« Switzerland is to gold what Bordeaux is to wine », Gilles Labarthe, Swiss journalist and ethnologist.

I wanted to do a review of the Swiss gold referendum on Monday just after the referendum but I decided to wait a week and analyze its impact better. I think I was right. As I expected and wrote it on Friday before the referendum a YES vote would have had a lot more impact on the gold market than a NO vote. My hypothesis was that the NO vote was already in the market so it will be no surprise. A YES vote on the other hand would be first a big surprise but would have had many consequences in the gold market and also in central bank reserves management. It would have not influenced central banks in the short term but it would have created a trend and it would have forced other central banks to reconsider their attitude about gold. I am certain the US Fed breathed easier on Monday.

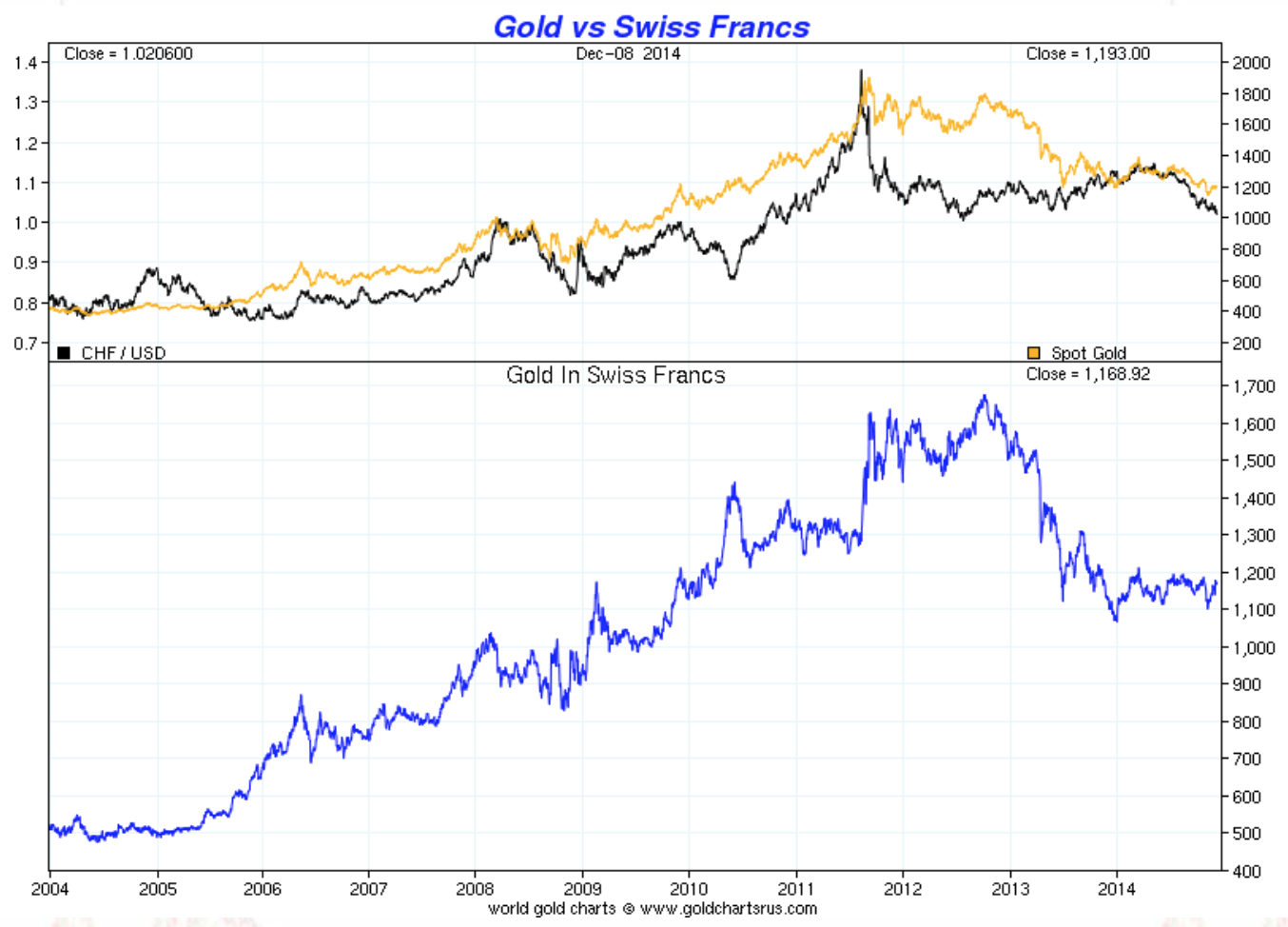

The vote was a surprise to me only by its astounding majority. It was definitely a big defeat for the pro gold camp. Still, I expected a short recovery after an initial drop on Monday due to shorts covering their bets (“buy the rumor, sell the news”). This is what actually happened. However, as soon as Monday and as the week was advancing, something interesting started to show in the charts. Downtrend momentum was fading fast and actually reversing. It is true that the gold market was already oversold for weeks but make no mistake, this Swiss referendum was a major event in the gold market. The bears should have taken the gold price much lower and at least maintained negative momentum. It became evident for me by the end of the week that the bears did not capitalize on this major defeat for the bulls and that momentum was totally reversed to the upside.

After the first poll that gave the YES vote as being close to 50%, I observed that the Swiss National Bank (SNB) panicked and went all out campaigning for the NO vote. Although not contrary to Swiss law, I found that action surprising and very dangerous. What if the YES vote would have won? No matter what the vote was, the SBN had to implement it if it likes it or not. It would have become immediately the law. The SNB should have, in my view, stayed out of the debate.

During a debate on the Swiss French television just before the vote I was surprised by some of the statements made by the NO camp but also a pro NO side taken by the moderator. What struck me was when the 6,000- year gold history argument was brought up by the YES camp, a director of the SNB (pretending not to speak in the name of the SNB) reposted by saying that we certainly don’t want to go back to Antiquity. The moderator added that she hoped the YES camp didn’t really want her to go back to Antiquity. If both had spent some time in a physics or mathematics class they would have certainly known that we do still live in Antiquity. The algebra and geometry taught to engineers today is at least 4,000 years old, with very little change, and without it, no engineer or physicist would have been able to design the computers, TV studio equipment, cell phones, etc. that she was using today. Not everything old is obsolete, on the contrary. The SNB director also dismissed 6,000 years of data ignoring one of the most basic principles of statistics (which I am sure he uses every day to support his economic models) that says that the more data you have the smaller the error and better the projections. It seems, and I heard it frequently in economics, that any data older than five years is “a relic of the past”. No surprise we had the LTCM fiasco.

Some critics of the referendum, including gold bulls, have argued that the proposition was too extreme. It is possible and I think it was one reason the initiative failed but I think the biggest obstacle was that gold was close to the end of a major bear correction. It is very hard to convince people of the value of something at the bottom of a bear market. You have to be a contrarian and that is not human. Humans are a herd animal projecting the most recent past.

A recent poll shows the SNB at the top of the trust pyramid of the Swiss national decision makers with 64%, which might also explain in part the referendum result. I was also surprised by the quick and very aggressive statement put out by the SNB after the vote. There was no desire to take into consideration the pro gold ideas. I became convinced that the Swiss will not lead in this reintroduction of gold into the international monetary system but will follow. The leadership is now in Europe; if it comes, it will have to come from the European Central Bank (ECB).

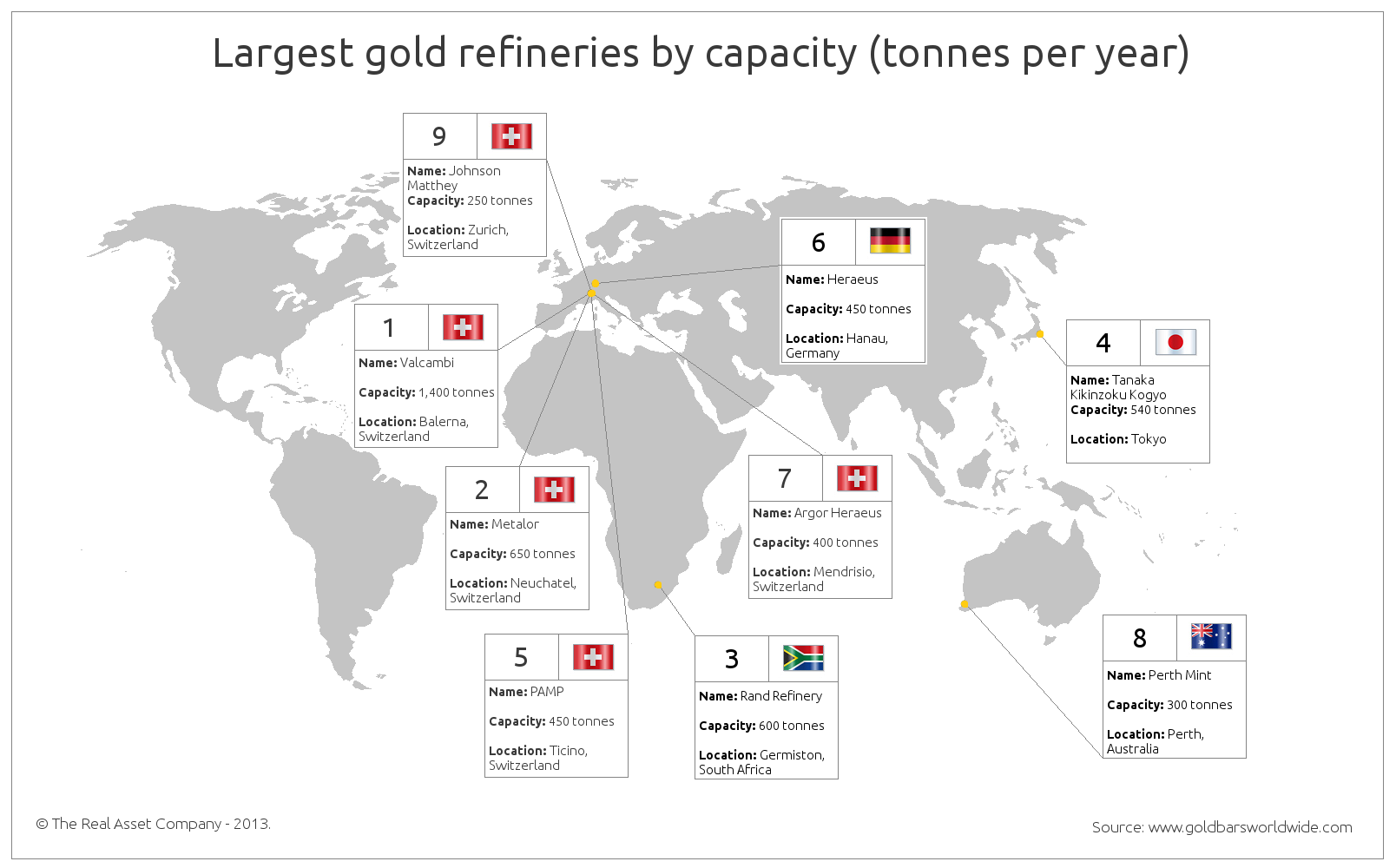

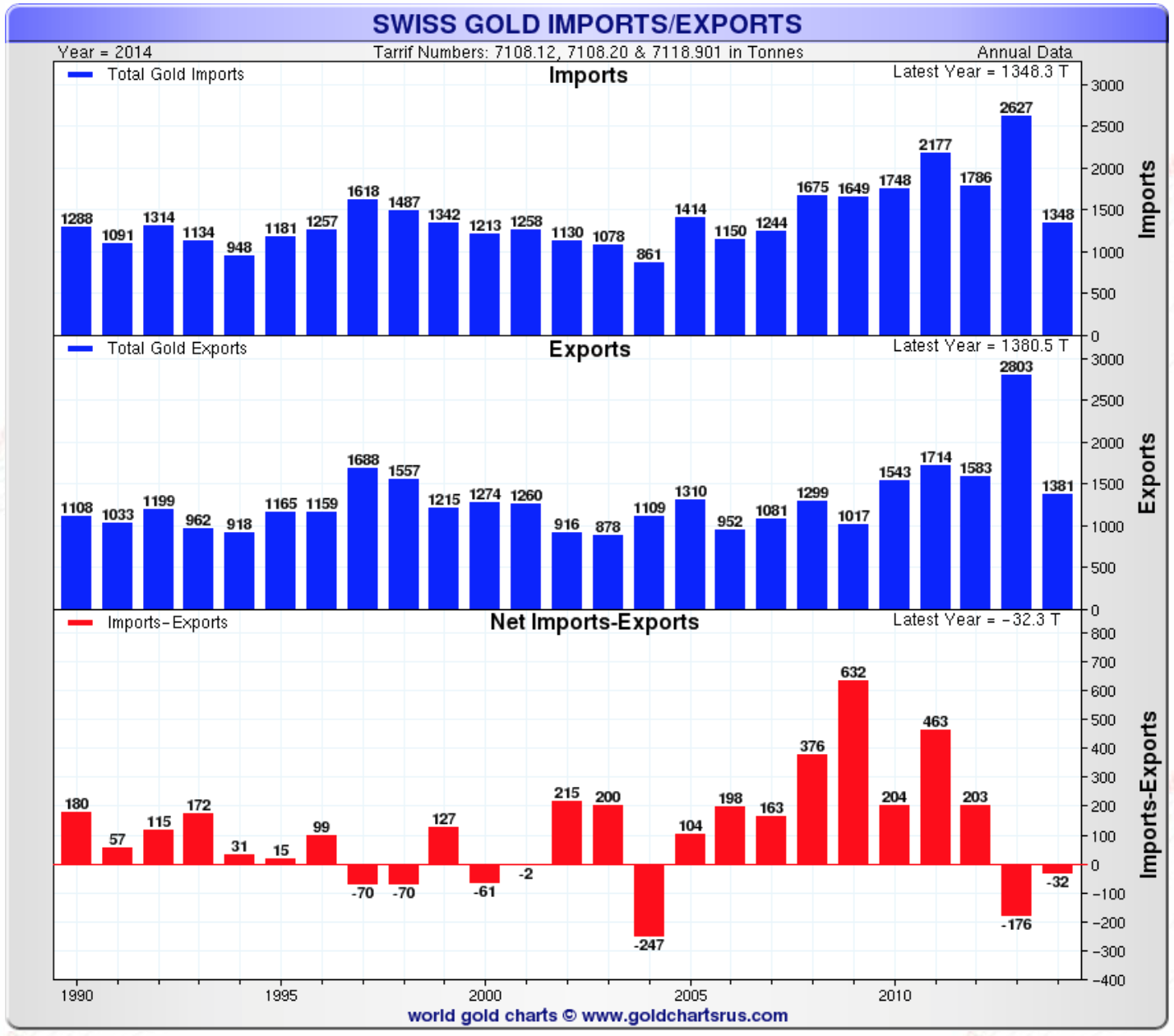

Many were even surprised by the initiative brought by the Swiss people but if you know the role gold plays in the Swiss economy, you wouldn’t have been surprised. Switzerland is a major player in the gold market. More than 70% of world gold transits through Switzerland, going from the West to the East. The largest and the best gold refineries are in Switzerland. As recently as1999, Switzerland had over 40% gold backing for its Swiss franc requirement in the constitution.

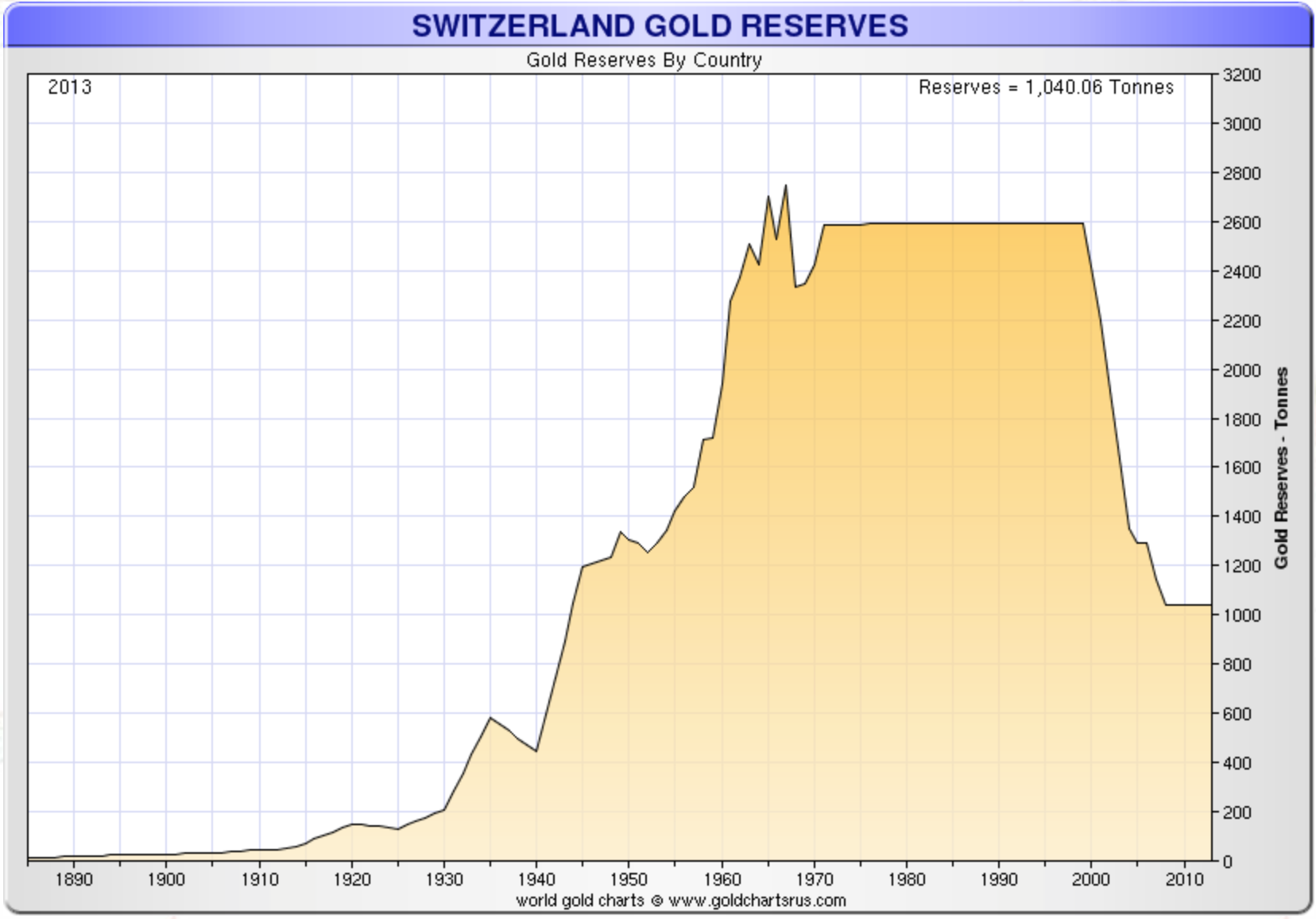

To understand why some Swiss are alarmed by the recent policies of the SNB we can just look at what has happened to the Swiss gold reserves since 2000. Gold reserves have dropped close to 60% from 2,600 tonnes to 1,000 tonnes and replaced by foreign debt.

Still this is not the end of the story. There is another initiative on the way on gold, and others will be brought up knowing the Swiss. In a new bullish environment and a major currency crisis, I expect a Swiss gold initiative will succeed. The present monetary policy of the SNB, in my view, is going to fail but it will be in good company (follow the herd and not lead is safer).

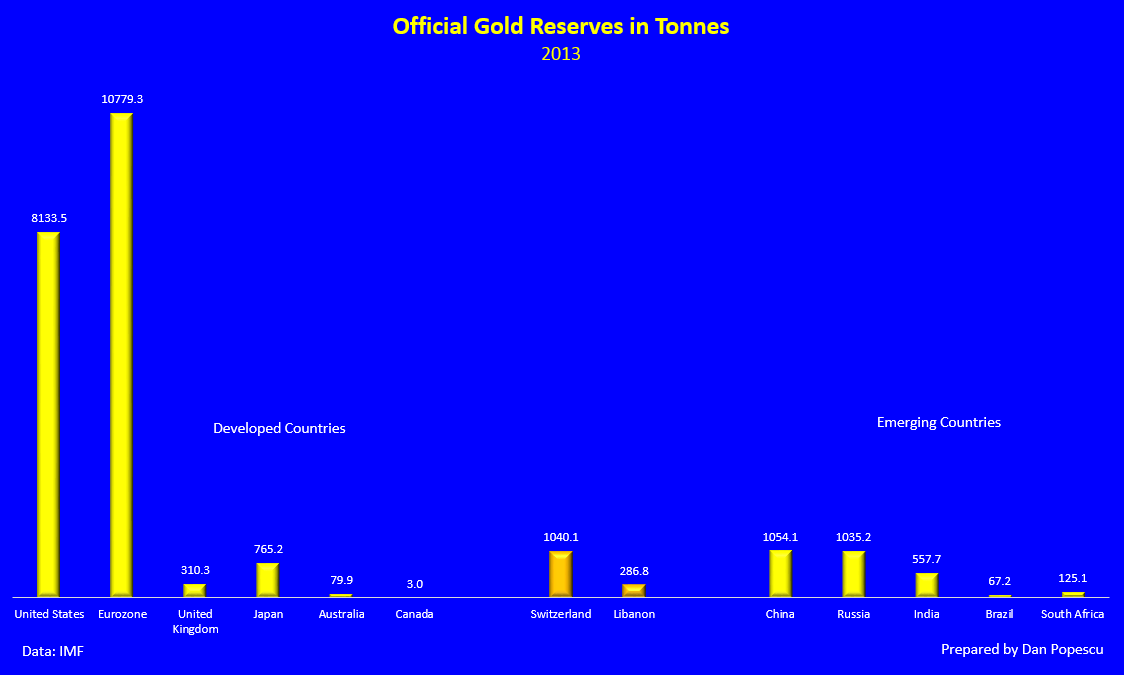

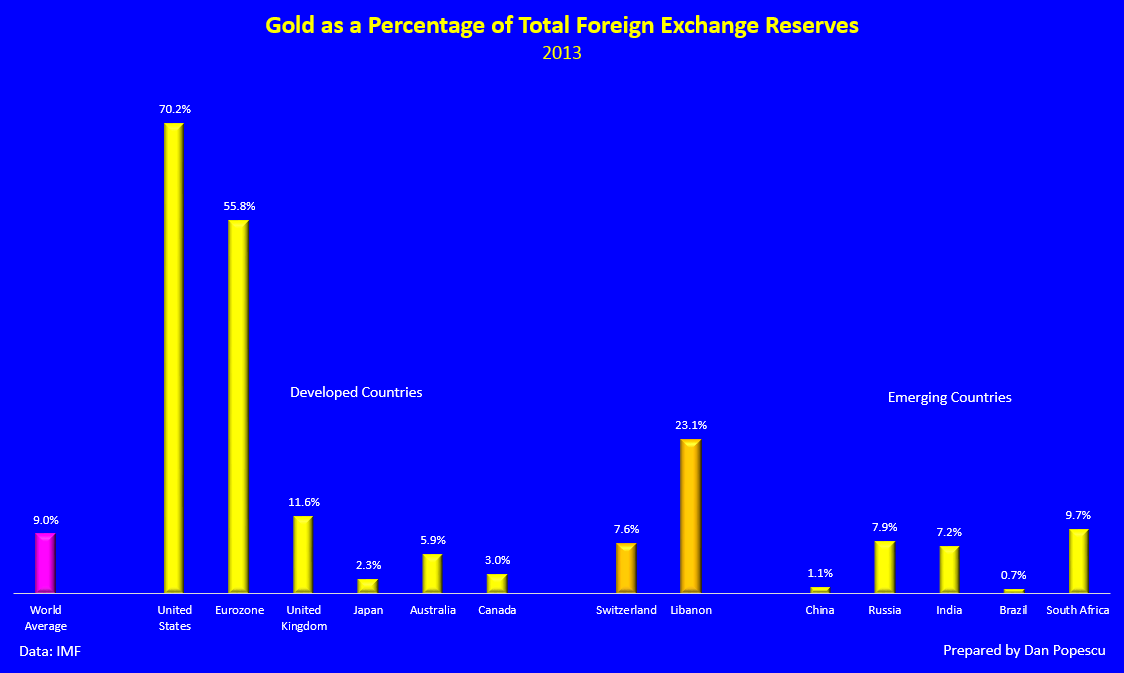

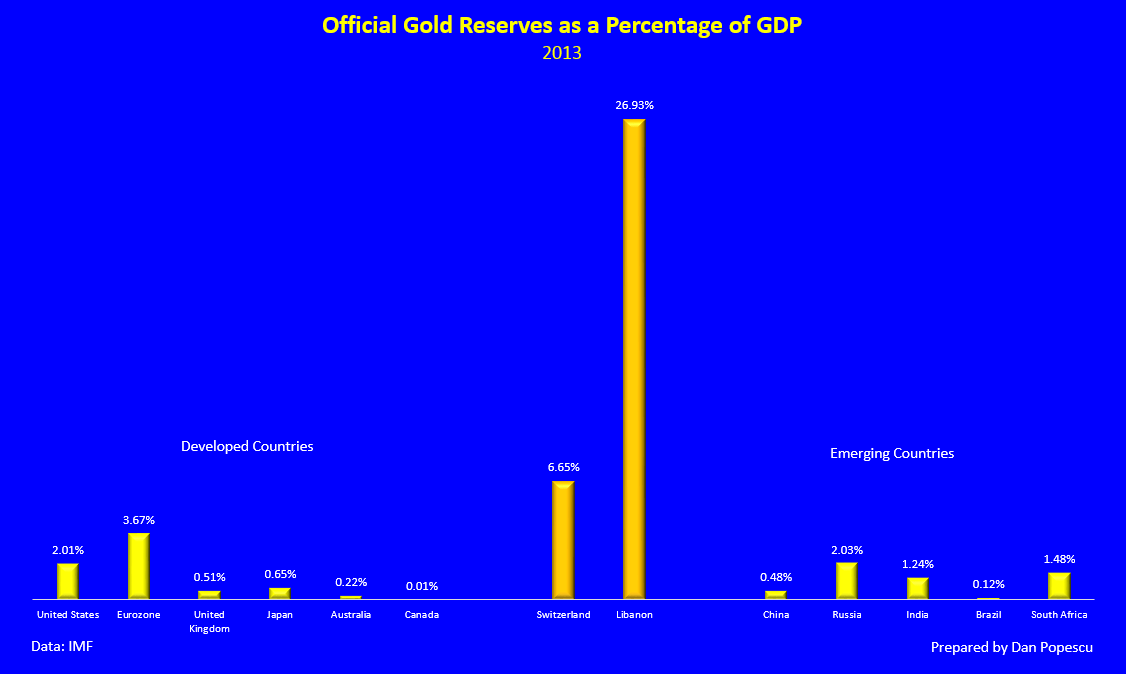

To put things in perspective I would like to show you that Switzerland is still, relatively speaking, a large holder of gold in its official reserves and a lot of private gold is stored in Switzerland in private vaults very discreetly. Switzerland still holds 1,040 tonnes of gold representing 7.4% of total foreign exchange reserves and approximately 6.65% of GDP. Compared with other countries, developed and developing, Switzerland is still a major holder of gold.

What is interesting to observe is that while the Swiss referendum on gold was an astounding failure, during the week that followed Belgium had announced that it is thinking also to repatriate their gold reserves from the U.S., following Holland. Austrian central bank considers repatriating its gold. France also is being pushed by the opposition to do an audit and repatriate any gold left outside its borders. Holland’s repatriation took many by surprised since publicly the central bank’s message was not indicating any such action.

I said it many times that the gold market is very opaque, and both official and private individuals do not like to talk about their gold holdings. However, if we observe their actions, it is evident that there is accumulation of gold. Even the U.S., who never misses a chance to speak negatively about gold, has not sold its remaining gold reserves. The U.S. still holds 70% of its foreign exchange reserves in gold if we are to believe their public statements. Switzerland has decided not to take the leadership in the monetization of gold but rather follow the Eurozone. The leadership remains for now in China’s hands and to a lesser extent Russia.

If after such a major bearish event as the Swiss NO vote and a technical bearish break out from a triangle formation, the bears were not able to take gold much lower, than this to me indicates we are close to the end of this major correction and we will soon see the beginning of a new bullish move.

Again, I repeat that I would not be surprised at all that the next bull move will be a parabolic one with large one-day moves ($500/day or more) as in the ‘70s. It will end with a major international monetary system reset. A black swan event can start such moves. We have a new Cold War, currency wars, gold wars, an oil war and the Middle East is collapsing. Any of them can become a black swan.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.