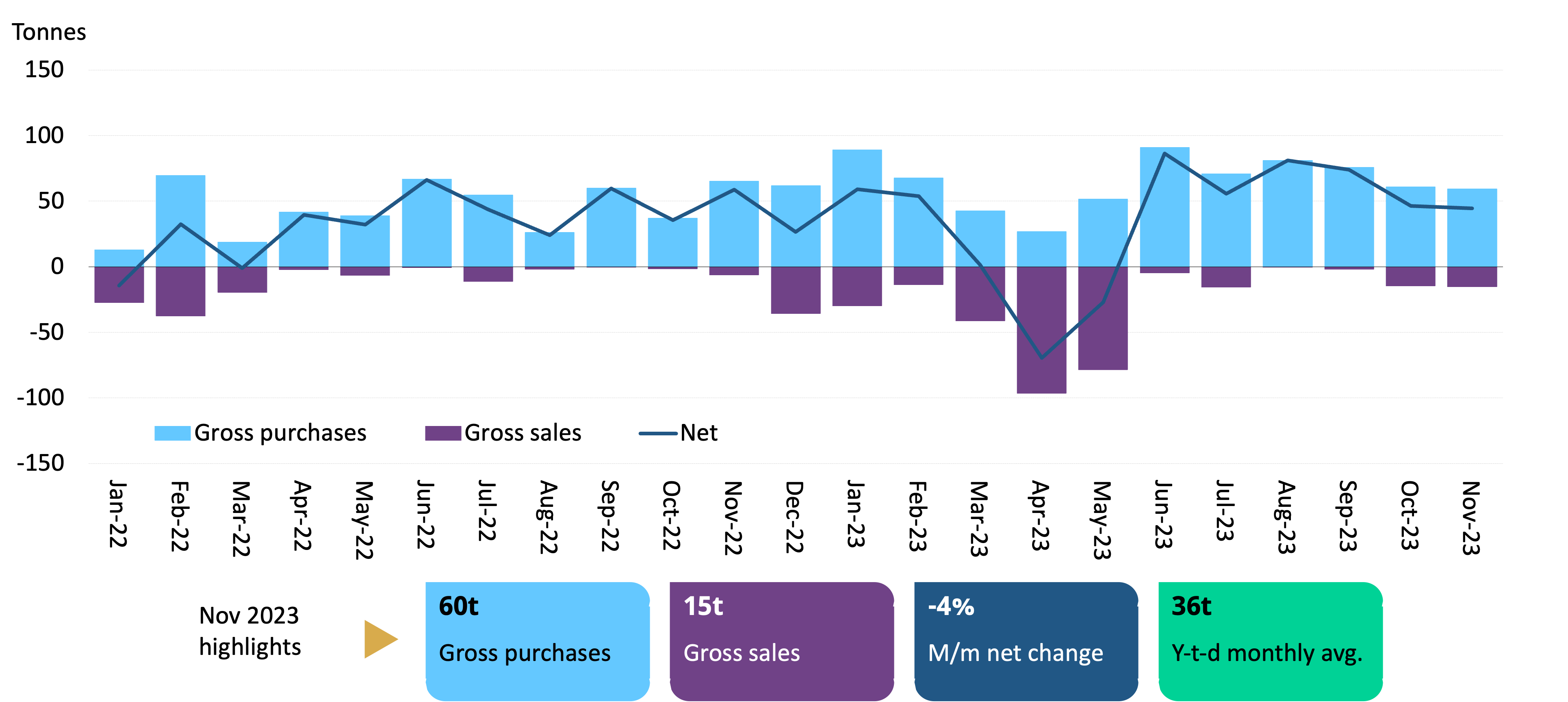

- Reported global central bank gold reserves, via the IMF and publicly available sources, rose by a net 44t in November.

- Gross purchases (60t) heavily outweighed gross sales (15t) as central bank demand maintained its momentum.

Change by country

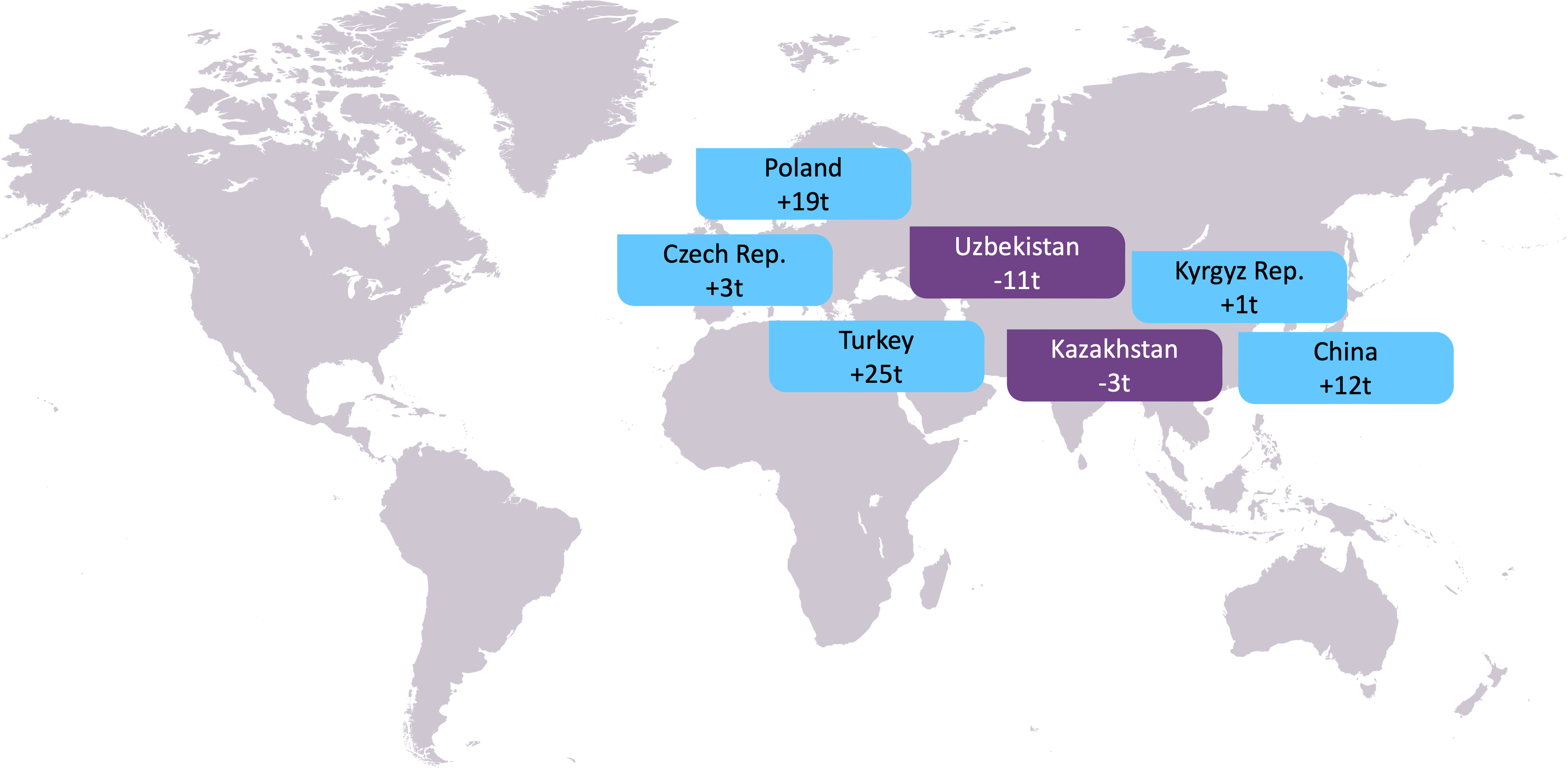

Central bank purchases in November 2023 continued to be dominated by banks who have been regular buyers so far this year.

Major buyers were all from emerging markets. The Central Bank of Turkey added the most gold during the month (25t), followed by the National Bank of Poland and the People’s Bank of China.

Changes year to-date

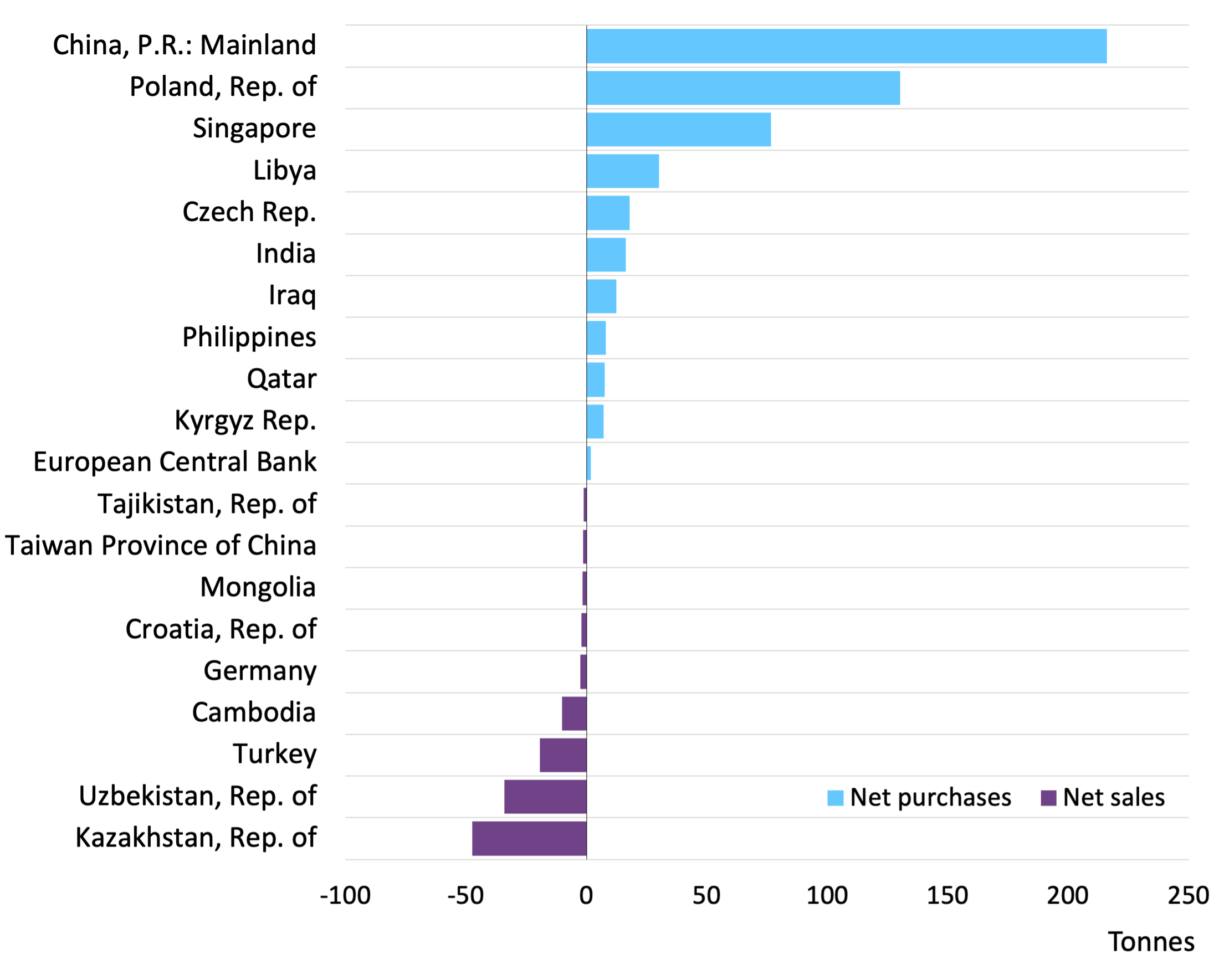

- The People’s Bank of China remains the largest gold purchaser in 2023.

- Emerging market banks have been the driving force on both the purchases and sales side.

- The Monetary Authority of Singapore continues to be the sole developed market bank adding gold to its reserves (the ECB addition was related to Croatia joining the eurozone in January).

Original source: World Gold Council

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.