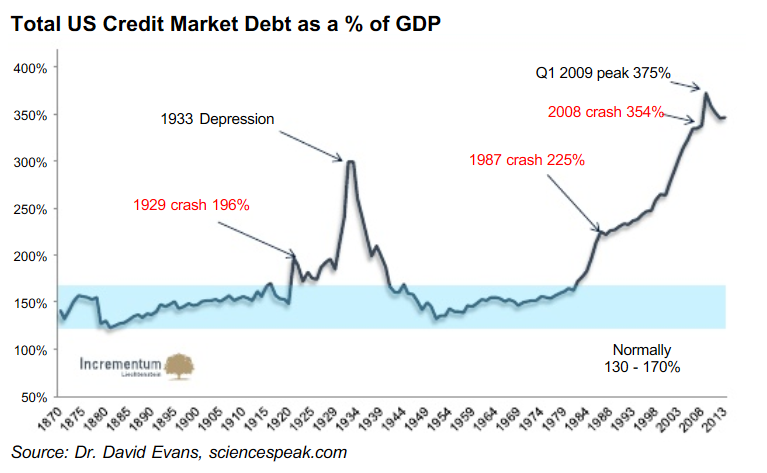

I believe the next 7-year cycle, from 2015 to 2021, will bring a crisis of “biblical proportions”, much worse than the 2008 crisis, that might resemble the ‘30s Great Depression even more but, this time around, with massive devaluation of the dollar and other paper currencies against gold.

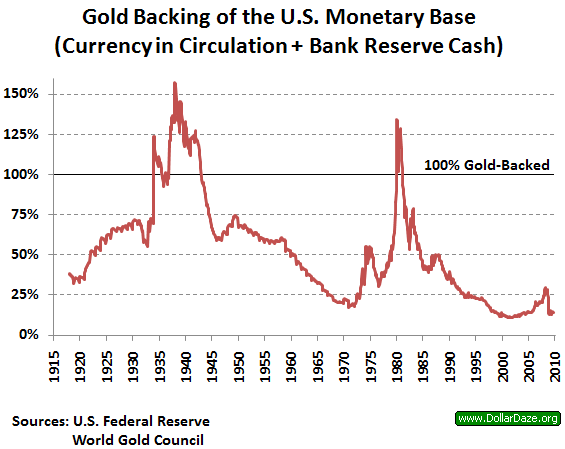

In 1934, the dollar had been devaluated by 41% against gold, but total debt was not exerting as much weight in the system and the Fed’s gold could then cover many more circulating dollars than it can today, no matter the money aggregate used (M0, M1, M2 or M3). Today, the Fed’s gold (if it still exists) can only cover 2% of M3 and 8% of M0 (monetary base).

In any case, banks are already prepared for the next insolvency crisis and will be allowed to use savers’ accounts to cover their losses. In such an environment, accumulating cash will be risky, thus perhaps encouraging the move of some capital toward gold and silver, outside the banking system.

It is said that a bomb never falls twice in the same hole... the next crisis won’t look like 2008 where, at first, gold and silver had plunged along with the rest of the assets. The next crisis will propel gold and silver to dizzying heights. The current period in the gold and silver markets represents the calm before the storm.

Being positioned ahead in precious metals is of the utmost importance because, when the Fed loses control of the markets, it will lead to long “bank holidays” where it will be impossible to buy even an ounce of gold. When such a huge boat is sinking and life vests are limited, no one will want to sell you one... at any price.

To those who sold their physical gold in 2013, scared by the massive paper gold selling on the COMEX, I offer my sympathy for the next few years, because all that gold withdrawn from ETFs has made its way to Asia, where it will stay. They will learn the hard way that the gold price is determined at 99% by paper gold and that 100 claims may exist for the same ingot on the COMEX. On the scale of the banking system, this claim/ingot ratio is hard to evaluate, but one thing is certain: many gold owners unknowingly own paper gold only.

With political leaders devoid of any long-term vision and corrupt bankers manipulating markets in so many ways, the West has been accelerating wealth transfer toward the new emerging economic powers, i.e. China, India and Russia. The weakening of the economy and military power in the West will not be without consequences on the geo-political scene, and the world chessboard risks being profoundly disturbed.

I think Putin is quite aware of the real situation in the global economy, and especially of the dollar’s dire situation. For him, a crisis equals an opportunity. Let’s not forget that Russia has witnessed incredible structural changes in its history. This large country was radically transformed under communism and, later, experienced another radical transformation after the fall of communism. The changes in this country are far from over, and it could fare much better in the 21st century than old Europe and the United States. The Russians are good chess players, and they’re already preparing for a world after the dollar by slowly accumulating gold in their reserves, all the while sitting on cushy strategic commodities reserves.

One must understand that the nature of this current wave of correction is in the natural order of things. In the ‘80s and ‘90s we have witnessed political changes that have encouraged financial speculation and challenged workers’ purchasing power, despite an important increase in productivity. Households may have experienced a rise in their standard of living since the ‘70s, but this was only made possible by growing credit. In the same period, we have seen the wealth gap between the rich and the poor grow larger, an unavoidable result of paper money and financial speculation.

The world of 2021 is at risk of being profoundly disturbed and the standard of living may have to rise from a much lower level. World demographics might also play into drawing standards of living to a more reasonable level, due to rising energy costs, ergo food costs.

In a more general way, one can observe a clear decline in great revolutionizing discoveries since Man set foot on the Moon. Certain fields of research, such as GMOs, are still controversial, and they seem to enrich the companies that patent them rather than serve humankind.

Global economic growth during the next Kondratieff Spring (2021-2040?) might not equal the growth of the past century, because the technological revolutions that were feeding the ascending waves of the K. Spring were much more numerous then, more frequent, and were really transforming the look of cities and the lives of people (steam locomotives, electricity, automobiles, planes, chemistry, refrigerators, radios, television sets, nuclear plants, computers).

One thing is certain: In a finite resources environment (oil, gas, metals, drinkable water, farm land, forests, fish, livestock...) growth cannot continue indefinitely. Even though extraction or exploitation techniques are being more refined, we are reaching the system’s limits, and the next Kondratieff waves may lose in amplitude. Another Russian scientist, Constantin Tsolkovsky, stated in 1920: “The Earth is humankind’s crib... but one does not spend one’s life in a crib”. The future of growth will forcibly be in space exploration and colonisation, but we will have, before that, to solve many problems on Earth and, as far as we’re concerned, adopt a much more conservative strategy with our financial assets.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.