Hubris is a deadly sin. It is an arrogance and conceit of the highest degree that eventually leads to failure. As we reach the final stages of the current economic cycle, hubris is prevalent everywhere. Central bankers and bankers believe that they can continue to create wealth by printing and borrowing money. Since it has worked so well for 100 years in this latest cycle, why can’t it continue?

THE LAWS OF NATURE CAN’T BE SET ASIDE

Throughout history, governments have attempted to set aside the natural laws of sound money by manipulating the financial system using criminal methods like counterfeiting and creating money out of thin air. With their hubris, they believe they can get away with their evil deeds. All they would need to do is to look at history. Long term, no one has ever got away with creating a system based on fake money, unlimited debt, zero or negative cost of money with the government and the bankers being the main beneficiaries. They will of course not succeed this time either but the power and massive wealth created by a small elite make the “Powers That Be” so corrupt and so arrogant that they can’t even see the consequences.

The politicians are suffering with the same hubristic disease. Just take the EU, a massive bureaucratic dinosaur in Brussels with unelected and unaccountable leaders. Juncker, the President of the European Commission personifies the hubris of his organisation. Their extremely arrogant treatment of the UK in connection with Brexit is just one example of their conceit.

The hubris we are seeing in many parts of the world is a typical sign of the end of an era. Another sign is the fear created by authorities which leads to draconian measures to control the people.

PROTECTION OF THE PEOPLE BY CONTROLLING THEM

In the US for example, a new Bill has been introduced in the Senate. The name says it all: “Combating Money Laundering, Terrorist Financing and Counterfeiting Act of 2017”. The purpose of the law is to “Improve the prohibitions on money laundering and for other purposes”. Money laundering has an extremely wide definition and anyone who carries money over $10,000, cryptocurrency or a blank check, has a prepaid mobile can fall under this law. In summary, if the incumbent has not in advance filled in a form to declare these items, it allows the government to seize all his assets and put him in prison for 10 years. The bill also gives the right to surveillance and wiretapping.

If this law was used only to catch real criminals, it might be acceptable. But we know that when a body is given such extensive and ill-defined powers they will be widely abused. And this is how slowly but surely a police state is created. A lot of smaller measures that most people don’t pay any attention to until these draconian powers are unfairly applied to innocent people.

In Germany, similar measures are being discussed. The German Interior Minister is preparing a new law introducing surveillance of the people to combat terrorism. It gives the authorities the power to fingerprint and give access to mobile phones, social networking apps even down to 6 year olds. Germany is also considering installing software on mobiles so that the authorities can read messages before they are encrypted.

Many other countries are considering similar methods or are already applying them tacitly. The combination of increased immigration and terrorism will continue to lead to more surveillance measures around the world in all aspects of life. It is not just physical surveillance but bank records, fiscal control and the banning of cash transactions and cash. This trend is unlikely to stop until this cycle ends. We will need to see an end to the socialism and globalism which is creating the current unpleasant trends. We will also need to have an implosion of the debt and asset bubbles which are part of the current problems.

CRYPTOCURRENCIES IS NOT WEALTH PRESERVATION

But sadly, the final stages of the current cycle will involve severe hardship for most people in the world. There are of course ways for the people who have assets to alleviate the suffering. Cryptocurrencies seems to be the speculative craze that many use to avoid the system. The rise in many of these currencies has been spectacular and it could very well continue to a much bigger bubble. Personally, I have always stated the cryptocurrencies have nothing to do with wealth preservation. It is electronic money with no underlying asset. The more successful these currencies become, the more governments will control or regulate them. The new US Money Laundering Act which I have discussed above is one way for governments to make cryptos illegal. Another risk is that the production of cryptocurrencies can increase dramatically, just like with other fiat money. I also understand that liquidity is extremely thin when there is a bit of selling pressure. This is what eventually could make these currencies worthless just like the tulip bulbs in the 17th century. It will be impossible to get out at any price.

CENTRAL BANKS WILL FAIL TO RESCUE THE SYSTEM

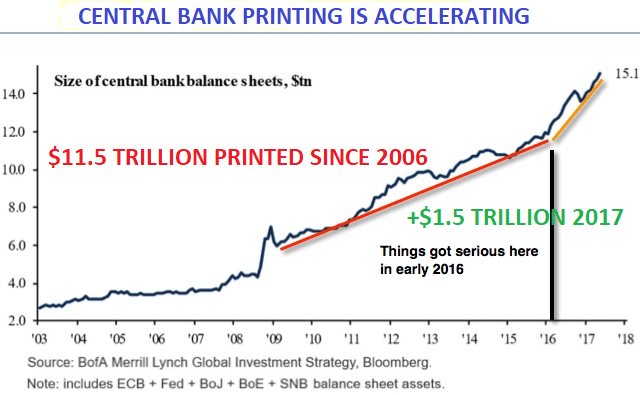

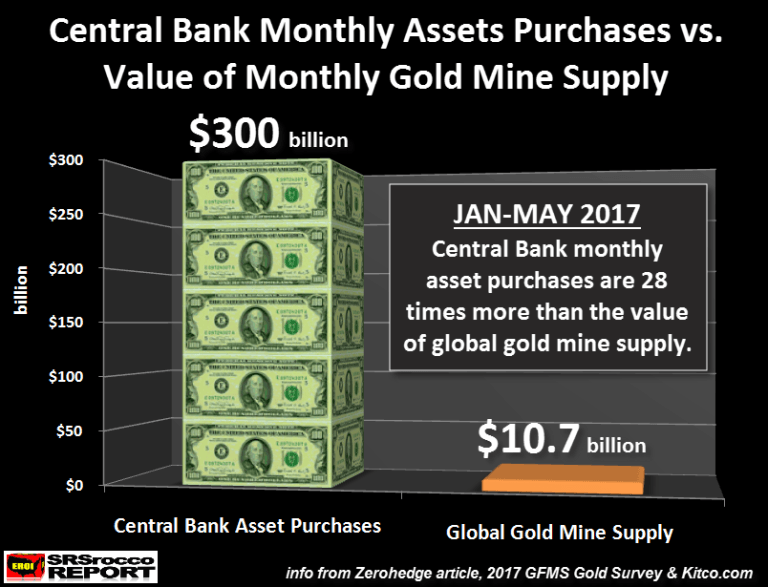

It is interesting to observe how central banks always fail in their attempt to manage or rather manipulate the economic cycle. The financial system was bankrupt and almost went under in 2006-9. Since 2006 interest rates worldwide have come down to virtually zero or negative in most countries. At the same time, the major central banks have printed over $11 trillion since 2006.

The printing curve became steeper in 2009 and since 2016 global printing is accelerating further. At the same time, global debt has grown from $130 trillion in 2006 to around $250 trillion today. This massive stimulus which the world has received in the last 10 years should have had a major impact on global growth. But that is certainly not the case. Just take the US. US GDP 2007-16 has grown at an average of 1.3% per year. This is exactly the same rate of growth as during the US depression 1930-39. So neither global money printing nor US printing has made the US fare better in the last nine years than during the 1930s depression. This is a very clear sign that the US economy is running on empty. Pushing on a string has no effect. And why should it. If we all could just live on printed money, we could stop working and just print some more. For some incomprehensible reason, central bankers and governments don’t understand that they have come to a point when they can’t fool all of the people all of the time, including themselves. I suppose they consult Nobel prize winners like Krugman who doesn’t understand what sound money means either.

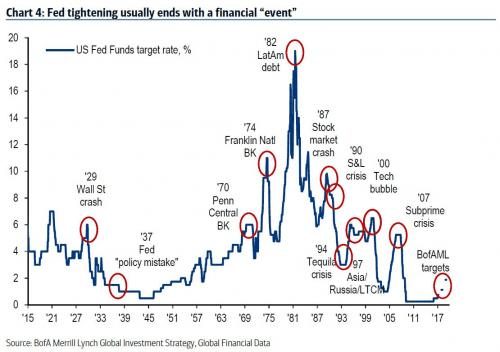

CENTRAL BANKS ARE ALWAYS BEHIND THE CURVE

Since central banks and especially the Fed are always reacting to events, they have for decades always been behind the curve. The best solution is to abolish central banking totally and let the cycle regulate itself. That would stop all the booms and the busts and just create natural cycles of a much smaller magnitude.

So the Fed increased rates now when the economy is turning down. Retail sales, a leading indicator, are very weak and tax revenues are not growing in line with expenditure. That is why real deficits in coming years will rise dramatically, just like they have every year since 1960. But even if the Fed is several years too late to raise rates, it looks now even with a weak economy that the interest rate trend is turning up.

Looking at the long term trend since 1915, it is clear that we are at a 72 year low and there is only one way to go which is up. Yes of course rates could stay in this region for yet a little while. If we look at shorter term charts, US 10-year rates seem to have bottomed in July 2016. So even if higher rates will be very serious for a weak and highly indebted economy, it is likely to happen. To me this looks like another confirmation of inflation going up, eventually leading to hyperinflation.

LET’S LOOK AT A COMPARISON WITH THE 1970S.

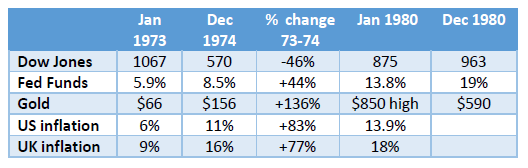

The Dow made a high in Jan 1973 and then declined by almost half into Dec 1974 which was the bottom. It continued to fluctuate under 1000 until 1982 when the current bull market started.

US rates rose from Jan 1973 to Dec 1974 as the Dow went down 46% and the economy was in a severe recession. As the table shows, Fed Funds increased by 44% between 1973-74. At the same time, inflation went up by 83% from 6% to 11%. In the UK, it was even worse with inflation going from 9% to 16% between 1973 and 1974.

Having experienced high inflation in the 1970s in the UK, I can sense that we are now likely to enter a similar period in many countries. With debt today substantially higher, the consequences will be exponentially greater. During most of the 1970s there was high inflation in many countries. The US average inflation rate 1974-81 was 8.1% with a peak of 14.5% in 1980. In the UK average inflation for the same 8 year period was 15.5% with a peak of 24.2% in 1975. Living in the UK at the time, my first mortgage was as high as 21% for quite some time. When interest rates return to these levels in coming years, no individual and no government will be able to pay the interest on their debt.

In 1971 the dollar was released from its gold backing and gold went from $35 in 1971 to $66 per ounce in Jan 1973. As interest rates and inflation rose, so did gold. It doubled between 1973 and 1974 and eventually reached $850 in January 1980.

So, what lessons can we learn from history?

As Mark Twain said:

“History doesn’t repeat itself but it often rhymes”.

Sadly, governments learn virtually nothing from the past. Everyone believes it is different today. Why otherwise would the world create $2.5 quadrillion in debts and liabilities that can never be repaid nor financed as interest rates rise. What we can observe from the table above is that inflation can rise very quickly from one year to the next. As inflation rises, so will interest rates. In the 1970s they doubled very quickly and stayed at high levels throughout the whole decade.

WATCH THESE SIGNS

In the next few years, we will experience the consequences of the failed experiment in creating wealth from printed money. The signals will be quite obvious like:

- Rising inflation

- Higher interest rates

- Falling dollar

Interestingly, all those three factors are already happening, albeit at a slow pace currently. In the next year or so we will see much higher inflation and interest rates as well as a crashing dollar. This will be a vicious cycle that will feed on itself. Massive debts are not a friend of high interest rates. Higher rates will put enormous pressure on governments, consumers and corporates. We know that none of these groups can ever repay their debt but as rates go up, they will not even be able to finance the debt. Our friendly central bankers will stand by and print unlimited amounts of worthless fiat money. But this time it won’t work. The printed money will not save the system but only create inflation leading to hyperinflation and eventually a collapse of the financial system.

Just like in the 1970s, physical gold and some silver will protect investors from the ravages of inflation. At that time, gold went from $35 to a high of $850 or up 24x. A similar increase this time would take gold over $6,000. But history won’t repeat itself but it will rhyme very nicely. This means that gold will go up substantially more than 24x due to the massive amount of money that will be printed to cover $2.5 quadrillion of debts, derivatives and liabilities. It will be impossible to forecast the level but it could be the $150,000 or $2.6 million as I discussed in my article last week. Or it could even be 100 trillion as in the Weimar Republic.

PROTECT YOUR ASSETS FROM BIG BROTHER

The level becomes irrelevant. What is important is the protection that gold will give against the implosion of most asset values as well as currencies as well as assets lost in the failure of the financial system. This is why gold and silver must be kept safely and legally outside the banking system and outside your country of residency.

The draconian measures in the US and Germany that I discuss above are just the beginning. The Big Brother is Watching measures will become much worse. This is why it is important to store assets legally outside your country of residence. The time will soon come when it will neither be possible to take out currency or assets. It is less likely that assets already abroad will be required to be repatriated.

Gold at $1,255 is as low as the $300 early this century if adjusted for real inflation. The manipulation of gold has made it possible for many investors to buy gold at extremely favourable prices just as the Chinese and the Indians are doing continuously. But when the next upleg starts, there will be no physical gold available anywhere near current prices. Gold will go “NO OFFER” which means that sellers of gold are not offering it at any price. So for anyone who is not fully protected, now is the moment to acquire wealth protection insurance in the form of gold.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.