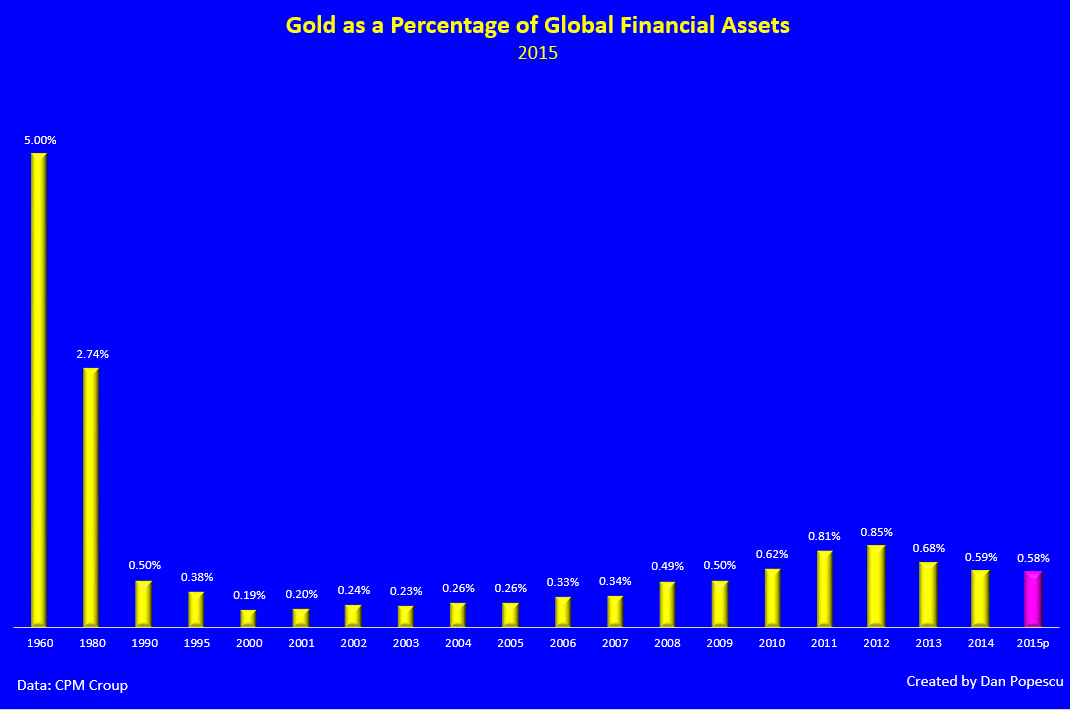

Gold is becoming more and more acceptable in the investment community and especially since interest rates have approached zero and in some countries even gone negative. Until recently no portfolio manager would have mentioned gold and even less recommended it. Since the beginning of the year, soon after some called gold just a useless and worthless rock going down to at least $400, a list of hedge fund managers came out with bullish calls for gold and indicated they have been buying. After years of denigrating gold, the investment profession is starting to discover the liquidity trap and acknowledge the value of cash and, more specifically, gold and its place in a diversified portfolio. It remains that gold, as a percentage of global financial assets in 2015, represented only 0.58% vs 2.74% in the ‘80s and 5.00% in the ‘60s.

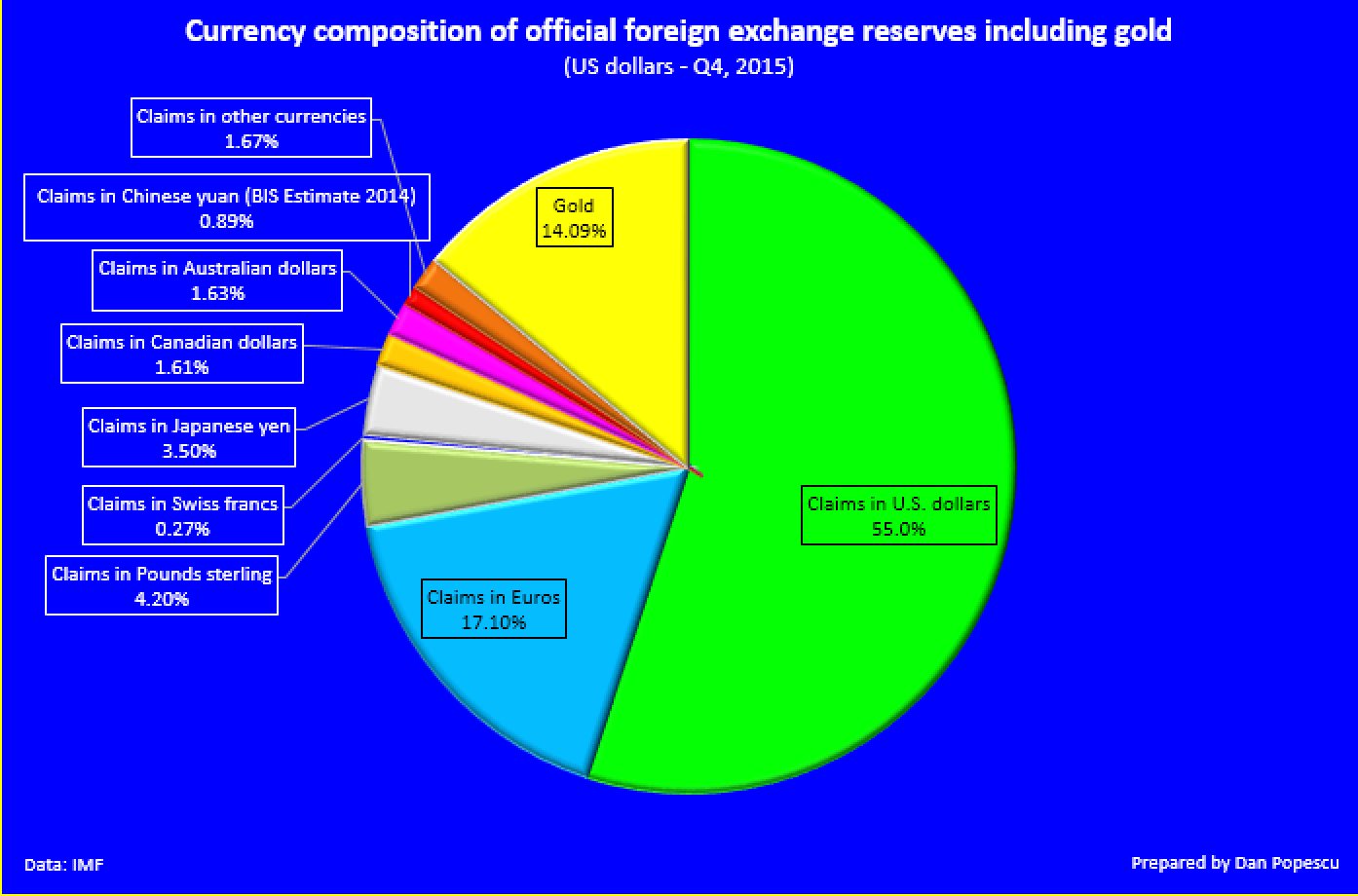

World central banks are much better positioned in 2015 with 14.09% of international reserves, with the U.S. and the Euro Area well above a historically considered prudent level of 10% in a balanced investment portfolio.The world average is 9%. The U.S., with 74.9% , and the Euro Area, with 55.9%, are well above that, while Canada, with 0%, is well below.

In a recent (May 11, 2016) interview Solita Marcelli, fron JPMorgan Private Bank, said, "Central banks may consider diversifying their reserves [as they anticipate] negative rates on existing holdings," and, "Gold is a great portfolio hedge in an environment where the world government bonds are yielding at historically low levels." She also added that, "Gold is looking more and more attractive every single day … As a non-yielding asset, it has a minimal storage cost, so when you compare it to negative-yielding assets, it actually has a positive carry."

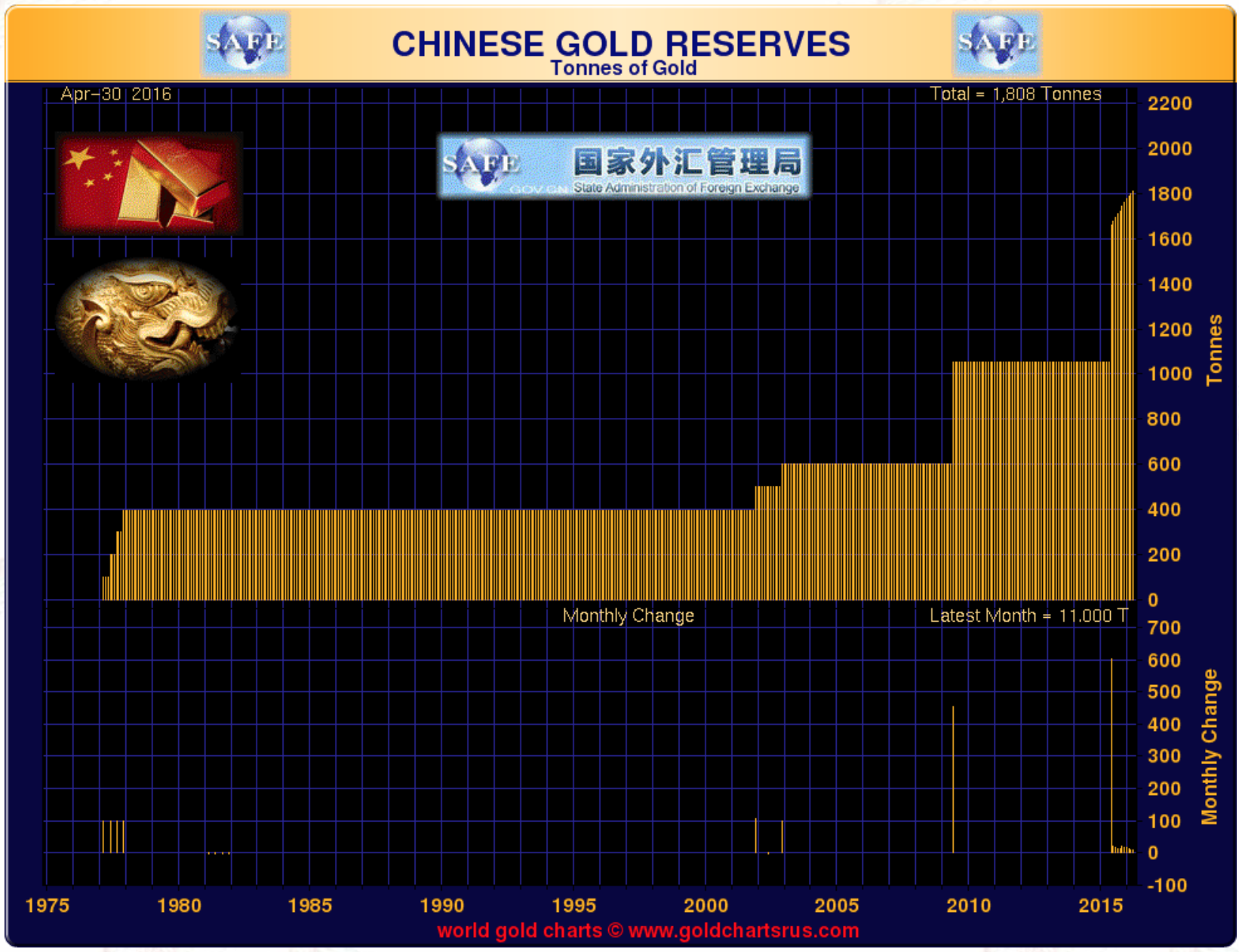

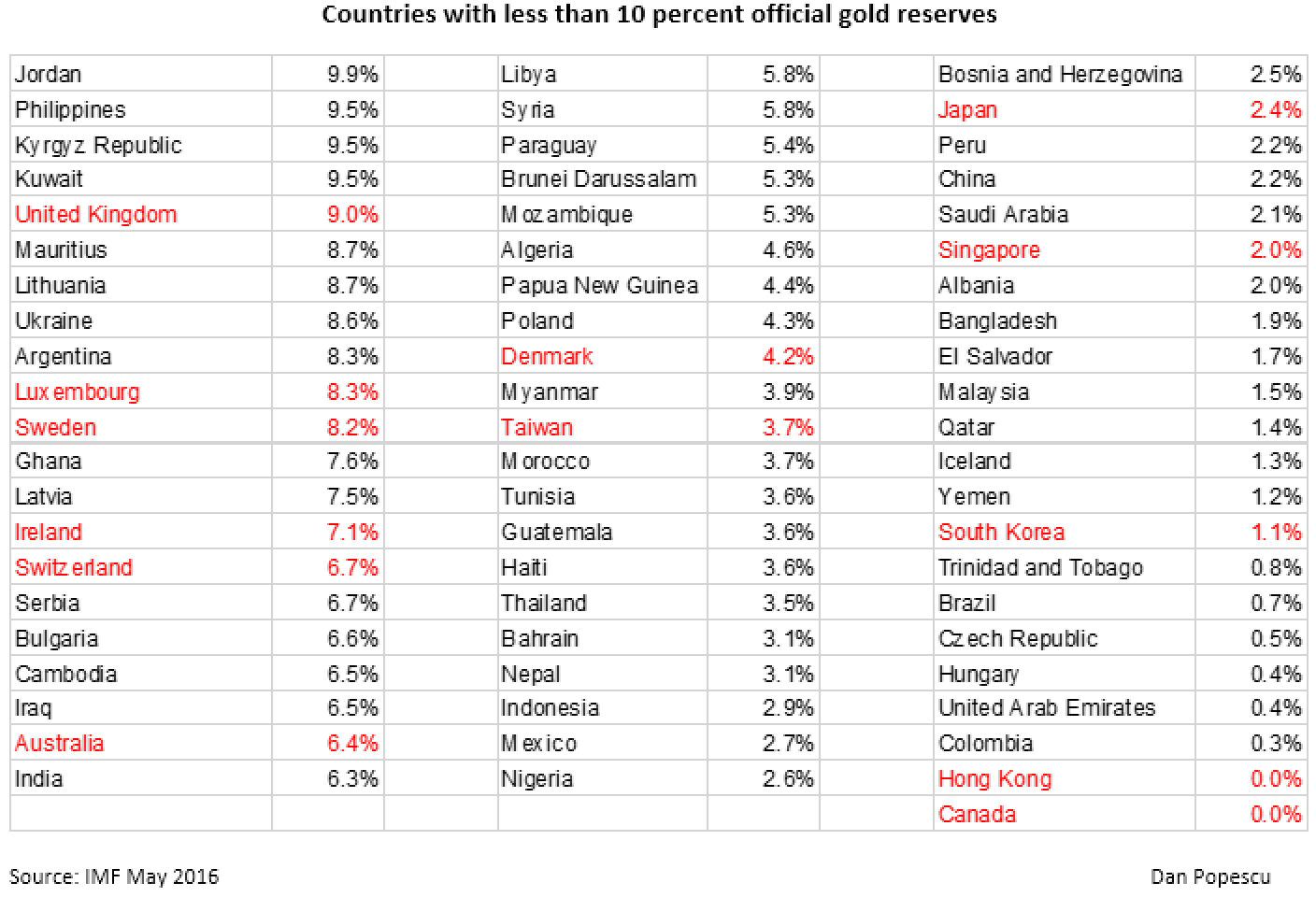

In a May 3rd, 2016 article Kenneth Rogoff, former chief economist of the IMF and Professor of Economics and Public Policy at Harvard University, recommends that developing countries and, more specifically, China increase their gold reserves above 10%. For China to increase its gold reserves from the present 2.2% level to more than 10%, it would mean a substantial increase in gold purchases, which are already high. If only China of all the developing countries would do it, it would have a significant impact on the visible gold market, which was only 4,455 tonnes in 2015. I and most gold analysts think China already has 4,000 tonnes of gold in its possession, but not accounted as official international reserves. All China would have to do is switch those gold holdings from the other institution that holds it to the Popular Bank of China (PBOC).

Below I created a table with all the IMF countries with gold reserves below10% who qualify, according to Mr. Rogoff. The major developed countries are in red and the developing countries are in black.

According to Kenneth W. Hoffman, metals and mining analyst at Bloomberg Industries, “Based on conversations with officials in China and Mongolia, it’s evident that China feels they want as much gold, as much as the U.S.” The U.S. has 8,133.5 tonnes. However, China doesn’t want to disturb the gold market by substantially increasing its gold purchases and thusly push the price higher before it has achieved its target of just a little bit more than the U.S., around 8,500 tonnes.

Kenneth Rogoff surprised many by his 10% recommendation. He is not a gold advocate and he actually himself takes enormous care to distance himself, not in a very professional manner I would say, from those who advocate a form of gold standard by calling them “American far-right crackpots”. Kenneth Rogoff has argued recently in favor of banning cash so that governments can effectively introduce negative interest rates. He states in his article that, “With interest rates stuck near zero, rich-country bond prices cannot drop much more than they already have, while the supply of advanced-country debt is limited by tax capacity and risk tolerance.”He continues by saying, “Gold, despite being in nearly fixed supply, does not have this problem, because there is no limit on its price. Moreover, there is a case to be made that gold is an extremely low-risk asset with average real returns comparable to very short-term debt. And, because gold is a highly liquid asset – a key criterion for a reserve asset – central banks can afford to look past its short-term volatility to longer-run average returns.” Gold, after being denigrated for years by the investment and economic profession as a worthless and useless rock (not even a metal)… to hear an eminent economist (not from the Austrian School of economics which are supposed to be “American far-right crackpots“) calling gold “extremely low-risk asset” and “highly liquid asset” is quite a surprise.

Why would he do it and why now? Author Jim Rickards of The New Case for Gold speculates in his latest newsletter Strategic Intelligence, and I think he is right – that what Mr. Rogoff wants is to push the price of gold up and, in so doing, create inflation by having the IMF and emerging markets do the dirty work so the U.S. Congress and the taxpayers wouldn’t know where the inflation is coming from.

When I became bullish on gold in 2004 and speculated that gold would hit $5,000 within about 15 years, it was based among other things on a stampede by central banks similar to what happened after the collapse of the London Gold Pool in 1968. If Kenneth Rogoff’s recommendation is reiterated by other well-known personalities it will give credibility and acceptance by central banks in general to increase their gold reserves, ridicule Bank of Canada’s decision to sell all its gold reserves and encourage the investment management community to do the same, creating a stampede on gold as in the ‘70s. The major players in the official gold reserves sector that could follow Mr. Rogoff’s advice are already major buyers of gold: China, India, Iran and Saudi Arabia. Russia is already above that level at 15% and is continuing to increase its gold reserves at a fast pace.

Mr. Rogoff doesn’t mention developed countries but I would not be surprised if some would do it too. I am thinking of the UK, Switzerland and Canada who, in recent years, have been quite anti-gold. Economists like Mr. Rogoff can give public officials the needed cover to reverse their decision.

In an interview I did in 2014 with Marc Faber, editor of the The Gloom, Boom & Doom Report, he told me to “be your own central bank and buy gold”. I think this is excellent advice. The 10% Mr. Rogoff recommends for developing countries’ central banks is also a good allocation, more or less, for individuals, depending on their personal circumstances

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.