The gold price is determined in a Casino with massive leverage and has nothing to do with the real price of physical gold. More about that later in the article.

At what point will gold turn from a minority interest attracting less than 0.5% of world financial assets to a mass-market investment?

Three decades ago I identified physical gold as the best asset to hold for wealth preservation purposes. Then, almost two decades ago we decided to invest properly in physical gold for ourselves and the investors we advised at the time. Part of our wealth protection plan was obviously to store the gold outside the area we saw as the biggest risk, namely the financial system. Anyone who holds gold in a bank, ETF or some gold fund has not understood the purpose of physical gold.

99.5% OF INVESTORS DON’T UNDERSTAND OR HOLD GOLD

Being holders of a minority asset means that 99.5% of the investment population sneers at you and believes you live on a different planet. As a company who passionately wants to help others to protect their wealth, we are fortunate to meet like-minded people. But most of our clients feel very isolated because they have no one to discuss their concerns about the world with.

I would advise anyone with a gold interest to attend a good precious metals conference. In the last two weeks I have been speaking at two excellent gold conferences. One was the Gold Symposium in Sydney and the other one the Edelmetallmesse (International Precious Metals & Commodities Show) in Munich. It is important to pick a conference which includes many participants talking about the risks in the world and who see gold as a remedy against these risks. Most gold conferences are more geared towards gold mining and therefore less interesting for the wealth preservationists.

For anyone who wants confirmation that they are not alone in their analysis of the risks in the world, it is good for the soul to attend one of these gold conferences. Both the show in Sydney and Munich had a very enthusiastic crowd. For someone who has written newsletters for many years and appeared in interviews, like myself, most people in the audience will know you and want to talk to you. The Australians are more expressive and want to shake your hand and have a photo taken. The Germans are a bit more shy but also have a lot of questions. Both conferences were very well attended. More than in previous years.

SOMETHING ROTTEN IN THE FINANCIAL SYSTEM

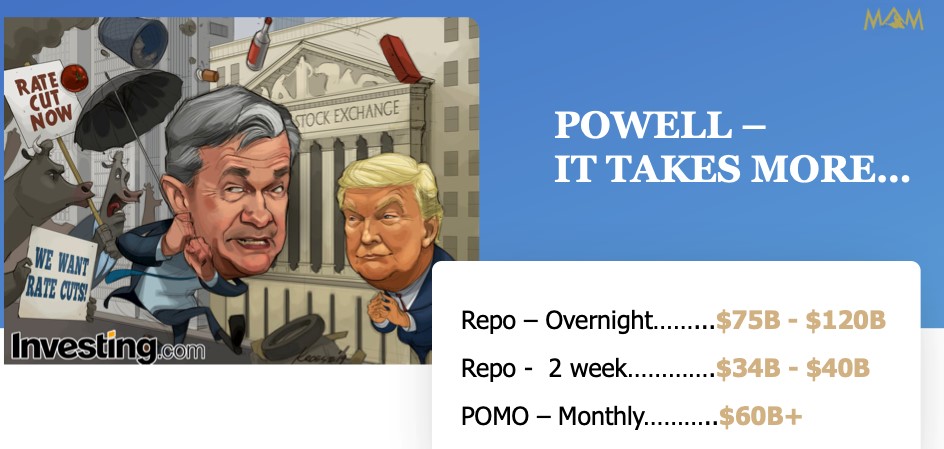

I have expressed in previous articles that there is clearly something very rotten in the financial system currently. Central banks are panicking and QE is back with a vengeance. The Fed is injecting a total of $200 billion monthly if you add up Repos and Pomos (permanent open market operations). The ECB has started with €20 billion a month but that is likely to increase since Lagarde most certainly also will do “whatever is takes” as Draghi stated. These are massive amounts and a clear indication that these two central banks are seeing real problems in the system.

NO TRUE MARKETS AND NO TRUE PRICES

The whole financial system is just a massive paper tiger but the world hasn’t realised it yet. In effect there are no true markets, no true prices and no solid counterparty standing behind any transaction. Financial markets are a casino full of drunken gamblers. A small minority has rigged the system in their favour and this is the way players like, investment banks make massive profits every day. These investment banks make gambling bets that are exponentially greater than the risk they can cover when all goes wrong. They are totally aware that they are too big to fail.

TOO BIG TO FAIL

The world experienced the “too big to fail” syndrome during the LTCM collapse (Long Term Capital Management) in 1998 as well as during the 2008 collapse. Both these times, the financial system was minutes from a total breakdown but the investment banks had to be saved at an enormous cost. No senior banker was fired or prosecuted and their bonuses continued to even more ridiculous levels. The winner takes it all!

With central bank printing and guaranteeing at least $25 trillion, the system was saved temporarily. But it wasn’t actually saved. All that happened was that a smaller problem became an exponentially bigger problem. And this is where we are today. The 2006-9 Great Financial Crisis was never resolved just deferred. So the proverbial can was kicked down the road again but the next time it will be too big to kick.

DON’T CONFUSE THE GOLD PRICE WITH THE PRICE OF PHYSICAL GOLD

Just to understand the size of markets, let’s for example consider the Forex market. Daily turnover in the Forex Casino is in excess of $5 trillion. That means $1.5 quadrillion a year is traded in foreign exchange. That’s 19x annual global GDP of $80 trillion. But since global trade is only $20 trillion, global forex trading is 75x the amount of goods that involves foreign exchange.

So the majority of the $1.5 quadrillion forex trading is pure speculation leading to the currency price being set in a casino with no relevance to the underlying goods traded. Thus the price has very little correlation to the products or services traded.

If we look at the gold market, exactly the same thing is happening. The annual mine production of gold is around 3,400 tonnes with a value of $159 billion. But if we look at the daily trading volume of gold it is a staggering $187 billion, and thus greater than annual production.

That makes annual gold trading $48 trillion or 1,030,000 tonnes. All the gold ever produced in the history is 170,000 tonnes. So annual gold trading is an incredible 6X all the gold ever produced in history and 300X annual mine production. It is important to understand that this gold trading is virtually all paper trading with a very small percentage of physical.

So for all of you who own PHYSICAL gold and believe that last week’s closing price of $1,460 per ounce is the real price of gold, please think again. $1,460 is the paper gold price in the casino. It has nothing to do with the real price of physical gold.

Today we can still buy physical gold for the same price as paper gold. That is an anomaly which will not last. All the physical gold that is produced in the world is absorbed by the market in spite of relatively slow market conditions.

THE PAPER GOLD MARKET WILL FAIL

The corrupt and manipulated paper gold market is guaranteed to fail. A market that is leveraged 300X the underlying physical or real market has no chance of survival. When the holders of paper gold realise that they are holding a worthless piece of paper, the whole paper market will implode and gold surge. This is not a question of IF but WHEN.

And WHEN is getting closer quickly. Stocks are very near the end of their secular bull market and the coming moves down will frighten the world. Bond markets might hold out a bit longer but will surprise everyone how quickly they will come down. The coming fall in stocks and bonds will shake confidence in all markets with many investors looking for protection in gold. Other positive factors for gold are the major increases in QE happening right now, as well as negative real interest rates.

COMING SURGE IN GOLD DEMAND CAN ONLY BE MET AT MUCH HIGHER PRICES

The physical gold market cannot satisfy the coming increase in demand at current prices. The only way that new buyers can find gold will be at much, much higher prices.

So I advise holders of physical gold and silver not to worry. This correction is soon over and in the next few years we will see the price of gold and silver reaching multiples of the current prices.

But remember that you are holding physical precious metals as essential life insurance for long term protection of your wealth and not for short term price gains.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.