Before we get into this topic, let's take a brief look at the markets that interest us.

On March 23, the G20 announced the debt suspension for emerging countries, breaking the bullish panic generated by the halt in world trade due to the epidemic.

As of this date, the dollar has been in a well demarcated bearish channel, as noted in my article last month. We should see a big drop off, as soon as 92.20 support breaks, it's a matter of days now.

If we look at the monthly gold chart, we can see that prices are pulling back on the former resistance of 2011-2012 to verify that it has become support. Once this technical movement is over, if the support has held up, gold will be able to resume its rise to new highs towards $ 2,300 or $ 2,400 which should be reached in early 2021.

Silver

The monthly silver chart looks extraordinarily bullish to me.

The resistance that prices came up against in April, May, July and August will be above $ 50 in the last days of February. So I expect a doubling of the courses in the next 3-4 months.

A friend of mine is an important player in the recovery of precious metals and is in close contact with the Swiss refiners. Last week, to deliver a ton of metal, they required between 4 and 6 months of delay, that is to say a delivery at the end of March or the end of May. Knowing this, wholesalers who have inventory hoard because they believe that prices should rise sharply.

However, we are living in a pivotal period, which can generate high volatility. What could cause precious metals to fall as supply tends to tighten and the dollar is still in a downtrend. It would take a trigger event, which would wreak havoc on the derivatives market, that is, paper money and paper gold.

CFTC Finalizes Position Limits Rule on commodities ;

Les Echos, the 16 of October published an article saying :

"From oil to metals, via corn and soybeans, the American policeman of the commodity derivatives markets (CFTC) is preparing to tighten up against speculation. The CFTC approved Thursday by 3 votes to 2, the introduction of limits for the positions taken by hedge funds and other hedge funds on a dozen commodity markets."

Going up the track to the CFTC site, I come to the minutes of the October 15 meeting

At its open meeting today, the Commodity Futures Trading Commission approved three final rules, including one regarding position limits for derivatives, completing the Commission’s major rulemakings related to implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

Final Rule: Position Limits for Derivatives

By a 3-2 vote, the Commission approved a final rule amending regulations of speculative position limits to conform with certain Dodd-Frank amendments to the Commodity Exchange Act. Among other things, the Commission adopted new and amended federal spot month position limits for derivatives contracts associated with 25 physical commodities, and amended single-month and all-months-combined federal limits for most of the agricultural contracts currently subject to federal position limits. Under the final rule, federal non-spot month position limits were not extended to the sixteen new physical commodities.

…

In summary

The CFTC will impose limits on traders' positions, which will affect 25 commodities, but there is no list of relevant commodities and the position limits are not quantified.

This is part of the enforcement of the Dodd-Frank Act.

Some of these new rules will come into effect 60 days after publication in the Official Journal. Others will not be implemented until September 1, 2021.

October 22, 2020 there has been a meeting between the CFTC and the SEC to harmonize their positions on the rules cited above.

There too, no details on the underlying concerned, but it is obvious that the leverage will be reduced and that the security deposits will be increased.

The dates of application of these rules have not been given either.

After the 2008 “subprime” derivatives crisis, which led to the bankruptcy of Lehman Brothers, the Dodd-Frank Law was supposed to make these markets transparent and prevent a new systemic crisis. In 2010 and 2011 I was following with passion the attempts to implement the Dodd-Frank Act and the endless battles waged by lawyers for the big Wall Street banks, to lessen its scope and delay its implementation. At the time, the CFTC had recruited an incorruptible team around Bart Chilton, whom the GATA likened to Eliot Ness. A page of my book is devoted to this subject. It is definitely worth re-reading. I deliver it to you below.

The CFTC and the Dodd Frank Law

In 2010, the US Congress passed the Dodd-Frank law, aimed at regulating, among other things, derivatives. The CFTC, the control body for the commodities market, admitted that it had long hesitated to put this law into practice and in particular the article concerning the limitation of the positions of the various actors.

Officially, the CFTC considered that if this law were implemented, this position limitation could trigger a systemic crisis.

Why ?

The JPM-Chase and HSBC Banks, in particular, have naked short sold gold and silver in phenomenal quantities, particularly through derivatives. The GATA cites the figure of 3.3 billion ounces sold short (4.7 years of production) and derivatives to the tune of $ 65,000 billion according to statistics from the B.I.S.

If these banks were required by law to deliver this metal, they would have to offer investors with silver prices well above the current fictitious prices. Silver could cost several hundred dollars briefly. It is likely that the premiums method under the JPM's table would be favored to disinterest buyers, rather than to let silver prices soar.

The judges leading the CFTC were partly changed by Obama in May 2011, thus theoretically giving the majority to supporters of a major clean-up of these Augean stables. The CFTC's recruiting campaign for positions of responsibility within this government agency shows that many heads have fallen in a notoriously corrupt service and that the new leaders were seeking to form a team of incorruptible worthy of Elliott Ness's reputation. If this law were finally enforced, even gradually, silver could fly without limit, until all short positions were redeemed. This sudden spike in inflation could destroy the value of the dollar and induce an emergency monetary change. This change has been prepared for a long time, but has already been postponed several times.

The application of the Dodd-Frank Law passed in summer 2010 was due to come into force in December. It was first shifted to July 2011, then September,... then January 2012… then March. But bank lawyers still fought over the word “SWAP”. On Tuesday July 12, 2012, the CFTC released the legal definition of the word "SWAP". Actors in the derivatives markets therefore had 60 days, before October 12, to exit from all their dominant positions.

Another twist, on September 29, Judge Robert Wilkins of the Washington court ruled that the CFTC had to provide proof that "position limits" on commodity markets could reduce or prevent excessive speculation. He also argued that the Dodd-Frank Act did not give the CFTC a clear and unambiguous mandate to establish these position limits. The Banksters who play against market regulation have therefore won one more battle.

The bitter observation of 2012 was justified, since 10 years after the passage of the Dodd-Frank Law, the limitation of derivative products has still not been implemented.

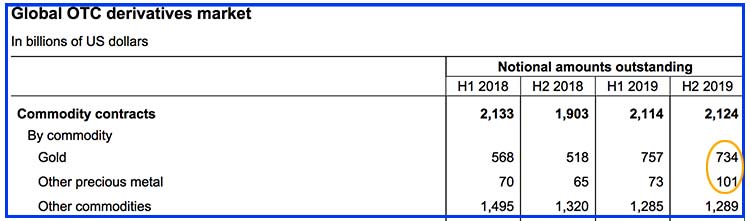

In the statistics of the BIS, we even see a 50% increase in derivatives linked to precious metals between 2018 and 2019.

Nevertheless… Remember that the precious metals market has changed a lot over the past two years.

On July 8, 2019, Member of Parliament for Stafford, Jeremy Lefroy, questioned Treasury Secretary John Glen in session in the House of Commons on the matter. (See the report of the meeting) Jeremy Lefroy made an extremely clear presentation of the state of the market, where electronic gold and silver, which have no real existence, are 100 times physical gold and silver. He denounces the manipulations carried out through ETFs, which also have no obligation of reality, nor any obligation to audit. In conclusion, he shows that these markets are falsified fraudulently, contrary to British law.

Andrew Maguire knew Jeremy Lefroy very well and had helped him to put together the clearest possible record for the House of Commons on these price manipulations of gold and silver.

In an interview with Craig Hemke of TF Metals report, Andrew Maguire announces that new rules are being put in place and that these new rules will prevent price manipulation. Maguire is certain of what he is saying.

LBMA: The new rules

In August 2016, the Financial Times published an article “Goldman up against JPMorgan in gold battle” revealing that Goldman Sachs and Chinese bank ICBC, the No. 1 in the world, joined forces to oppose JPM and HSBC on the future of the gold market. The former (GS / ICBC) want to create a new market, totally transparent, regulated by a supervisory authority, while the old JPM / HSBC accomplices, simply want to improve the LBMA, but by continuing OTC (Over The Counter) negotiations, which we can translate as “over-the-counter”, therefore opaque.

Since September 12, 1919, in the aftermath of the Great War, gold fixing has taken place in the office of N M Rothschild & Sons between the 5 largest gold brokers in London.

In 2004, the Rothschilds took over, just as the GLD ETF was launched, a financial product allowing speculators to gamble on gold, but without having to touch, insure or find a safe for their bullions. GLD is assumed to buy physical based on the number of shares purchased by speculators. Some analysts have argued that the cash flow of speculators playing on the rise in gold, on the contrary, served the banks to take an opposite position in the markets. The same product was launched two years later, for silver with the ETF SLV. JPM and HSBC were the official custodians of the metal stocks of GLD and SLV, and at the same time the two biggest players in the gold and silver markets, and custodians of these same metals warehouses for COMEX and for the LBMA.

But, after the LIBOR scandal, judicial inquiries into the various banks manipulating the markets started to rain and very gradually the LBMA was forced to change.

Basel III: long-term structural liquidity ratiO

As you know, gold went Tier one in March 2019 and all banks will be required to be Basel III compliant by December 31, 2021.

In the Basel III standards, it is a question of NSFR (Net Stable Funding Ratio) or Long-Term Structural Liquidity Ratio, the definition of which you can read in full on the BIS website This NSFR obliges banks to have sufficiently liquid capital proportional to their market commitments.

There have been tough negotiations since the start of 2020 between the LBMA, the European Union and the BIS, to force the bullion banks to have NSFR liquidity covering 85% of their speculative positions in precious metals. The LBMA has been campaigning to reduce this liquidity ratio to 50%. (See Reuters)

50% or 85%, this structural liquidity ratio on the LBMA is a real handicap for the bullion banks, which on the COMEX could speculate with only 5% or 6% of guarantee until now and therefore gigantic levers. The 12 bullion banks found themselves on a suicide mission on the LBMA. They risk finding themselves in a short-squeeze in the face of very strong demand and an increased shortage.

A trio of U.S. banking regulators (FDIC, OCC and the Fed) are set to move Tuesday 22/10 on finalizing a pair of long-running rulewriting projects aimed at ensuring banks have enough liquidity while minimizing volatility.

One rule will establish the so-called Net Stable Funding Ratio (NSFR), a long-term liquidity requirement, for 20 large banks. The second rule ups standards on “total loss-absorbing capacity” (TLAC) debt, which is debt banks must issue to ensure they have quick access to equity in times of stress. The new NSFR rule brings to a close a rulewriting project that dates back to 2016, and is the final project from U.S. regulators to bring their rules in line with the 2016 international Basel III standards.

While the London precious metals market is more opaque than ever, we know that the COMEX-LBMA tandem hit an iceberg on March 23, 2020.

The planes having been grounded and the borders closed by government decision, this prevented the delivery of physics, in particular to London. Then as COMEX refused deliveries of bars to British standards of 400 ounces instead of 100 in New York, this worsened the situation.

The bullion banks took the broth. Societe Generale threw in the towel after suffering huge losses. HSBC has withdrawn from the market. Scotia, London's oldest gold bank, announced its final retirement in June. We saw a general stampede.

Speculation between London and New York

One of the tenets of this game is that Bank X had a long position in the London spot market and a short position on COMEX futures. COMEX hardly ever delivered physical, but issued delivery notes called “Exchange For Physical” (EFP) to be cashed in London. In reality, there is no physical being traded, just a margin gained or lost between spot market and futures.

It is generally understood that in New York all traders are "naked".

Sellers (naked shorts) have no physical to deliver and buyers (naked long) would not have the cash to pay for physical, if they requested delivery.

Since the crash of March 23, 2020, the most apparent change had been on the COMEX. In 2018, deliveries of physics to COMEX represented only 0.02% of exchanges (51 tonnes in one year) and therefore 99.98% of exchanges were purely virtual. Their main purpose was to control the apparent erosion of the purchasing power of fiat currencies in general and of the dollar in particular, against gold as a monetary standard.

In 2020, for the months of April-May-June alone, COMEX delivered 301 tonnes of gold, six times more than during the previous 12 months. The schism between London and New York after March 23 was expressed by a gap in the price of gold in these two financial centers. As a result, the bullion banks arbitrated by being delivered to New York. (If you want to dig that precise point)

I think that we will see the establishment on all markets of the Basel III Long-Term Structural Liquidity Ratio, which requires banks and hedge funds to have 85% of their speculative positions in precious metals in cash or equivalent.

This will melt away the $ 734 billion in gold swaps and $ 100 billion in electronic-silver, which can still be seen today in the BIS statistics.

The daily trading average at LBMA is 30 Moz of gold and 359 Moz of silver compared to daily COMEX figures, 34 Moz of gold and 552 Moz of silver. (Reuters)

However, if you have been careful, it has been said above that the "long ones" do not seek to be delivered, because they do not have the necessary cash...

Long contracts will be forced to sell their positions to limit their ambitions to their real cash flow capacity...

Short contracts will also be forced to sell, but will seek to liquidate their positions as late as possible, to take advantage of the drop generated by the previous ones.

When the "shorts" buy back their short sell positions, prices will rebound extremely violently to the upside.

Certainly, when the new CFTC and Basel III rules come into effect, commodity markets will experience extreme volatility.

There are currently 100 ounces of virtual gold for an ounce of physical. This proportion will drop very sharply.

You will have to keep your nerves, when this happens... And keep your back during the downturn, until prices explode higher.

Is it necessary to remind you that on June 3, 2020, in front of the World Economic Forum in Davos, Kristalina Georgieva, the current director of the IMF, gave a talk under the title "The Great RESET". In her speech she declares that this epidemic is an opportunity to change the world.

Klaus Schwab, the president of the World Economic Forum in Davos, even specified that this pandemic offered a rare and narrow window to reimagine and reset (RESET) our world. "Narrow" means that the time for this opportunity is running out and you have to go ahead without procrastinating.

So the CFTC is not going to make you long to put these position limits in place.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.