In the second half of the 20th century, South Korea, Taiwan, Singapore and Hong Kong were commonly referred to as the "Asian Dragons", in reference to their decades of strong industrial growth. The Asian crisis of 1997 sounded the death knell for these extraordinary years. Now, as the world changes, Indonesia, Vietnam, the Philippines and Malaysia (all members of ASEAN) are differentiating themselves. Formerly known as the "Asian Tigers", these four countries are experiencing a veritable economic expansion, and have strong growth levers at their disposal, despite the return of protectionism and geopolitical tensions.

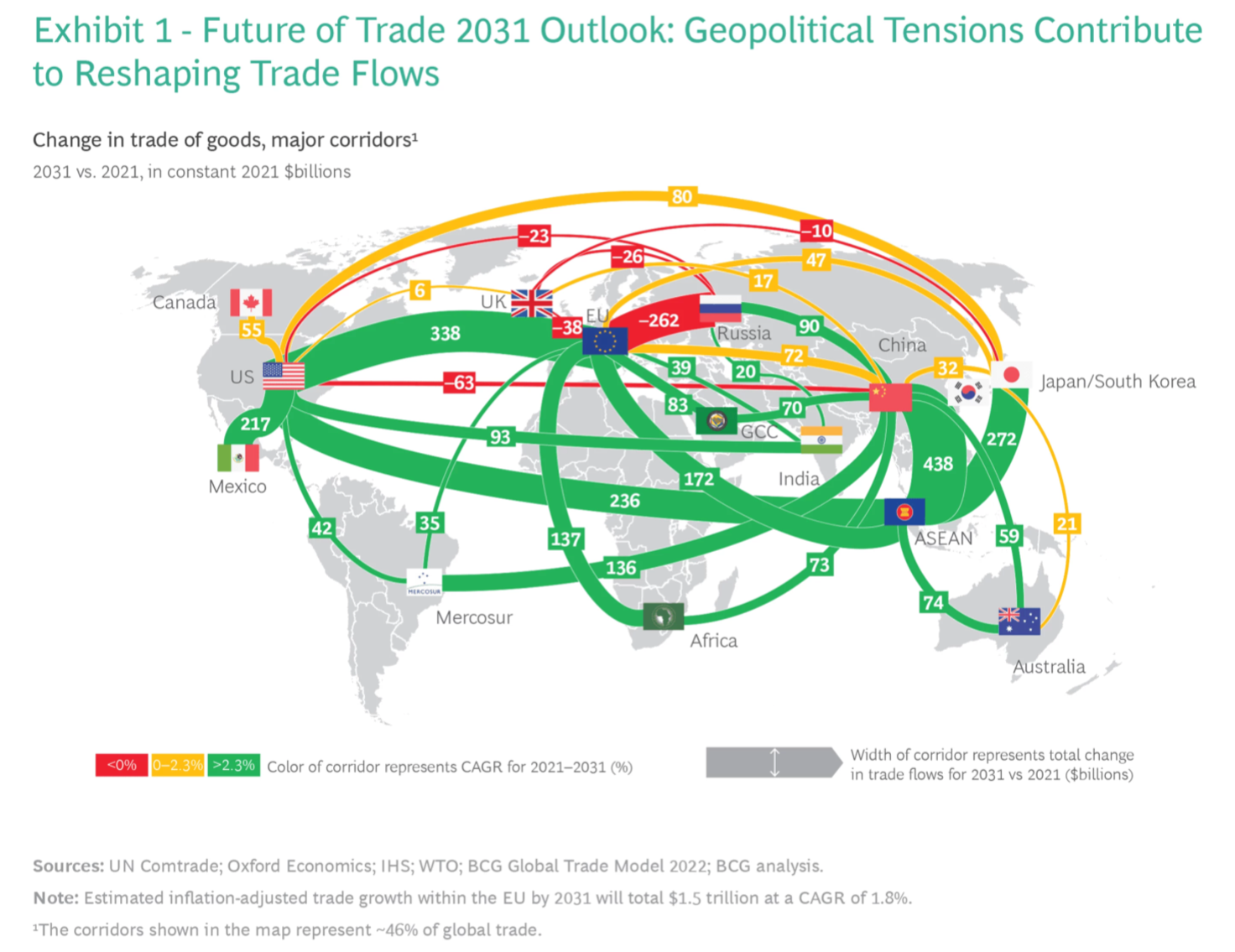

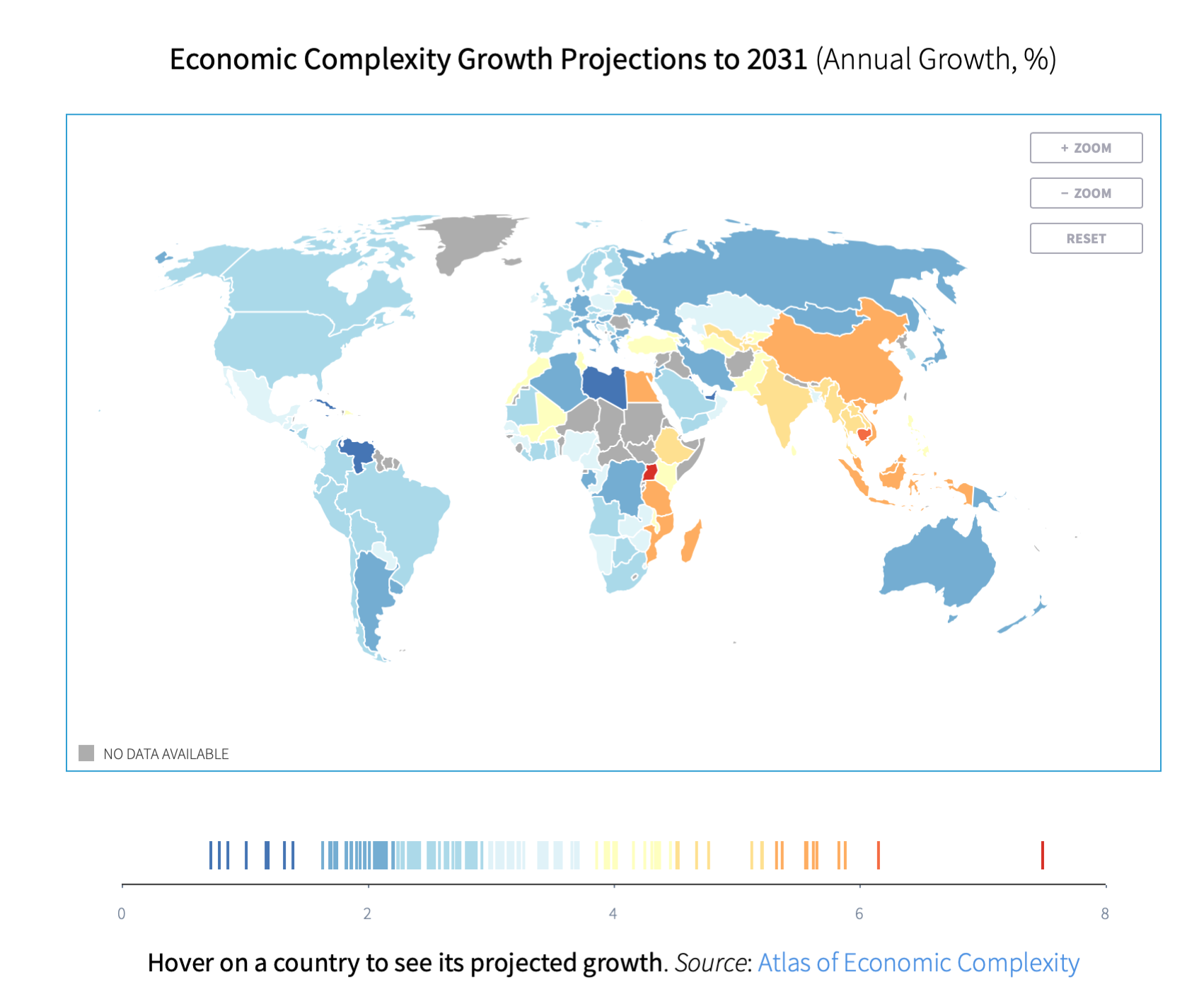

Today, Asia's GDP accounts for almost 30% of the world's, and this figure is rising all the time. Indonesia, Vietnam, the Philippines and Malaysia (known as "IVPM") play a significant role in this development. Their unmistakable strengths set them apart, both on the international stage and in the region. In particular, they have real demographic strengths, characterized by a consuming middle class and a relatively young population (almost half of the population is under 30), a highly digitized economy that allows for increased productivity and growth relays, as well as an improving education system that supports the labor market. Thanks to these resources, as well as an ideal geographical position (between two oceans, close to other high-growth nations) and diplomatic positions that build bridges of understanding, they will be at the heart of international trade in the years to come. Their trade with certain superpowers, including the United States, China, the European Union and Japan, will continue to grow. Over the next decade, annual growth in these " IVPM " countries will reach more than 4%.

Source : The Harvard Gazette

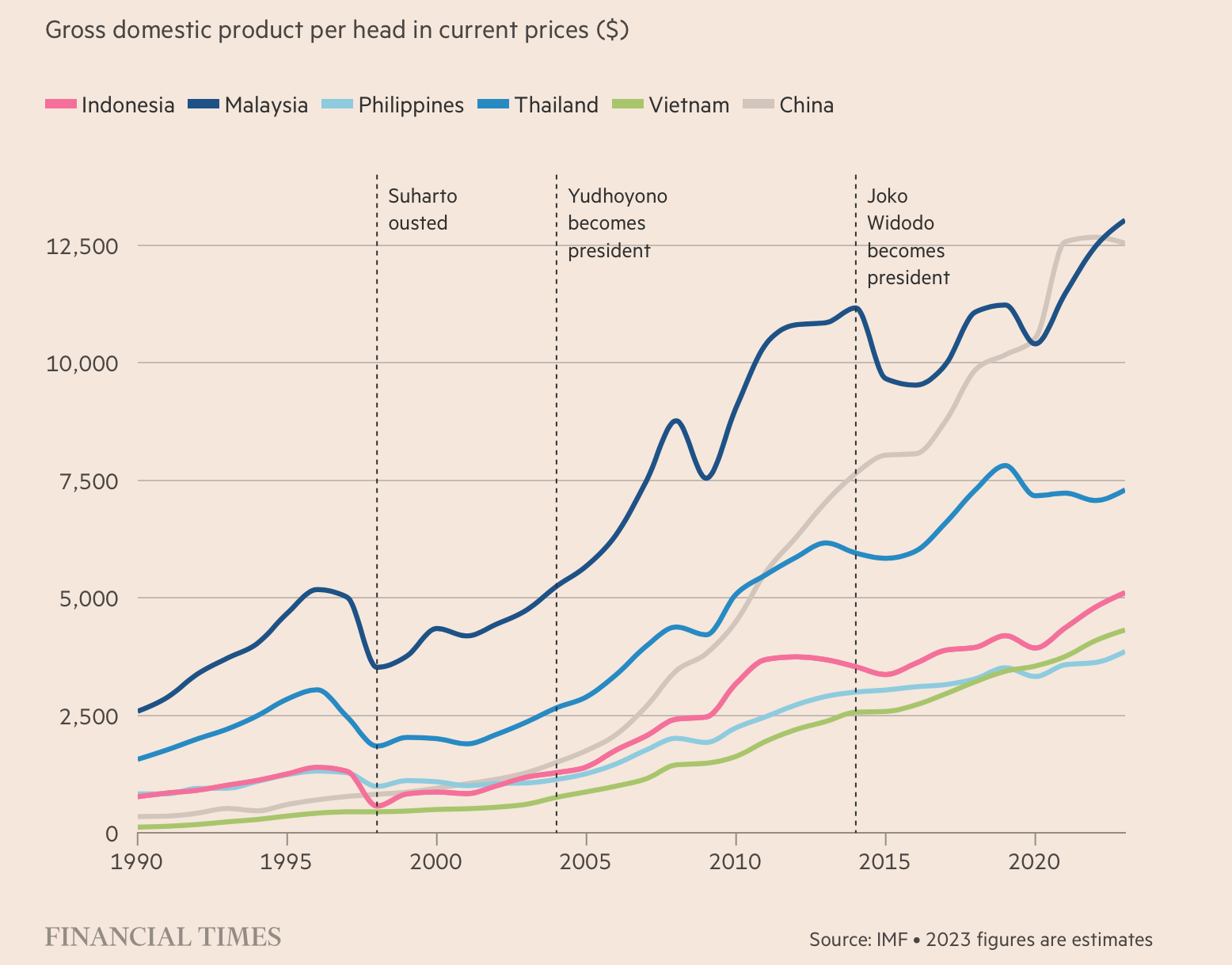

From a financial point of view, they all have reasonable levels of public and private debt. Despite heavy borrowing during the health crisis, public debt remains below 65% of GDP. Indonesia even has a public debt-to-growth ratio of around 40%, due to the introduction of fiscal rules similar to those of the eurozone (with a deficit limit of 3% and a debt limit of 60%), which it nevertheless respects. From an economic point of view, they have demonstrated strong growth in 2023 (albeit below expectations) despite the international slowdown. Last year, Vietnam's and Indonesia's GDP grew by over 5%, the Philippines by 6%, and Malaysia's slightly less at 3.8%, due to its greater dependence on the global environment. Per capita living standards have risen steadily in recent decades, in contrast to other countries in the region, such as China and Thailand, which have been experiencing a slowdown for several years.

What's more, despite the strong economic recovery in 2021 and geopolitical tensions, inflation has remained under control overall in the region (price rises have not exceeded 5-6% in any of these countries), a sign of resilient economic models.

They can also count on a "reasonable" monetary policy. The various interest rate hikes since the outbreak of global inflation have helped attract foreign capital without causing sharp depreciations against the dollar. As none of these countries is part of a monetary union, this depreciation has favored the short-term competitiveness of each of these states, with only a slight impact on price trends. Last but not least, their unemployment rates are extremely low, below 3.5%, and even close to 0% for Thailand according to official figures.

Investment opportunities for global companies

With manufacturing costs among the lowest in the world, these new ‘workshops of the world’ are emerging as investment opportunities for global companies. Particularly since the pandemic, logistical problems and ongoing international tensions, many companies are seeking to diversify their supply chains and have decided to set up operations in these countries. The slowdown in China and the sharp rise in middle-class living standards have also brought about profound transformations that are in their favor.

In addition to their low labor costs, these four countries stand out for their competitive energy costs and numerous tax advantages, as in Vietnam, where the first few years of setting up enable companies to be tax-exempt. What's more, their respective presences in key sectors, particularly the digital one, are attractive. For example, Malaysia is a key player in the semiconductor industry which is in great demand in the automotive market, and more broadly at the heart of technological developments. Indonesia, for its part, is investing massively in the use of electric batteries, while Vietnam plays a major role in the electronics industry, particularly cell phones (Samsung Electronics has one of its production plants there) and computers. As for the Philippines, the current president's "Build Better More" program includes heavy infrastructure investments in a wide range of sectors, attracting service companies looking to outsource to the island.

Strategic natural resources

These countries are also rich in strategic natural resources. Indonesia has the world's largest nickel reserves (essential for electric batteries), accounting for 25% of global production. Malaysia has large quantities of gas and oil, while Vietnam is rich in coal, in a world where fossil fuels still account for 80% of total production. They also have significant agricultural resources. Indonesia is a leading producer and exporter of coffee and cocoa. Malaysia is the world's leading producer and exporter of palm oil and tin, giving it considerable influence in foreign policy. Vietnam and the Philippines, for their part, produce large quantities of rice thanks to their extensive agricultural land.

For a variety of reasons, gold plays an important role in some of these countries. The Philippines and Indonesia are considered to be the richest countries in terms of gold reserves, despite the fact that they are hardly exploited. Beyond the importance of the yellow metal in local traditions, gold plays a strategic role. Despite diplomatic positions that do not encourage them to increase their gold reserves, some are planning to introduce the yellow metal into their monetary systems. In Malaysia, for example, the Prime Minister floated the idea last October of using the gold dinar as a reserve currency. In the Philippines, former president Rodrigo Duterte had a law passed in 2019 facilitating central bank gold purchases via dealers, with the aim of "strengthening the level of international reserves, which are the country's first line of defense against external economic shocks." The Central Bank of the Philippines is thus the largest holder of gold among the IVPM group, with 164 tons in its reserves.

An ambitious and resilient domestic model

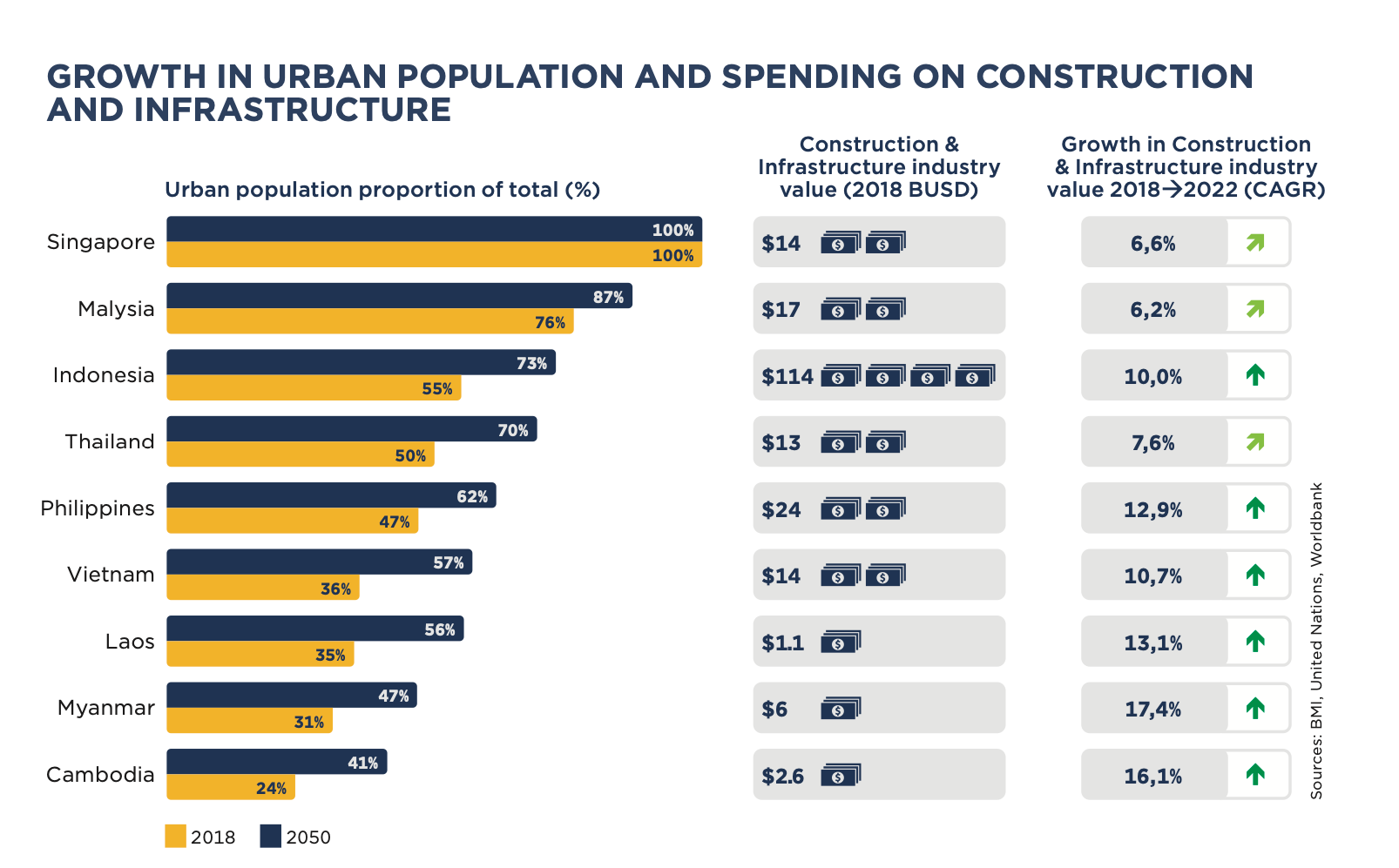

With a total population of around 500 million, favorable demographic dynamics and a rising per capita standard of living, they all feature high levels of domestic consumption (as opposed to China). In Indonesia, for example, private consumption accounts for around 53% of GDP and is growing at an annual rate of over 5%. By extension, the challenges faced by their inhabitants (water, transport, housing, etc.), linked in particular to high levels of urbanization, lead to a pressing need for infrastructure, which in turn stimulates growth.

One of their strengths also lies in their ability to constantly innovate for tomorrow's world. The construction of a multitude of smart cities (highly digitized intelligent cities) bears witness to this. Their development in these countries continues to intensify, thanks to the creation of the ASEAN Smart Cities Network (ASCN). Within the Asian Trade Association, projected revenues from the smart cities market are expected to grow at an annual rate of around 12% between now and 2028.

Despite this, these countries face major challenges, including high levels of inequality (despite a marked decline in extreme poverty), often complicated access to healthcare, and high levels of corruption in some countries, notably the Philippines and Vietnam.

As with all high-growth nations, the main question is whether or not they will eventually sacrifice national stability for external ambitions. The many challenges that lie ahead, particularly in social and political terms, must be given priority. Finally, as their financial hubs develop rapidly, they will need to maintain a stable financial model if they are to retain control of their economies.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.