Bridgewater Sees Gold Rising 30% to $2,000

Bridgewater’s co-chief investment officer Greg Jensen told the Financial Times that gold prices could rally to $2,000 an ounce.

Read article

Bridgewater’s co-chief investment officer Greg Jensen told the Financial Times that gold prices could rally to $2,000 an ounce.

Read article

Gold targeting $1700+, possibly $1800 area. Silver somewhere in the $20-$22 range, with $24-$28 a possibility.

Read article

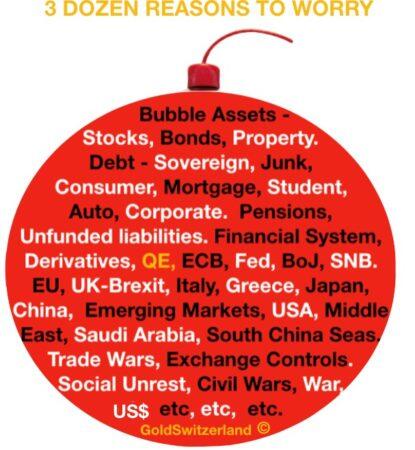

Whether the global economy will turn down early in 2020 or the euphoria will continue for a while is irrelevant. What we do know is that risk is at a maximum and therefore it is absolutely critical to protect your wealth. Throughout history physical gold has acted as the best financial risk insuranc...

Read article

If I’m talking about Caracas, it’s to draw a parallel with Wall Street. In Venezuela, the stock market goes up because the currency devalues... The same is true in New York.

Read article

Ronald Stöferle and Egon von Greyerz, discuss at the Precious Metals Summit in Munich, Germany, the massive risks of the world’s financial system. The two precious metal experts, share their view about how to deal with the profound downside threats and its implications for the global economy.

Read article

Gold is now a major bullmarket as evidenced by its strong breakout from a giant 6-year long base pattern in August. The larger trend is up. We had thought that it might react back closer to the breakout point before turning higher again, but it didn’t, and started higher again in recent days over th...

Read article

2020 seems to be the very early beginnings of the worst global depression that the world has ever experienced. It will be devastating for everybody. We can all prepare financially by holding some physical gold and silver which is the best insurance anyone can buy against what is coming.

Read article

Since January 1, 2019, gold has recorded a 21.7% return in euros, 16.4% in dollars and an average of 17.8% in the various currencies considered. Since 2001, this represents an average annual performance of 9.6% in euros, 10.4% in dollars and 10% on average. Is the "barbaric relic" sending us a signa...

Read article

The end of the year should see silver prices rise sharply. One thing is certain, 2020 and 2021 will mark a major turning point in the History of money. Hang on to your precious metals. They are your security in the mess ahead.

Read article

Charts laying out my views for the gold price in 2020 and beyond.

Read article

Gold’s impressive advance in 2019 -- aided by trade war frictions, easier monetary policy across the world’s leading economies and sustained central-bank buying -- may be set to spill into the new decade.

Read article

Gold - very similar pattern to our last big breakout and $150+ advance.

Read article

When stock markets fall, precious metals will continue their secular bull market which initially started in 1971 with the last leg starting in 2000. Anyone doubting that we are in a bull market needs to look at the annual charts of gold in US dollars and Euros.

Read article

China's gold reserves stood at 62.64 million ounces (about 1,948 metric tons) at the end of November, central bank data showed Saturday. Chindia and Silk Road gold demand.

Read article

Mongolia's central bank announced on Tuesday that it has bought a total of 14.4 tons of gold from legal entities and individuals in the first 11 months of this year.

Read article

If gold reaches $12,000 by say 2025, Viktor’s wealth will during a 55 year investment period have gone from $10,000 to $1 billion which is a return of 10 million percent. Quite remarkable for just taking 6 investment decisions during his 50 year life as an adult.

Read article