Since the start of this gold correction, the bearish arguments I hear are that there is no risk of hyperinflation or even inflation, but rather a risk of deflation (or a negative inflation rate, not to be confused with a lower rate of inflation increase, or disinflation).

What to make of it? First, let us define what we mean by inflation. In general, inflation is defined as an increase in the price of most goods and services. But what causes this increase? The price increase occurs, as an after-effect, because of an increase in the amount of money in circulation. And this happens when a central bank issues more money than is necessary for the transactions of goods and services. Instead, what happens in that case is rather a loss of value of the currency (dollar, euro etc.) due to its increased supply, rather than a change in the supply and demand of said goods and services.

In a period of deflation, the value of money increases and interest rates become negative, so people wish to keep some cash out of the banking system. This is catastrophic for the banking system and may even lead to its destruction. This is why deflation is the greatest enemy of the bank of banks, the country’s central bank. The most widely known, the United States Federal Bank, or the Fed, through its Chairman Ben Bernanke, has even proclaimed deflation to be the enemy number one for several years. However, after a prolonged period of leverage comes a period of deleverage that may lead to a period of deflation.

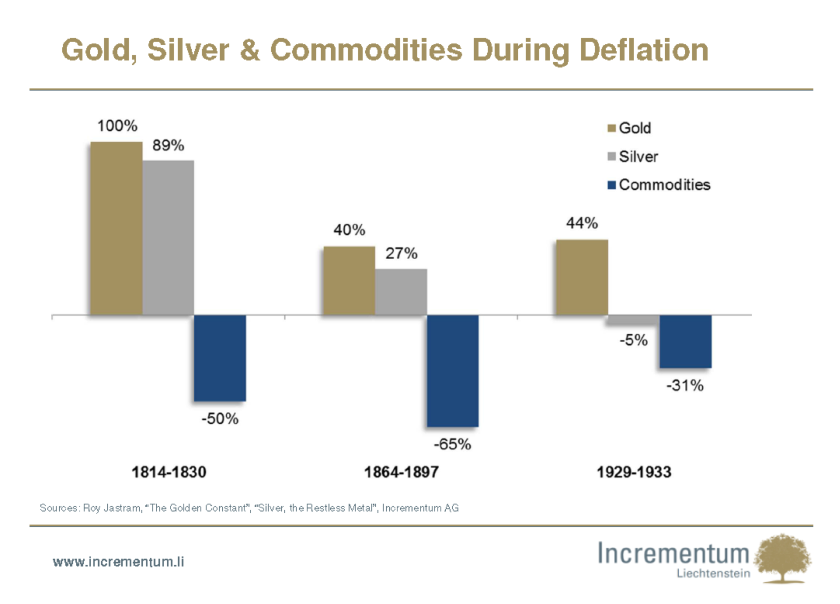

How did gold react in the prior periods of deflation? Roy Jastram, author of an excellent book on gold, The Gold Constant (1), has identified three major periods of deflation : 1814-1830 (16 years), 1864-1897 (33 years) and 1929-1933 (4 years). The only monetary parameter that stayed constant throughout those periods has been gold. A given quantity of gold would have been traded for 80% more commodities in 1896 in the United Kingdom than twenty years sooner. Between 1920 and 1933, prices fell to their lowest level in British history. Gold reacted by increasing in price at the same time as the commodities until it peaked in 1920. The gold price index has stayed constant, within one decimal, for 90 years. Then, between 1918 and 1920, it jumped by 33%.

Roy Jastram concludes that, during periods of major deflation, the operational value of gold increases. He also concludes that gold maintains its purchasing power over long periods of time (half-century intervals), not because gold moves toward commodity prices, but because commodity prices return to gold.

By de-stabilising the banking system and the monetary system, deflation creates a period of chaos and uncertainty, which is quite positive for the price of gold. Gold is the only money that is real and has no counterparty risk, contrary to paper currencies based on debt. During a period of deflation, there are many banks that go under, so people tend to keep their money outside the banking system and, preferably, in gold and/or silver.

In conclusion, it is not necessary to have a high rate of inflation or hyperinflation, as we often read in the media, for the gold price to take off. Even deflation can generate a major increase in the gold price. The only negatives for gold would be disinflation and moderate inflation.

Bibliography :

1. Jastram, Roy, The Gold Constant, 2009

2. Stöferle, Ronald-Peter, Incrementum Chartbook “Gold Bull and Debt Bear”

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.