Venezuelans have just been experimenting one of the risks associated with paper money.

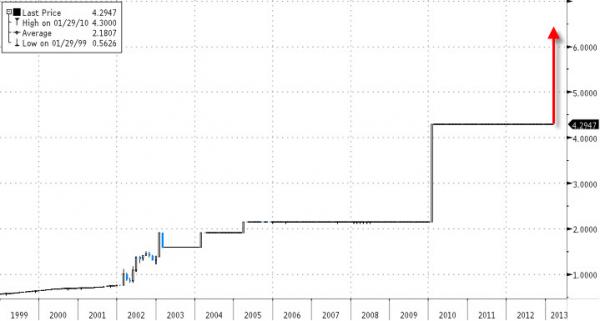

Actually, they just lost 46% of their purchasing power in a single day, following the Venezuelan government’s decision to devaluate the bolivar by 46%, from 4,30 to 6,30 bolivars (to the dollar).

The currency war to the bottom is raging on the international scene but, contrary to other countries (Europe, USA, Japan) using obscure language, like ‘quantitative easing’ and so forth to hide the reality of constant devaluation from their people, Venezuela has just released a very powerful bomb by announcing this radical devaluation.

Principally, what monetary devaluation does is lighten the debt load and boost exports, thus internal growth. In this context, certain currencies drop more slowly than some, but they all drop eventually, which, incidentally, explains gold’s performance in all of the currencies over many years.

To be perfectly clear :

1 • Venezuelans holding their capital in bolivars instantly lost 46% of their purchasing power.

2 • Those holding their capital in physical gold, inversely, just saw their purchasing power gain 46%.

3 • As Zerohedge points out, this phenomenon is going on now, but in a more insidious and progressive way in all the « developed » countries that are adopting exponential monetary printing policies. But it can also happen in a more radical or unexpected manner, like it did in Venezuela, in the months and years to come, in any country or monetary zone.

Venezuela is not an isolated case. Holding physical gold is a concrete way of protecting oneself from the governments’ irresponsability with monetary policies.

For any investors who would still have questions about the interest of holding physical gold, even in this context of price consolidation of the last few months, this very real case in Venezuela should clear any doubts and bring a clear answer.

In conclusion, let’s recall that it is impossible for any country or monetary zone to radically devaluate physical gold, while it’s potentially the case with all fiat currencies.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.