The US and Argentina have a lot in common. Both are beautiful countries with a major land mass and an abundance of natural resources and agricultural land. Both had very strong economies around the turn of the last century. Political and economic problems have gradually caused Argentina to grow at a much slower rate than the US. The US has had the major advantage of having the dollar as the reserve currency of the world. This has meant that the US in the last hundred years never had to default like Argentina but could just borrow and print more money. Argentina on the other hand has gone through several periods of default as well as high inflation or hyperinflation since WWII.

As the graph below shows, Argentina is now in yet another period of hyperinflation. Since 2001 gold has appreciated 9,000% against the Peso. And just in the last 12 weeks, gold has gained 90% in Pesos. This is an excellent example of hyperinflation being caused by a collapsing currency. Many emerging economies currently have the same problem. Gold in Russian Rubles for example has gone up 127% in the last two years.

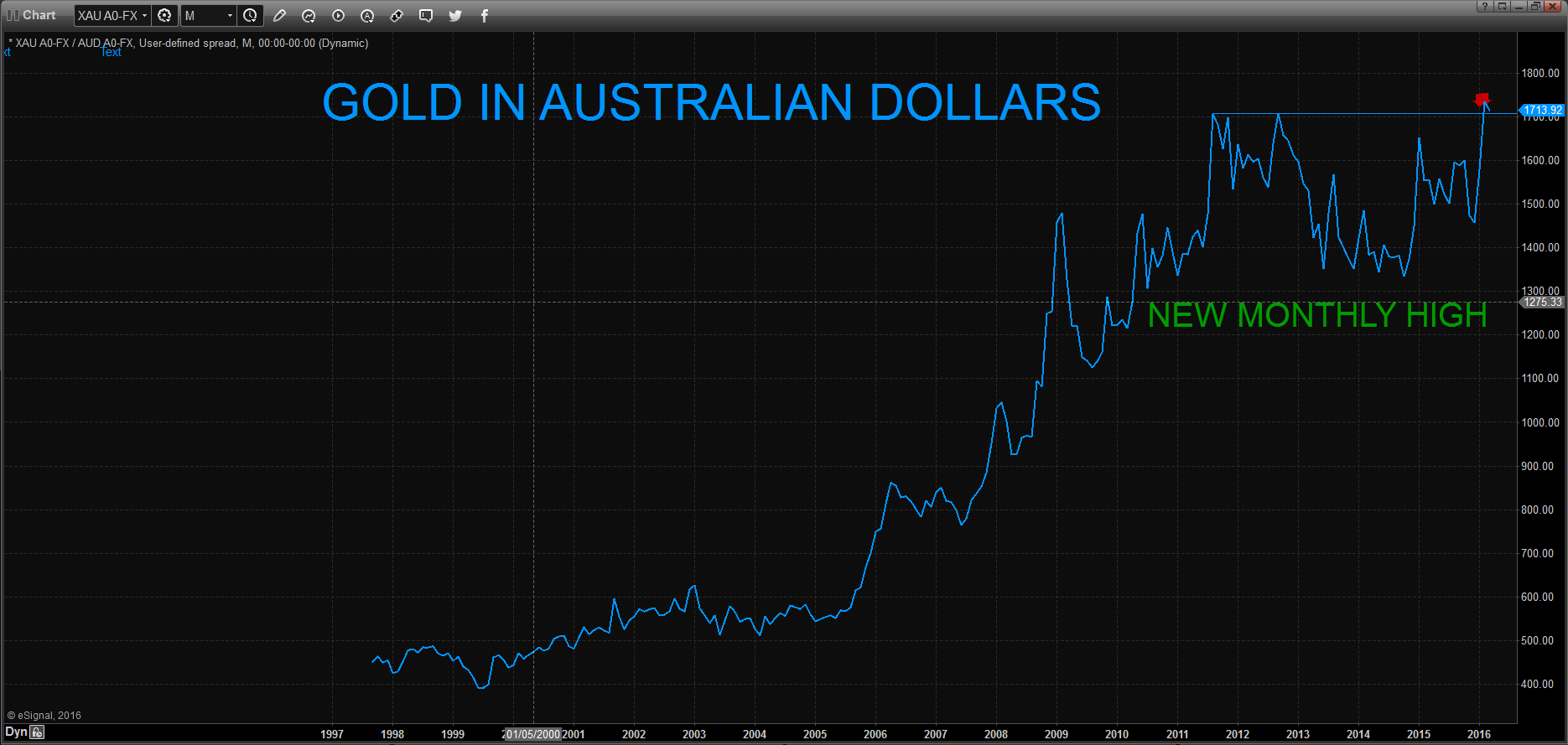

Also industrialised countries are experiencing increasing inflation as evidenced by a stronger gold price. Gold in Australian dollars made a new monthly closing high in February 2016. So for the Australian investor, gold is now past the equivalent of the US$1,823 monthly closing high in August 2011 (see chart below). And in Canadian dollars, gold is just 6% below the 2011 high.

Due to temporary US dollar strength, gold has been weaker against the dollar. However, it is very likely that gold has now finished the correction in all currencies. I would not be surprised to soon see new highs for gold also in US dollars. That could easily happen in 2016. But that is just the beginning. As the US dollar declines and the US economy deteriorates, the Fed will crank up the printing presses in an almost endless series of money printing. Whether gold in dollars reaches $100,000 or $100 trillion per ounce will depend on how much money will be printed. And the actual gold price in inflation terms is of course totally irrelevant. What is much more important is that gold and silver will not only preserve wealth and purchasing power but will outperform all other assets.

For silver investors it looks even more interesting. The gold silver ratio seems to be topping currently at around 83. Once that turns, which could be imminently, silver will greatly outperform gold. The ratio should reach at least the 30 level which we saw in 2011 when silver reached $50. This means that silver is likely to move up twice as fast as gold, at least initially.

Investors must remember that precious metals should not be bought as an investment. Instead gold and silver must be owned as insurance against a totally rotten financial system and against bankrupt sovereign states that can’t even make ends meet with massive money printing and zero or negative rates.

Original source: GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.