By Dan Popescu for Goldbroker.com

What role does the United States play in the gold market? The United States is, after the European Union, the largest holder of gold reserves, according to the International Monetary Fund (IMF). Besides China, Russia, India and the European Union, the United States is one of the most important players in the gold market. It is, in my opinion, the most anti-gold country of all the major five players. A whole generation of economists has been indoctrinated to ignore gold or denigrate it as a relic of the past, or a useless metal. Ferdinand Lips, author of Gold Wars, says in his book that “It had become un-American to speak about gold.”(1)

One just has to listen to billionaire Charlie Munger, an associate of Warren Buffett, stating that “gold is a great thing to sew onto your garments if you're a Jewish family in Vienna in 1939, but civilized people don't buy gold - they invest in productive businesses.“(2) Warren Buffett himself said, “[Gold] gets dug out of the ground in Africa, or some place. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”(3) Furthermore, economist Nouriel Roubini says, “Gold remains John Maynard Keynes’s “barbarous relic”, with no intrinsic value and used mainly as a hedge against mostly irrational fear and panic.”(4)

After President Nixon took the dollar off gold in 1971, there were flexible exchange rates for a few months but then countries went back to the dollar and not gold. The international monetary system then became a pure dollar standard. The Federal Reserve is the “de facto” central bank of the international monetary system, because the dollar is the monetary standard of the world banking system. However, “the problem with a pure fiat standard is that it works only if the reserve country can keep its monetary discipline”.(5) Aristotle said, 2,400 years ago, “In effect, there is nothing inherently wrong with fiat money, provided we get perfect authority and god-like intelligence for kings.”(1) It is evident today that the US is not holding its monetary discipline. The loose monetary policy pursued by the Federal Reserve in the aftermath of the financial crisis, coupled with the fiscal problems piling up is eroding the world’s trust in the US dollar. At the G-10 Rome meetings held in late 1971, John Connally, US Treasury secretary, proclaimed to his astonished counterparts, "the dollar is our currency, but it's your problem."(6) This American arrogant attitude is continuing to this day.

President Nixon and Secretary of State, Henry Kissinger, knew that their destruction of the international gold standard under the Bretton Woods arrangement would cause a decline in the artificial global demand of the US dollar. Maintaining this artificial dollar demand was vital if the United States were to continue expanding its welfare and warfare excessive spending.

In exchange for weapons and guaranteed protection from Israel, the Saudis agreed to price all of their oil sales in U.S. dollars only and invest their surplus oil proceeds in U.S. debt securities. The petrodollar is a term used for US dollars used by different countries in exchange for buying oil and other goods. It is extensive enough that it has become the reserve currency of the world. The significance for the United States is that the US depends upon being able to print an almost unlimited amount of dollars and circulate them outside the country, so that the US can export its inflation and buy many goods at cheaper value than it would otherwise. If the petrodollar comes into question as to how frequently it is going to be used, it would change the whole metric for the US. The US, therefore, has every reason to hate gold. Gold is the biggest threat to US dollar supremacy. No other fiat currency, without gold’s help, can challenge it today. It is for this reason that the US has and is manipulating the gold price.

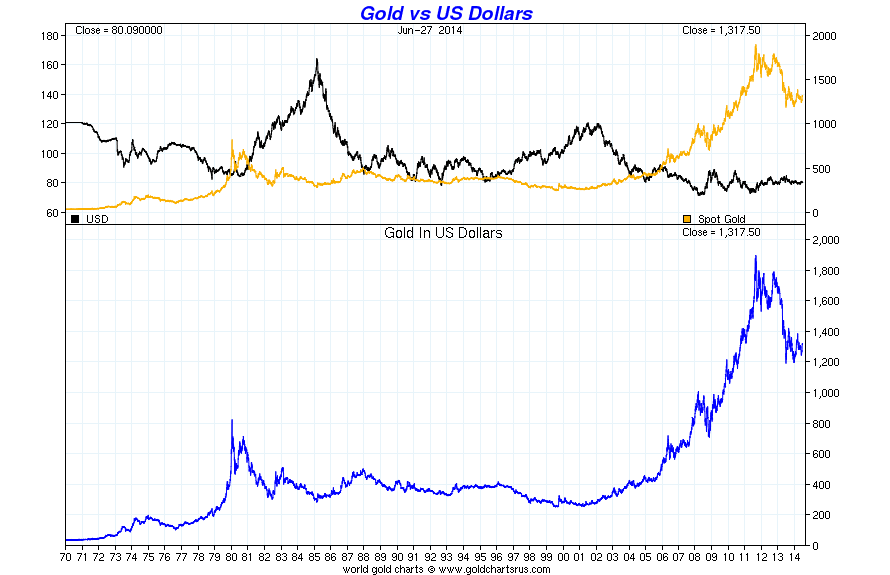

Graph #1: Gold in US Dollars

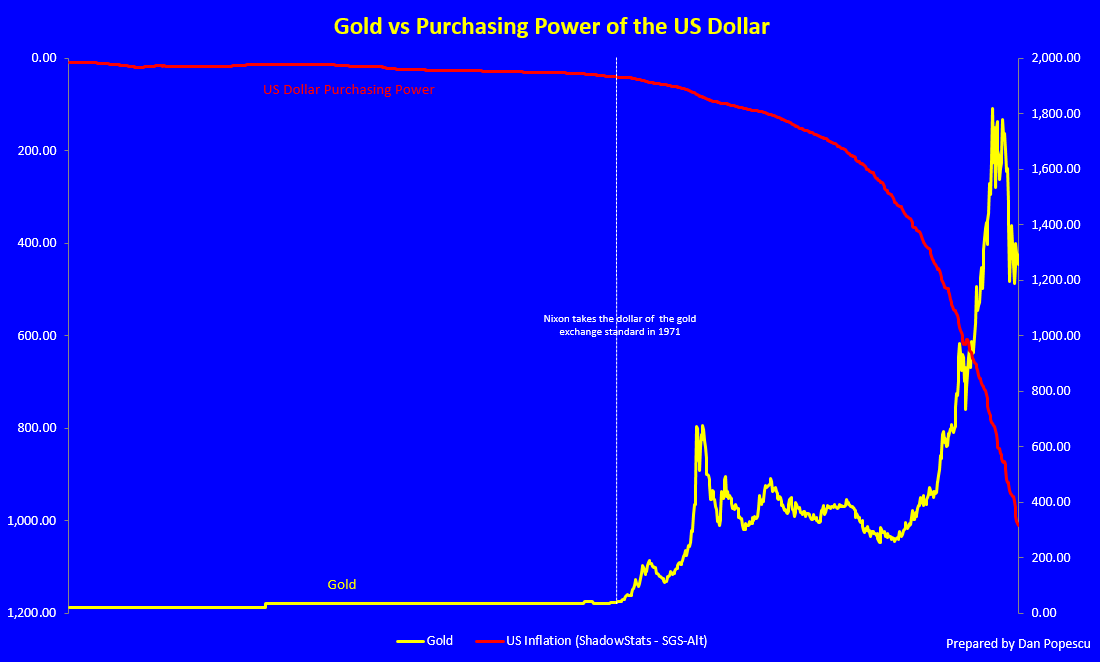

Since 1971, when the dollar was delinked from gold, gold has appreciated in dollar terms 3,621.8% or, we should better say, the dollar went down in gold terms 3,621.8%. As we can see in graph #2, the purchasing power of the dollar has almost totally vanished (down approx. 95%). Voltaire said, “Paper money eventually returns to its intrinsic value – zero.”(7) The US dollar is definitely on its way to confirm Voltaire.

Graph #2: Gold vs Purchasing Power of the US Dollar 1913-2014

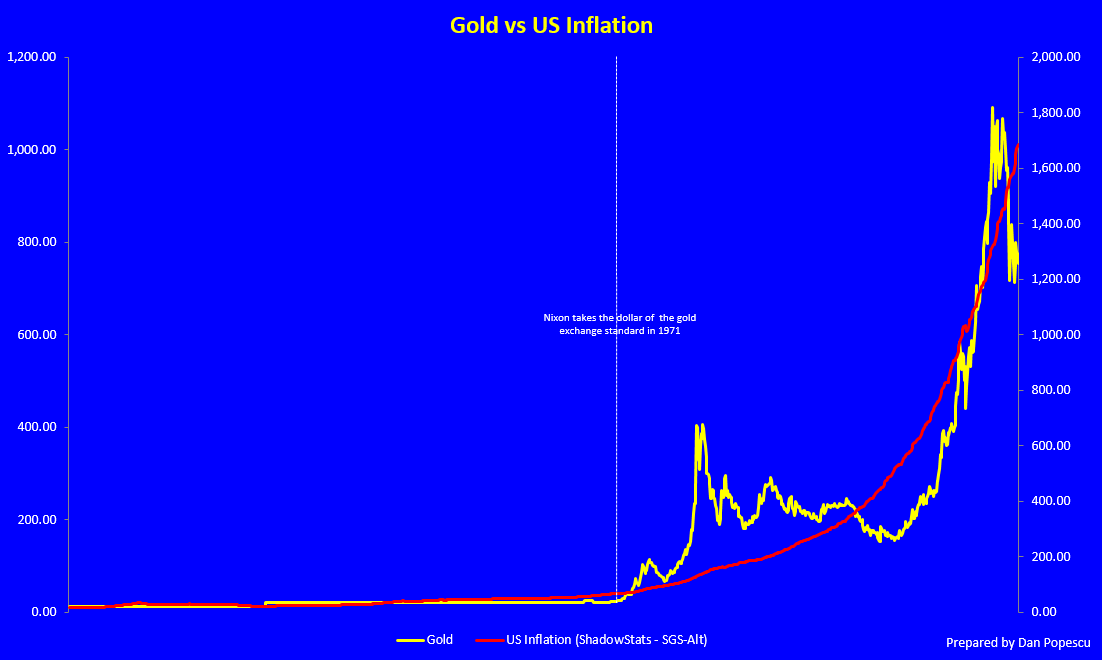

Since 1971, the price of gold has exploded, following closely US inflation (graph #3), sometimes leading and at other times lagging.

Graph #3: Gold vs US Inflation 1913-2014

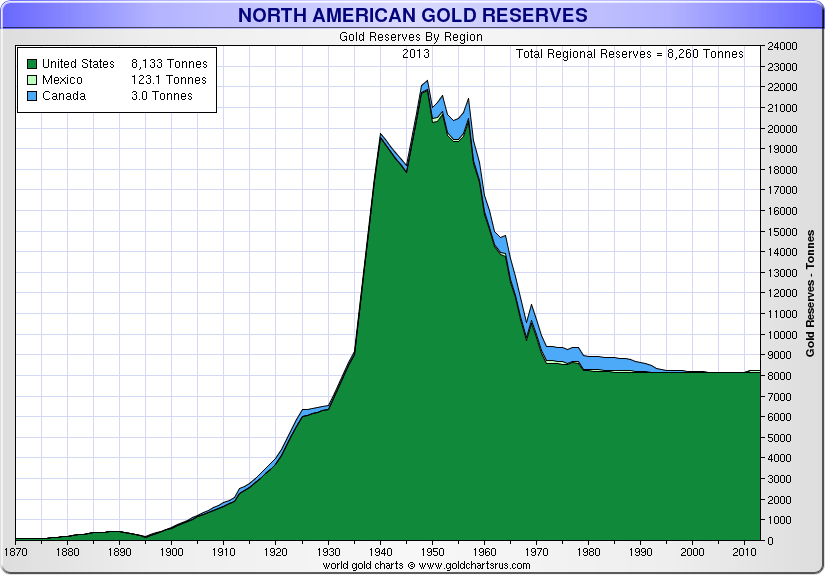

In the 1950s, the United States had close to 22,000 tonnes of gold reserves and by 1971, when President Nixon delinked the dollar from gold, the US had only 8,133 tonnes left. The U.S. had 70% of the world’s monetary gold stock in 1948. That is approximately a 64% drop in gold reserves in twenty years. In 1971, President Nixon took the dollar off gold, in order to keep the remaining 30%.

Graph #4: US Official Gold Reserves

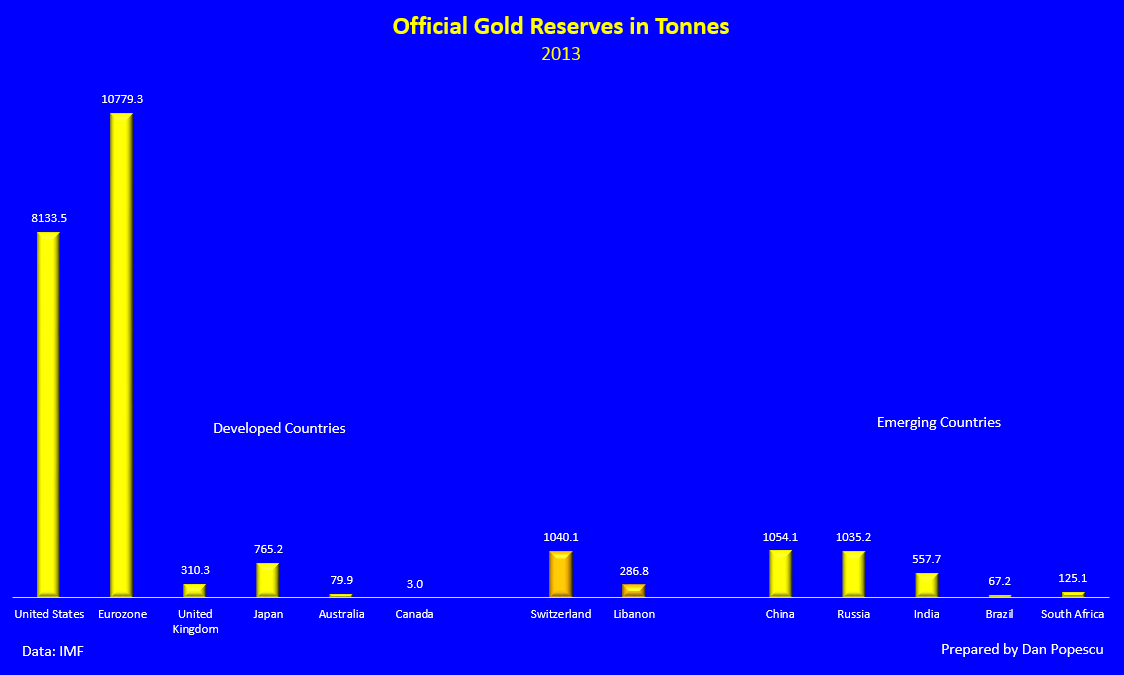

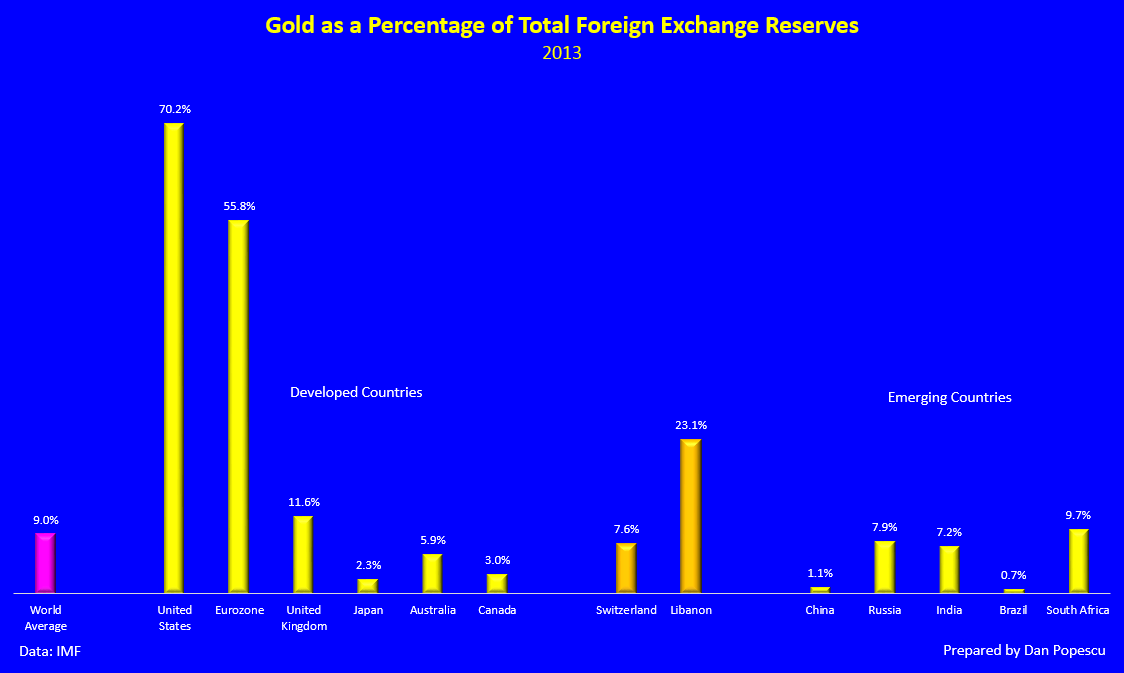

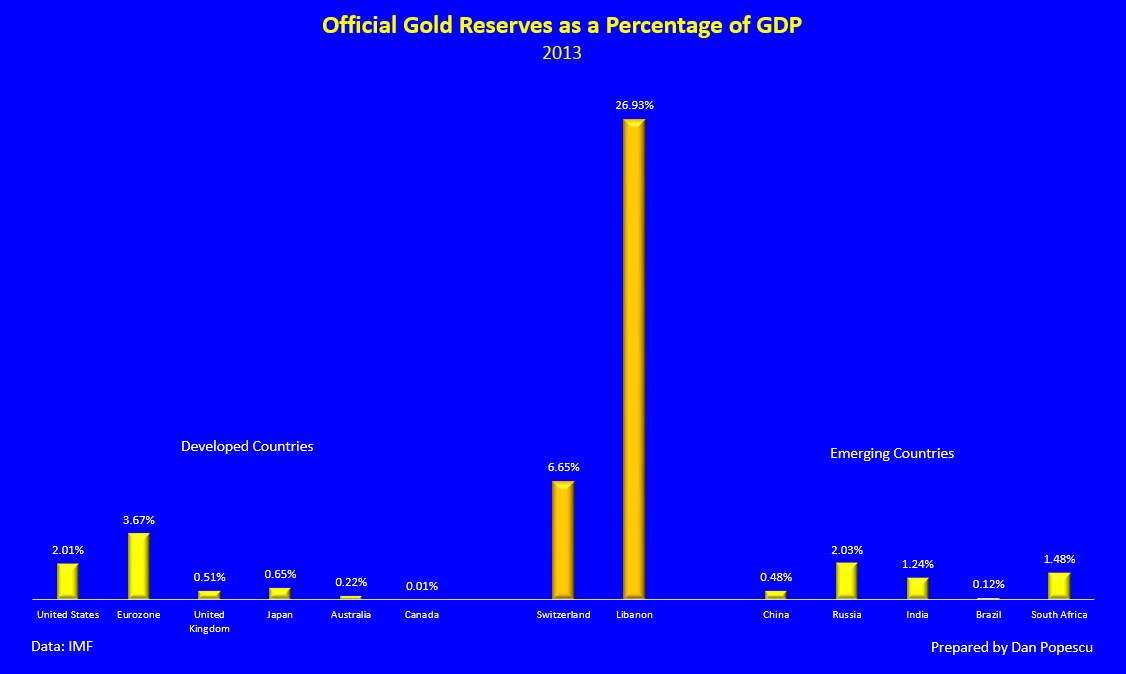

Today, if official data is correct, the US still has 8,133.5 tonnes of gold (graph #5), making it the second largest holder of gold reserves after the Euro Area. Gold still represents 70.2% of total US foreign exchange reserves (graph #6) and, as a percentage of GDP, It is 2.1% vs 3.67% for the Euro Area (graph #7). It seems to be a contradiction when you compare the US gold reserves with the anti-gold propaganda coming out of the US government and the economic and financial community. If gold is a relic of the past, then why is the US still holding so much of this “useless” and “valueless” metal? Or is it just ‘do as I say not as I do’?

Graph #5: Official Gold Reserves in Tonnes

Graph #6: Gold as a Percentage of Total Foreign Exchange Reserves

Graph #7: Official Gold Reserves as a Percentage of GDP

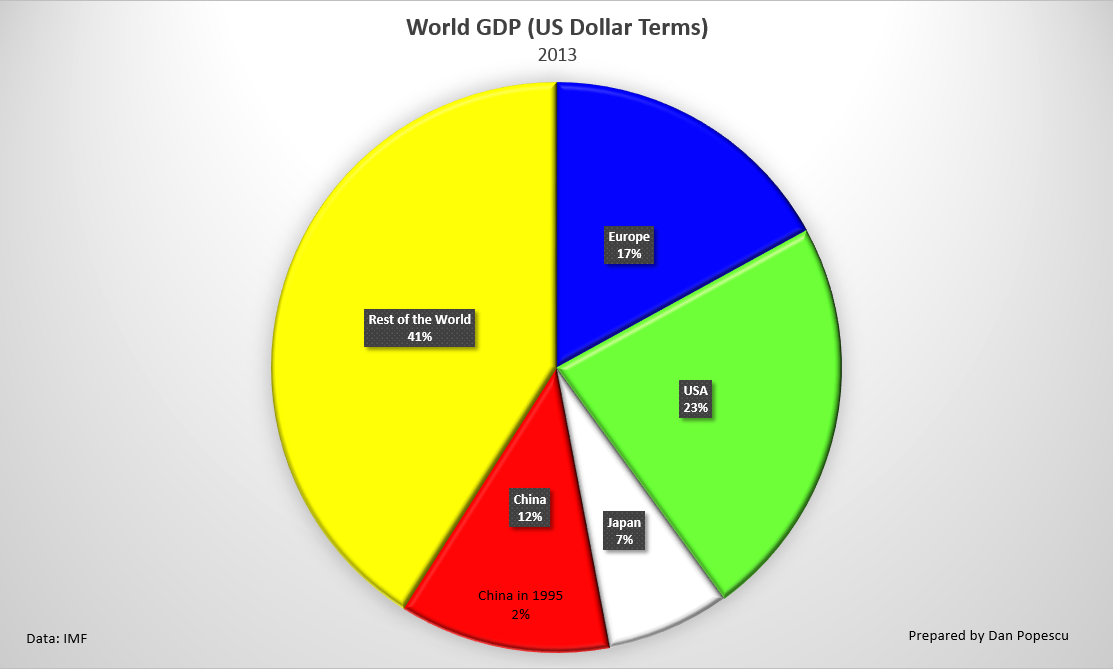

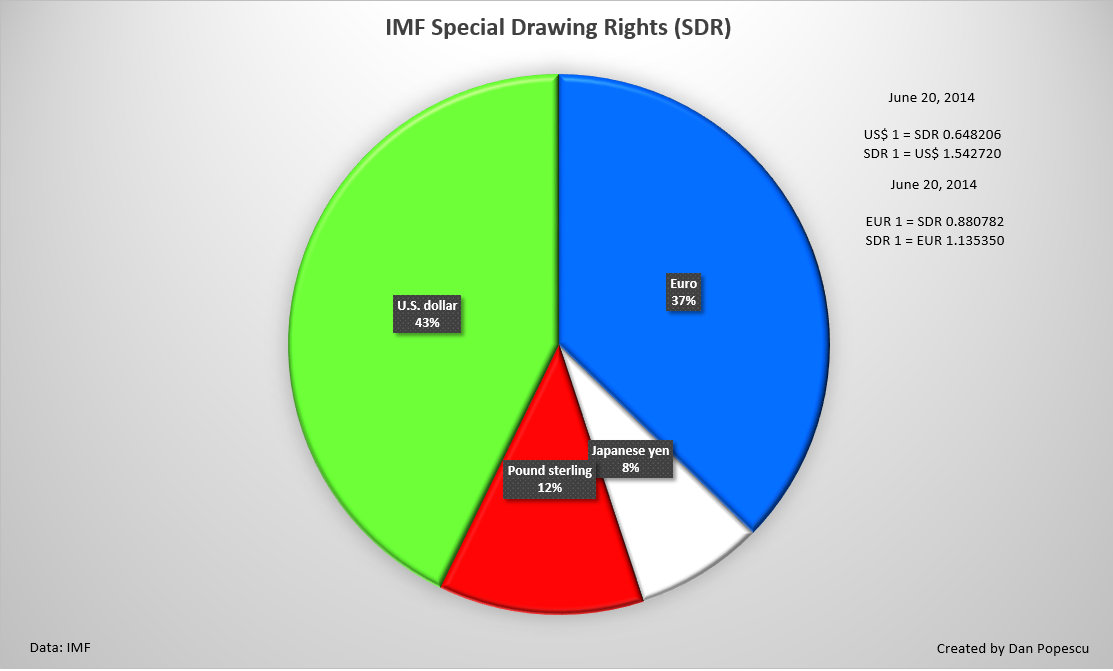

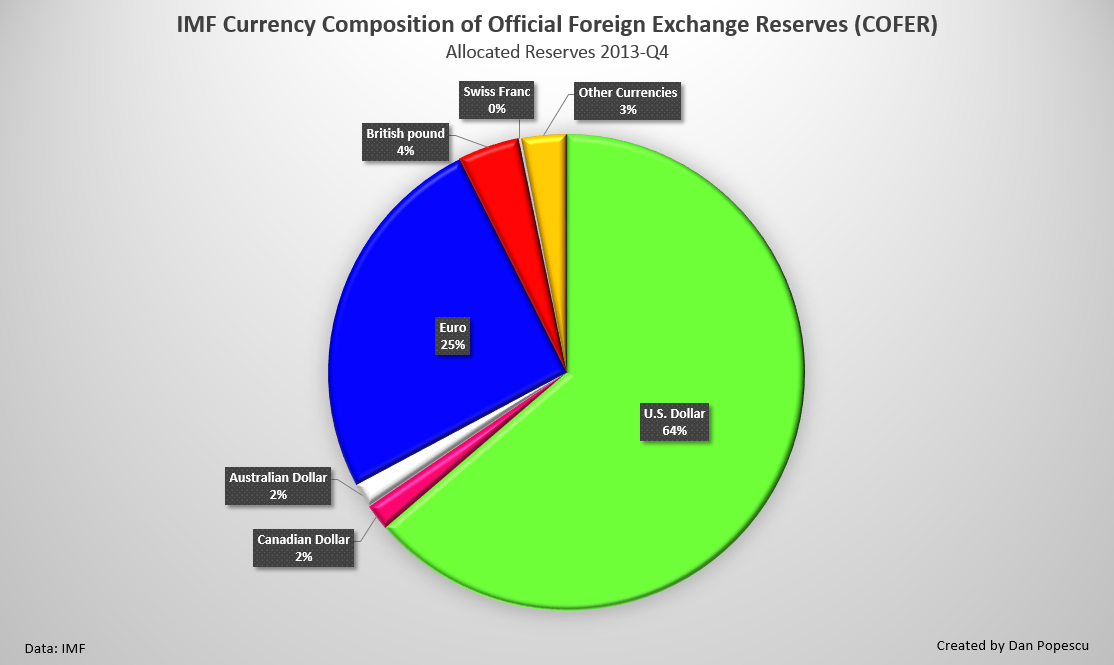

The US dollar has been the world's trade currency and the largest reserve currency for the past 43 years. In 2013, the US represented 23% of world GDP, Europe 17% and China 12% (Annex chart #1). The composition of the IMF’s Special Drawing Rights (SDRs )in 2013 was 43% US dollars, 37% EU euros, 12% British pounds and 8% Japanese yens, but no Chinese Yuan (Annex chart #2). The IMF’s currency composition of official foreign exchange reserves was 64% US dollars, 25% EU euros, and no Chinese Yuan (Annex chart #3).

It is evident that the Chinese and the Russians are working together against the Americans to dethrone the US dollar from its “exorbitant privilege” and delink oil from the dollar. If they succeed, and it seems they will, then the dollar standard will collapse. Many countries would be happy to join Russia and China in dethroning the U.S. dollar as the world’s reserve currency. Both China and Russia seem to indicate that gold is a major instrument in that process.There is a game that the Chinese play called Weiqi, and it is similar to chess. In Weiqi, you have to surround your enemy slowly and lay a trap, and then close the trap all at once. The Chinese think that way. They do not really disclose what their plan is; they just move tiny pieces around the board in a seemingly incoherent way, but when all the pieces are lined up that is when the trap is sprung. Looking at the recent currency agreements to bypass the US dollar signed by China, it is clear that this Weiqi game is China’s strategy, but also Russia’s strategy against US dollar supremacy.

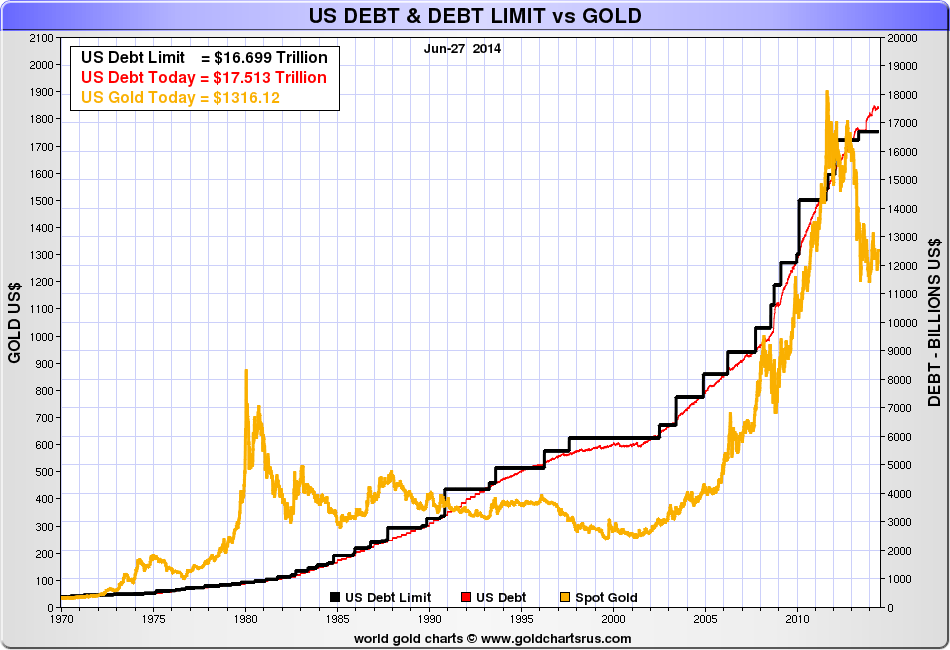

The US debt is greater than any other nation’s in the history of the world and it is still growing. Looking at graph #8, we see that the price of gold also closely follows the US debt.

Graph #8: US Debt and Debt Limit vs Gold

All that debt has to be monetized, hence the exponential increase in the money supply. In graph #9, we can see that the gold price also closely follows the money supply (M3). Since 2011 we can observe a divergence between the gold price and the money supply. It is argued by many that this is due to government intervention to suppress the price of gold. If that is the case, then we can expect the price of gold to explode to the upside when the manipulation stops. Market forces always win in the long-term.

Graph #9: US Money Supply M3 vs Gold Price

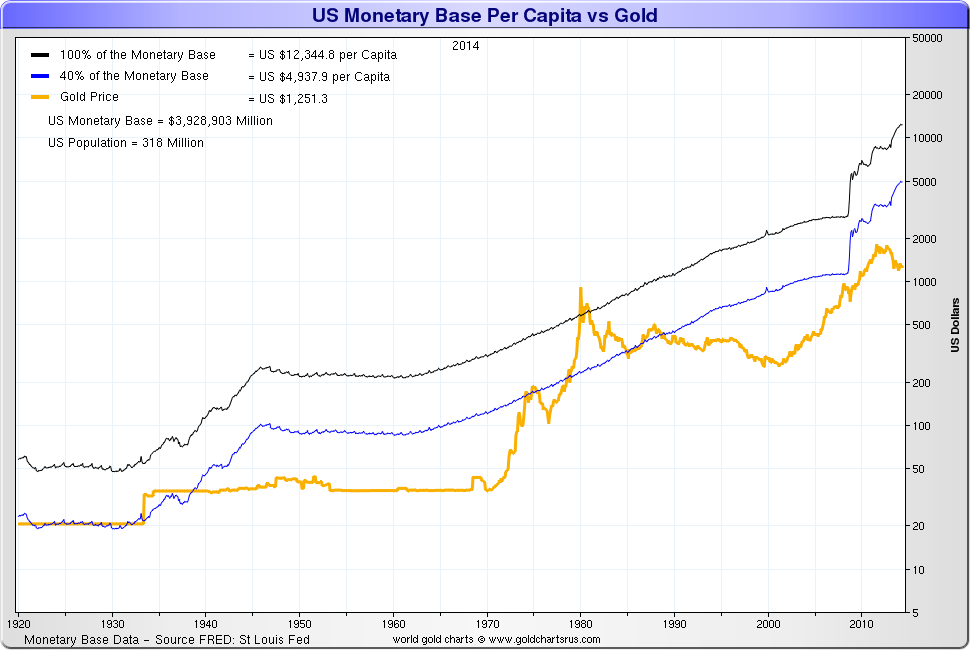

Chart #10 shows us approximately how much the price of gold should be if the gold price manipulation were to stop. If we consider a 40% gold coverage of the monetary base then the price of gold would be around $4,937.90 and, with a 100% coverage, it would be over $10,000.

Graph #10: US Monetary Base per Capita vs Gold

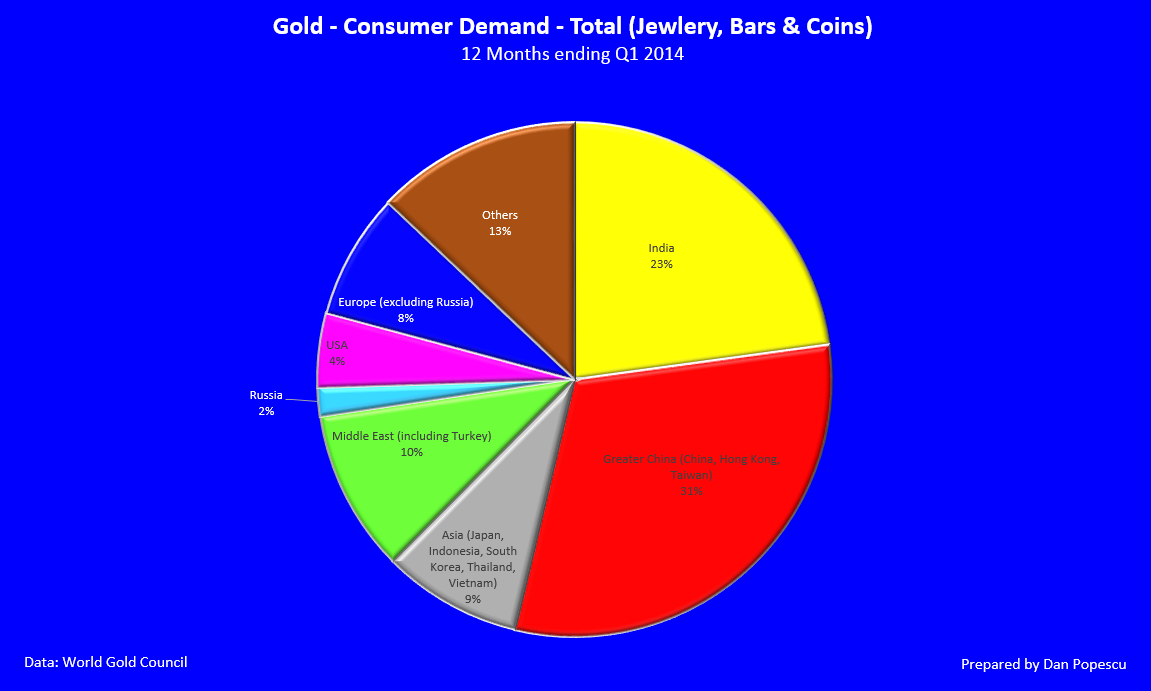

Looking at the US consumer demand (chart #11), we can clearly see that the propaganda against gold has succeeded, at least until now. Consumer demand for gold in the US is only 4% compared with China’s 31% and India’s 23%, according to the World Gold Council. Even in Europe, the consumer demand is double that of the US, at 8%. As for consumption per capita of gold, the US is not even in the twenty largest gold consumers (chart #12). However, even if the US consumer is not significant in the gold market, we have observed in recent years a substantial increase in the accumulation of gold by private individuals. Still, Americans accumulate a lot more silver than gold. It is also becoming much easier to buy gold in the US than it was the case in the past.

Graph #11: Total Consumer Demand (Jewelry, Bars and Coins)

Graph #12: Gold Consumption per Capita

US Gold and Silver 1 Troy Ounce Coins

100 US Dollar Note 2014 (backed by faith) vs 100 US Dollar Gold Certificate 1922 (baked by hard asset)

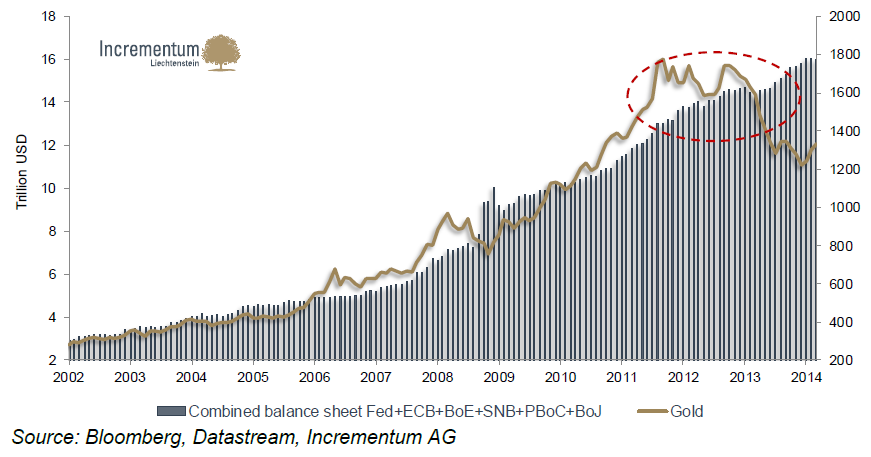

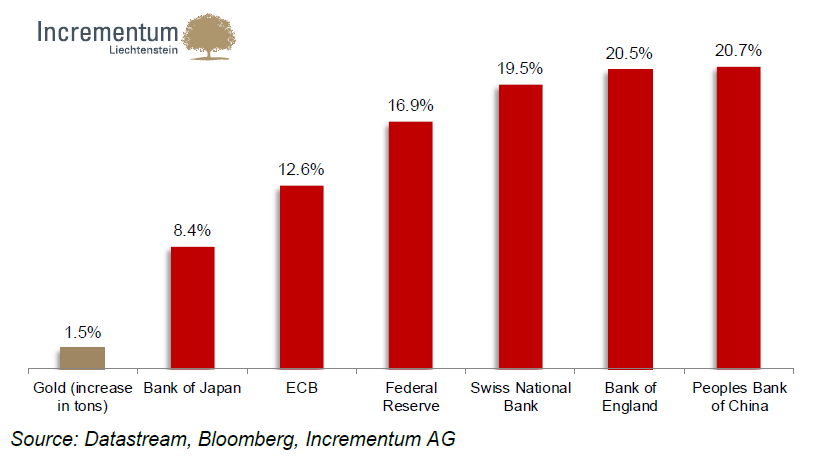

The global picture is in no better shape. The balance sheets of all the central banks (charts #13 and #14) are also in bad shape. This makes many believe that we will not have just a US dollar collapse, but a collapse of the entire fiat currency system, which has today at its core the US dollar. All currencies are linked in one way or another to the US dollar, and none are linked to gold.

Graph #13: Combined Global Balance Sheet Totals (Fed+ECB+BoE+SNB+PBoC+BoJ) in USD trillion (2002-2014)

Graph #14: Annualized Rate of Change of Central Banks’ Balance Sheets vs. Annual Growth in Gold Supply (2002-2014)

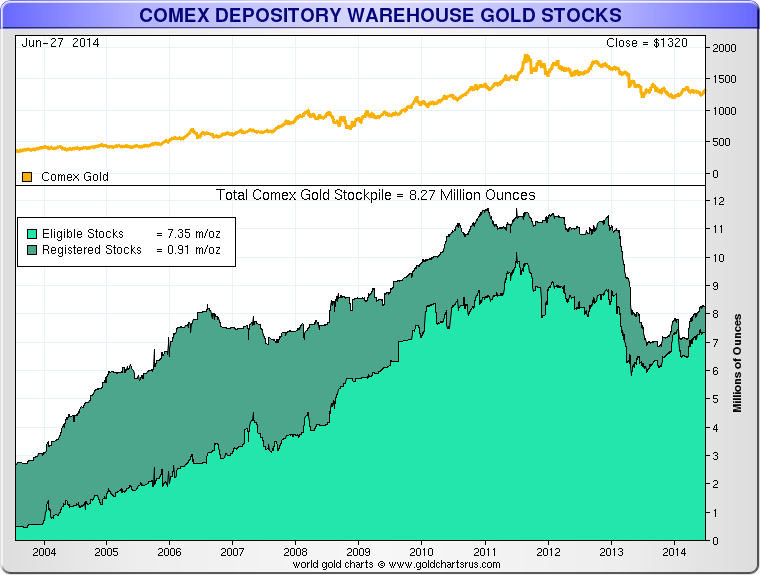

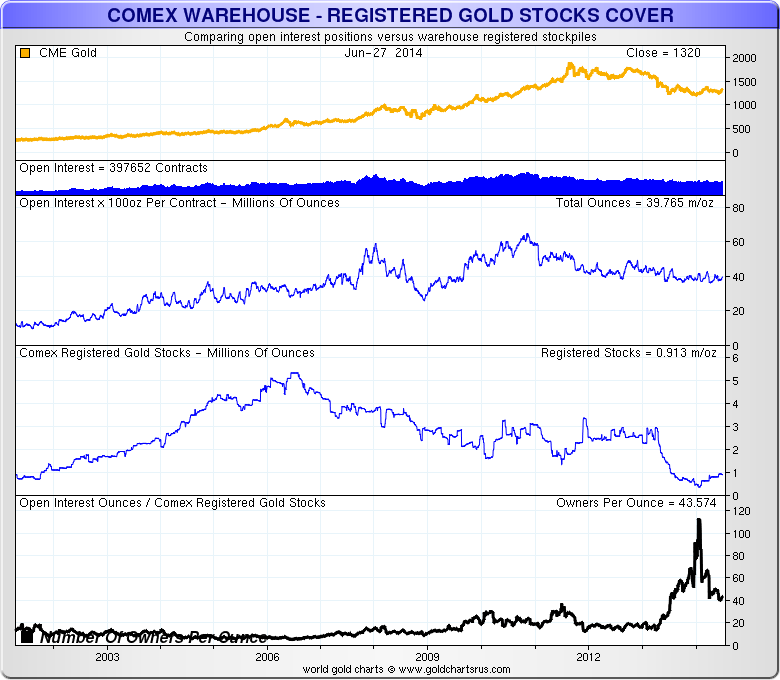

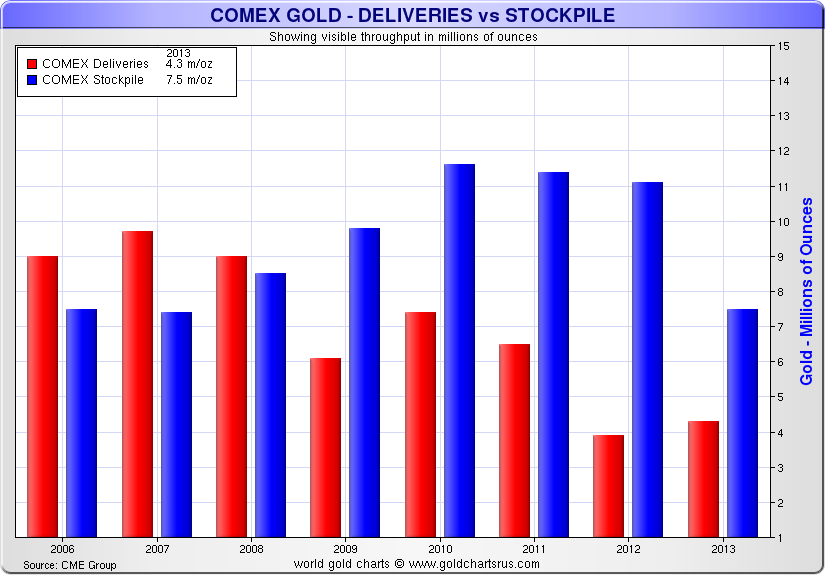

When we speak of gold and the United States, we cannot avoid speaking about the paper gold markets, and mainly of futures, options and ETFs. The US is by far the largest player and, in the last two decades, it has dominated the gold price discovery process through derivatives. It is also through the derivatives market that most of the gold price manipulation takes place. Even if the physical gold market has moved to Asia, the paper gold market remains dominated by the US; institutions (through futures, options and ETFs) and individuals (through ETFs). As you can see in graph #16, there are, as of June 27, 2014 ,43.74 owners of gold for each ounce of physical gold. Sometime in January 2014 there were close to 115 owners for each ounce of gold. Observe also the big drop in 2013 of the stockpile of gold at the COMEX, compared to 2012, of about 32% (graph #17). This has brought speculation that the derivatives markets will be in default in the near future. Physical gold is sold and delivered mostly to Asia and it will not come back; at least not at present suppressed prices.

Graph #15: COMEX Depository Warehouse Gold Stocks

Graph #16: COMEX Warehouse – Registered Gold Stocks Cover

Graph #17: COMEX Gold – Deliveries vs Stockpile

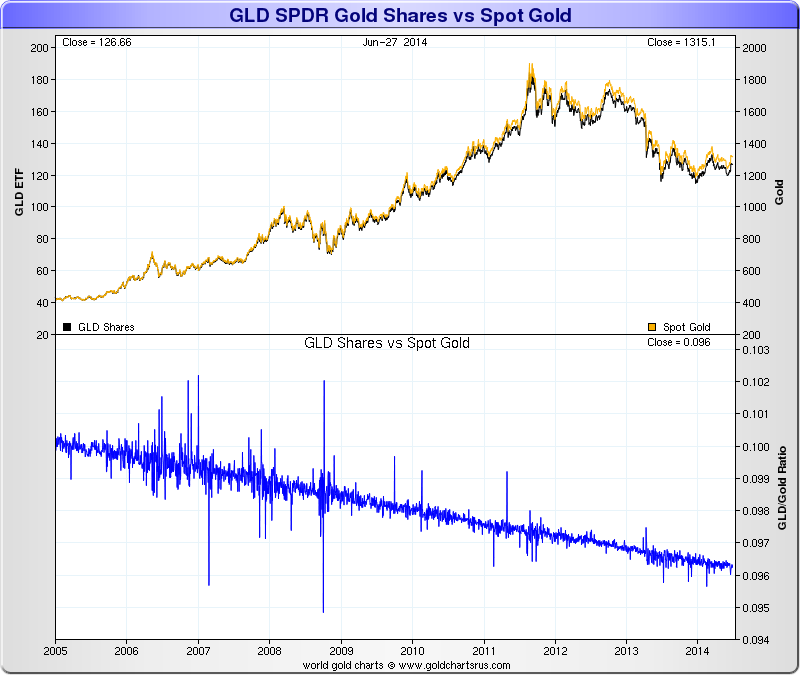

The GLD SPDR Gold Shares ETF vs Spot Gold graph #18, below, compares “paper” gold (ETFs) to “real” gold (bullion). GLD represents 1/10 ounce of physical gold less handling fees; hence, the price is always declining.

Graph #18: GLD SPDR Gold Shares ETF vs Spot Gold

Gold is more than just anti-dollar; it is also anti-euro, anti-swiss franc, anti-yen, anti-Yuan, etc., all at the same time; it is anti-fiat currency. The entire fiat currency system based on debt has been discredited and is collapsing, not just the US dollar.

Gold is real money. It is hard currency universally recognized. Charles de Gaulle, President of France, in 1965, just before US president Nixon took the dollar of the gold exchange standard, said:

“The time has come to establish the international monetary system on an unquestionable basis that does not bear the stamp of any country in particular. On what basis? Truly, it is hard to imagine that it could be any other standard than gold.

Yes, gold whose nature does not alter, which may be formed equally into ingots, bars or coins; which has no nationality and which has, eternally and universally, been regarded as the unalterable currency par excellence.”(8)

However, President Nixon and Secretary of State Kissinger managed to prolong the life of the dollar even without any link to gold by linking oil to the US dollar. Let me quote now economist and Nobel Prize Laureate in Economics Robert Mundell, on any possible change to the present dollar-based international monetary system:

“Historically, whenever there has been a superpower in the world, the currency of the superpower plays a central role in the international monetary system. The superpower typically has a veto over the international monetary system and, because it benefits from the international use of its currency, its interest is usually in vetoing any kind of global collaboration that would replace its own currency with an independent international currency. The United States would not talk about international monetary reform now anyway, because a superpower never pushes international monetary reform unless it sees reform as a chance to break up a threat to its own hegemony. From a national standpoint, the United States is never going to suggest an alternative to its present system because it is already a system where the United States maximizes its seigniorage. The more powerful the superpower becomes, the more it is tempted to expand beyond its international monetary potential and exact seigniorage from its clients (or victims?). The United States would be the last country to ever agree to an international monetary reform that would eliminate this free lunch. The more countries start to think about gold as an index, as a warning signal of inflation, the more the monetary authority will try to keep the price of gold from rising.”(5)

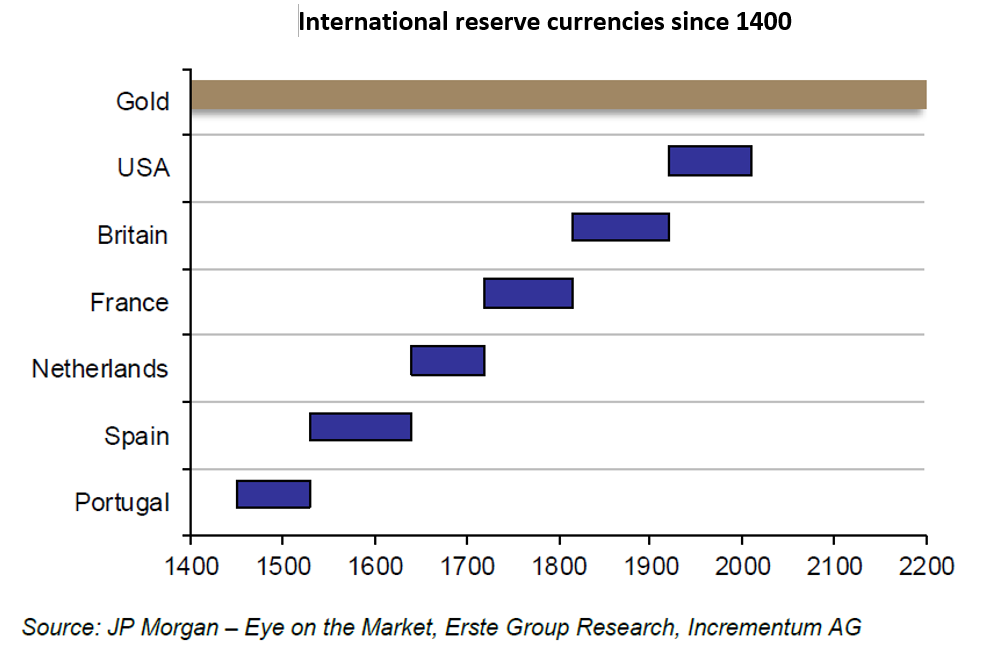

The US, in my opinion, will come to any negotiation to reform the international monetary system only in extreme circumstances, kicking and screaming, and will do everything in its power to abort the process if it can. The US government therefore has every reason to manipulate the price of gold to avoid a run on the dollar. If the US dollar-oil link ends, it will be the end of the dollar standard and it will have major negative consequences for the US economy. Could the US link the dollar to gold in some form and save its supremacy? It could but I doubt it. It is not in the US’s interest to initiate any change. There is a pro gold standard movement in the US, proposing to re-link the dollar to gold. However, as of today, it is not very strong. This present system was custom made for the US by the US at Bretton Woods in 1944. The US will use its gold reserves and the privilege of printing the international currency to sabotage any attempt to replace the dollar or that strays too far from the present system. However, I think we will have a “big reset” of the international monetary system soon, and gold is the biggest and the strongest adversary the US dollar has.Gold has been there for 6,000 years and has outlived every fiat currency (graph #19). What would that system be? I do not know but what I am sure is that gold will have a major role in the new system that will emerge, whatever it is.

In conclusion, gold is above all the anti-fiat currency and, therefore, we can definitely also say that gold is the anti-dollar. Of all the present major players in the gold market (United States, European Union, China, Russia and India), the United States ,in my opinion ,is by far the most anti-gold player, and for very good reason.

Graph #19: International Reserve Currencies since 1400

Annex:

Chart #1: World Gross Domestic Product (GDP) in US Dollars

Chart #2: International Monetary Fund (IMF) Special Drawing Rights (SDR)

Chart #3: International Monetary Fund (IMF) Currency Composition of Official Foreign Exchange Reserves

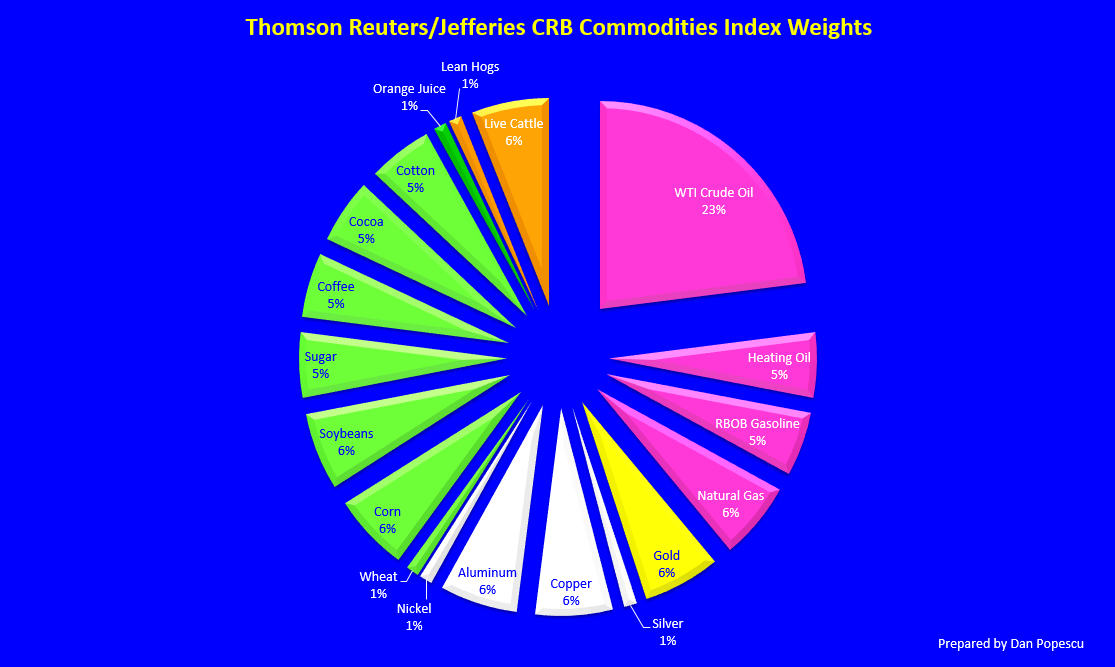

Chart #4: Thomson Reuters/Jefferies CRB Commodities Index Weights

Bibliography:

-

Gold Wars, Ferdinand Lips

-

Munger On Gold, Jews, And Civilized People

-

Gold: Is Nouriel Roubini right the ‘barbarous relic’ will sink to $1,000 by 2015?

-

The International Monetary System in the 21st Century: Could Gold Make a Comeback?, Robert Mundell

-

Notable Quotes

-

De Gaulle predicted the dollar crisis in 1965 and advocates the gold standard

-

In Gold we Trust 2014 Report, Ronald-Peter Stoeferle& Mark J. Valek, Incrementum AG

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.