It’s one of the most dangerous myths most people believe…

Boobus Americanus thinks cash he deposits into a bank is a personal asset he owns.

But that’s not true.

Once a deposit is made at the bank, it’s no longer your property. It’s the bank’s.

What you own instead is a promise from the bank to repay. It’s an unsecured liability. That’s a very different thing from owning physical cash stuffed under your mattress. Yet, 99.9% of people conflate the two.

Cash deposited into the bank technically makes you a creditor of the bank. You’re liable to get burned should the bank make a bad bet and get into trouble. The risk is not insignificant. Most banks gamble with their customer deposits on risky investment fads like mortgage-backed securities.

Government deposit insurance schemes are a false sense of security. With their current reserves, they could only cover less than half a penny for every dollar they supposedly insure.

People in Cyprus had to find all this out the hard way a few years ago. People awoke on an otherwise normal Saturday morning to the horror that the cash in their bank accounts had vanished.

It was perhaps the most potent, recent example of the risk of being totally dependent on a single country that suddenly found itself in financial trouble. It also shows why I am such a fan of owning hard assets outside the immediate reach of your government.

You probably already know it’s a bad idea to put all of your asset eggs in one investment basket. The same goes for holding all of your assets in one country. But how much thought have you put into political diversification?

International diversification frees you from absolute dependence on any one country. Achieve that freedom, and it becomes very difficult for any group of bureaucrats to control you. The results can be life changing.

While everyone in the world should aim for political diversification, it’s exponentially more critical for those who live under a government sinking hopelessly deeper into financial trouble. That means most Western governments and the U.S., in particular.

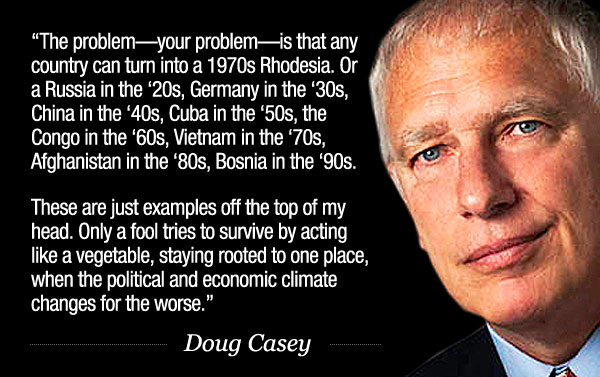

This brings up an uncomfortable truth for North Americans and Europeans. The way the political and economic winds are blowing, things are about to get much worse.

Central banks around the globe have created the biggest financial bubble the world has ever seen. Interest rates are the lowest they’ve ever been in 5,000 years of recorded history. In some parts of the world, they’re even negative. We’re living in a financial Alice in Wonderland.

I think the social and political implications of this bubble bursting are even more dangerous than the financial consequences.

An economic depression and currency inflation (perhaps hyperinflation) are very much in the cards. These things rarely lead to anything but bigger government, less freedom, and shrinking prosperity. Sometimes, they lead to much worse.

We’re already getting a small preview of what is to come…

It seems like each week, there’s a new attack or mass shooting. Racial tensions are on the rise. Europe is experiencing a migrant crisis that’s tearing the continent apart.

There’s no doubt the world has become a crazier place in the past couple of years. Unfortunately, I think it is only going to get worse…

Original source: Zerohedge

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.