By Eddie Van Der Walt

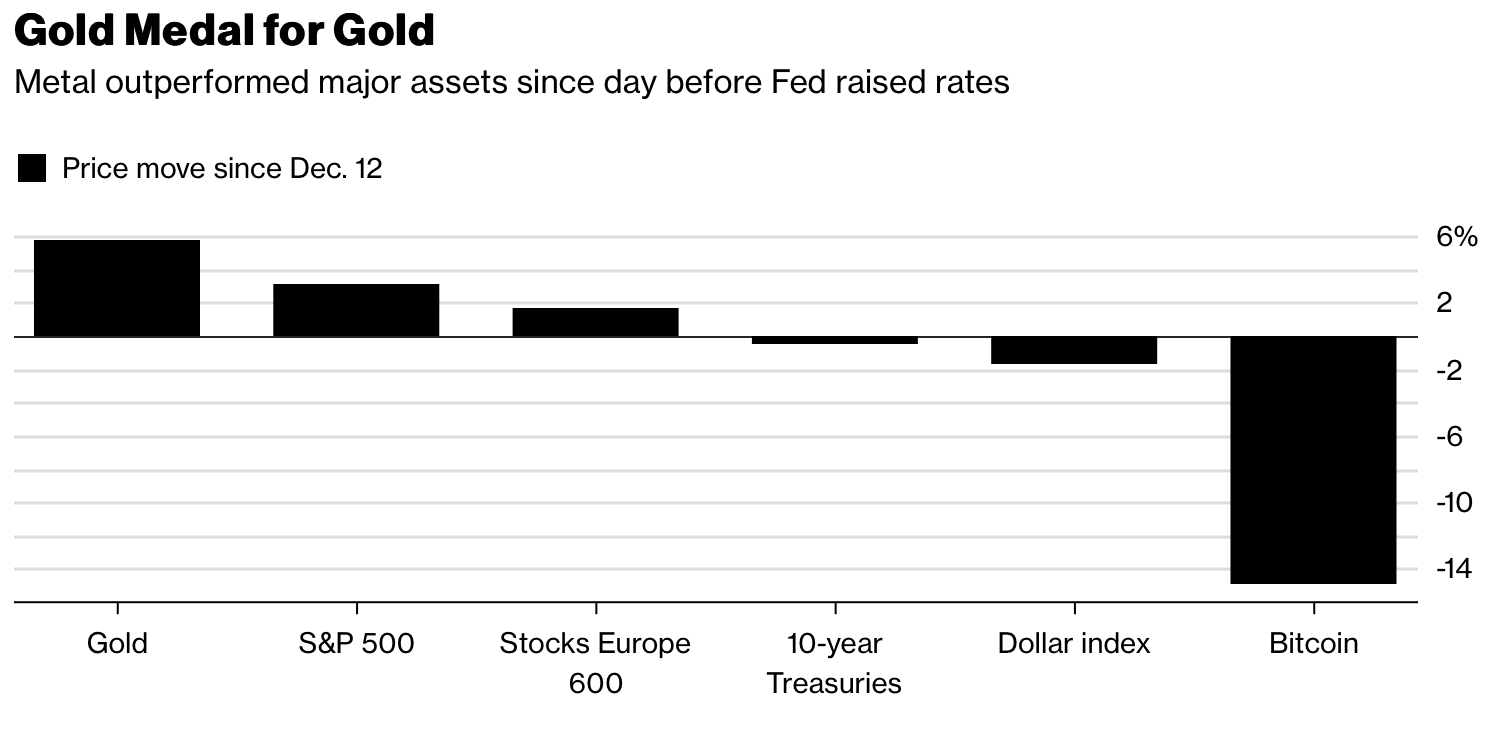

Gold’s outperformed most major assets since the U.S Federal Reserve last month raised interest rates -- even bitcoin.

“Since the December hike, gold is beating stocks, the dollar and bitcoin,” Bloomberg Intelligence analyst Mike McGlone wrote in a note. “Unless greenback weakness reverses, gold should shine.”

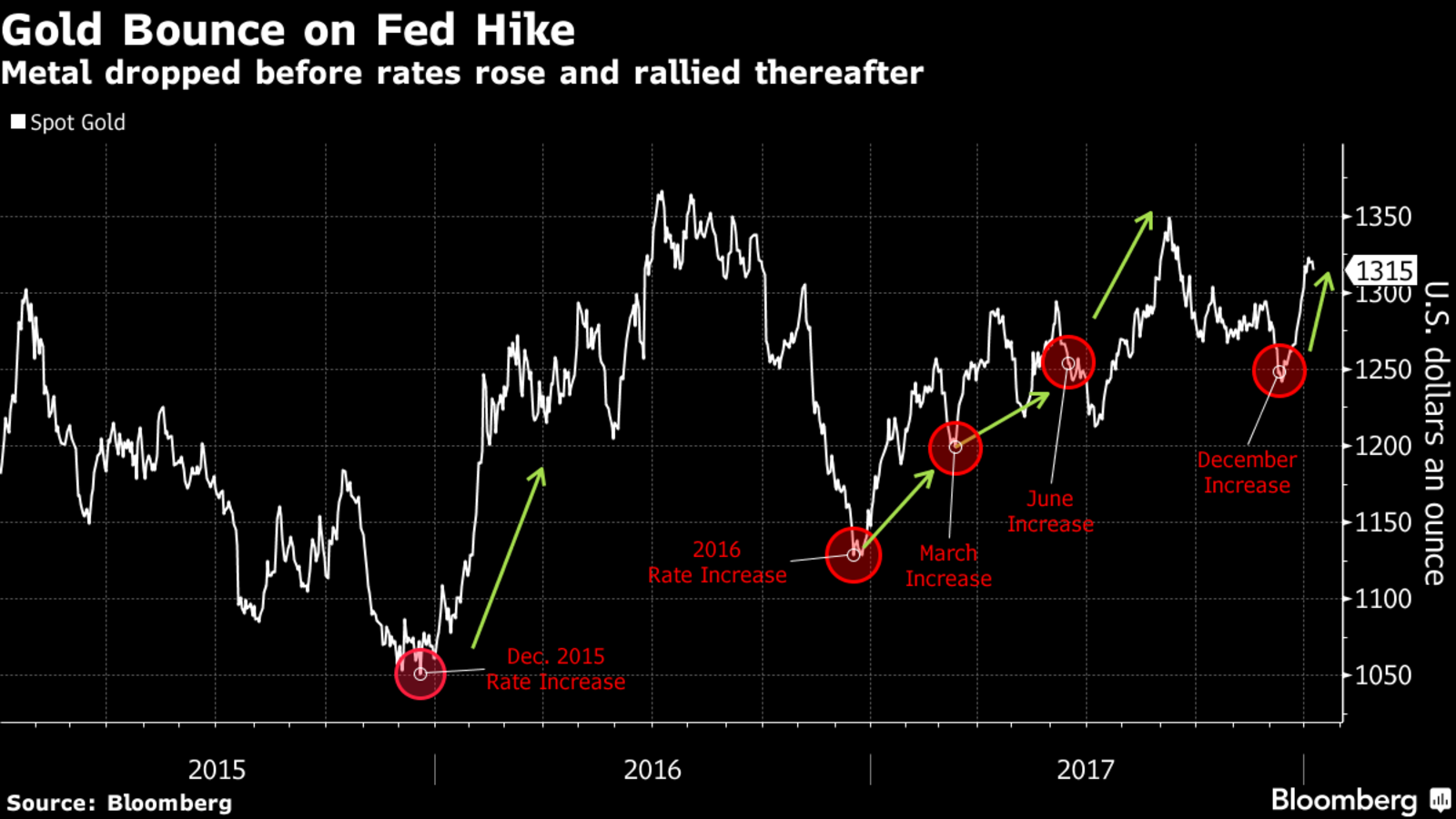

The metal’s sparkling performance in the face of tighter rates, though counter-intuitive, has become the norm. Gold prices have been turning higher soon after the Fed raises rates ever since the global financial crisis.

Since Dec. 12, the day before the Fed moved, gold climbed 5.7 percent to $1,314.36 an ounce, last week touching the highest level in three months. The S&P 500 Index gained 3.1 percent in the same period and bitcoin was down 14 percent. Gold’s advance was driven by the dollar, which fell 1.5 percent.

Original source: Bloomberg.com

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.