Keep It Simple: Gold vs. a Mad World

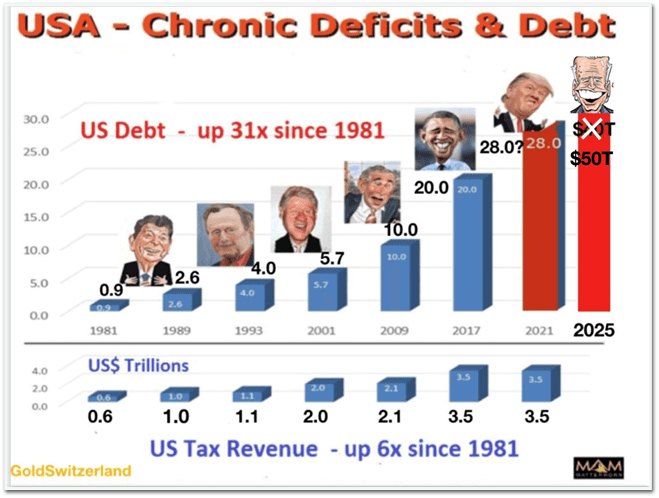

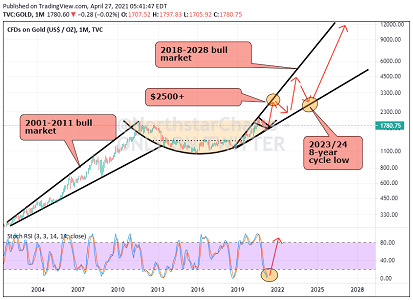

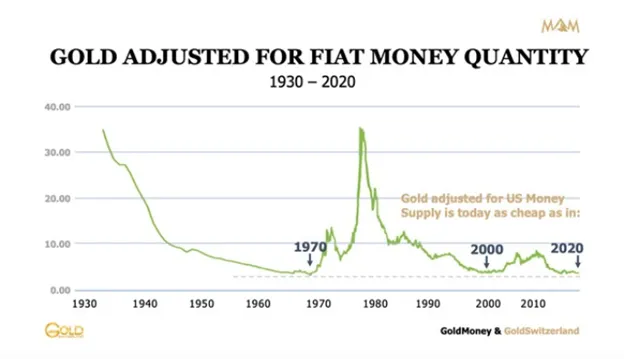

Those looking to swing at a fat pitch and invest for the long term in an asset that will rise in price while simultaneously hedging against now obvious inflation and equally obvious currency debasement, the gold solution is axiomatic rather than theoretical or speculative.

Read article