There is no doubt that our actual international monetary standard based on the US dollar, in place since the breaking of the Bretton Woods accords in 1971, is living its last days. What will replace it?

On August 15, 1971, Richard Nixon, United States President, addressed the nation announcing the "temporary" suspension of the dollar's convertibility into gold. In the address, he also stated, “In full cooperation with the International Monetary Fund and those who trade with us, we will press for the necessary reforms to set up an urgently needed new international monetary system.” Forty years later, nothing has been done. The « temporary » suspension has become permanent. Since 1971, the world is operating on a dollar system solely based on the integrity of the U.S. debt. Excessive debt, especially in the United States but also in the rest of the world, has just reached its limits. The 2008 crisis was just the start of the end game.

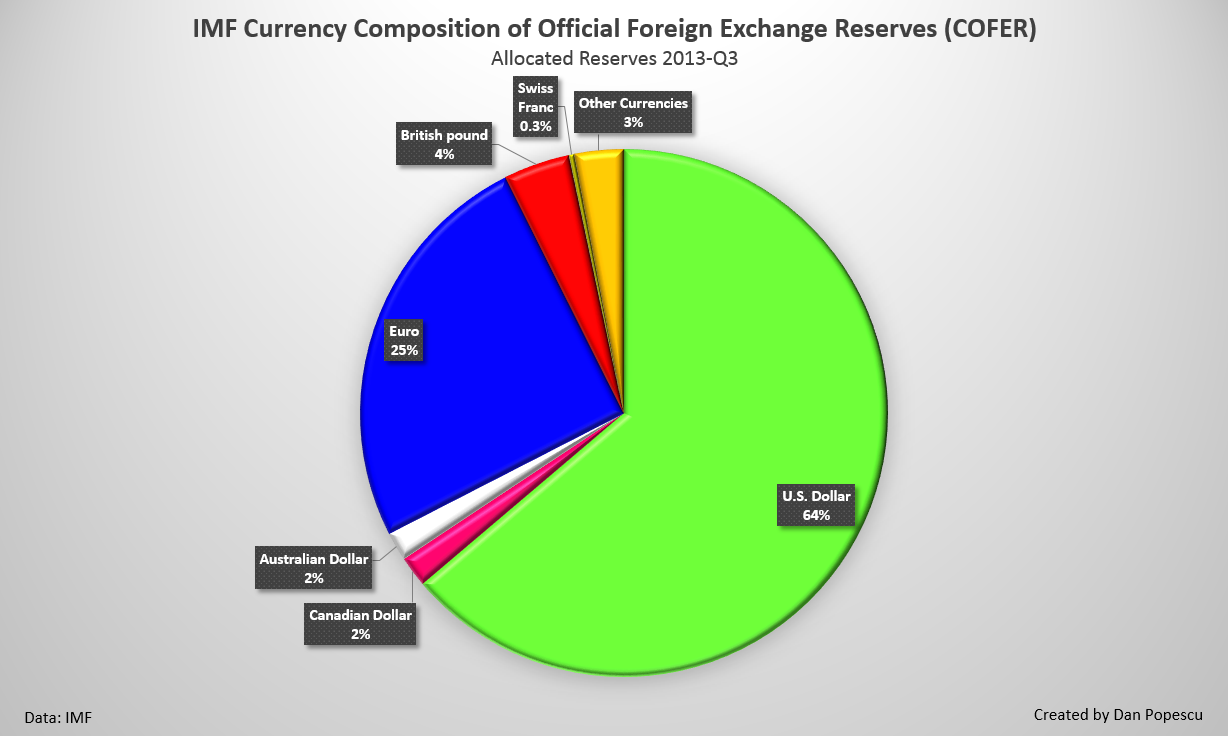

In chart #1, we can see how foreign currency reserves are distributed at the IMF since 2013. We observe that the US dollar, at 64% of the total, and the euro, with 25%, largely dominate. In 2000, the dollar reached a maximum of 71% of the reserves.

Chart #1 : IMF Foreign Reserves by Currencies (COFER)

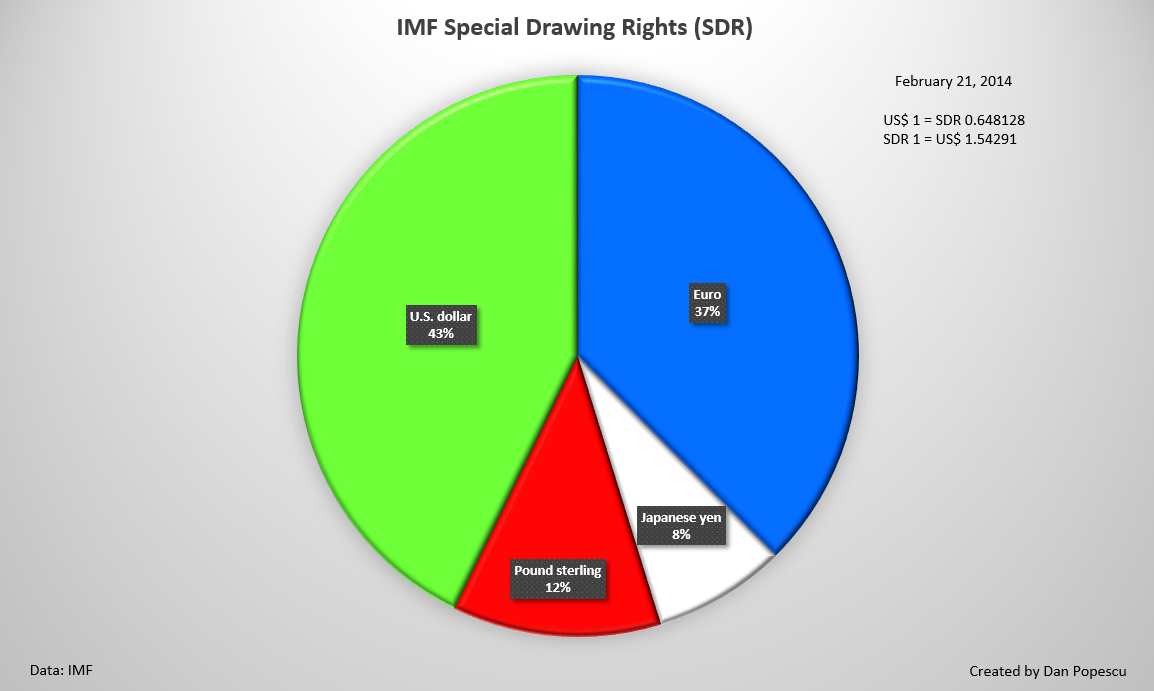

Special Drawing Rights (SDRs) were created by the IMF in 1969. Originally, the value of an SDR was defined as equivalent to 0.888671 grams of fine gold (0.028571oz) which, then, was also equivalent to a US dollar (1oz of gold = 35 SDRs = US$35). Anyhow, after the gold exchange standard, commonly called Bretton Woods in 1973, SDRs have been redefined as a basket of currencies, today comprising of euros, Japanese yens, British pounds and US dollars. The SDR rate in US dollars is posted every day on the IMF’s website. It is calculated as being the sum of a specific amount of the four currencies in the basket, rated in US dollars based on the exchange rate fixed at noon, each day, on the London market.

Chart #2 : IMF’s Special Drawing Rights (SDRs)

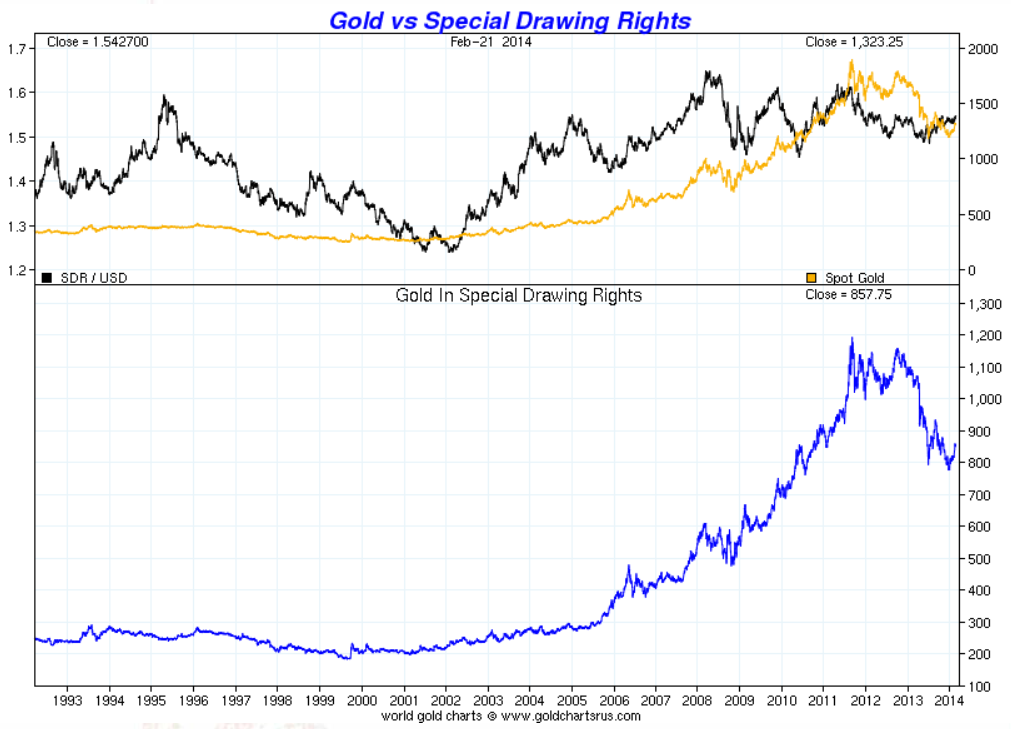

Today, since December 2010, the value of one SDR equals the sum of 0.423 euro, 12.1 yens, 0.111 British pound and 0.66 US dollar. On February 21, 2014, one SDR was worth $1.542905, an ounce of gold was worth 857.75 SDRs, and it was worth $1,323.25. This clearly shows the devaluation of paper currencies compared to gold since 1971 (-2,450.71%).

Chart #3: Gold vs Special Drawing Rights Gold in SDRs

According to the statutes of the IMF, member countries are forbidden to tie their national currency to gold. This is the reason why Switzerland was forced, when it became an IMF member in 1992, to abandon its 40% gold coverage of its currency which was until then written in its Constitution. SDRs are neither a currency, and neither are they IMF-issued credits. It is rather a potential claim on the free-floating currencies of the IMF members. China is the only one of the six large world economies whose currency (Yuan) does not have reserve currency status.

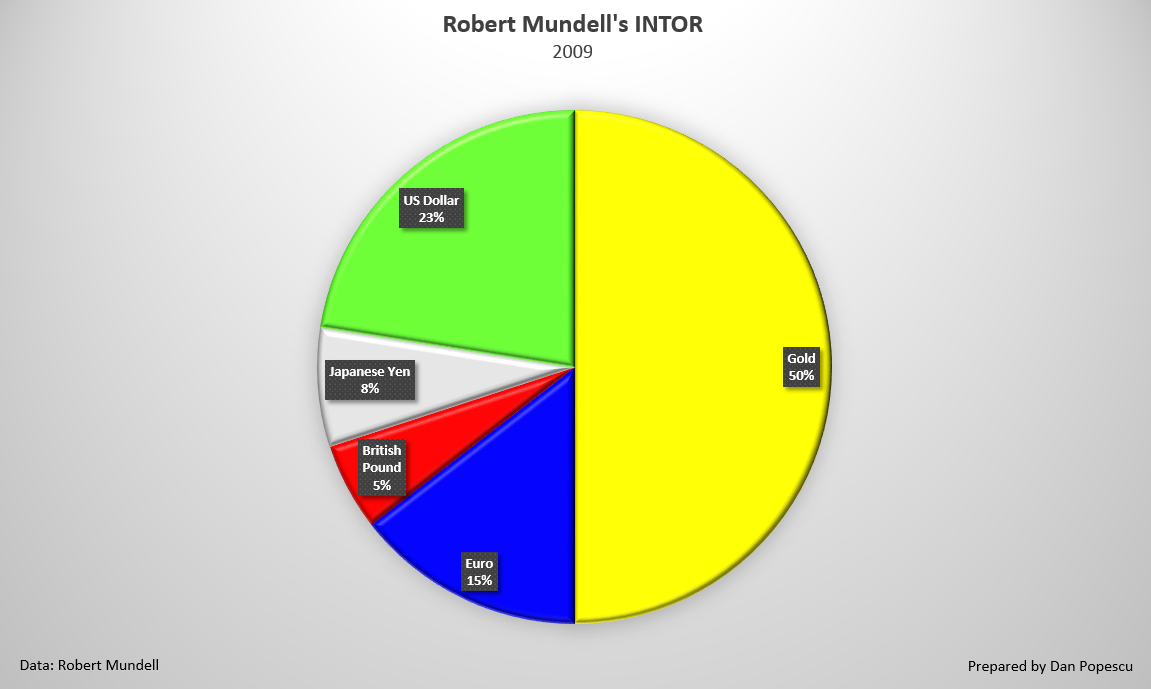

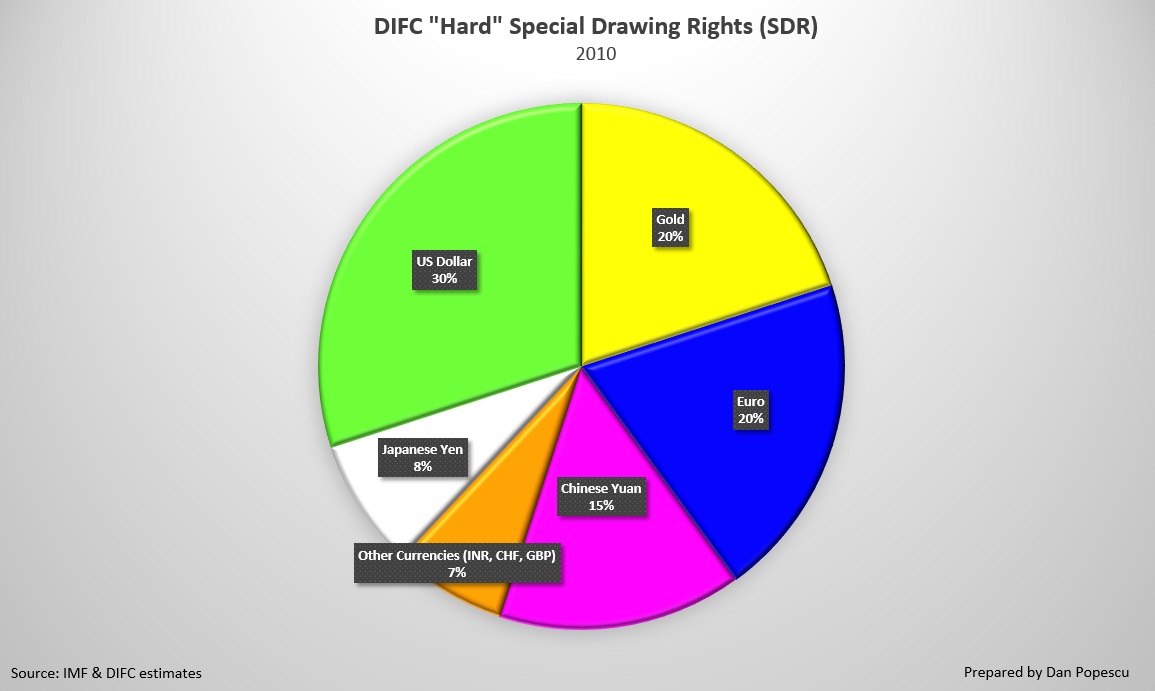

It seems that there are secret negotiations going on at this moment under the auspices of the IMF and the Bank for International Settlements (BIS) in order to prepare for a new international monetary system. Many scenarios exist, from creating an international paper currency, still based on a basket of currencies like the SDRs (chart #3), but that would include the Chinese Yuan and other currencies from developing countries (Russian ruble, Indian rupee, Brazilian real, South-African rand), to an SDR that would also include a percentage of gold (charts #4 and #5). Robert Mundell, Nobel Prize laureate in economics, was already proposing an international currency in 1998, the INTOR, comprising 50% of gold and a basket of paper currencies (chart #4), while Dubai’s DIFC, in a 2010 study, was proposing 20% in gold.

Chart #4: Robert Mundell’s INTOR

Chart #5: « Hard » Special Drawing Rights of the DIFC

Robert Zoellick, former chairman of the World Bank, in a Financial Times article in 2010, was also proposing an SDR, but tied to gold. It looks similar to what existed when the dollar was linked to gold before 1971. Bank of China’s governor Xiaochuan is proposing to develop SDRs as a « super-sovereign » reserve currency, disconnected from any particular country and able to remain stable on the long term. In view of the massive gold buying from China, it is obvious that a link to gold is part of China’s strategy.

All of those scenarios pre-suppose preparations, along with an international conference, before a major monetary crisis occurs. Obviously, the current system has been quite profitable for the United States, and that it does not wish for profound changes. « The dollar may be our currency, but it’s also your problem ». This U.S. position, aptly expressed in 1973 by John Connally, U.S. Treasury Secretary, in a speech to Europeans, still seems to be predominant today.

If a monetary crisis and a crash of the current fiat system based on debt occur, then the chances of negotiating a solution will become thinner and thinner, and a de facto standard will impose itself. What will it be? It is the one already here, in the shadows when everything is fine, and shines when disaster strikes... and that has been there for 5,000 years: gold that is (or gold and silver).

According to a study from the OMFIF: “The role of gold is likely to be bigger in the transition period to a multiple reserve currency system than when such a system is in existence; in both cases, it will be greater than today.”(1) Also, “History shows that the fall in the value of one reserve currency does not necessarily translate into a rise in the value of others. Instead, turbulence for one reserve currency may well spell turbulence for all, prompting markets to seek a non-currency safe haven. The answer, usually, is gold.”(2)

Jim Rickards, author of Currency Wars, states in an article, “When all else fails, possibly including a new SDR plan, gold is always waiting in the wings as a stable, widely accepted store of value and universal money. In the end, a global struggle between gold and SDRs for supremacy as “money” may be the next great shock added to the long list of historic shocks to the international monetary system.”(3) Gold’s role will be much more important during the transition period to a new international monetary system than afterwards.

As far as I am concerned, I cannot conceive, just like General de Gaulle, president of France (in his 1965 speech, at the end of the « gold exchange standard »), that « there might be any criterion, or standard, than gold. Yes! gold, that is never altered, that can be made into bars, ingots or coins, that has no nationality, that has been held, eternally and universally, as the most excellent unalterable and fiduciary value ».(4)

Throughout the centuries, in countries being much different, economically or politically, whether the price was fixed or free, gold has maintained its real value and has remained constant despite significant fluctuations over short periods.

Gold Standard – 1kg – 51.9 cm³

“The main thing we miss today is universal money, a standard of value, the link between the past and the future and the cement linking remote parts of the human race to one another.”(Robert Mundell) (5) The world is in need of a monetary standard that would be constant in time and space, like the meter (distance), the liter (volume), the kilogram (mass), the hour (time) or the degree Celsius (temperature), and would be linked to others (e.g. 1kg/51.9cm³).

It is impossible now to know what system will be chosen, or which one will impose itself, because it all depends on the chain of events that will trigger the end of the current « dollar » system based on debt (mainly U.S. debt). The United States will be the last country to accept a reform that would eliminate the « exorbitant privilege » (6) offered by the present system, and it will make no proposition to stray from the current system. This system maximizes its stronghold. It is however certain that the gold price will rise sensibly until a new monetary system is in place.

Notes:

(1) OMFIF, Gold, the renminbi and the multi-currency reserve system

(2) OMFIF, Gold, the renminbi and the multi-currency reserve system

(3) James Rickards, Currency wars and a growing role for the International Monetary Fund (chapter 7), Currencies after the crash, Sara Eisen, Editor

(4) Charles de Gaulle on gold and the monetary system: http://www.les-crises.fr/de-gaulle-smi-1/

(5) Citation from Robert Mundell in The Power of Gold, Peter Bernstein

(6) Valéry Giscard d’Estaing, French finance minister

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.