Previously, we’ve seen that gold – first and foremost a form of anti-crisis insurance – is not a “generational” investment. It is meant to be sold at the right time rather than being transmitted. Previous gold bull markets have seen gold rise from 71% to 590% in US dollars, which leaves a lot of room for progression if the coming months were to validate the hypothesis of a new bull market.

But for the yellow metal to constitute real wealth insurance, it must be acquired through a commercial partner in position to offer a certain set of guarantees.

The easy solution for any Wealth Management Advisor (WMA): allow clients to buy physical gold via a bancassurer

Bancassurers are indispensable partners for wealth management professionals. As a WMA, you are already partnering with them for their life insurance contracts, trading accounts or stock market savings plans, or even for helping your clients raise funds.

So it’s only natural, then, to consider their “physical gold” offerings. What could be simpler than allowing a client to purchase gold coins or bars where he is already a client? Well, I think it’s a bad idea... And since there is no reason for you to take my word for it, I shall try to prove it to you.

It makes more sense for banks to sell phone packages than physical precious metals

If we are to believe an article from Les Echos, March 2017, “all bank networks offer their clients the purchasing and selling of gold, except Banque Postale.” Actually, there are few bancassurers hyping their precious metal offers. If you type on your favourite search engine “buy gold” followed by the name of a large French bank, you’ll barely find anything. Only LCL and BNP Paribas have a full web page on physical gold, but consisting mainly of general information on the yellow metal rather than commercial offers.

In 2013, as I was writing my gold market investment guide, Cortal Consors (BNP Baribas’ online bank) was the first bank broker allowing the purchase of physical gold online (since January 2011). Their offer was a package consisting of physical gold products (limited to Napoléons and bars), a safety box and insurance, in order to facilitate the steps associated with traditional banking offers. For reasons I cannot grasp, this “Online physical gold” offer won the innovation prize at the 2009 Forum de l’investissement. Cortal Consors has since stopped its activities, on May 1, 2016.

In 2016, a WMA, a colleague of mine, asked me what I thought of the “physical gold” offer from a bancassurer well known within the profession. Since this offer was only available for WMAs and online commercial support wasn’t available to the general public, I had then commented publicly the offer, without revealing the bancassurer’s name.

Why are banks so secretive on that subject, when they go a long way to promote their products, including those that have nothing to do with the core of their business, such as automobile insurance, phone packages and health care?

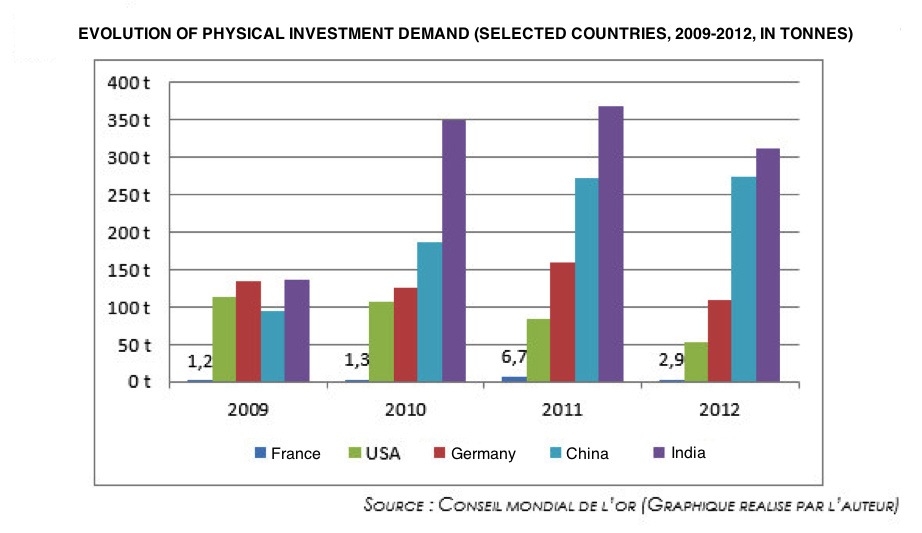

This chart may give us an answer:

The amount of gold purchased by the French savers is microscopic in comparison with other European countries and the United States and, even more so, with the two Asian behemoths, India and China. This state of affairs is not conducive to the development of innovative precious metals purchasing offers by the large bancassurers.

Consequently, it is much more probable that banking advisors become subcontractors for Netflix than starting to praise the virtues of physical gold to their clients and developing innovative commercial offers.

Bancassurers cannot offer the best service for physical gold trading

Actually, there was nothing “innovative” when Cortal Consors was awarded a prize for innovation. Since 2001, innovation is driven by new actors, independent from the banking and insurance sectors, whose exclusive specialty is precious metals trading and related services. The rise of Internet helped in reaching a more and more connected clientele. As you will see, it was easy for them to distinguish their offers of products and services from those of traditional actors.

Criteria for choosing a solution with maximum security when buying physical gold

There are more and more solutions for purchasing precious metals, but the criteria for maximum security remain the same, as I explained in great detail in the sixth chapter of my book:

- The seller must be established and have a good reputation;

- The seller must get his products from a provider close to the source of production (national mints);

- A large selection of coins and bars (no more offers limited to Napoléons and bars);

- Storage solution included with the offer, with essential criteria: 1) Storage external to the broker and outside of the banking system; 2) Account must be “segregated” with “allocated” assets (to reduce the counterparty risk to a minimum and have a clear indication of ownership of the coins and bars); 3) In a stable country that protects private ownership; 4) Storage with an established custodian; 5) Regular publication of audits by an independent and respected third party, or emission of storage certificates by a well-recognized storage company with the possibility of inspecting personally one’s precious metals;

- Possibility of taking delivery of one’s assets;

- Ease of purchasing and re-selling;

- Broker’s working language;

- And last but not least: charges associated with purchasing, re-selling and storage, since security has a price.

Finally, it makes some kind of sense that bancassurers have poor “physical gold” offers, since they have to develop offers that target as many clients as they can to bolster profitability, even if they stray from their main historic core business, and they are not to be blamed for it. However, have your clients subscribed to a phone package with their bank? I would guess that not too many did. “To each his own job,” as they say!

Goldbroker.com addresses all of the criteria listed above. In the next article, we will compare GoldBroker.com’s commercial offer to this check list, and we will introduce to you its business providers program.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.