I really don’t like going too far “off the rails” in looking for explanations to occurrences that are completely dislocated from reality. An example of an occurrence that is entirely disconnected from reality is the 300:1 paper gold to deliverable gold ratio on the Comex. The only explanation for that is that entities operating the Comex are implementing extreme measures to limit the upward movement of the price of gold. How can there be any other explanation when there is no other futures market in the history of the world in which the ratio of the paper futures contracts outstanding were 300x greater than the amount of the underlying physical commodity available for delivery into those markets.

Try this exercise: Imagine where the price of gold would be if gold futures trading were removed from the equation. Too be sure, it would reduce the number of hedge funds involved in trading the gold market via futures. But the market would be left to find a market clearing price based on the actual amount of physical gold available for delivery and the amount of gold being demanded by buyers for actual delivery.

Occasionally an event occurs in the gold market which points to the extreme degree of artificiality imposed on the market. It’s a variable that occurs outside of the control of the banks and Central Banks who are highly motivated to keep a lid on the price of gold.

This event is known as backwardation. Backwardation occurs in a futures market when the spot price of the commodity – in this case gold – exceeds the futures price. For a lot of technical reasons, futures markets should almost never experience backwardation except in extreme circumstances. If you can sell your gold at the spot price and buy a futures contract to “guarantee” the delivery of the gold you sold in the future at a lower price than what you get paid today to sell at spot, you’ll do that trade all day long until you run our of gold to sell. It’s free money – also known as arbitrage. Arbitrage opportunities should quickly remove backwardation from any futures market.

Only in the gold market it’s not free money. When gold goes into backwardation it’s because investors who have gold are not willing to engage in “free money” arbitrage because are unwilling to risk the possibility that their futures counterparty will be unable to deliver gold in the future. In other words they don’t trust the future availability of physical gold. The risk of delivery default by the counterparty removes the “free” aspect of arbitrage from gold market backwardation.

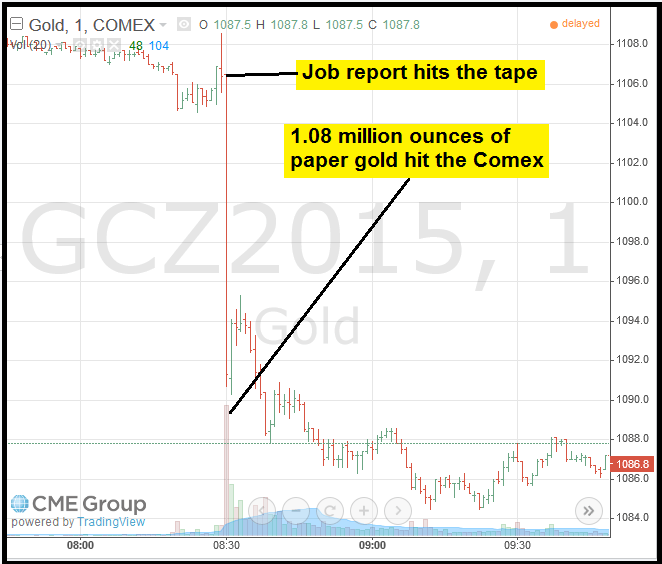

On November 6, when the phony employment report hit the tape – at the exact moment – 10,800 December futures hit the Comex in the first minute. This drove the futures price down nearly $20. This is 1.8 million ounces of paper gold. Yesterday’s Comex vault report shows that there were only 151.3k ozs of gold reported to be available to deliver into the December contract. This is manipulation in the extreme.

Of course, the unintended consequence of this is that this artificial market activity cause extreme backwardation in the gold market. This is best illustrated with this graphic posted on Twitter by Sandeep Jaitly (@bullionbasis), who is a fund manager:

What happened today in gold after the non-farms? Someone was scooping up real gold. 4% backwardation reached... pic.twitter.com/e9J7gvFjRO

— Sandeep Jaitly (@Bullionbasis) November 6, 2015

Without getting into the “gory” details of futures trading terminology, this graph shows what happened between the spot price of gold and the futures price of gold. The red line represents the backwardation in the market that occurred when the futures prices were slammed at 8:30 EST. It represents the annualized rate of return you would earn if you sold your gold in the spot market and bought December futures to replace the gold you sold. This of course assumes that you actually receive delivery of the gold.

Another way to think about the backwardation that occurred on November 6 in the futures market is that the spot market did not “believe” that the big hit in the futures market when the employment report hit the tape had any basis reality other than that it was a massive paper manipulation operation. We know this because the spot market price did not adjust accordingly when the futures price was smashed.

The graph above reflects the backwardation that occurred in the Comex futures market. Backwardation in the London LMBA “physical bullion” market has been persistent since 2013. Prior to 2013, backwardation was an extremely rare occurrence in the gold market. It happened briefly in 2000/2001 – when the 20 year bear market in gold ended – and it occurred briefly in 2008, just before gold began a run from $700 to $1900.

The fact backwardation in London has been occurring with persistent frequency and lingering for extended periods of time reflects the extreme “disconnect” between the paper gold and physical gold markets. It reflects a gold market in which the price is being kept artificially low with paper gold because backwardation would only occur when demand for physical gold now is greater than the promised supply of that gold in the future.

Several market indicators are now signalling the amount of intensity being exerted by the elitists to keep the entire global financial system from collapsing. Negative rates in the European sovereign yield curves which extend out several years now; the high volatility in the stock markets; the growing divergence between high yield bond prices – which are quasi-equit – and the S&P 500; the negative 10-yr interest rate swap spread; the very large and very frequent Fed reverse repos; and, of course, the backwardation in the gold futures market, which directly reflects the amount of manipulation required to keep the price capped.

There’s no telling how long this fraud can last, but there will be a lot of people who wished that they had loaded on the Wall Street Journal’s “Pet Rock” when the price was low because at some point acquiring possession of physical gold and going to be extremely difficult and expensive.

Original source: Investment Research Dynamics

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.