Will the world experience a catastrophic debt implosion?

Just like the Titan Submersible that recently imploded, the global debt bubble can implode “within just a fraction of a millisecond”. More later in the article.

Are we now in the third circle in Dante’s Inferno?

Dante describes the 9 circles of hell. The 3rd circle is Gluttony which is fitting for a self indulgent Western world with excessive consumption of both material and financial resources.

Each circle represents a gradual increase in evil, culminating at the centre of the earth where Satan is held in bondage. The sinners of each circle are punished for eternity in a fashion fitting their crimes.

Financial markets have also been dominated by gluttony for an extended period. This has led to the biggest asset bubble in history.

But in spite of unprecedented risks in investment markets, for the few investors making the right choice, now is a period of great opportunity not just to preserve wealth but also to enhance it. More later.

End of the current Western empire

But here we are in the 21st century with the current Western Empire in the final stages of a secular decline which looks very similar to the fall of the Western Roman Empire in the 5th century. Wars, debts, deficits, collapsing currencies, decadence, corruption and socialism – Plus ça change (the more things change, the more they stay the same.

Whether this cycle is the end of a 100, 300 or 2000 year era, only future historians will know the answer to.

War drums and NATO

To diffuse the real reasons for the collapse of the Western economy and the Financial System, there is nothing like starting a war. Leaders love to play real war games although most of them have never been near the front line. A war creates fear in the people and permits the leaders to govern the country irresponsibly, both in relation to the economy and by controlling the people.

So all the Western leaders got together for the NATO meeting in Vilnius, Lithuania last week to listen to Zelensky’s rantings about more money and more weapons in a war that Ukraine is unlikely to ever win. But since this is a proxy war for the real battle between the US and Russia, the West is grudgingly giving in to many of Zelensky’s demands, thus escalating the war to levels which could have catastrophic consequences for the world.

This war could at best lead to 100s of thousands of additional deaths. The Ukrainian people don’t want war, probably more than 10 million of them have left the country and won’t return. Neither the Russian, American or European people want war, only their leaders. When it comes to wars, leaders have ultimate power and also access to money. Although no country has funds available for this war, they all borrow and print to the detriment of the countries and their people.

At best this war will be limited but go on for years at a massive cost of lives and resources. At worst we could have a global and nuclear war with disastrous repercussions.

Western leaders would serve their people much better if they instead sent peace makers and focused on their economies which are on the verge of a major implosion.

Coming back to debt, this is what will finally destroy the West and likely lead to decades of misery.

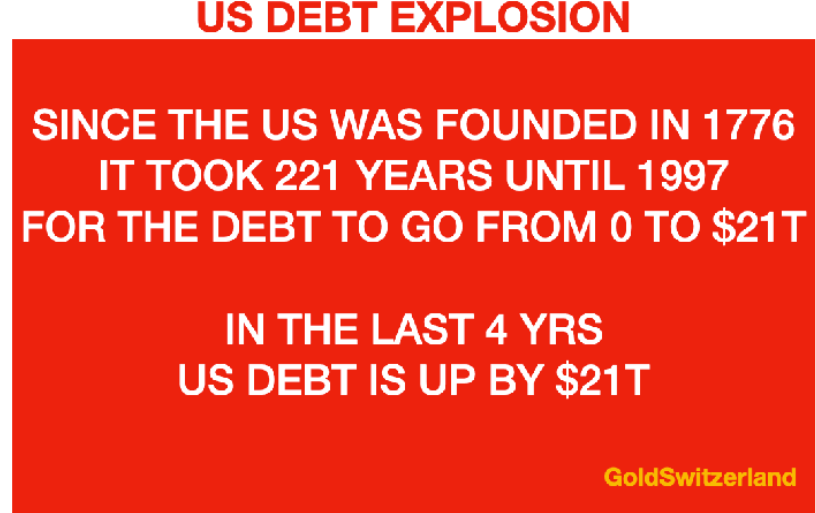

US debt up by same amount in last 5 years as the first 221 years

The latest financial crisis started in September 2019 when the US banking system came under serious pressure and the Fed injected major liquidity into the near bankrupt system. Since that time, total US debt has increased by $21 trillion.

Let’s put this into perspective. It took the US 221 years to go from Zero debt in 1776 to $21 trillion in 1997 and just in the last 4 years, debt has gone up by that same $21 trillion.

Now some will argue that it is not the same money today as 200 years ago.

No of course it is not the same money. Because every government destroys the value of their currency by creating unlimited amounts out of thin air to the detriment of savers and pensioners.

The graph below shows the debt explosion during my working life so far. Up from $1.5 trillion in 1969 to $95T today – a totally mind boggling 63x increase.

To gain power the incumbent government must promise the earth. Once in power they realize that there is no chance of maintaining prosperity without buying votes through chronic deficits and money printing. That’s why there have only been a handful of years since 1930 when US federal debt didn’t go up. Even in the Clinton years debt went up so the surpluses declared were due to false accounting.

But total US debt of $ 95 trillion is only part of the total liabilities. Add to that unfunded liabilities of Social Security and Medicare of say $150 trillion. Then there are gross derivatives within the banking system and in the shadow banking system of probably $2-2.5 quadrillion. This is a form of credit that can easily blow up when counterparties fail.

A coming inferno

Coming back to Dante’s Inferno, the 9 circles of hell are: 1. Limbo – where there is no god, 2. Lust, 3. Gluttony, 4. Greed, 5. Wrath, 6. Heresy, 7. Violence, 8. Fraud, and 9.Treachery.

Many of the 9 sins in Dante’s Inferno apply to today’s world but maybe Gluttony is one of the more fitting to a self indulgent Western world.

Cerberus, the three-headed beast of hell, guards the gluttons mauling and flaying them for eternity. (Sounds pretty horrible. A more modern version might be the song “Hotel California” by the Eagles – “You can check out any time but you can never leave”.) Also Homer wrote about Cerberus.

What we do know is that in this final phase that probably started in 1913 with the foundation of the Fed and accelerated from 1971 when Nixon closed the gold window we have seen the required excesses or gluttony that inevitably lead to a severe punishment.

We have seen historical bubbles in all asset markets whether in Stocks, Bonds, Property and many others.

We have also seen debt explode, especially since 1971. As always in the final stages of an empire, real growth first slows down and then stops.

The world has reached peak cheap energy

The primary driver of economic growth since the second half of the 1700s has been the discovery and use of energy on an industrial scale, starting with the industrial revolution.

The growth of the economy is not driven by money but by energy.

As Tim Morgan of Surplus Energy Economics states:

“The economy is a surplus energy equation, not a monetary one, and growth in output (and in the global population) since the Industrial Revolution has resulted from the harnessing of ever-greater quantities of energy. But the critical relationship between energy production and the energy cost of extraction is now deteriorating so rapidly that the economy as we have known it for more than two centuries is beginning to unravel.”

The dilemma is that the Energy Cost of Energy is constantly increasing. In 1990 that cost was 2.6% of fossil fuels and is estimated to be 12% in 2025. According to Dr Morgan, with the current Energy Cost of Energy, the real economy as well as prosperity has started to decline and that trend will continue for several decades. Fossil fuels still represent 83% of all energy globally and renewable energy is unlikely to make any significant difference in the next few decades.

So we are now looking at peak cheap energy at a time when asset markets are in bubble territory with debts and deficits at levels which can only result in an implosion.

Again let me emphasize that cheap energy is a prerequisite for economic growth.

Panicking governments take irrational measures

So what are governments doing about this. They are clearly aware of the risks and this is why they invent all kinds of events that will enable them to control the people. This includes Covid lockdowns, forced vaccinations, climate control, CBDCs (Central Bank Digital Currencies), wars and unlimited rules, regulations and laws. The US for example now has over 300,000 laws controlling all aspects of daily life and making everyone a likely daily felon.

Revaluation of gold

I have already in previous articles discussed the seismic shift that will take place from West to East and South based on commodities and manufacturing rather than debt and services. That will be a long process which is just starting: “A DISORDERLY RESET WITH GOLD REVALUED BY MULTIPLES”.

Whilst a lot of gold investors are excited about the prospect of a BRICS currency backed by gold, personally I think that is far away. The Tweet by an official at the Russian embassy in Kenya is not quite enough to confirm this.

As I have already written about here , I believe that gold will be the asset of choice for central banks to hold as reserves rather than dollars. Such a move would have a major impact on gold which I wrote about here: “MAJOR REVALUATION OF GOLD AND PRECIOUS METALS IS IMMINENT”.

So with risks facing the Western world of a magnitude never seen before in history, including geopolitical, financial, economic, with the biggest asset and debt bubble in history coming to an end.

It is clearly impossible to predict how this will play out. It is not even worth speculating.

What we do know is that risk is now at a level which makes investment markets extremely dangerous. In the next few years major fortunes will be lost permanently.

Asset & debt explosion - implosion

Before we look at how to survive the biggest global asset bubble that has ever existed, let’s first look at the spectacle we have witnessed in the last 54 years. This is a selfish time period and reflects when in 1969 my working life started in banking in Geneva.

This period conveniently coincides with Nixon closing the gold window in 1971. That was the end of sound money and the beginning of a free-for-all bonanza in money printing.

So during my working life since 1969 US total debt has gone up 63X from $1.5 trillion to $95T.

Bubbles always burst, without exception. But we know of course that bubbles can always grow bigger before they burst.

What few people realize is that when a debt bubble explodes or more likely implodes, it could go almost as quickly as the recent implosion of the Titan Submersible.

The pressure on this vessel was remarkable:

A catastrophic implosion is “incredibly quick,” taking place within just a fraction of a millisecond, said Aileen Maria Marty, a former Naval officer and professor at Florida International University.

“The entire thing would have collapsed before the individuals inside would even realize that there was a problem,” she told CNN. “Ultimately, among the many ways in which we can pass, that’s painless.”

I doubt that global debt and the world financial system will implode in a fraction of a millisecond but as I have warned many times, an implosion of the $3 quadrillion of debt and derivatives could happen very, very quickly. It would unroll at such a speed that no central bank would have time to react.

And as I have also pointed out, when the debt implodes, so will all the assets which were inflated by the debt.

So even if it doesn’t happen in milliseconds, it will be too quick to save. We saw this in the middle of March when 4 banks, led by Silicon Valley Bank, collapsed in a matter of a couple of days. And shortly thereafter Credit Suisse imploded too.

As we know, it is impossible to time such an event. But the good thing is that we don’t need to time it.

A major opportunity

Investors must forget about gluttony and greed and stay away from Cerberus’ hell. If they can steer away from the current risks in the system, the opportunities to not just evade disaster but even enhance wealth are considerable.

So forget about short term timing. And forget about greed.

Just avoid the potential implosion of asset markets and safely position yourself for incredible opportunities, whenever they may happen.

Personally, I don’t think things will take too long to unravel but I don’t care about the timing as long as I am sitting right.

My views are not recommendations but only my personal risk assessment.

Firstly I would hardly touch the following assets with a barge pole:

- General stocks, bonds of any kind, corporate or sovereign, currencies, bank deposits, investments in commercial or residential property.

There are of course always exceptions like commodity related stocks, defense stocks and many others.

But remember that in a real bear market, all stocks tend to suffer.

Even for the best companies, profits can halve and P/Es go from 20 to 5. That for example would lead to a decline in the share price of 88%!

When I was at Dixons Plc in the UK during 1973-4 stock market collapse, I experienced a similar decline in our share price although the company was sound financially. From there we built Dixons to the leading electronic retailer in the UK and a FTSE 100 company.

So anyone who believes that a 90% fall can’t happen to good businesses is seriously mistaken.

What not to own is easy but what should we own?

The answer is self-evident as far as I am concerned.

- Commodities started an uptrend in 2020 and have a long way to go.

With gold being the only money which has survived and maintained its purchasing power in the last 5000 years, it is clearly the wealth preservation asset par excellence.

We have mainly stayed away from silver in the last 20 years due to its volatility. It has not been a good metal if you want to sleep well at night. But now with the gold/silver ratio at 80 (meaning silver is relatively cheap vs gold), and with strong industrial demand for solar panels, electricals etc, we are likely to see a decline of the ratio to 30 initially and eventually to 15 or lower. That means silver will go up 3-5x as fast as gold.

But physical gold is the king of metals for wealth preservation purposes and a smaller investment in physical silver should be seen as an investment/speculation with a massive potential.

In addition to yellow gold, black gold – oil – moves very similar to the yellow metal. Thus major price increases in oil are likely.

So owning stocks in good gold and silver companies as well as oil companies is likely to be an excellent investment for a number of years.

But again I must stress that protection against the probably biggest asset implosion in history necessitates holding the majority of investment assets in physical gold and some silver, stored outside the financial system in a very safe jurisdiction and vault.

Preferably the majority of your metals should be stored outside your country of residence. In case of emergency, you should be able to flee to your reserve asset.

A world at crossroads

What is very clear to me is that the Western world is now at a crossroads. As Brutus said in his speech, the right turn “leads on to fortune” whilst with the wrong turn you end up “in shallows and miseries”.

For anyone who realizes the severity of the situation, the choice should be obvious, if not we will “lose our ventures”.

Facing such a momentous risk, protecting our families and stakeholders must be the only option.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.