One cannot understand gold without understanding its supply side. Although gold production accounts only for 1.64% of existing above-ground gold, it still represents 64% of the gold market supply. Can we predict the price of gold by observing the gold mining index? As a reference for this article, I have chosen the Barron’s Gold Mining Index (BGMI), since it has been published since 1940 and thusly provides a long basis for analysis.

Firstly, one has to know that shares of a mining company are not the same thing as physical gold. The share prices are derived from the price of gold, but also from other factors. Those are companies managed by fallible people facing multiple corporate risks. Several things have to go right within those structures in order for individual shareholders to profit from the price of gold. Gold is liquid money without any counterparty risk, whereas mining companies’ shares are an investment. Gold protects capital whereas shares can increase it considerably, but with the risk of losing it. There is a 40% volatility in the gold mining shares, whereas the correlation between gold mining shares and physical gold is around 0.642.

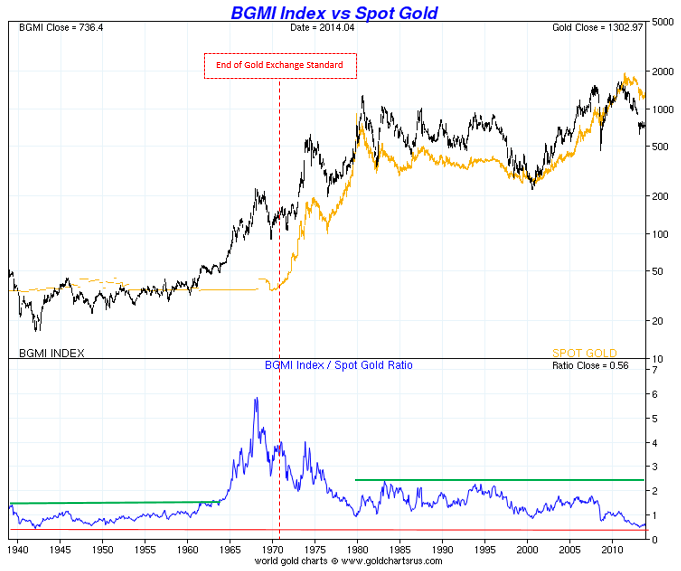

If we look at chart #1, we can see that the BGMI index signaled the start of the rise in the gold price in 1960 nearly ten years before it started. However, one has to know that at that time, the gold price was fixed, whereas the prices of mining shares were floating. Investors had rightly predicted that such a situation could not last and that the gold price had to be readjusted higher or liberated. We also see that the increase in the prices of mining shares, compared to the one in gold, has diminished after the closing of the « gold window » by the United States. In 2000, this gold mining index hasn’t signaled the start of a new bull market, but it coincided with the start of gold’s bull market. We can see that, once the shock of liberating the price of gold has subsided, the price of the mining index in ounces of gold has stabilised. It is now at its lowest level since 1943.

The market being an aggregate of very differentiated opinions, the theory goes that it can predict the future of the economy. This implies a diversity of opinions and an absence of collusion. Conditions for « crowd wisdom » are diversity, aggregation and stimulus. If only one of those elements is missing, there is no crowd wisdom, but rather collective madness. Crowds are wise under these conditions, but they become mad when diversity disappears. In such a case, crowds act like herds. Diversity always disappears in the midst of uncertainty. Since 1980, and even more so since 1990, financial markets have been dominated by almost 80% of institutional investors using more and more computer systems to execute their trades, whereas before 1980, individual investors dominated the market. Since most institutional investors use the same quantitative approaches or very similar ones, there is no more diversity (needed for wisdom of the crowds), and financial markets have become herds that follow the trend. Thus, it has become difficult and even dangerous to trust market signals. This time, the signal of a new gold bull market will not come from the gold mining indices. It will be the opposite, in fact. Gold will be giving the signal of a new bull market, money will then flow in the mining companies, and they will outperform.

Chart #1: BGMI Share Price vs Gold Spot Price – BGMI Share Price in Ounces of Gold 1940-2014

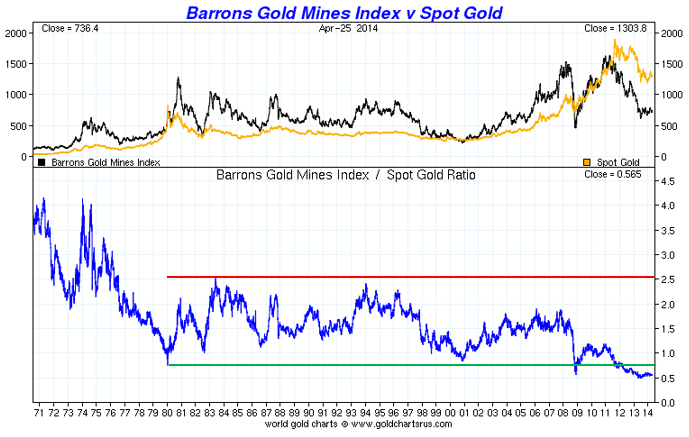

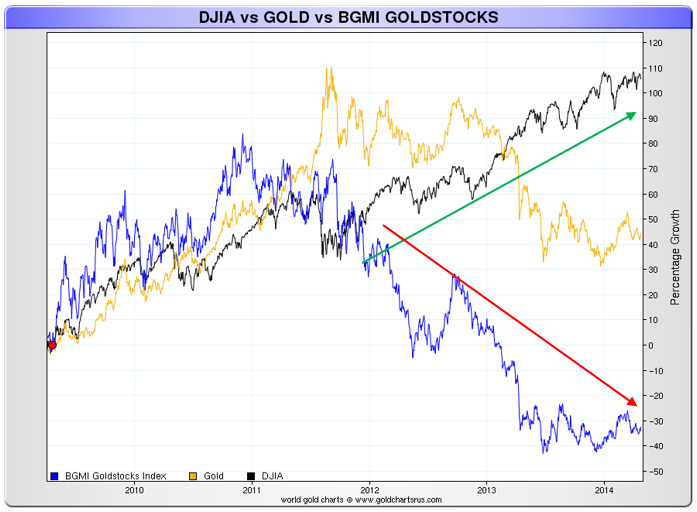

Chart #2: BGMI Share Price vs Gold Spot Price – BGMI Share Price in Ounces of Gold 1970-2014

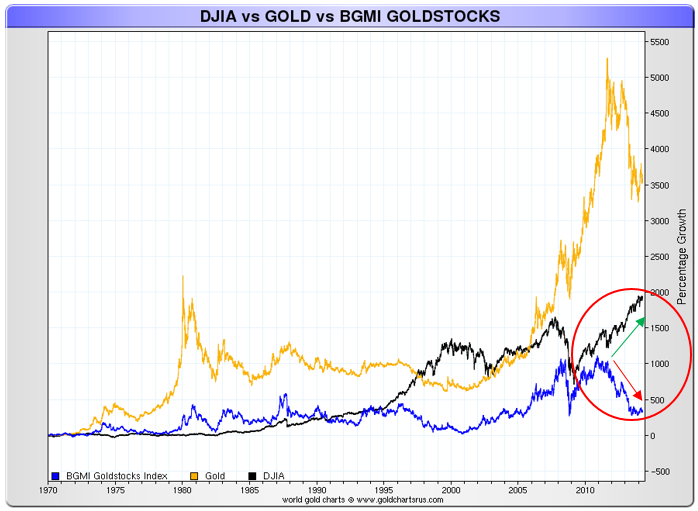

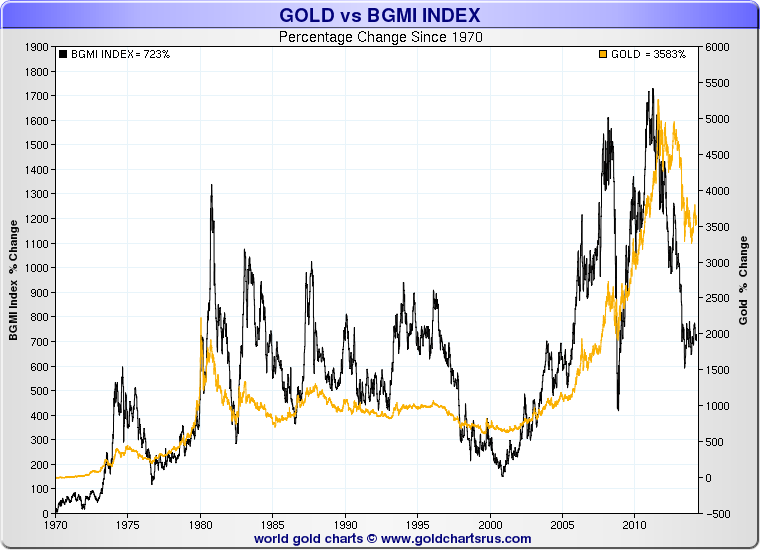

I have always considered gold not as an investment, but rather as hard liquid money. Real tangible money with, above all, no counterparty risk. If there is something I agree with Warren Buffett on, it is that I don’t invest in liquid money, but in businesses, companies or industries. I find refuge in liquid money, above all in gold, when risks are too high and I don’t see any interesting investment opportunity. This does not exclude the possibility of speculating on currencies or commodities (gold, silver, oil, dollar, euro etc.) on the very short term. If I want to invest in gold or silver, I buy shares or businesses linked to gold or silver, such as mining companies, precious metals storage companies, precious metals brokers, jewellers, etc. It needs to be said that there has been times where liquid money has been king. It is said that, in a financial bubble, ‘gold is trash’, while in a financial crisis, ‘gold is king’. There are rare periods in which risks warrant finding refuge in the safest liquid money, or gold, that is. I believe we are in one of those periods. If we look at the long-term performance of the gold mining shares index since 1970, we see that it is closer to the general stocks indices like the Dow Jones Industrial than to the price of gold. In chart #3, we can also observe, since 2008, a divergence between the gold price and the mining companies versus the DJI. I believe that the start of a bear market on the DJI shares will act as a trigger of a new bull market in gold and in gold mining companies. In a recent article, I analysed the Dow Jones Industrial Index vs Gold, which demonstrates the negative correlation between the gold price and the DJI. This gold bull market should correspond to a major fall of the US dollar along with a monetary system crisis.

Chart #3: Dow Jones Industrial Index vs Gold Price vs BGMI Index (growth in percentage)

Chart #4: Dow Jones Industrial Index vs Gold Price vs BGMI Index (growth in percentage)

In chart #5, we can see that the volatility of returns on mining companies is much higher than that of the gold bar since 1970. This indicates that, in a bull market, mining shares will outperform gold, though with much more risk involved. It is becoming more and more costly to find gold and extract it. In the last decade, we have seen production costs increase very rapidly, which has greatly limited the mining companies’ performance, even in a gold bull market.

Chart #5: Gold Price vs BGMI (variations in percentage)

Ever since I was a little kid, I have always been told to have from 5% to 10% of my savings in gold and hope never having to use it. Gold, as ex-Fed chairman Alan Greenspan so aptly says, is « in extremis » money (gold is the money of last resort), whereas gold mining companies shares are an investment, which entails risks and a certain correlation with the Dow Jones Industrial Index.

« I’m more worried by the return of my money than the return on my money. » Will Rogers

Charts courtesy of Nick Laird, www.sharelynx.com

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.