As my last report for 2023, I wanted to hit the big issues blunt in the face—from debt and sovereign bond markets to themes on the USD, inflation, risk markets and physical gold.

This will not be short, but hopefully simple.

No one likes hard macro facts, especially at holiday parties, so I’ll sip my champagne in silence and share my views here instead.

Powell: From Hawk to Dove to Jive Turkey in 30 Days

So, hawkish Powell is now talking about dovish rate cuts in 2024.

Powell, however, is neither a hawk nor dove but more of a jive turkey or, in the spirit of Christmas, a cooked goose.

The sad but simple fact of the matter is that our Fed Chairman, like so many of the so-called “experts,” has a genuine problem with admitting failure or speaking honestly—which is why I recommended long ago to bet against the experts…

Looming Rate Cuts? No Surprise at All

For any who have been following my blunt views on US debt markets, bond volatility, interest rate gyrations and Fed-speak vs. Fed-honesty (our first oxymoron), this pivot toward rate cuts should come as zero surprise.

ZERO.

As indicated many times, rising rates break things, and so many things have broken (banks, Gilts, USTs, the middle class…) that even Powell can’t deny this anymore.

Powell, as I wrote earlier this year, has only been raising rates so that when the denied recession that we are already in becomes an official 2024 recession according to the always too-late NBER, at least the Fed will have something to cut.

Powell, of course, is a politician, and like all politicians, has learned the art of bending truth to straighten his career and legacy.

It’s The Recession, Stupid

But even Powell, despite all his rhetoric on (mis) hitting target inflation via his pseudo-Volcker-esque profile of “higher-for-longer,” always knew (and still knows) that America is already in a hard-landing recession thirsty for cheaper rates and even more debt…

The evidence of this recession, as I’ve said, is literally everywhere—from classic economic indicators like the yield curve (inverted), the Conference Board of Leading Indicators (dipped below 4% threshold last December) and a dramatic 4% decrease in the M2 money supply (inherently deflationary), to basic Main Street indicators like record-breaking bankruptcy filings, ongoing lay-offs, equally record-breaking car and credit card delinquencies—all encapsulated by the Oliver Anthony Indicator.

Debt-Rollovers Needed Lower Rates

But there are more reasons these rate cuts are of no surprise…

Never forget this: The Fed serves Wall Street (and capital gain taxes), not Main Street. And Wall Street is screaming for help.

The over-valued and cheap-credit-addicted S&P 500 (led by 7 names only) is riddled with countless zombie enterprises staring down the barrel of $740B in debt rollovers in 2024, and another $1.2T in 2025—all at currently Powell-higher rates.

That is a problem.

And Uncle Sam is looking at 30% of his $34T in IOUs (about $17T worth) re-pricing over the next 36 months at equally higher, Powell-driven rates.

That too is a problem.

And as I warned: Rates would have to be cut to avoid a market bloodbath and sovereign bond debt trap.

Et voila—here comes Powell announcing rate cuts. Real shocker…

A Mug’s Game

Does such foresight make me/us psychic? Blessed with mystical powers?

Hardly.

Predicting any near-term move in the markets or even in the minds of a Fed official (which are essentially now the same thing), is indeed a mug’s game.

No one can pick the day, hour or even month of a watershed move.

But for those who follow deficits, debt markets and hence bond dysfunction, the signals (i.e., basic math) can offer pretty sound ideas of what’s coming.

Such instincts are nothing radical or genius, but boil down to common sense, something most of us own. You know, like how most of us reach for an umbrella on a cloudy day—because, well: Clouds warn of rain ahead.

What the Storm Clouds (and Debt Bubbles) Portend

The clouds we’ve been tracking in the bond markets were easy to see for everyone willing to open their eyes–except perhaps for politicians, who prefer to keep their well-made heads buried in the sand.

For months and months, we’ve been pounding our patient little fists that debt actually matters, and hence by extension, bond markets actually matter.

With this simple, (i.e., common sense) premise in mind, we thus had very little long-term faith in the short-term words or policies of our fork-tonged and financially-trapped central bankers about “higher for longer.”

Like Luke Gromen, and frankly even Charles Calomiris of the St. Louis Fed, we saw (and warned over and over and over) that the cost of Uncle Sam’s own IOUs under Powell’s “higher-for-longer” meme-war against inflation would fail.

Why?

For the simple reason that rising debt costs would force the Fed to reduce rates and eventually print more money just to pay for Uncle Sam’s True Interest Expense.

That’s called “Fiscal Dominance.”

In short, and despite all of Powell’s rate-hiking and chest-puffing, we saw a rate pause, as well as rate cuts, as effectively inevitable.

As warned, Powell then paused the rate hikes. And now, as 2023 winds toward a disastrous end, he is talking of rate cuts for 2024.

Again: Hardly a shocker. And here’s why.

Hitting a Wall of Fiscal Dominance

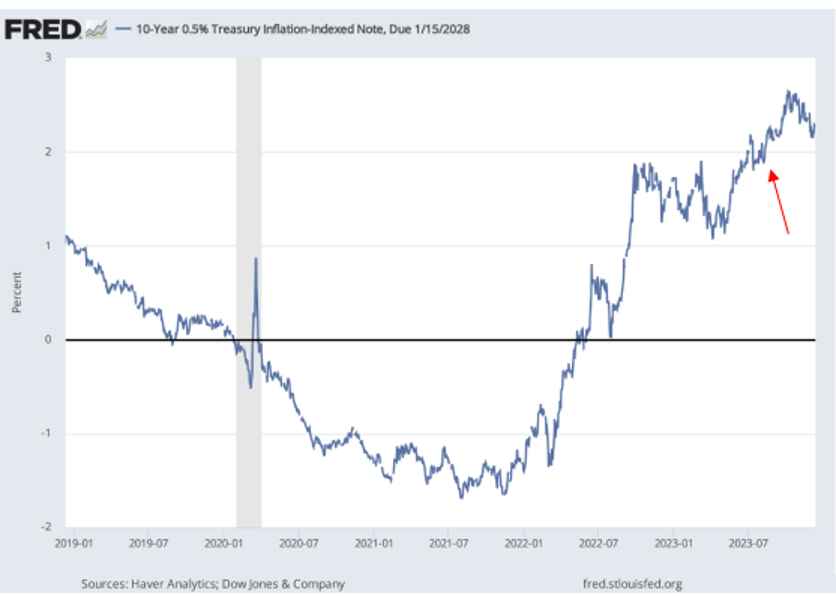

When official (as opposed to honest) CPI inflation falls while interest rates (as best measured by the yield on the unloved 10Y UST) rise, then “real” (i.e. inflation-adjusted) rates go positive and north.

And when real rates approach 2%, this means debt becomes really painful for companies, individuals, and, of course, broke governments like the U.S.

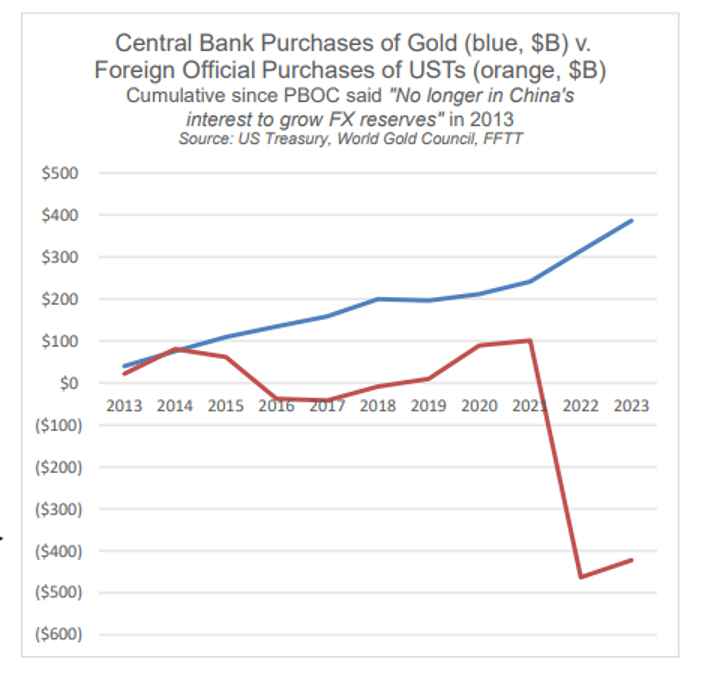

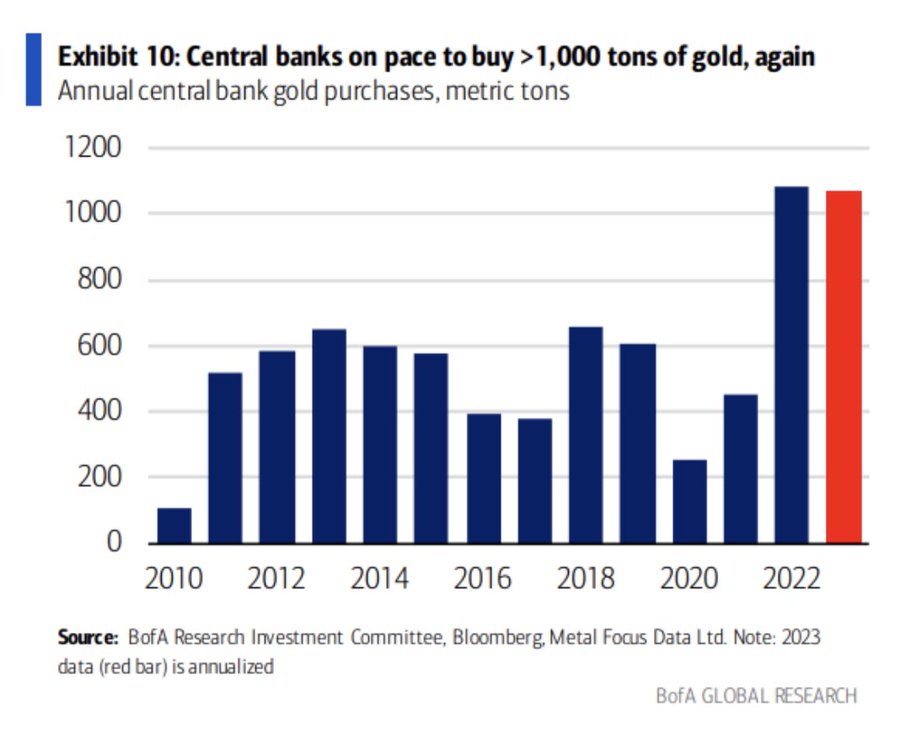

The rest of the world knows this too, which is why central banks have been dumping Uncle Sam’s unloved USTs (red line) and stacking gold (blue line), as they’d rather own real money than a declining asset from a bad credit.

This global dumping of USTs pushed bond prices down and hence yields and rates up, which meant Uncle Sam’s interest payments only got worse—i.e. $1T a year.

That stings.

And even poor old Janet Yellen, having slithered from a position as Fed Chair to Treasury Secretary (how’s that for insider power?) realized there was a real problem with Powell’s rate hikes.

As she confessed just last week: “Rising real rates may impact Fed decision on rate path.”

Well, as we seasoned bond experts say on Wall Street: “Duh.”

Meanwhile, the Financial Media Gets It All Wrong: The Truth About US Bonds

But despite this moment of “duh,” the main stream financial media, which like all media, has simply devolved into a propaganda arm of a centralized government with a weaponized Dollar and a “puppet-ized” president, tried to tell the world that November was a banner month for Uncle Sam’s bonds, which saw its best month in 40 years.

This, they boasted, was proof that America’s IOUs were loved IOUs.

As usual, however, just about everything the mainstream media says is approximately 180 degrees from the facts and hence truth…

November’s historical yield compression and bond price rise, for example, was not the result of resurging natural demand, but rather a spike in un-natural DC intervention at its best and most desperate.

For the fifth time in four years, and reminiscent of the already forgotten Treasury General Account tricks of last October, the Fed and US Treasury Department were hard at work at trickery hiding in plain sight.

That is, panicking central planners saw a need for liquidity that wasn’t coming from the rest of the world.

They thus saved the 10Y UST from an over-supply sky-fall by simply over-issuing more bonds from the short end of the yield curve to buy time.

And at the same time DC was shuffling risk from the 10Y to the 2Y UST, they got even more clever by sucking liquidity out of the Treasury General Account to the monthly tune of $150B to keep bond yields from spiking out of the Fed’s increasingly weakening control.

And that, folks, is what made November an historical month: Not a natural rebirth of global demand for Uncle Sam’s IOUs, but a series of loosening tricks wherein DC drinks its own expensive Kool aide and calls it a national victory.

But if, according to consensus, November was such a Fed and bond victory, why is the December version of a once-hawkish Powell now talking dovishly about more rate cuts in 2024?

From Fake Victory to Open Decline: No Good Options Left at the Fed

The simple answer is because America is not in a period of victory, but one of open and obvious decline clear to everyone but the word-heavy yet math-challenged media, the deficit-popular-politicos and the cornered central-bankers.

And boy do I mean cornered.

Why?

Because as warned month after month, debt destroys nations and hence corners central planners, who have nothing but bad options to address very bad math.

That is, if they don’t cut rates and print more fake money, risk assets tank and the economy falls with it into a hard recession.

But if central bankers loosen policy to save the system, they kill the currency’s inherent purchasing power, which is precisely what Powell will do next—as all broke nations sacrifice their money to cover their butts…

Very Scary Math

To keep this sensational but all too sad point real, just consider the facts rather than the drama of a nation whose debt profile makes growth impossible.

Current US debt to GDP has crossed the Rubicon of 100% well into the 120% range; our deficit to GDP is at 8% and rising; our Net International Investment Position (i.e., piggy bank of foreign assets) is at negative 65%; our public debt is at 34 TRILLION and counting, and according the Congressional Budget Office, Uncle Sam is about to spit out at least another $20T in US IOUs over the next 10 years, and this modest number (?) is assuming no intervening recession…

But who will buy Uncle Sam’s IOUs to cover his skyrocketing deficits?

According to simple math and hard facts, the answer since 2014 is basically no one but the Fed…

Such facts have the global chief economist at Citi Group worried and wondering, and it’s never a good thing when even the beneficiaries of a Fed-driven debt bubble are worried about the size of that bubble…

Meanwhile, combined public, corporate and household debt in the debt-imprisoned land of the free is around $100T.

I don’t even know how to write this number out, but I can assure you that no one in DC knows how to pay it either.

This, of course, is a problem…

Collateral Debt Damage—The Dollar, Inflation, Markets Etc.

All of this debt, alas, brings us to the corollary topics of inflation and the next chapters of the USD, because debt and currencies, like just about everything else, including risk assets, are all connected and inter-twined.

That is, if one understands debt, one can see the patterns of broader markets—past, present and future.

The USD: Relative Strength Aint Enough

When it comes to the USD, let’s not kid ourselves: The world still needs it. 70% of global GDP is measured in USDs and 80% of global trade is settled in Dollars.

And as Brent Johnson’s milkshake theory reminds, there is a great big straw (“sucking sound”?) of global demand for USDs coming from Euro Dollar markets, derivative markets and oil markets.

I agree that this super straw (or better yet, global “sponge”) is enormously powerful, and hence the need for Dollar liquidity is a massive tailwind for the USD.

But… this massive tailwind is not an immortal tailwind.

De-Dollarization: More Than Many Think

Evidence of increasing de-dollarization post-US-Russia sanctioning (and Dollar-weaponization) is not merely a bearish meme but an open and undeniable reality.

China and Russia are moving ever more toward oil purchases in CNY (which Russia then converts into gold on the Shanghai Gold Exchange/SGE) while an exponentially increasing number of bilateral trade agreements among the BRICS+ nations are now happening OUTSIDE of the USD.

Just as Nixon’s de-coupling of the gold-standard in 1971 lead to a slow death by a thousand cuts of the USD’s inherent purchasing power (a 98% loss when measured against gold), the weaponization of the USD will lead to a similar (but slow) death by a thousand cuts of the USD’s global hegemony (when measured against a world turning away from the debt-backed rather than gold-backed USD).

We warned of this from day 1 of the sanctions against Russia.

A Supreme Dollar Losing Respect

For now, however, the USD is still supreme, but unlike Brent Johnson, I don’t see even its relative strength pushing the DXY to 150.

This is for the simple reason that even Uncle Sam knows that the rest of his global friends and enemies can’t afford to pay-back $14T in Dollar-denominated debt at such a level without having to dump more of their foreign held USTs (about $7.6T worth), which would crush UST pricing and lead to skyrocketing (and unsustainable) UST yields and rates for Uncle Sam himself.

In short: Even Uncle Sam fears rising rates and a too-strong USD.

Such a fear of rising rates along with the reality of growing US deficits (and hence a growing need for more US IOUs) will soon lead to an over-supply/issuance of USTs down the road.

And the only buyers of those USTs to control yields/rates will be the Fed, not the rest of the world (See graph above…).

That kind of bond buying with money created out of thin air kills a currency.

No Milkshake Straw for USTs = Mega Money Printing Ahead

Thus, while the milkshake theory correctly sees immortal global demand for USDs, there is no similar straw (or demand) for USTs.

This means the Fed will have to print trillions of more Dollars to buy its own sovereign bonds, an inherently inflationary policy which weakens rather than strengthens the Dollar longer term.

This is why Powell’s “pause,” and now “cutting” in 2024 will eventually be followed, in my opinion, by “mega printing.”

After all, “pause, cut and print” is the pattern of debt- cornered central bankers, and eventually (despite TGA and short-duration bond tricks) Powell will need massive amounts of mouse-click money to monetize Uncle Sam’s sickening (and growing) deficits.

We saw this exact pattern between 2018 (QT) and 2020 (unlimited QE).

The end-game is thus more money creation, more money debasement and hence more inflation.

But First the Deflation

But before then, we are marching into an “official” recession in 2024, and recessions are inherently dis-inflationary if not outright deflationary.

Again, the inflation-deflation debate is not a debate but a cycle.

Historically, moreover, the dramatic declines in M2 ALWAYS result in deflation. Always.

And More Risk Asset Bubbles?

As for our stock and bond bubbles, they certainly like cheaper debt (i.e., lower rates) and mouse-clicked trillions (i.e., QE).

For now, markets are expecting (pricing in) the former and waiting for the latter, which can and will make them giddy.

With about 25% of US GDP sitting in cash equivalents, Powell’s 2024 projected rate cuts will send a lot of that money into the market bubbles, sending asset inflation even higher, which means more needed tax revenues for Uncle Sam.

If the DXY stays low, markets will rise. And if the Fed is accommodative, markets will rise. This includes BTC.

It’s just that simple: Tight policies are a market headwind, loose policies are a market tailwind.

This is because capitalism died long ago and the Fed is essentially the de facto market-maker for the S&P, Dow & NASDAQ.

But trying to determine, or time, how long this charade of Fed-driven asset bubbles can avoid a sickening moment of mean-reversion is the topic of another article.

Gold: The Brightest Star on the Tree

Gold, of course, merely sits back and patiently watches all these debt forces—and hence inflationary and currency debates/reactions–with a calm smile.

Why?

Well, gold loves chaos, and thanks to decades and decades of policy makers who believed they could solve one debt crisis after the next (think Paul Krugman) with more debt, the financial/recessionary chaos (as per above) is literally everywhere.

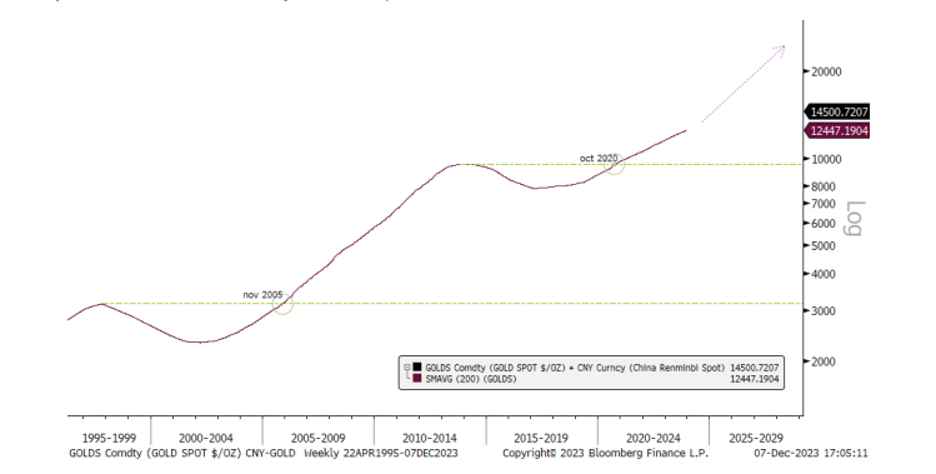

Thus, even when rates are officially positive, gold reached record highs, despite my own argument that gold loves negative real rates.

And even with a relatively strong USD and DXY, gold has reached record highs, despite the standard view that gold favors a weak USD.

And even with yields spiking, gold has reached record highs, despite another common misconception that investors prefer higher-yielding bonds over zero-yielding “pet rocks.”

Gold, in other words, follows more than just conventional indicators. It has a profile, life and history of its own, one which few investors understand unless their aim is solvency and wealth preservation.

In fact, the easiest way to understand gold is that it’s more loyal than paper money.

Despite all the endless debating, and all the spot-price manipulations in the OTC markets and all the crypto comparisons and fiat-money apologists, the fact is that informed investors, like a growing list of informed countries, just don’t trust the US, its bonds or its fiat-Dollar like they used do.

They’d rather have gold:

And in the years ahead, they’ll get a fairer gold price on the SGE than in London or New York, which means the West will soon have to behave on actual supply and demand principles rather LBMA bank price manipulations…

Iconic America has devolved from a gold-backed currency and the world’s leading creditor, manufacturer and trade partner to a debt-soaked America with a gold-welched-dollar and is now the world’s biggest debtor, weakest manufacturer and open loser to a trade war with China.

This is hardly a proud evolution from its Greatest Generation…

In short, the iconic America is no more, and there’s a far better Sharpe Ratio in gold than there is in topping risk portfolios…

Like it or not, believe it or not: Gold is rising because the home of the world reserve currency with its shining façade of free market price discovery has lost its way, replacing capitalism with feudalism and altruistic leadership with egotistic opportunism.

If WE know this. So too does gold.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.