Investing Basics

Bars

Coins

Ownership

Storage

Gold & Silver in USA

Gold Market

Paper Gold

More Info

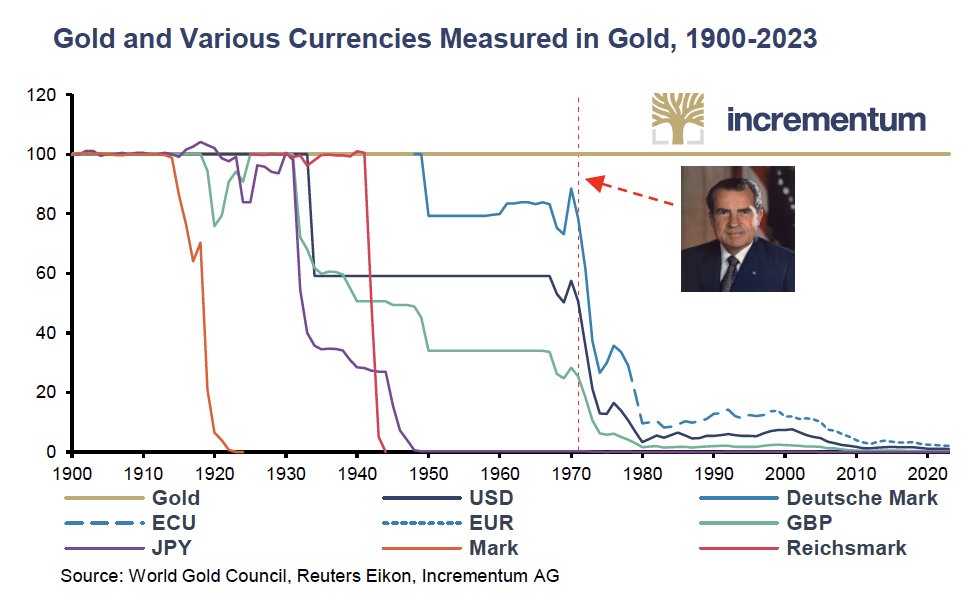

As history has shown, physical gold is a better long-term store of value than any currency. The yellow metal has traditionally been considered the ultimate safe-haven asset for preserving purchasing power.

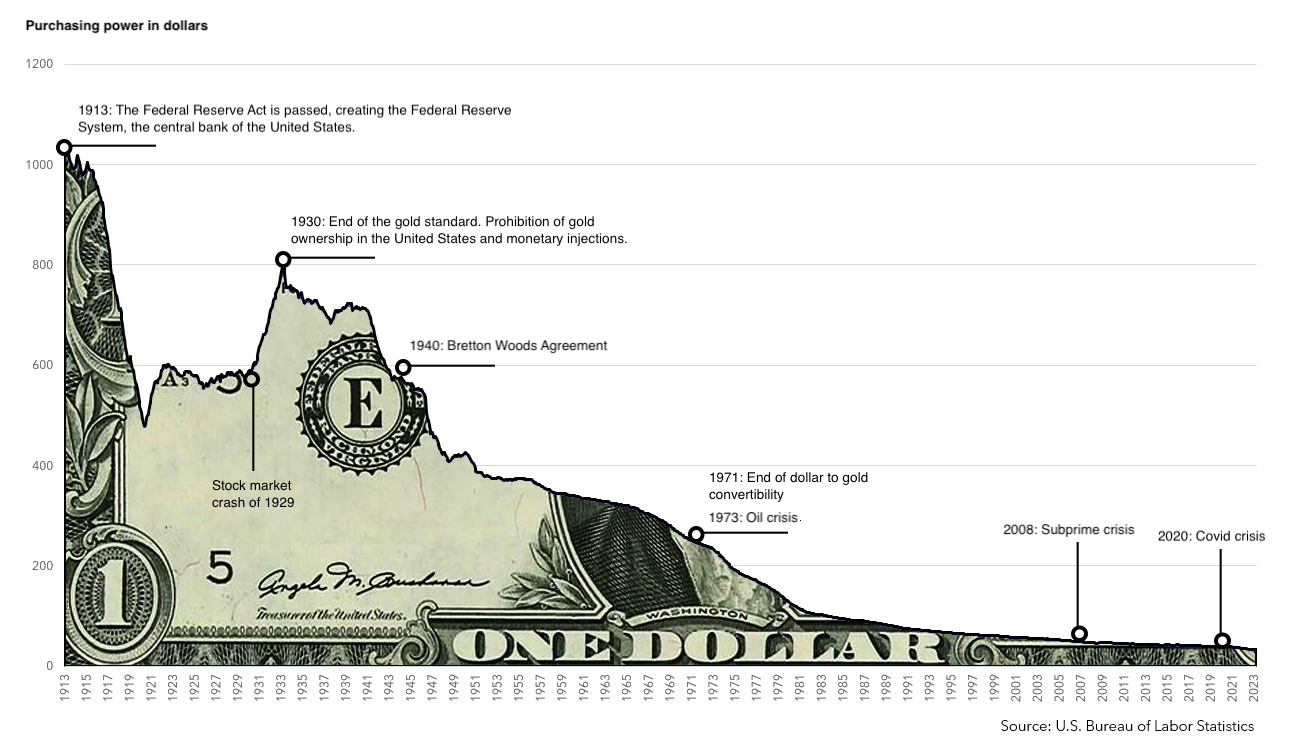

Currency devaluation has accelerated dramatically since the end of the gold standard. Under this system, the value of a currency was directly linked to a fixed quantity of gold in circulation. The gold standard made it more difficult for governments to create money excessively, which greatly encouraged its abandonment and accentuated the depreciation of the dollar.

The trivialization of liquidity injections into the economy is unlikely to slow down the currency devaluation machine, which has been in operation for almost a century now.

The more money in circulation, the less it will retain its value. When the quantity of money in circulation increases rapidly, this naturally leads to higher inflation, which in turn leads to a real decline in purchasing power. In other words, each unit of money allows you to buy fewer goods or services than before...

In reality, there is no such thing as an inflation of prices, relatively to gold. There is such a thing as a depreciated paper currency.

Unlike fiat currencies, physical gold has an intrinsic value that has been recognized for thousands of years (the first gold coins were minted in 212 AD in the Roman Empire). It has proven its relevance over time.

To illustrate that gold maintains its value and therefore its purchasing power over several centuries, gold specialists like to tell the story that in ancient Rome, with an ounce of gold, a notable could buy a fine toga as well as a belt and espadrilles. And that 2000 years later, with an ounce of gold, or around $1,900, you can still dress elegantly in a suit, shoes, shirt and tie. Similar examples exist with horses or cattle.

Gold offers excellent protection against the depreciation of fiat currencies, as we can see from this inflation-adjusted chart of gold in dollars:

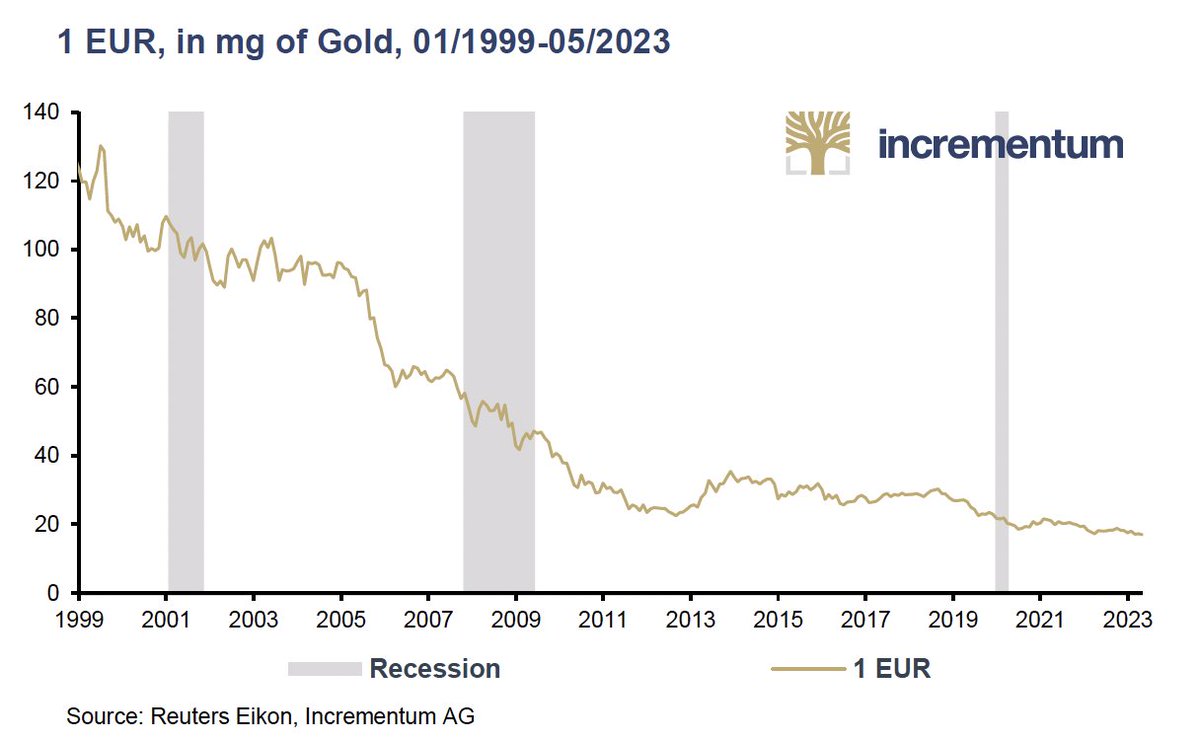

The price of gold in euros has risen by 555% since the creation of the euro:

As the quantity of gold on earth is limited, the yellow metal will continue to appreciate strongly over time, acting as a safe haven and an hedge to protect wealth against currency devaluation.

Why Do Currencies Lose Value Against Gold ?

The currencies can depreciate against gold due to several economic and financial factors. Here are some common reasons why currencies may lose value against gold:

- Inflation: When there is a widespread increase in the prices of goods and services in an economy, it is referred to as inflation. If inflation is high in a country, the value of its currency may decrease compared to gold, which is considered a tangible and stable asset. In other words, the amount of gold needed to purchase the same amount of goods and services increases, leading to a decrease in the value of the currency relative to gold.

- Accommodative monetary policy: When a central bank adopts an accommodative monetary policy by lowering interest rates or injecting more liquidity into the economy, it can result in a depreciation of the currency against gold. An increased money supply can reduce the currency's value in international markets.

- Budget and trade deficits: High budget deficits and persistent trade deficits can impact confidence in a currency as it may signal economic weakness. Investors may turn to gold as a form of value preservation in such circumstances, leading to increased demand for gold and a depreciation of the currency.

- Political and geopolitical instability: Political conflicts, geopolitical uncertainties, and economic crises can prompt investors to seek refuge in assets considered safer, such as gold. This can drive up the demand for gold and decrease the value of currencies in affected countries.

- Speculation and market sentiment: Market movements and speculations by traders can also influence exchange rates between currencies and gold. The overall sentiment of investors regarding the global economy and market prospects can lead to fluctuations in the relative value of gold against different currencies.

It is important to note that exchange rates and gold movements result from the complex interplay of numerous economic and financial factors. The relationship between currencies and gold can be dynamic and subject to changes depending on global economic circumstances.