The price of gold beats its record, both in dollars ($2,146 per ounce) and euros (€1,903). Bitcoin climbs, but remains far from its 2021 high. At the same time, the stock market is making some headway (S&P 500, Frankfurt DAX - not the CAC 40, which has been stable since January 1), and housing is more or less depressed across the globe. Something is going on. Aside from cyclical explanations (a slowdown in inflation, which raises hopes that central banks will stop raising interest rates), aren't there deeper reasons?

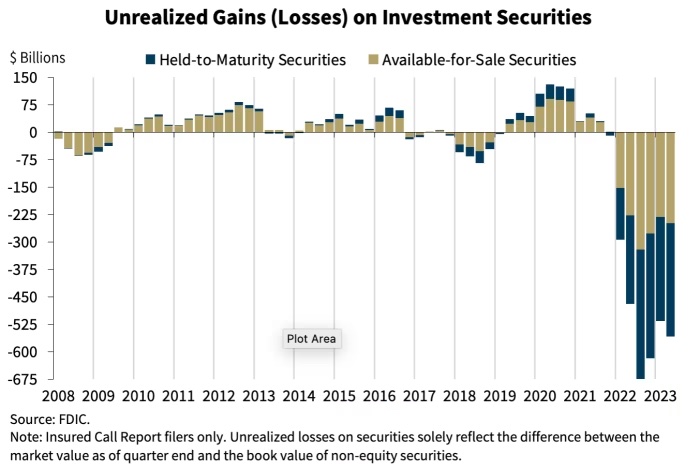

Note the interesting observation by financial analyst Didier Darcet, who asserts that the mega-crisis has in fact already occurred, without anyone realizing it. The crash has happened, and it's a bond crash, resulting from the sudden rise in interest rates initiated by central banks to counter inflation. All old bonds issued at low or negative rates suffer significant depreciation when new issues are made at 3%, 4% or more. Here's a graph illustrating these losses in the United States:

"It's impressive (and the situation is similar in Europe), but it's gone unnoticed," explains the analyst, "because most of these bonds are issued by governments and they have the option of waiting or raising taxes, unlike bankruptcy or cutting public spending, which are not among their options. So we feel nothing.

However, it is essential to add that these bonds are assets of financial institutions. If these institutions are forced to sell them in a panic, for example because their customers wish to withdraw their funds, the losses incurred may exceed their equity capital, leading to their bankruptcy. This is precisely what happened to Silicon Valley Bank in the United States and the insurer Eurovita in Italy (we reported on this last March).

Since then, there have been no new bankruptcies, but aren't we beginning to feel the cracks? In the subprime era, the first warnings came in April 2007 with the bankruptcy of mortgage lender New Century Financial Corporation, followed in August 2007 by the freezing of three funds at BNP Paribas' US subsidiary, before the crisis really erupted one year later, on September 15, 2008, with the resounding collapse of Lehman Brothers. The collapse in bond values would dangerously constrain many financial institutions, without this information being publicly disclosed. In this context, one of the avoidance strategies for those in the know would be to turn to gold, thus explaining its current rise. A hypothesis that seems entirely credible. This bond crisis won't be able to slide over us like water over a duck's feathers.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.