2021 is likely to be a year of awakening. This is when the world will start to realise that the $280 trillion global debt has no value and will never be paid back.

But even worse than that, of the $280t a staggering $200t has been created in the last 20 years.

Let’s say that it took 2,000 years to go from zero to $80t in 2000. It doesn’t really matter where we start counting since most of the $80t debt was created after Nixon closed the gold window in 1971.

AS DEBT IMPLODES SO WILL ASSET PRICES

Looking at the other side of the balance sheet, there will be an even bigger shock for investors and property owners as debt implodes. Because asset valuations are a function of the debt. And if debt implodes, which is inevitable, so will asset prices.

This is why prices of stocks, bonds and property will implode by more than 95% in real terms (gold) as I outlined in my article last week.

So it took just under 2000 years for global debt to grow from zero to around $5 trillion in 1971. Thereafter it took 29 years to year 2000 to grow by $75t to $80t. That was the exponential phase.

And now we are in the explosive phase with debt growing by over $200t in 20 years.

Anyone who can’t see what is happening is either blind or hasn’t studied history.

+$5t – 1,971 years – Year 0 to 1971

+$75t – 29 years – Year 1971 to 2000

+$200t – 20 years – Year 2000 – 2020

We saw exponential debt expansion 1971 to 2000. Since then the growth has been explosive.

HYPERINFLATIONARY PHASE NEXT

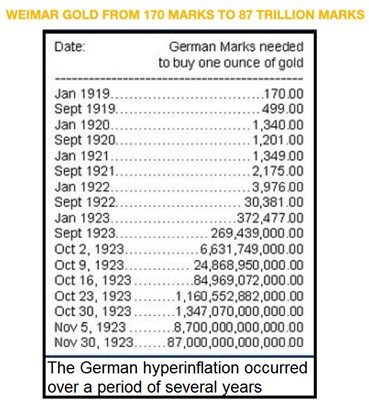

The next phase will be hyperinflationary and that is likely to start in 2021. Just look at the graph and table from the Weimar Republic.

Gold was 170 marks in Jan 1919, 1,340 marks in Jan 1921, 3,976 Jan 1922 and 372,000 marks in Jan 1923.

By November 1923 gold was 87 trillion marks!

This is what happens after a debt explosion when money dies. We have had the debt explosion AND THE DEATH OF MONEY WILL NOW ACCELERATE.

Remember the dollar is down, 97% since 1971, (in real terms or gold), and down 85% since 2000.

So the hyperinflationary phase could start in 2021, 99 years after Weimar. Or will it be in 2022 on the 100 year anniversary?

Hyperinflation is a currency event. This means that it arises not as a result of rising prices but due to the collapsing currency. The dollar index is already down 12% since the March high. The combination of the Covid crisis, debt explosion and money printing could easily start a dollar waterfall in 2021. This would mean that hyperinflation starts. And just look at history (which you can read in the table above) and you can see that once it starts it goes explosively fast.

Hyperinflation is guaranteed. It is only a question of when.

We have had the debt explosion and after that it gets dramatically worse as I show above.

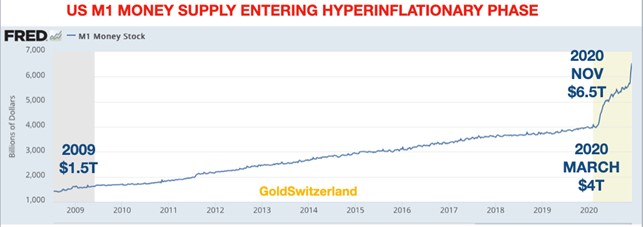

Here is even more confirmation of the coming hyperinflation in the form of US M1 Money Supply. In 2009 when the Great Financial Crisis was over M1 was $1.5 trillion. Then 11 years of “economic boom”??? saw an increase in M1 of $2.5t to $4t in March 2020.

Clearly not a real boom but just debt induced.

Then in March 2020 it all exploded with M1 up to $2.5t by Nov 30th.

So it took 11 years from 2009 to March 2020 for M1 to go up by $2.5t

And from March 2020 to Nov 30 we have seen a further $2.5t increase in 9 months.

Money production has clearly become extremely efficient! Just in the last 2 weeks of Nov M1 jumped up by $1/2 trillion.

This will clearly end badly!

DOLLAR COLLAPSE NEXT

So now everything is in place for hyperinflation. Velocity of M1 is still low but that will soon change as the dollar collapses.

We have of course seen the first part of the currency slump already. A fall of 97% since 1971 certainly looks like a collapse to me. Now the time for next fall of 99% or more is here. Anyone who doesn’t see that denies history. (Sadly, denying history or even rewriting history has become very popular currently.)

It is quite ominous that 100 years after Weimar, the world is standing on the cusp of a similar debt and currency collapse with hyperinflation as a consequence.

100 years ago it was primarily the problem of one country whose debt the world could afford to write off. Well they had no choice since it was worthless anyway.

But this time it is a global problem with every country in the same situation. There will be no one to save individual countries or the global financial system. Yes, all major central banks will print endless amounts of money. But that will only exacerbate the situation.

A debt problem can never be solved with more debt. And a dying currency cannot be resurrected.

So the world is in for a major shock in the next few years. The problems will be at all levels – financial, social, political and geopolitical.

The easiest level to solve for investors who have savings at whatever level is to buy some insurance in the form of physical gold.

BITCOIN & GOLD

There is a major debate going on between BTC and gold. Investors, including institutions, are putting major amounts into BTC.

I am not a Bitcoin expert. But I am very clear that the reasons for recommending gold as the ultimate form of wealth preservation cannot be fulfilled by Bitcoin.

I have stated many times that BTC could be a spectacular investment and go to $1 million as for example Raoul Pal (RealVision) advocates. He is a very smart investor and bases his forecast on stock to flow.

On the other hand, in my view, BTC could go to zero if central banks ban it as they introduce their own digital currencies. Since BTC is not backed by any asset or any central bank it would be worthless if it was banned. Sure, there could be a black market but that wouldn’t serve much purpose if virtually no one would accept payment in BTC.

The degree of wealth preservation required to preserve capital depends greatly on where we are in the investment cycle.

If investment markets are sound and not overvalued as a result of speculation or false markets, stocks and bonds can represent sound wealth preservation.

However in the present bubble markets, all assets are overvalued as a result of unlimited credit expansion and money printing. As I stated above, the risk of a 95% fall is much greater than a 100% gain.

Government bonds, used to be the ultimate form of wealth preservation. Many investors have still not realised that heavily indebted governments, who are totally dependent on money printing to make ends meet, are an extremely poor risk.

CRITERIA FOR WEALTH PRESERVATION

So we are now in a period when wealth preservation requires the application of very strict criteria.

Let’s look at some of these:

- The wealth preservation asset must not be dependent on electricity, internet, or computers

- The asset must not be hackable

- It must not depend on a code which is crackable

- It should not be traded online

So these four criteria clearly exclude any digital form of money or other digital asset.

I will not go into the detailed reasoning behind the above criteria but to an investor who wants the safest foundation for his wealth pyramid, as well as the best insurance possible, they should be obvious.

The ultimate wealth preservation asset must be (as my good friend Simon Mikhailovich states):

- Independent

- Scarce

- Permanent

The above points 1-4 partly define independence. But more importantly, physical gold doesn’t need the financial system. Even less so when the system is totally dysfunctional like currently.

Bitcoin is definitely not independent based on the 1-4 criteria.

Gold is clearly scarce. 190,000 tonnes ($11t) have been produced in history. Virtually all of that is still here. Around 1.5% is added annually in new mine production.

Investment gold is only 43k tonnes or $2.6t. That represents 0.5% of world financial assets – a minuscule part.

So this is the one thing that gold and Bitcoin have in common – they are both scarce.

Where physical gold is superior to any other financial asset is its Permanence.

Gold has been money for 5,000 year and is the only money which has survived in its original form.

Again we are back to history. If only one currency has survived for 5,000 years, it clearly proves that it has the right attributes. Anyone who wants to argue that Bitcoin or other crypto currencies can assume the mantle of gold after 11 years’ existence is premature by a few thousand years.

Cryptos/digital currencies are such a new development that even if they survive, there will be 100s or even 1000s of mutations over time. So permanence is very unlikely.

The risk with digital currencies, whether it is BTC or issued by a central bank, is also that they can disappear in a millisecond. Anything from EMP attacks (electromagnetic pulse) to quantum computers can make this form of money just vanish.

CHINESE QUANTUM COMPUTER 100 TRILLION TIMES FASTER

The Chinese have just invented a quantum computer that is 100 trillion times faster than current computers. It is also 10 billion times faster than the computer that Google is working on. The risk of the Chinese hacking or destroying major parts of the global internet and the digital financial system must be major.

GOLD MUST NOT BE HELD IN AN ETF

Gold ETFs are a very risky way to invest in gold. Many of them don’t have the gold. Please see my article “BUYER BEWARE – GOLD ETFs LIKE GLD OWN NO GOLD.”

Ronan Manly of BullionStar just tweeted about troubling developments at the biggest gold ETF – GLD.

According to Ronan, the GLD CFO resigned one day before the financial year end on 29 Sep 2020. Never good news when the finance chief resigns at critical times.

Also, data on amounts of gold held at the Bank of England was omitted. And finally, the auditors KPMG have raised a “Critical Audit Matter” pertaining to the existence of GLD’s gold holdings held by sub-custodians.

So my advice is the same, gold ETFs have nothing to do with wealth preservation and should be avoided.

PHYSICAL GOLD – HISTORICALLY TESTED FORM OF WEALTH PRESERVATION

Finally, my position hasn’t changed for over 20 years – The only way to hold gold is in physical form, outside the banking system with direct access to your gold.

That is the only true and history tested form of wealth preservation and therefore critical at a time when the survival of the financial system will be severely tested.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.