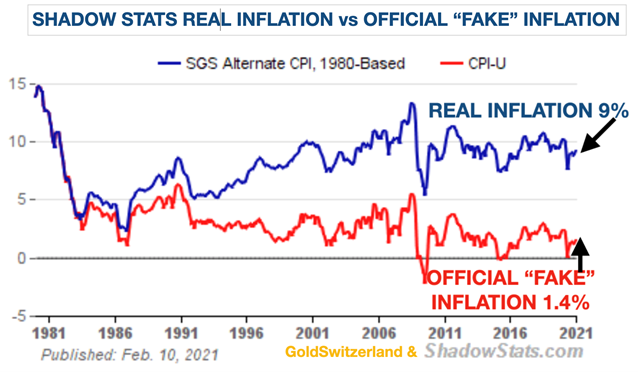

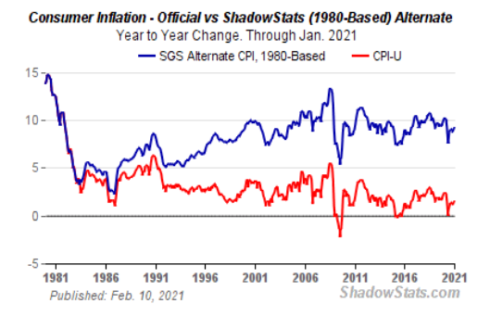

The Fed’s Most Convenient Lie: A CPI Charade

“Reset” or no “reset,” currencies will continue their slow death spiral, and gold, always patient, always REAL rather than virtual, will continue its rise above the semantic dust and financial rubble of a broken banking system and failed monetary experiment driven by delusion, myth and alas, blatant...

Read article