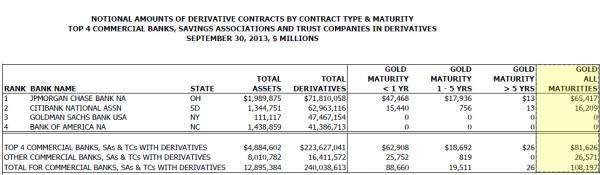

Perhaps the only question we have after seeing the attached table, which shows that as of Q3, 2013 JPMorgan owned $65.4 billion, or just over 60% of the total notional ($108.2 billion) of all gold derivatives in the US, is whether the CFTC will pull the "our budget was too small" excuse to justify why it allowed Jamie Dimon to ignore any and all position limits and corner the gold market?

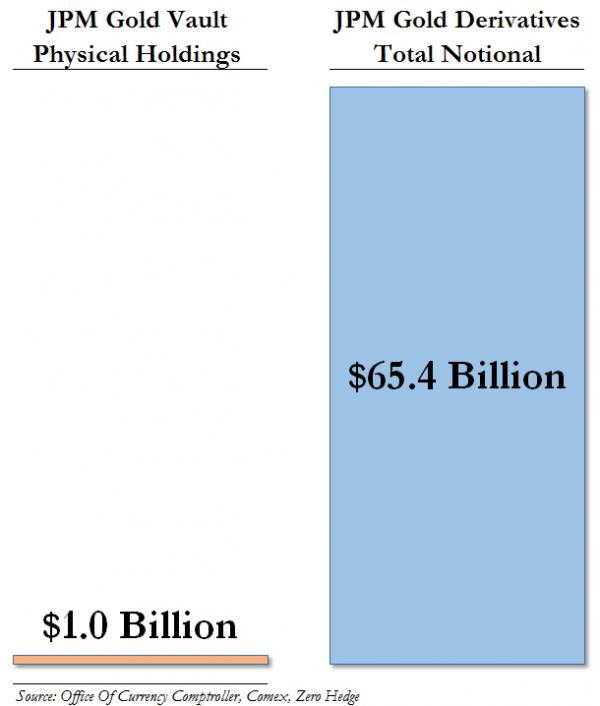

And purely as a reference point, the chart below compares the total value of gold held in JPM's vault (registered and eligible) as of Friday's closing price with its reported gold derivative notional holdings.

Finally, for the purists out there, we realize that gross is not net... until there is a breach in the derivative counterparty collateral chain, and gross becomes net.

Original source: Zerohedge

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.