Gold started a short-term down trend within a longer down trend on June 22 and as of July 3, it is testing it to the upside but has not broken it yet, closing the week at $1,168.40. The longer down trend started around May 20 remains intact.

Silver is also in a downtrend since May 20. It is testing the downtrend but without breaking it to the upside. Silver closed the July 3 week at $15.67.

Longer term both gold and silver are still in a sideway pattern giving no indication yet of any up or down direction.

- China sets up largest gold fund to purchase gold for the central banks

From an article by the Chinese news agency Xinhua at the end of May, we learn that China has set up the largest gold fund, which will facilitate gold purchase for the central banks of member states to increase their holdings of the precious metal. About 60 countries have invested in the fund. "China does not have a big say in gold pricing because it accounts for a small share of international gold trade," said Tang Xisheng of the Industrial Fund Management Co. "Therefore, the Chinese government seeks to increase the influence of RMB in gold pricing by opening the domestic gold market to international investors." According to Mr. Tang, the fund will invest in gold mining in countries along the Silk Road. The fund, led by Shanghai Gold Exchange (SGE), is expected to raise an estimated 100 billion yuan (16.1 billion U.S. Dollars) in three phases.

China sets up largest gold fund to purchase gold for the central banks http://news.xinhuanet.com/english/2015-05/23/c_134264324.htm

- Bank of China first Chinese bank to join gold price benchmark

IN mid-June, Reuters reported that The Bank of China will join seven others participants on the new electronic platform that sets the gold price benchmark. Bank of China joined the LBMA as an initial member in 1987, and has been participating in the gold trading business in London for over forty years. China is the world's second biggest gold consumer and largest producer but China has never played a major role in the global gold fixing. China is also looking at establishing its presence as a benchmark hub that could compete with the London benchmark. China's state-run Shanghai Gold Exchange said last month, it was working on launching new price benchmark fixing products as a new service to market participants.

A change in the structure of the global gold market is coming that will eventually shift pricing power to Asia. This is a step in that direction. China is increasing its influence in gold and currency markets worldwide as the country seeks to make the yuan a viable competitor to the US dollar.

Bank of China first Chinese bank to join gold price benchmark http://www.reuters.com/article/2015/06/16/gold-fix-ice-idUSL5N0Z21W420150616

Bank of China Joins Auction Setting Gold Prices in London

http://www.bloomberg.com/news/articles/2015-06-16/bank-of-china-to-participate-in-lbma-gold-pricing-lbma-says

- China and India are ‘changing the nature’ of gold bullion markets

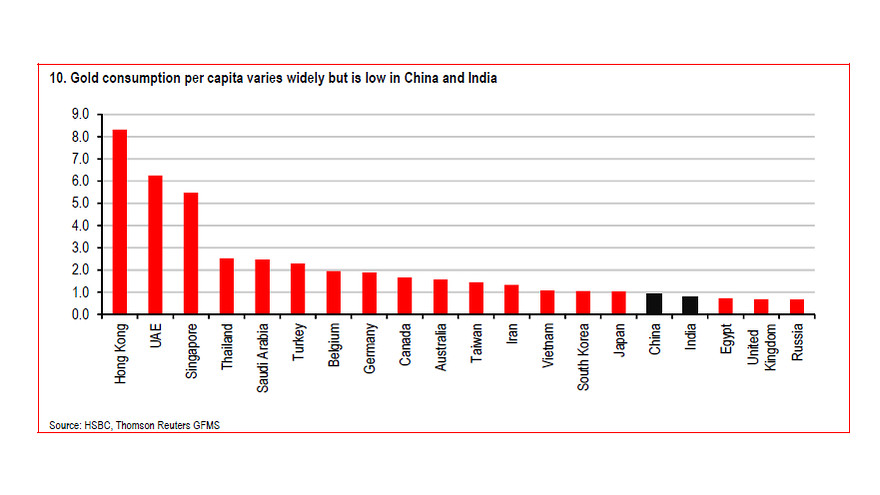

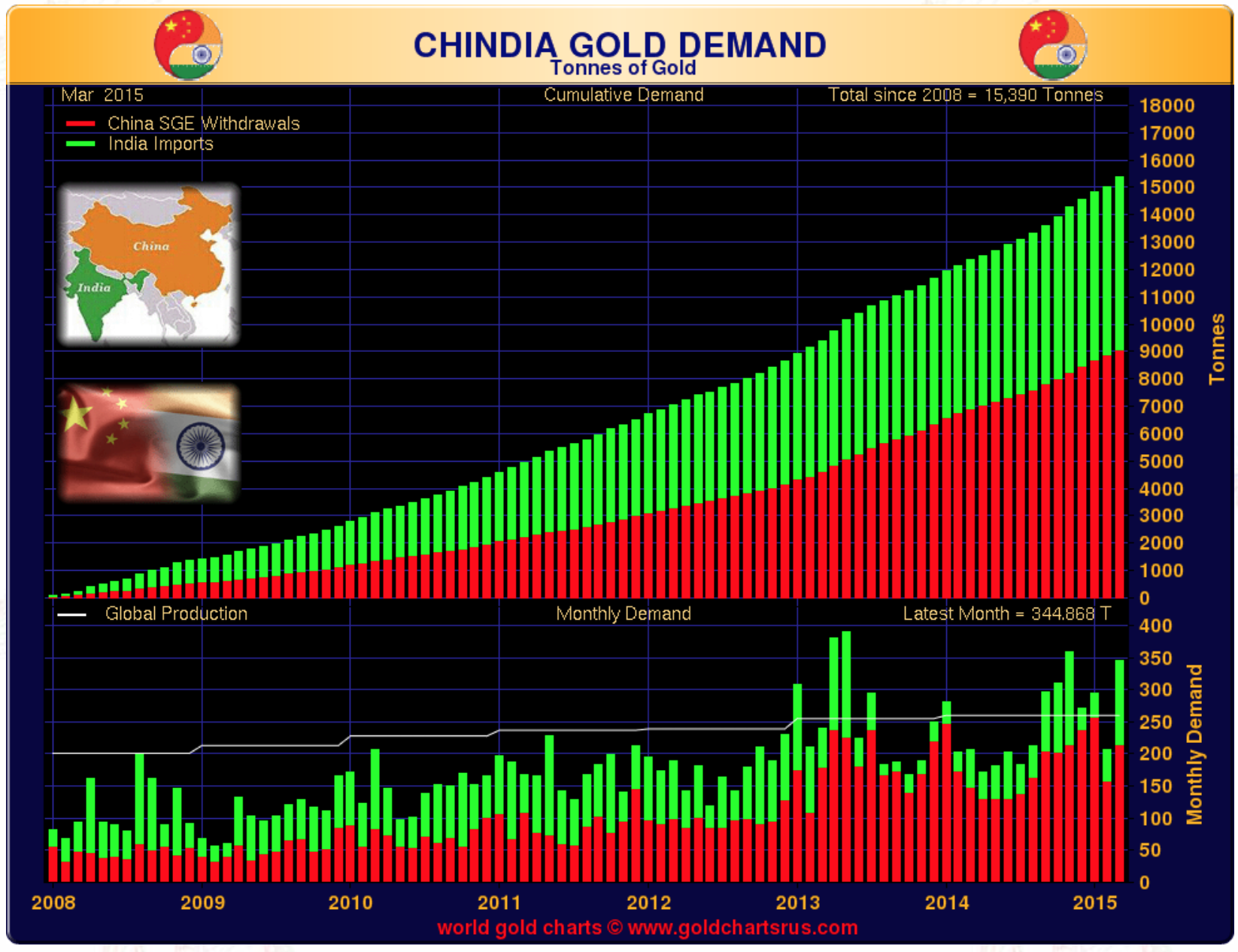

Myra Saefong for MarketWatch reports that there is a shake-up in the gold market and emerging markets like China and India are to blame. In China, gold demand has been hurt by a moderating economy, a pullback in demand for luxury goods, a reduction in official gift giving and strong domestic mine output, which all contributed to the nation’s slowing appetite for imported gold. But China’s imports are “still robust by any historical measure,” sais HSBC analysts, led by James Steel, with 2014’s imports marking the second best year for bullion demand in the country’s history. In addition, so far this year, imports are running well ahead of the five-year average. Consumers in important gold-consuming nations such as China and India “may have fewer tools at their disposal with which to protect savings and household wealth against rising prices or low or negative real interest rates” the analysts said. So gold in these markets remains broadly popular since it is viewed as an “efficient and reliable store of value,” they said. Gold consumption per capita in India and China is low. China and India buyers and sellers “largely define” the range for gold—with prices near $1,100 an ounce attracting buyers, but prices near $1,300 causing buyers to “shy away from purchases,” the HSBC analysts said.

China, India are ‘changing the nature’ of gold bullion markets http://www.marketwatch.com/story/china-india-are-changing-the-nature-of-gold-bullion-markets-2015-06-16

- Texas Pulls $1 Billion In Gold From NY Fed, Makes It "Non-Confiscatable"

Zerohedge reports that the lack of faith in central bank trustworthiness is spreading. First Germany, then Holland, and Austria, and now Texas has enacted a Bill to repatriate $1 billion of gold from The NY Fed's vaults to a newly established state gold bullion depository in Texas. Texas Governor Greg Abbott signed a bill into law on Friday, June 12, that will allow Texas to build a gold and silver bullion depository. In addition, Texas will repatriate $1 billion worth of bullion from the Federal Reserve in New York to the new facility once completed.

In 2011, Zerohedge already reported, “The University of Texas Investment Management Co., the second-largest US academic endowment, took delivery of almost $1 billion in gold bullion and is storing the bars in a New York vault, according to the fund’s board.”

There’s a Pile of Gold in Manhattan. Texas Wants It Back http://www.bloomberg.com/news/articles/2015-06-19/there-s-a-pile-of-gold-in-manhattan-texas-wants-it-back-

Writing's On The Wall: Texas Pulls $1 Billion In Gold From NY Fed, Makes It "Non-Confiscatable" http://www.zerohedge.com/news/2015-06-13/writings-wall-texas-pulls-1-billion-gold-ny-fed-makes-it-non-confiscatable

- Greek Gold Sales to Raise Funds Seen Unlikely by Commerzbank

A recent Bloomberg story raises the possibility for Greece to sell gold to raise funds. However, Commerzbank AG sais in the article that Greece is unlikely to resort to selling gold because disposing of the hoard valued at about $4.3 billion would only postpone a default. “Selling gold would deprive the country of its only really valuable reserves, which could be put to good use at a later date, perhaps to stabilize a new currency if Greece exits the euro,” Commerzbank analysts including Frankfurt-based Eugen Weinberg wrote in a report. The report adds that selling into the open market would probably not be compatible with an agreement made between European central banks to avoid large disposals that would disrupt the market.

Greek Gold Sales to Raise Funds Seen Unlikely by Commerzbank

http://www.bloomberg.com/news/articles/2015-06-19/greek-gold-sales-to-raise-funds-seen-unlikely-by-commerzbank

- Marc Faber: Hold gold and silver physical and preferably outside the US, Europe Union and Switzerland

Marc Faber, publisher of The Gloom, Boom & Doom Report said in a recent interview on Fox Business Network’s The Intelligence Report with Trish Regan that “Everything is in a Bubble”. Marc warns of “colossal systemic risk” in the markets. He also advises people to hold physical gold and silver and preferably outside the US because in the US and even European Union and Switzerland there is a threat that one day when things really will go bad central bankers will blame the gold holders for the disaster and they will say we have to take the gold away. This is less likely in Asia says Marc Faber.

Marc Faber: Everything is in a Bubble http://www.foxbusiness.com/markets/2015/06/22/marc-faber-everything-is-in-bubble/

- Islamic State of Iraq mints its own 'Islamic Dinar' gold coins

A story in the British daily The Telegraph reports that the Islamic State of Iraq and the Levant (Isil) has begun minting its own “Islamic dinar” coins according to Syrian activists. Pictures posted on social media showed a series of gold sovereigns bearing Isil inscriptions, and with a reported value of one gold dinar being with $139 (£89).

Islamic State mints its own 'Islamic Dinar' gold coins http://www.telegraph.co.uk/news/worldnews/islamic-state/11694838/Islamic-State-mints-its-own-Islamic-Dinar-coins.html

Around 2500 years ago, the Greek philosopher Democritus said: “Gold is the sovereign of all sovereigns”. It is as valid today as it was then.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.