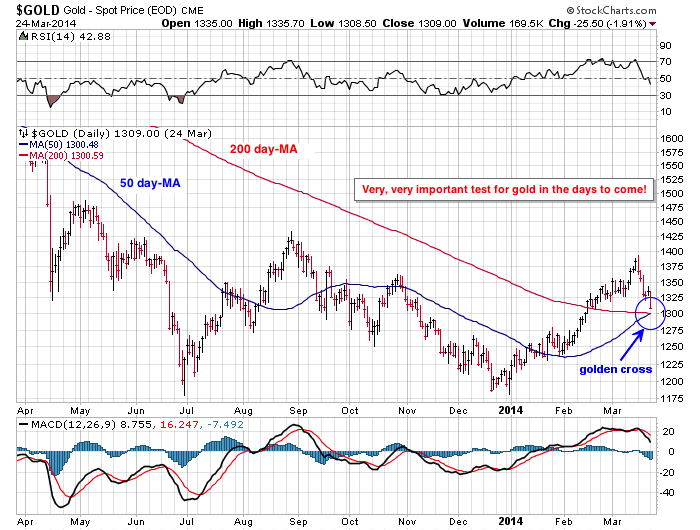

I think we are getting to a very important test for gold, around $1,300, without a doubt the most important test of the year. Selling volumes on the GDXJ (junior miners’ fund) broke all records yesterday. Dropping below the 50-day MA for the HUI, the main miners index, triggered a lot of panic and many investors just jumped out of the window without asking any questions. As far as I’m concerned, there are two possible explanations.

The first one : This is a brutal, albeit normal, correction in the miners that started this panic movement as gold was simply coming back down to its 50-day and 200-day moving averages, precisely at $1,300. And, as a coincidence, these two MAs are crossing each other at this moment and are showing a strong « golden cross » bullish signal! The natural volatility of gold miners is often frought with very disconcerting episodes.

The second one : Two days before the Fed’s announcement, the manipulators decided to gain back control of the gold market by launching powerful attacks to break its bullish recovery, in order to break through these MAs and destroy the bullish signal coming from the crossing of the MAs. The fact that the miners fell so violenty yesterday could validate such a scenario.

If we recall, in 2013, the miners acted as an advance signal for what was in store for the gold market. We can thus give them the benefit of the doubt with this slight break, but not that much! Either the mining companies succeed in closing quickly above their 200-day MA (230 pts for the HUI), or at least not exceeding by more than 8% their closing below it, or we will have to admit that the manipulators are back and using the bulldozer... and get out of the gold miners market, and come back to it if it proves to be a false alarm.

The historical data around the gold bull market recoveries in 2001 and 2009 teaches us a lot on false breakdowns under the 200-day moving average, just after a « golden cross »!

For the moment, I’m keeping a positive outlook on this ongoing test of the 200-day MA for gold, but I’m keeping an eye on the relative value of those false breakdowns, both for gold and the miners. A clean break, I think, would signal that the manipulators are back in full force, trying to break this market’s philosophy before the next phase of parabolic rise. But, contrary to 2013, all weak hands have gone away, and the gold that remains in ETFs will be much harder to remove. The task for the manipulators is going to become more and more arduous, and Goldman Sachs’ public negative statements about gold’s perspectives will have less and less effect. On the long term, the more this manipulation lasts, the more this uncoiling movement will be violent and chaotic to get to the price that would be fixed by a free market, e.g. way above $3,000.

The road to a gold bull market recovery does not look like a long and quiet river!

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.