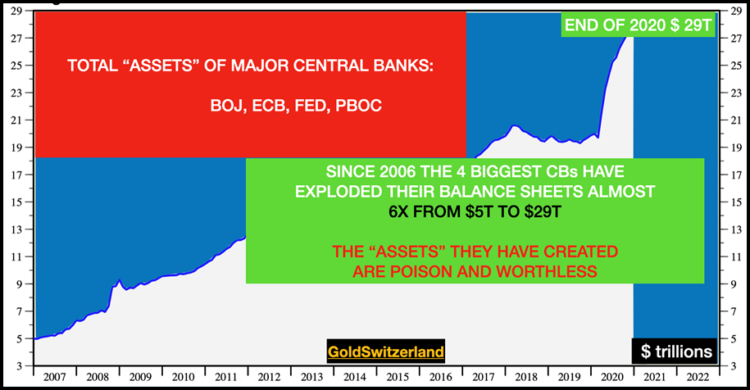

Calling The Holdings Of Central Banks “Assets” Is A Travesty

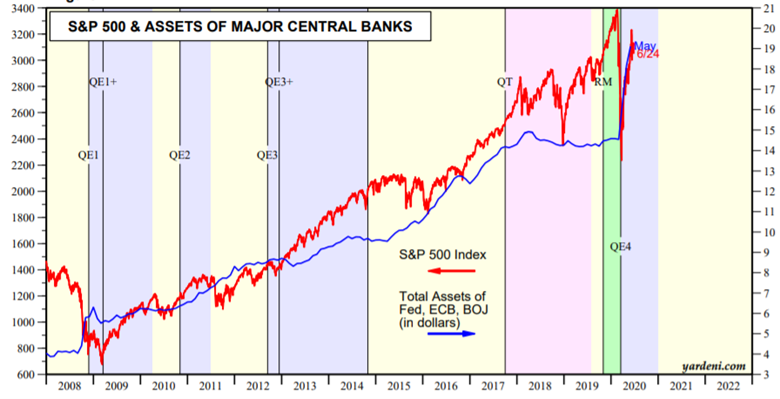

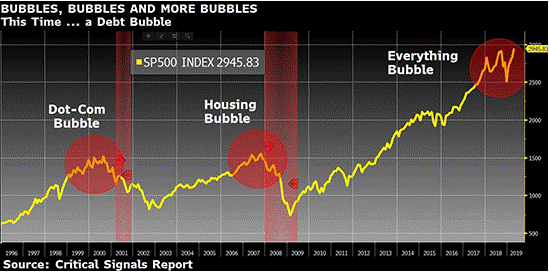

When a world already in trouble was hit by a severe financial crisis in September 2019, the dose of debt was already excessive. But as the Fed and the ECB opened the money spigots fully, they filled the world with poisoned or fake money. The BY team (Biden & Yellen) will now be certain to finish thi...

Read article