By Nicolas Perrin

« In the business world, the rear-view mirror is always clearer than the windshield ». This adage from the Oracle of Omaha (Warren Buffett) is particularly true in regard to these times. Interest rates almost at zero, countries multiplying debt the way Christ was multiplying bread, central banks buying back this debt with money they themselves create and that doesn’t cost anything but the price of paper : no one can tell for how long this system will hold. As Charles Gave explains, this « fusion » of the finance ministries with central banks, in order to keep certain sovereign bonds from falling, constitutes « a monetary experiment without any equivalent in History ».

With such a limited visibility, it is difficult to determine what sort of investments one should go for. Sure, « past performances can’t vouch for future performances », but they can influence them, and analysing them may let us discern the large on-going trends. So, let’s take a look in the rear-view mirror.

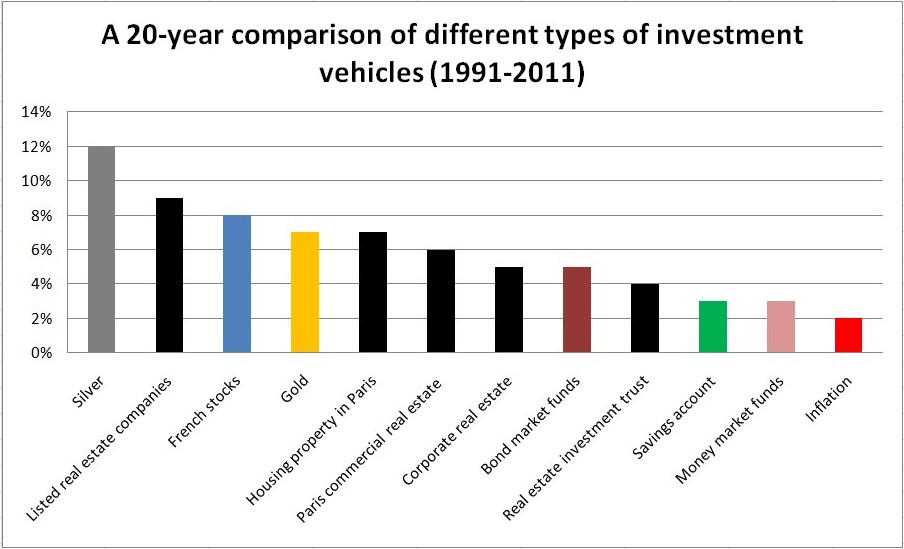

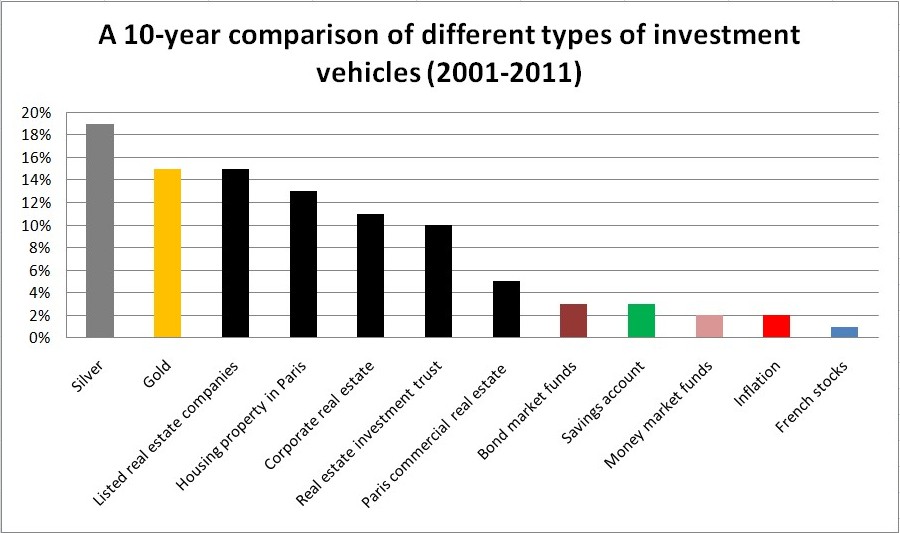

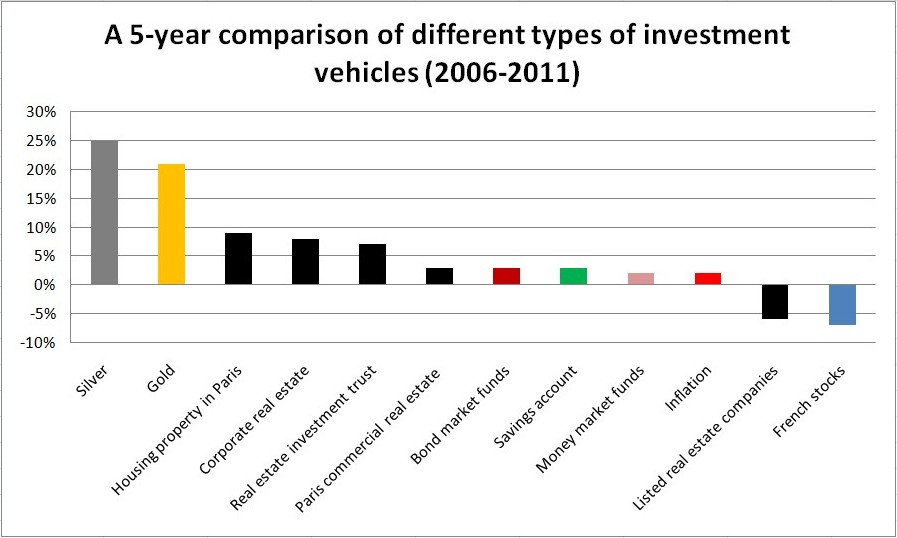

Each year, the IEIF (Institut de l’Épargne Immobilière et Foncière) publishes its analysis of long-term investments. And the three graphs below are graphic representations of the numbers of their last report dating back to March 2012. I added silver, which was greatly absent from the IEIF study.

On the long term (1991-2011, 20 years), all assets have performed better than the official inflation rate. Yield products are lagging and stocks have a high mean return, superior to gold’s but inferior to silver’s. « Poor man’s gold » leads the field, far ahead of the yellow metal. Nothing abnormal here : 1991 is the most favorable comparison year for silver, because it is in January of that year that the gold/silver ratio entered this bearish trend in which it’s still in.

On the mid-term (2001-2011, ten years), stocks go down to yield products level, with barely no return on investment. This is a rather atypical decade that has seen a stock market crash (2000-2002) and a multi-shaped crisis lasting since 2007. Physical assets are king : this is clearly the decade of precious metals and real estate. The year 2001 marks the start of the great loss of value for the US dollar, which is still going on.

With an average yearly performance above 20%, precious metals have been the most profitable assets on the short term (2006-2011, five years). In a context of a rush on physical assets, physical real estate is gaining on paper real estate. The return on stocks is negative and the yield products have return rates very close to the level of inflation.

Many pundits are explaining that this situation started to turn around in 2012, when gold’s and silver’s performance, in euros, was « only » 7% and 4%. On the other hand, the CAC 40, with a 15% hike, had its best year since 2009. Certain pundits (always the same ones) feel they « have » to explain to the savers that precious metals are « out » and that they have to come back to the stocks.

On what basis ? One wonders... on the 0,1% of growth predicted by the European Commission or on the 0,2-0,3% expected by Matignon (French government) ?

But, maybe, France is an isolated case... so let’s look to the United States.

What do you think... will it, won’t it ? The last two times the S&P 500 attempted to get above 1,500 points (January 2000 and July 2007), the peregrine crickets stepped in and did their damage. Is it different this time ? With an anemic growth caused, to a great extent, by an exorbitant budget deficit, the situation is far from being reassuring. Hence I’ll heed Buffett’s advice : « Most people get interested in stocks when everybody else does. The time to buy is when nobody wants to buy. You can’t buy what’s popular ». To the point, Philippe Béchade was explaining this week that « there is an awful lot of insider selling ».

How about those life insurance funds bonds, one might ask? They could be used for safety purposes, but certainly not for return on investment. In a scenario in which the Western States would put in place adequate policies that would insure their mountain of debts be paid back in full, and with real money, why not? But the problem, as Reinhart and Rogoff have shown in their work, is that, when the debt exceeds 90% of GDP, growth becomes strangled, employment slows down, which aggravates the situation in public finances and, thus, the deficit. Now, Capital.fr had this headline in December 2012 : « French public debt at 89,9% of GDP at the end of third quarter », which doesn’t – I think you’ll agree – leave us much more time. With a level of economic growth inferior to the interest rates, it is hard to imagine that the burden of debt could diminish any time soon. In France, courageous policies should have been implemented in the 1990’s, when the debt/GDP ratio was still under 60%. Last but not least, debt restructurations are under way. Last week, Philippe Herlin reminded us of the case of Ireland, following Greece’s.

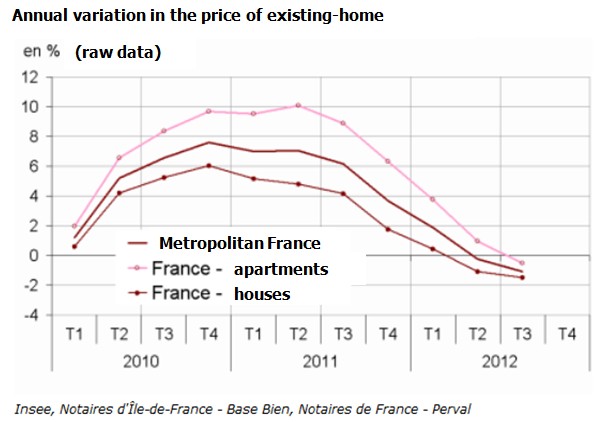

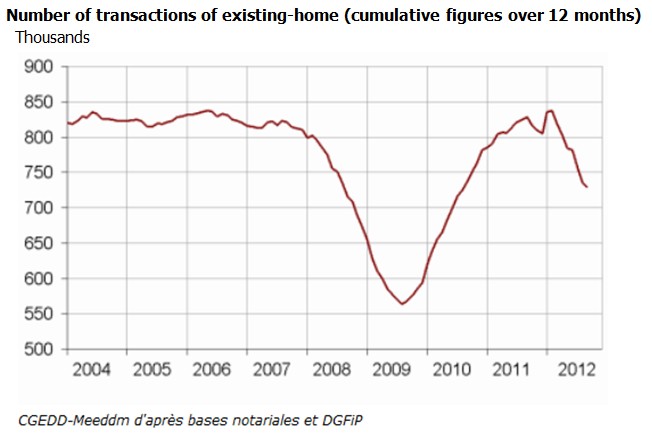

Real estate, then? Even though the announced crash hasn’t materialized, the prices of existing apartments continue their decline that started in the first quarter of 2011. Transactions are in a free-fall since the first quarter of 2012 (Indices Notaires-Insee), which doesn’t bode well for a price hike.

Then there are the precious metals. From 2001 to February 25, 2013, gold has fallen eight times more than 10%, in dollars. In a bull market, it’s quite normal to witness regular phases of mild corrections. The drop in Apple’s stock, which seems unstoppable since September 2012, is one of the best examples of the violent moves an asset can face, when its valuation rises too quickly, without being based on sound fundamentals.

On the contrary, those corrections in gold and silver are sound, in the sense they help discern between a bull market and an asset bubble. Case in point, those corrections haven’t kept gold from performing to the tune of 476% for the period, and each correction has constituted an opportunity for buying the metals at a discount. This is justified, in my opinion, by the fact that the fundamentals have not changed. Also, this is what Fabrice Drouin Ristori was writing about in his last Market Report.

Original source: Yahoo

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.