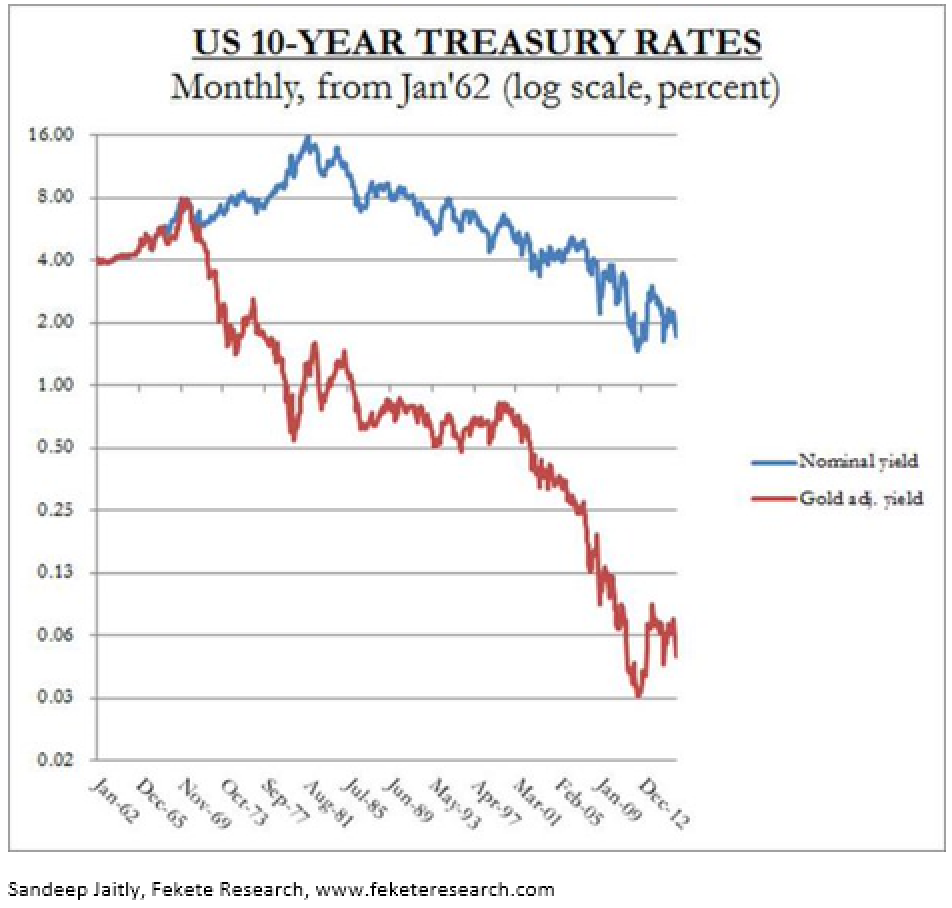

We hear more and more talk about moving into negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks the question as to what tools the Fed has left to support the economy and discusses in this article the use of negative rates. We have to first define what we mean by negative interest rates. For nominal rates it’s simple. When the interest rate charged goes negative we have negative nominal rates. To get the real rate of interest from the nominal rate we have to subtract inflation. That’s what we call the illusion of inflation.

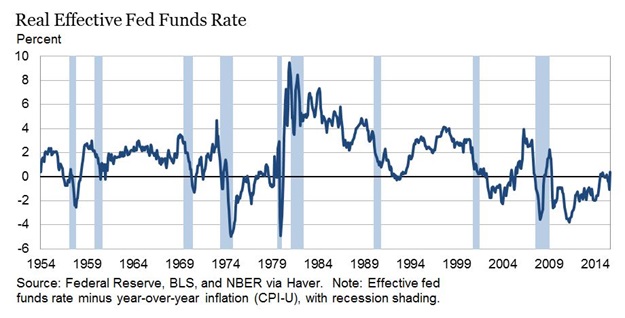

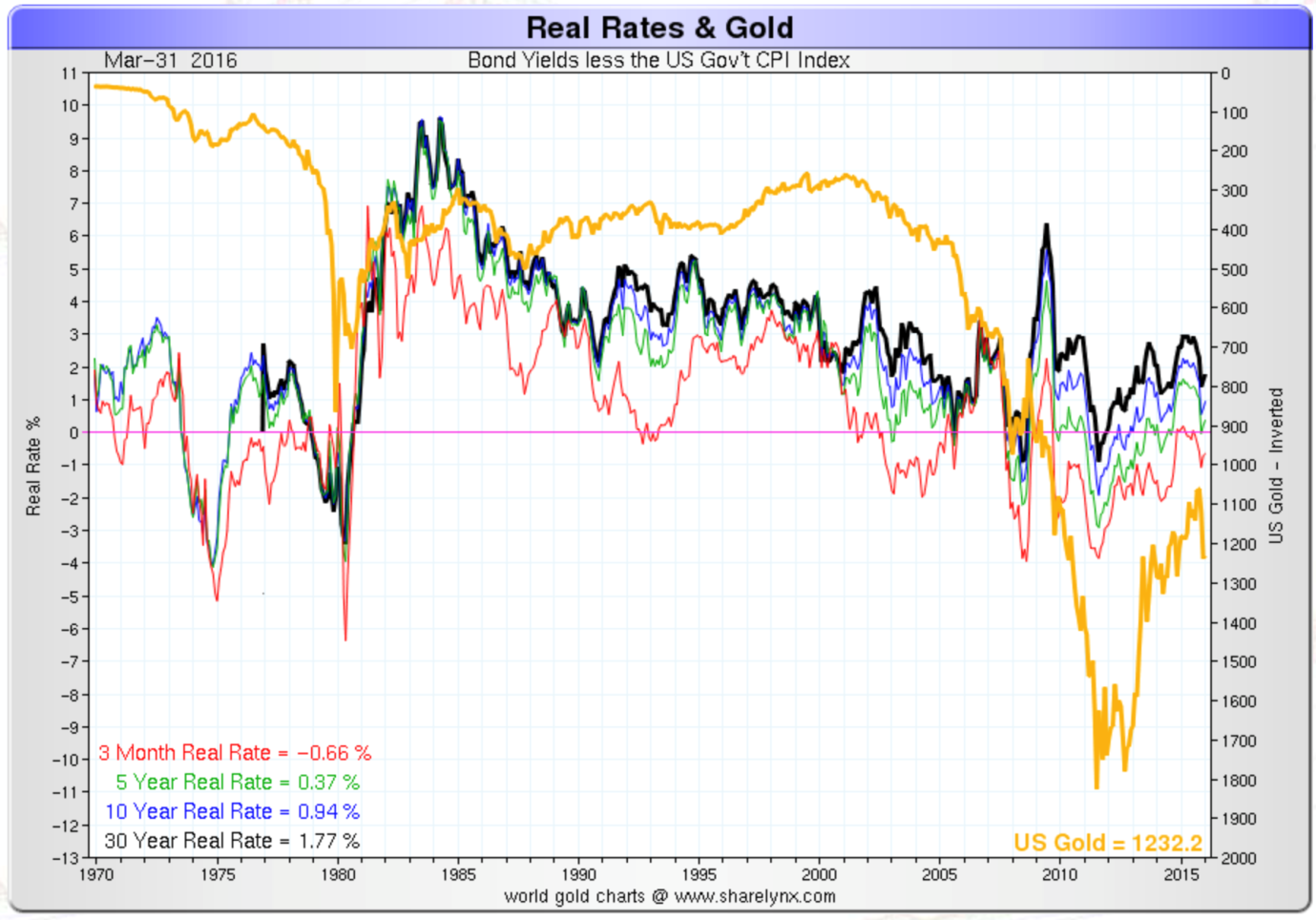

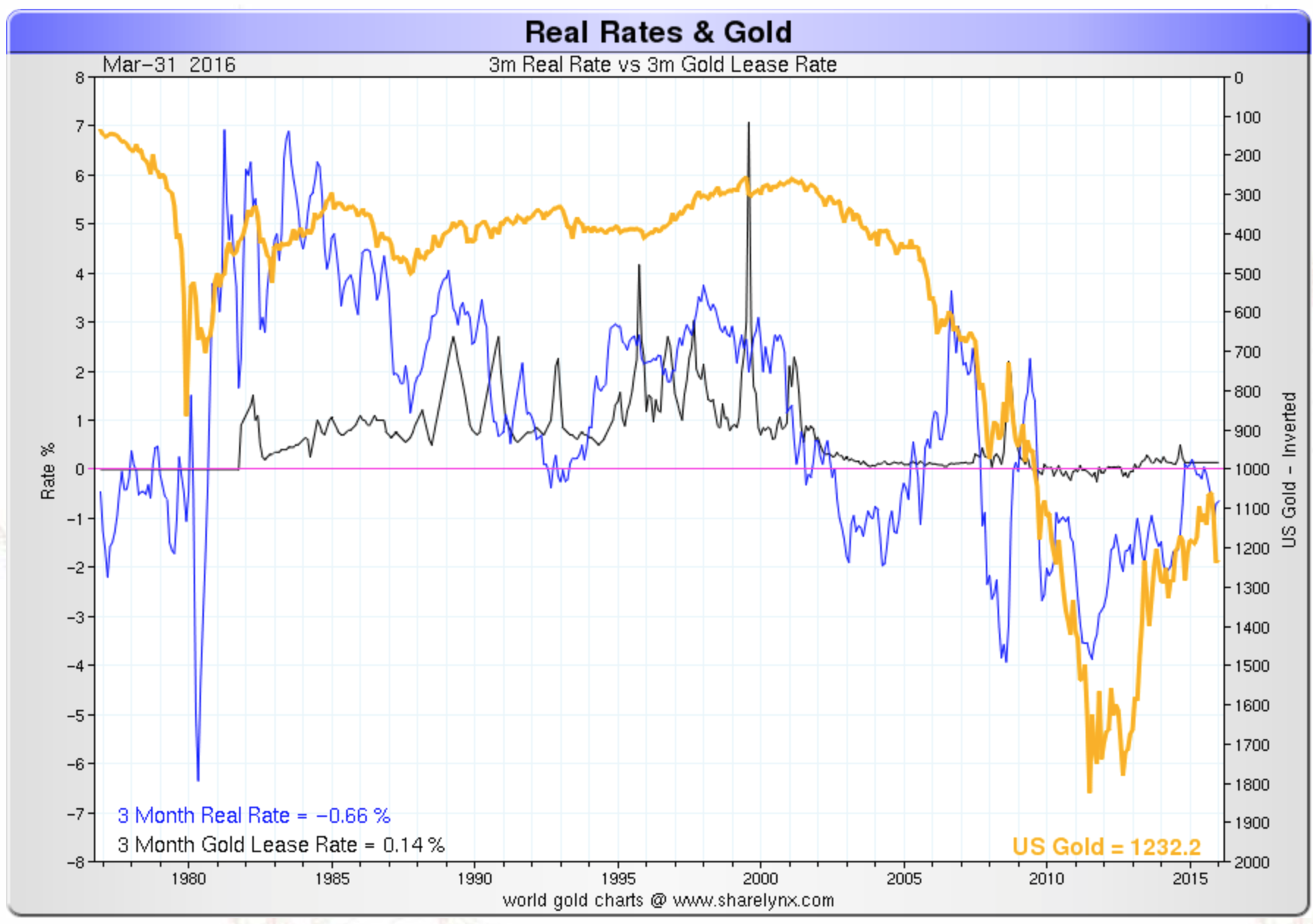

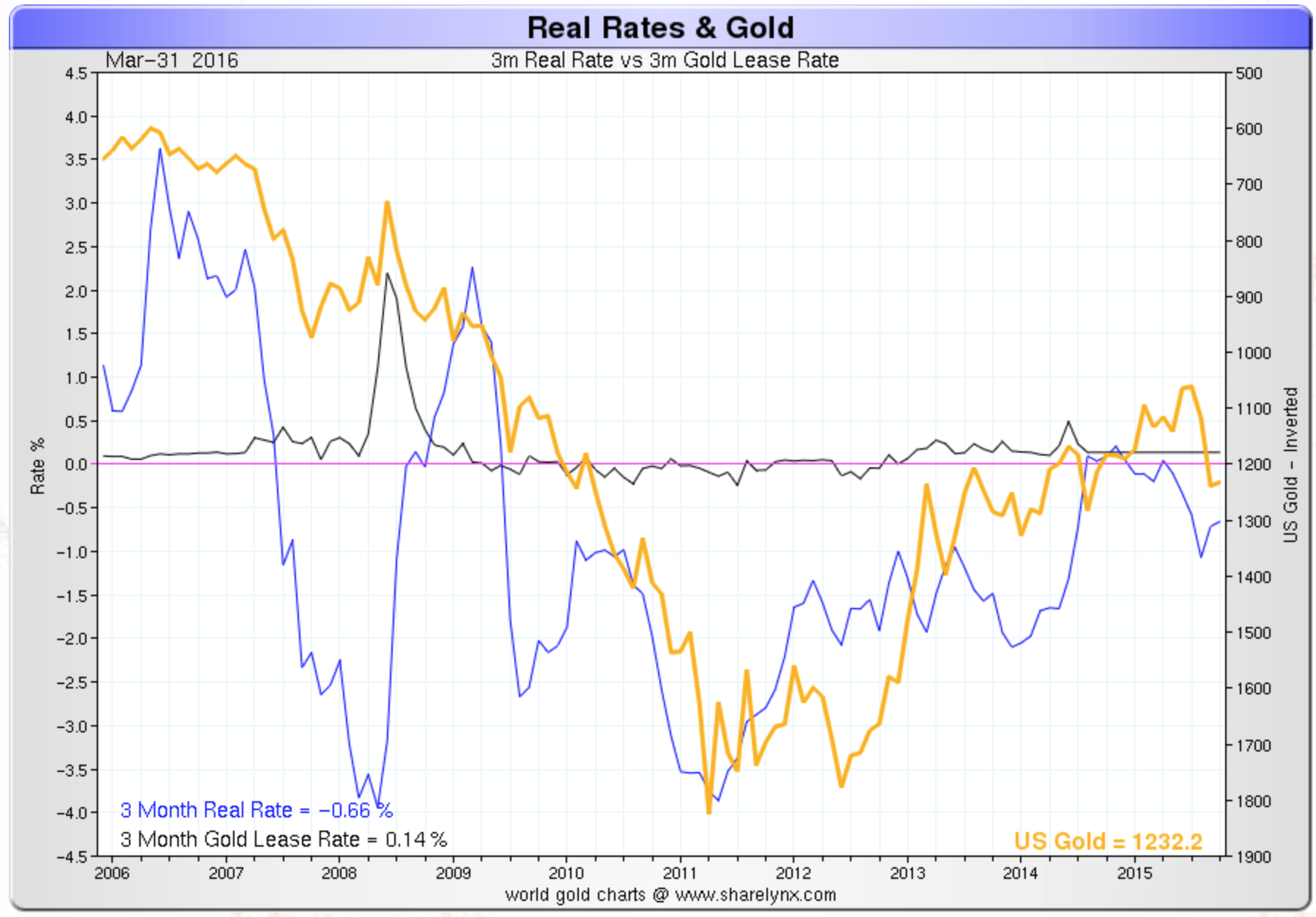

Real interest rates have been negative fairly often, including for most of the period since 2009. The problem then comes in choosing the appropriate measure of inflation. Since the calculation of inflation is highly subjective and easy to manipulate I came to adjust nominal prices to gold to get the real interest rates. In the chart below you can see nominal U.S. 10-year Treasury rates versus gold-adjusted rates since 1962.

Ben Bernanke says in his article that, “The fundamental economic constraint on how negative interest rates can go is that, beyond a certain point, people will just choose to hold currency, which pays zero interest. (It’s not convenient or safe for most people to hold large amounts of currency, but at a sufficiently negative interest rate, banks or other institutions could profit from holding cash, for a fee, on behalf of customers). Based on calculations of how much it would cost banks to store large quantities of currency in their vaults, the Fed staff concluded in 2010 that the interest rate paid on bank reserves in the U.S. could not practically be brought lower than about -0.35 percent.”

In Japan, the European Union and Switzerland, where negative interest rates are already there, an increased demand was observed for safes and cash. When negative rates took effect in mid-February in Japan, queries about home safes surged, especially from customers aged 50 and over. Sales of safes are now running some 40 to 50 percent above this time last year, according to a Reuters’ article. In the European Union Reuters reports the same trend. The European Central Bank's negative interest rates are sparking demand for safe deposit boxes, where bank customers can store cash to avoid the prospect of paying the bank interest on their accounts, said German bankers to Reuters. The same trend was observed recently in Switzerland, not only with private investors but also with pension fund managers.

At the same time, we learn that negative rates have boosted demand for gold in Japan. According to Takahiro Ito, chief manager at Tanaka Kikinzoku Kogyo K.K.’s store in Tokyo’s Ginza shopping district, “Many customers are wagering that it’s better to turn their savings to gold as a safe asset rather than deposit money at banks that offer low interest rates,” reports Bloomberg. Consumer gold demand in Japan rose to 32.8 metric tonnes in 2015 from 17.9 tonnes a year earlier, also reports Bloomberg in the same article. Gold bar sales climbed by 35 percent to 8,192 kilograms in the three months ended March 31 from a year earlier, Tanaka Kikinzoku Kogyo K.K., the country’s biggest bullion retailer, said, according to Bloomberg.

A boom in safe-deposit-box companies was also observed in Switzerland in the canton of Ticino, according to another Bloomberg article. The rise of safe-deposit boxes has created a boon for jewelers along Lugano’s Via Nassa, home to Cartier, Bulgari, and Bucherer boutiques, as people race to convert cash into assets they can lock away. Bloomberg reports that, “Investors are buying more gold as an alternative to holding Swiss franc cash deposits, according to Vontobel Holding AG, a Swiss bank and wealth manager… “We keep noticing that gold is coming back into favour with investors,” said Vontobel’s Chief Executive Officer Zeno Staub.”

Gold in a negative interest environment is the best way to store large amounts of cash. A gold coin of 1 once (31.1 grams) stores about $1,230 while a one-kilogram bar of gold stores about $39,620 today and is just about the size of your palm. With the threat of banning cash and with the one-hundred-dollar bill being the largest denomination, both in the U.S. and Canada, you can easily see the advantage of holding gold in a safe or under the mattress. In the European Union there is also talk of banning large euro denominations like the 500-euro bill.The largest denomination in the UK is just 50 pounds.

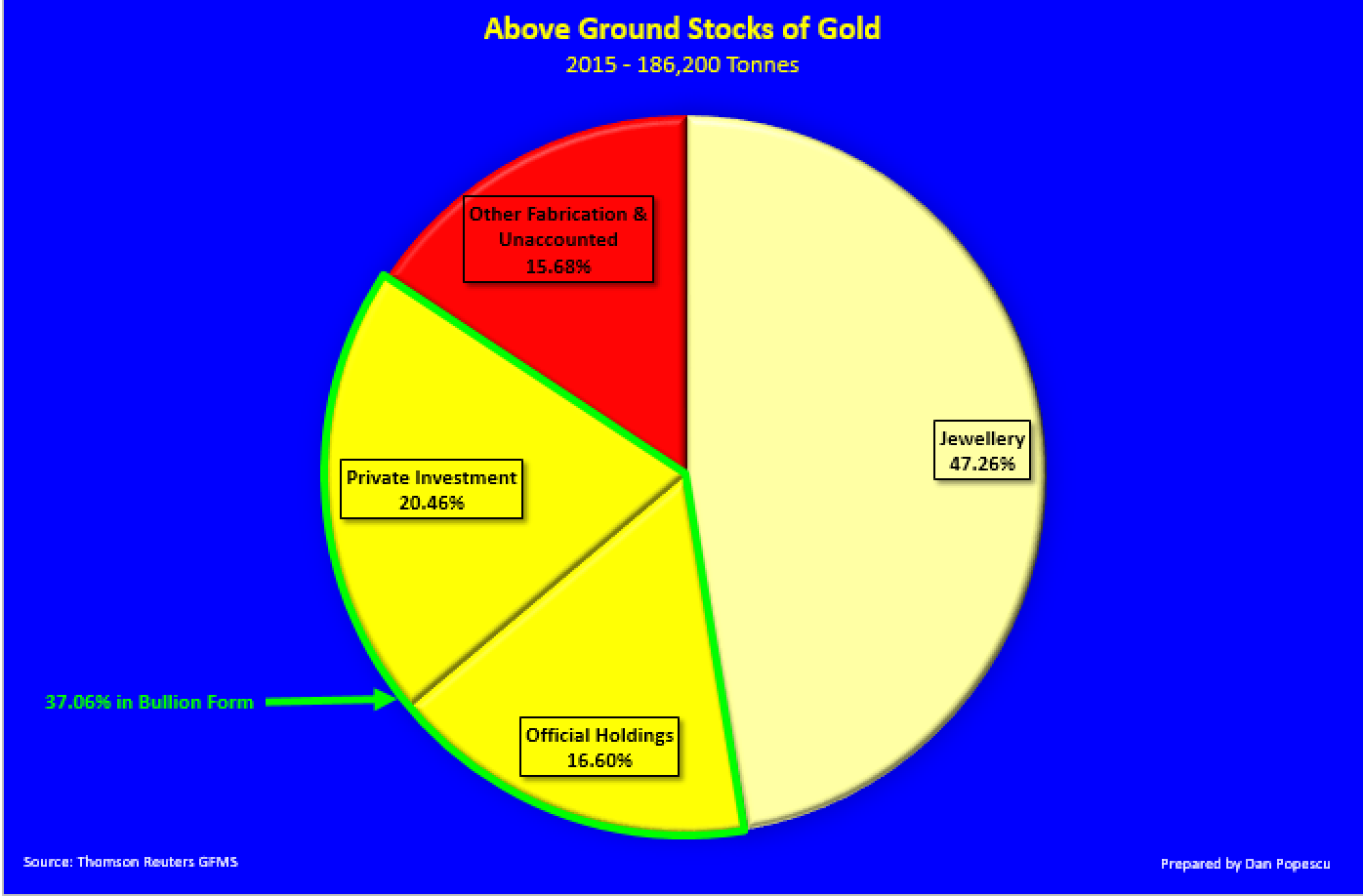

But negative interest rates also increase the cost of doing business for the banks, which find it hard to pass on those costs to borrowers, therefore weakening the banking system. This has the effect of encouraging people to buy gold and hold it outside the banking system despite the inconveniences. It is for this reason some economists are associating negative interest rates with a ban on physical currency. In order to impose effectively negative rates, you must have control of people’s cash. The state can easily control access to electronic money by limiting the amount of withdrawal from the banking system just with a small adjustment in the software. The state can stop printing fiat money but it can’t easily ban physical currency like gold and silver. It is estimated that there is approximately 20% of the above-ground gold in private hands and in the purest bullion form. A large part of the jewelry stock can also be used, if necessary, as cash.

Today in this negative interest rate environment you should be more concerned about the return of your money, than the return on your money. Compared with negative interest rates it is obvious why people are rediscovering the value of holding gold. Gold tends to perform well in declining or negative real interest-rate environments. The more central banks move to negative rates, the more gold is going to take off because there's no carrying cost. High real rates are bad for gold while negative real rates are good for gold.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.