The US Mint has just announced it would stop selling 1/10oz gold coins. The disconnect between « paper » gold and physical gold is nearing its terminal phase.

The « paper » gold spot price has declined spectacularly these last few days, which is in total contradiction with the physical gold market, where it’s getting harder and harder to acquire any gold. The difference between the spot price and the price at which one can acquire physical gold or silver has increased dramatically since the orchestrated crash.

If it gets difficult (or impossible for smaller coins) to acquire physical gold based on the spot price, it means that there is a problem with the mechanism to determine the spot price, or that it’s just unreal.

The spot price does not reflect the physical reality anymore.

It cannot be trusted anymore in determining the real value of gold (or of silver), as attested by the growing spread.

Looking quickly at the premiums on silver coins, one can see a 40% difference between the spot price and the price of actual coins.

Reuters :

Read Zerohedge

Update 24/04/2013 :

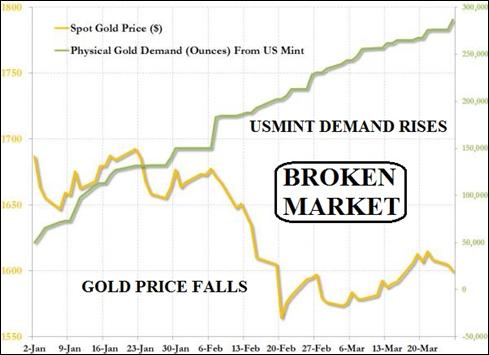

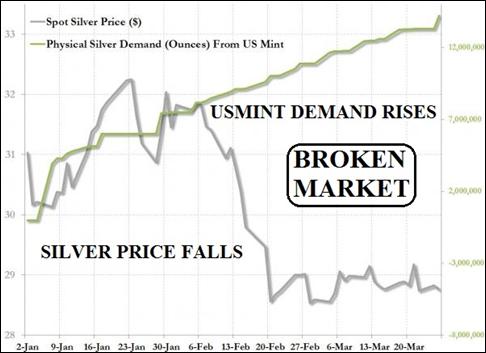

The next two graphics reveal the total disconnect between the « paper » spot prices and the physical markets. They represent the spot prices compared to the actual demand from the US Mint.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.