Falling Markets, Rising Inflation & Invisible Wealth

Egon von Greyerz and Matthew Piepenburg, swap thoughts on the bearish decline of U.S. risk assets along side an equally painful rise in inflationary forces.

Read article

Egon von Greyerz and Matthew Piepenburg, swap thoughts on the bearish decline of U.S. risk assets along side an equally painful rise in inflationary forces.

Read article

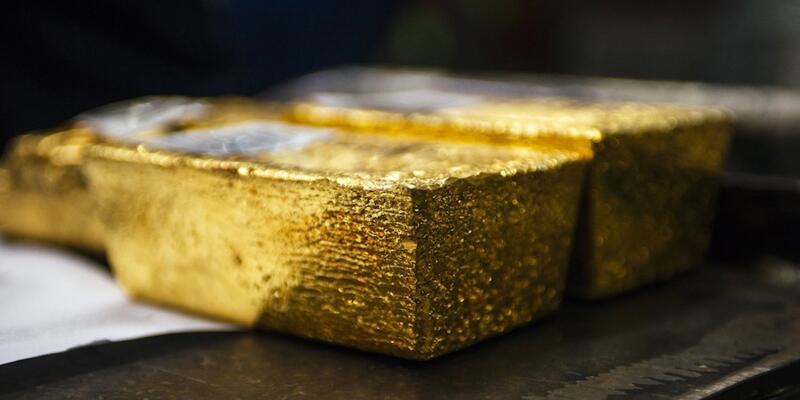

Investors who exited the stock markets early enough will have to re-invest their cash somewhere. However, the stocks are falling and so are the bonds. The safety is certainly to place them in the precious metals, whose charts and fundamentals are extremely reassuring.

Read article

The intensity of the bond market's decline is unprecedented. Bloomberg's Aggregate Index, which measures a basket of more than 28,000 bonds, has lost more than 15% since the beginning of the year, a drop not seen since the 1970s.

Read article

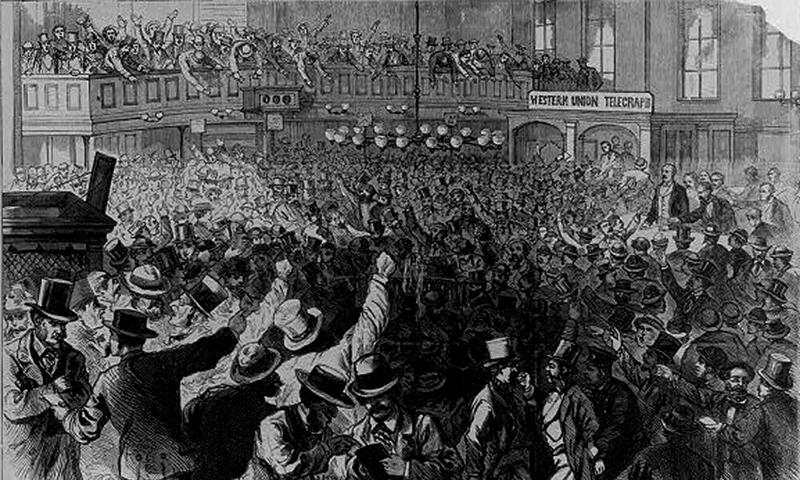

Gold is known for its rarity and reliability. However, the usefulness of gold has not ceased to evolve over the last few centuries. Both an object of desire and speculation, gold has experienced several panics synonymous with crashes or price explosions. In the 19th century, financial markets were l...

Read article

Inflation is here to stay. But the question now is: can it degenerate into hyperinflation?

Read article

The recession forecasts is leading many speculators to bet on the coming fall in commodity prices. this strategy of short selling on commodities is coming up against a problem of physical supply. In metals, reserves on the London Metal Exchange have never been so low, and the latest correction has o...

Read article

This article will discuss if investors in coming years really have more than the Hobson’s choice of one. Gold has been one of the top performing asset classes in this century and still nobody owns it with only 0.5% of world financial assets invested in gold.

Read article

Gold is logically regaining its stable monetary value in an increasingly tense geopolitical context, at a time when the energy future of the European continent poses many questions and when the risks of stagflation have never been so great since the Second World War.

Read article

Gold remains a strong competitor. The yellow metal is particularly popular with countries that want to de-dollarize. Central banks that bypass the dollar system of financing are the ones that have bought the most gold over the last twenty years. The acceleration of de-dollarization will therefore in...

Read article

The risk is there: "the most fragile countries are not Italy or Spain, but France, Greece and perhaps Portugal." What the Greeks experienced in the 2010s - and they are still paying the bill - could soon happen to the French.

Read article

The difference between the number of certificates and the investment in physical metal is now very clearly marked. At a time when the situation on the physical stocks of industrial metals and precious metals is becoming more and more tense every week, it is finally quite logical to see so many inves...

Read article

Rising wages, falling productivity: inflation is not transitory and is becoming uncontrollable for the Fed, because it is linked to a problem in the supply of raw materials.

Read article

Gold is as cheap today relative to US money supply as in 1971 when the price was $35 and in 2000 when gold was $290.

Read article

Monetary policies are often analyzed in terms of their impacts or correlations with macroeconomic indicators, such as GDP, unemployment or the balance of payments. They are more rarely analyzed according to the consequences they generate at the individual level.

Read article

Christine Lagarde's denial, its refusal to raise the key rate, and its apathy towards inflation, will prolong the weakening of the euro against the dollar, thus creating an additional cause of inflation (raw materials being paid in dollars, the fall of the euro mechanically increases their price). B...

Read article

Inflation figures will probably still be very high in Europe and the United States, especially because of record high fuel prices. But it is the Japanese inflation numbers that now need to be scrutinized.

Read article