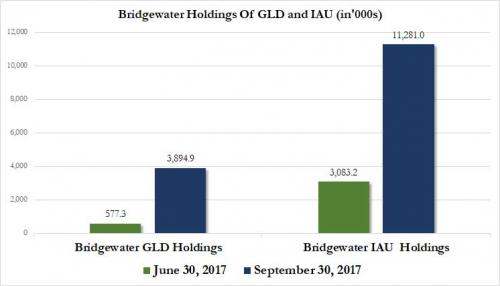

Until last quarter, the world's biggest hedge fund had, curiously, never held a position (according to our records) in any of the most liquid gold ETFs, whether the SPDR Gold Trust, the GLD, or the iShares Gold Trust, the IAU. That changed in the second quarter of 2017, when Bridgewater made its first tentative purchases in the gold ETF space, buying up 577,264 GLD shares, for $68.1 million, as well as 3.1 million IAU shares worth $36.8 million.

That was just the beginning, because as readers will recall, back on August 10 Ray Dalio urged investors to buy gold in case "things go badly." This is what Dalio said:

"When it comes to assessing political matters (especially global geopolitics like the North Korea matter), we are very humble. We know that we don't have a unique insight that we'd choose to bet on. We can also say that if the above things go badly, it would seem that gold (more than other safe haven assets like the dollar, yen and treasuries) would benefit, so if you don't have 5-10% of your assets in gold as a hedge, we'd suggest you relook at this. Don't let traditional biases, rather than an excellent analysis, stand in the way of you doing this."

And that's also what he did, because in the third quarter Bridgewater was very busy buying gold: in fact, according to the just released 13F, after $3.8BN and $2.9BN positions in EM ETFs VWO and EEM, as well as a $1.3BN position in the SPY ETF, Bridgewater's 4th largest position as of September 30 was GLD, with 3.894 million shares, worth $473 million. In other words, in Q3, Ray Dalio went on a gold buying spree, increasing his GLD holdings by a whopping 575%.

As a result of the surge in holdings, Bridgewater as of this moment, the 8th largest holder of paper gold, known as GLD.

It wasn't only GLD, however, because Bridgewater also nearly tripled its IAU holdings, increasing its paper iShares gold holdings by 266%, from 3.1 million shares to 11.3 million.

And now that Ray Dalio is rapidly buying up GLD, IAU and other gold holdings, we wonder how long before the momentum chasers send gold, both paper and physical surging, and whether this shift in momentum could potentially impact the ongoing surge in bitcoin.

Original source: Zerohedge

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.