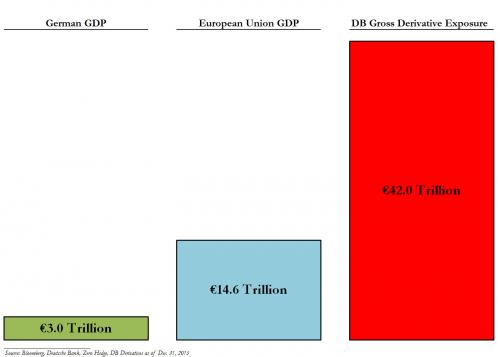

The €42 trillion (notional) derivatives mess known as Deutsche Bank remains under severe pressure. Its market cap is $17 billion. It has no earnings and pays no dividend.

On April 23, Deutsche Bank was Fined $2.5 Billion over LIBOR rate rigging. Twenty-one people face criminal charges following a seven-year investigation.

On September 16, the US Department of Justice Fined Deutsche Bank $14B for mortgage securities fraud leading up to the 2007-2009 global meltdown.

Today, German Chancellor Angela Merkel Ruled Out Assistance for Deutsche Bank.

No Comment

Chancellor Angela Merkel has ruled out any state assistance for Deutsche Bank AG in the year heading into the national election in September 2017, Focus magazine reported, citing unidentified government officials.

The German leader also declined to step into the Frankfurt-based bank’s legal imbroglio with the U.S. Justice Department, which may seek as much as $14 billion in sanctions against Deutsche Bank’s mortgage-backed securities business, the magazine said. A German government spokesman declined to comment on the report Saturday. A Deutsche Bank spokeswoman also wouldn’t comment.

Understanding the Fine

The Guardian reports $14bn Deutsche Bank Fine – All You Need to Know.

The prospect of a $14bn penalty from the US Department of Justice has rattled investor confidence in Deutsche. The penalty aims to settle allegations, dating back to 2005, about the way the bank selected mortgages, packaged them into bonds and sold on to investors. These bonds are known as residential mortgage-backed securities (RMBS).

Can Deutsche Afford the Bill?

Deutsche Bank has been quick to describe the fine as an “opening position” from Washington. It is easy to see why. It would be one of the largest ever fines levied by the US. It could also strain the bank’s finances. For 2015, the bank reported its first annual loss since 2008 and could be heading for another loss this year regardless of the threatened justice department fine. According to Tomas Kinmonth, an analyst at Dutch bank ABN Amro, a settlement on that scale could impede Deutsche’s ability to pay coupons – or regular interest payments to investors – on a special type of bond. The bonds are known as AT1s, which are intended to shore up Deutsche in a time of crisis.

The bank, though, has made clear it has no intention of agreeing to a fine at this level and has stressed it has the resources to keep making payments on the bonds until 2017, at least. However, one analyst told Reuters that any fine topping €5bn would force it to raise fresh funds in the financial markets by tapping shareholders for cash.

Is this the end of Deutsche Bank’s regulator troubles?

The bank has set aside €5.5bn for litigation costs but does not spell out exactly what that sum is for. It is battling more than 7,000 legal cases, although the ones gaining most attention are the RMBS case and one relating to activities in Russia, where the bank is facing an investigation into so-called mirror trades, where clients bought shares in Russia and simultaneously sold similar shares abroad in foreign currency. Regulators are investigating whether or not these trades skirted international sanctions against Russia by turning Russia-held roubles into dollars held outside the country.

Could other European banks be affected?

Deutsche is the first European bank that appears to have started talks with the DoJ over RMBS. Barclays and the Swiss bank UBS are among others waiting for settlement talks to be concluded.

Cooking the Books?

On September 20, I asked Is Deutsche Bank Cooking its Derivatives Book to Hide Huge Losses?

One reader commented:

German Banks do not get to net long and short derivatives under the same ISDA [International Swaps and Derivatives Association agreement] to the extent that US Banks do. The Germans like to see the courts having agreed that netting is applicable under an ISDA in a few bankruptcies before they allow for ISDA netting in reg reporting. So as a starting point German banks always look worse on paper. So if DB is long a swap with JPM and short the same swap with JPM it could show up as having one side as exposure, when in reality it has near zero exposure. US Courts have accepted ISDA netting agreements as valid. Likewise if DB is long a swap and short the futures strip (thus having only a relatively small basis risk) that also probably shows up as 1x the exposure as opposed to near zero.

What is worse, all the big banks have less than perfect reporting systems. They fail to fully net the internal corporate relationships and thus DB can be long and short to itself and record both sides of the internal trade as ‘Gross Notional Assets’. Do this a few hundred thousand times, and not get around to tearing up the matching contracts and Gross Notional Assets balloon to the moon. Why would they want to let this happen. Partially it was because Banks didn’t care about Gross Notional Assets before the Great Financial Crisis, and partially it was because idiots in the ‘C’ suite liked to talk about how ‘big’ they are.

DB needs to get its netting under control, they need to do tearups of back-to-back contracts that don’t get netting benefit, and most importantly they need to get costs under control.

Depositor Bail-In Coming Up?

In a September 21 Veritaseum article, Reggie Middleton provided an analysis of Deutsche Bank’s likely recapitalization effort while asking German Tax Payer Bailout or German Bank Depositor Bail-in?

Deutsche Bank is going to need some money, and it’s going to need some quite soon. The next two or three articles that I write will focus on why there is such a need. In a concerted effort to reduce or potentially eliminated the risk of taxpayer-funded bail-outs of European banks, the EU implemented a new “bail-in” regime beginning on January 1, 2016. As such, rules which require banks and certain systemically significant market participants in EU member states will have to write-down, cancel, convert into equity or otherwise modify certain unsecured liabilities if such steps are required to recapitalize the institution. What is the most bountiful unsecured liabilities of a bank?

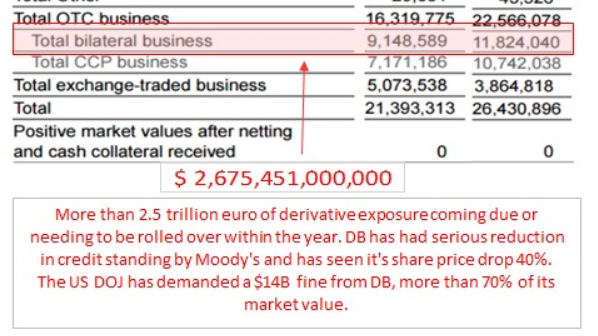

Middleton noted Deutsche Bank has over $2.5 trillion in derivatives exposure that needs to be rolled over.

Is this a net-zero non-problem or is Middleton correct with his claim “Even without market losses (and there’s plenty of reason to believe those are coming), DB will have a hell of a time with added credit expenses due to its lower credit rating (use both rating agencies and bank’s internal scoring models)”

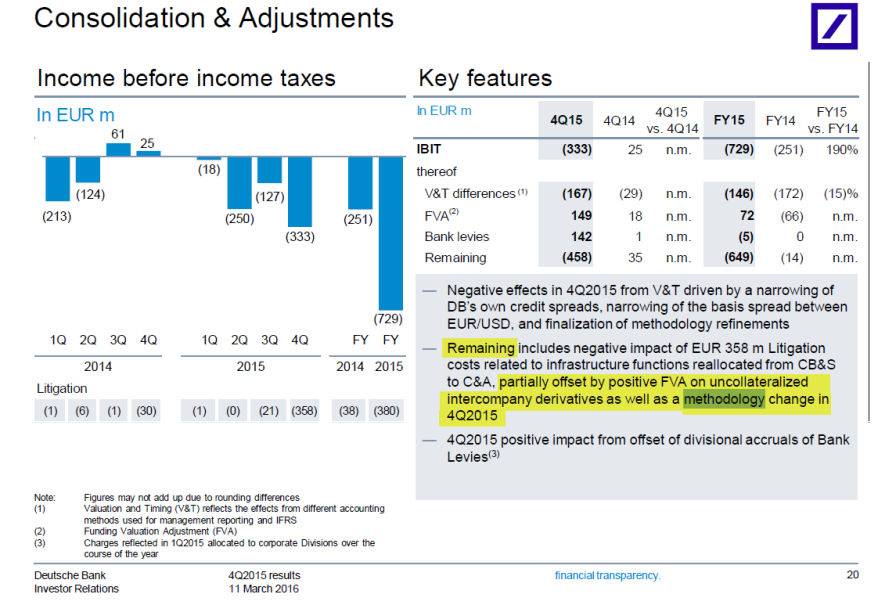

Pointing to an image I posted, Middleton says …

There will be some losses and conflict upon resolution of some of these. How do we know? We believe have identified the counterparty of DB and it has booked a profit for the derivatives that DB booked a loss for. Of course, that loss was booked before DB changed their valuation methodology, which now makes it a profit. Hat tip to Mish’s Blog

That’s the image I posted on September 20.

Middleton commented ….

Almost 50 % of Deutsche bank’s risk profile (both risk weighted assets & Economic Capital) is dominated by their Corporate Banking & Securities Division, mostly because of the trading activities related with this division.

Noticeably, in first quarter of 2015 Deutsche Bank adopted a new methodology to determine “Diversification benefit”, resulted in an overall reduction of risk by 2.3 billion euros from 2014 to 2015. Though because of this new methodology Deutsche Bank’s total risk reduced significantly but, the methodology for the calculation of diversification benefit is not mentioned in their Annual Report. Without that it cannot be clearly substantiated whether Deutsche Bank is shuffling bad loans to a different unit and classification in order to make their NPAs look better. One thing is for sure, it definitely does look fishy!

Do you know what smells even fishier? The high probability that DB uses this “new found risk calculation metric” to determine the cost of capital for their level 2 and level 3 assets. Voila! Instant profits, Mr. and Mrs. Investor! Yeah, right? You see, DB counterparties are not going to want a hyped up model input as payment, they’re probably thinking more along the lines of cash. Add to this, the 50+% drop in share price, .25x BV multiple, and the multiple lawsuits, including the DOJ’s request of $14B dollars (from a $17B market cap), and you have a pretty stringent need for a recap. I will supply even more (actually, much more) fodder for capital contemplation of the nest week. Of course, no one is bringing this point up except for us. I could very well be wrong, I just wish for someone to show me where.

Guessing Game

We are all guessing. Here are two of my guesses.

- Deutsche Bank’s problems go far beyond the fines.

- Its derivatives mess is so tangled that it may not know itself where it stands.

Questions Abound

1/ What is Deutsch Bank’s exposure to the collapsing Italian bank system?

2/ What is Deutsch Bank’s exposure to other troubled European banks?

3/ Is Deutsch Bank Prepping for an Avalanche of Fraud Charges on its Gold Derivative Products?

4/ If a depositor bail-in is not coming, how can Deutsche bank pay the fines now that Merkel ruled out state aid.

Depositors beware!

Original source: Zerohedge

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.