionary action by buying real assets and, more specifically, the most liquid: gold and silver.

There is no other way of liquidating this exorbitant global debt, except by default or hyperinflation. What do you think governments will prefer? In both cases, gold and silver will at least maintain their value in real terms.

“In effect, there is nothing inherently wrong with fiat money, provided we get perfect authority and god-like intelligence for kings.” Aristotle (≈2,400 years ago)

“Yes... Remember what we're looking at. Gold is a currency. It is still, by all evidence, a premier currency. No fiat currency, including the dollar, can match it.” Alan Greenspan (2014) > Video here

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.