Is the credit tap closing?

With the recent rise in interest rates, demand for credit is collapsing in many sectors of the economy.

The fall in demand for corporate credit is impressive in the United States, but Europe is also experiencing a significant drop despite a measured rate hike:

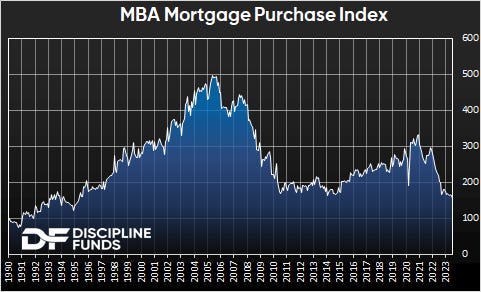

This drop in demand for loans is also affecting real estate, the sector most affected by the rise in interest rates.

Demand for mortgages is at its lowest level since 1996:

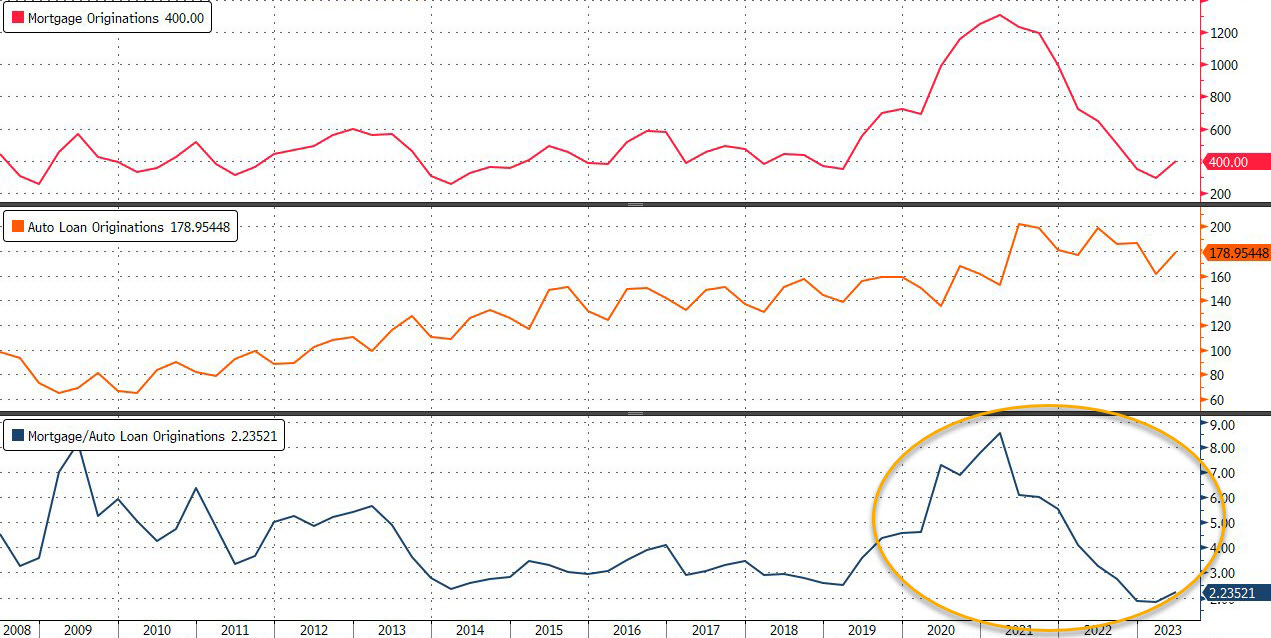

Rising interest rates have broken the home loan pump, but have not yet affected demand for consumer and car loans.

Applications for loans to buy a new car remain at historically high levels, especially compared to home loan issuances, which have collapsed:

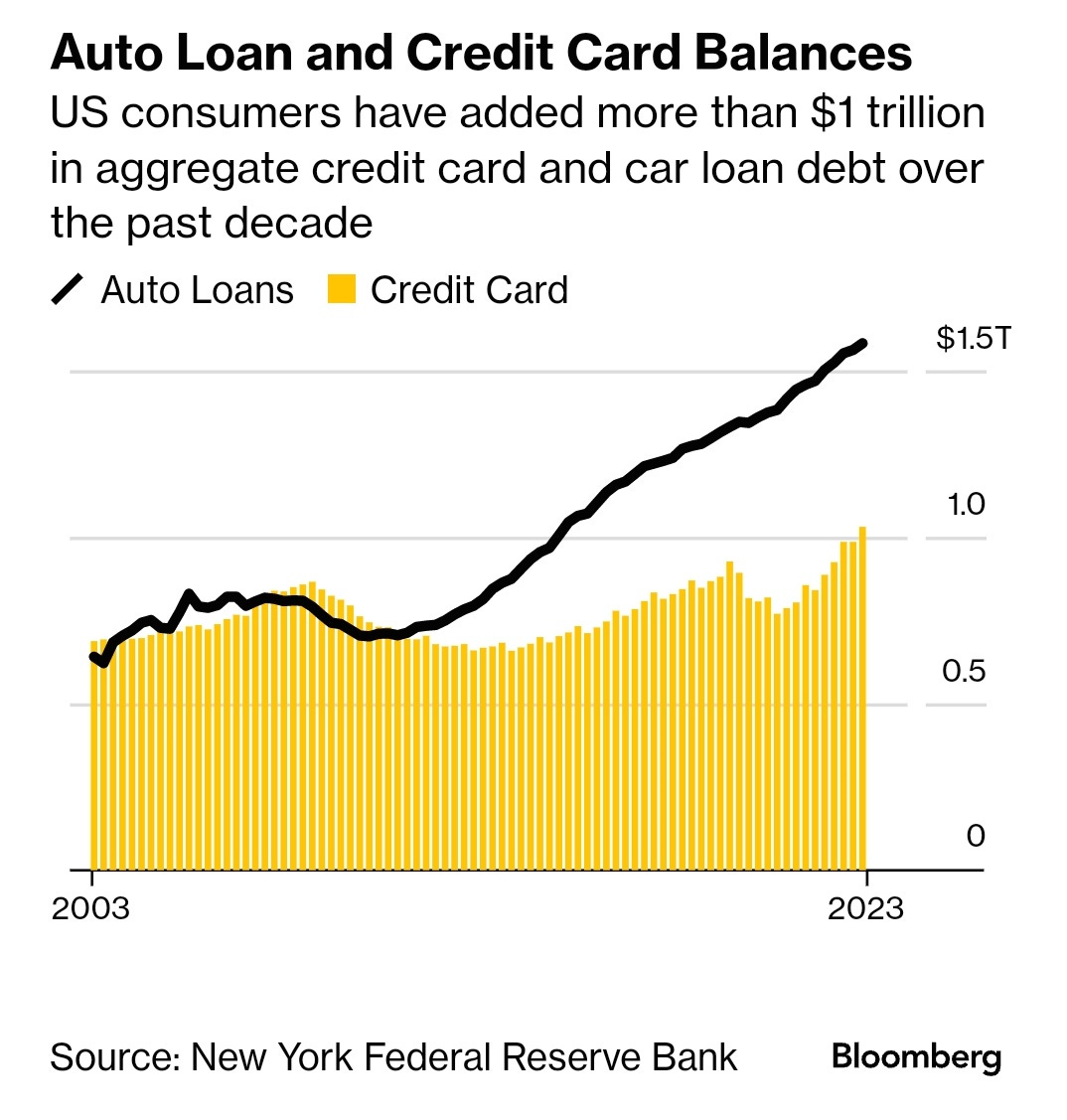

The amounts borrowed by Americans to buy a car or to consume on credit have never been so high. In these two areas alone, Americans have accumulated more than $2.5 trillion in debt:

It's precisely when debt reaches an historically high level that we see an inflection in late repayments of outstanding loans.

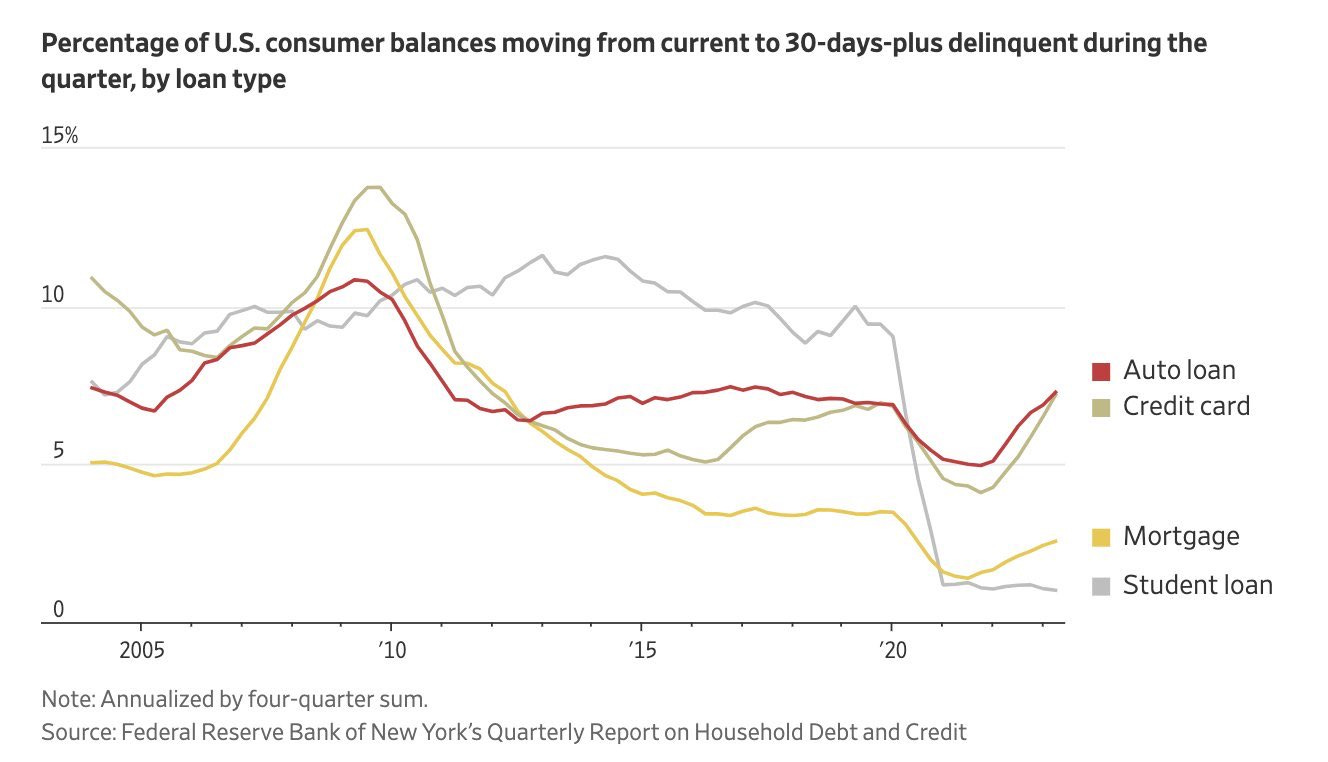

More and more Americans are unable to meet their repayments on time. This is particularly true of car loans and consumer credit.

Delinquency rates are lower than those seen during the 2008 financial crisis, but they are increasing at a pace that could quickly become problematic:

Late repayments are piling up, and the delinquency rate is reaching record levels.

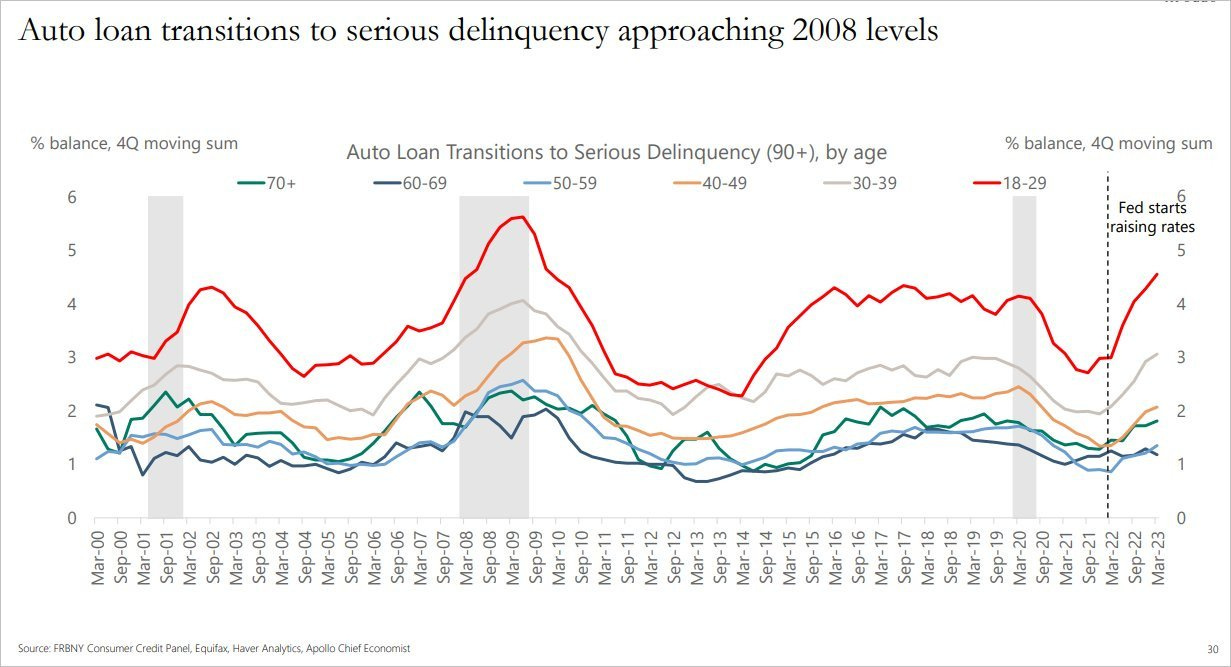

In the car loan sector, the delinquency rate is approaching 2008 levels:

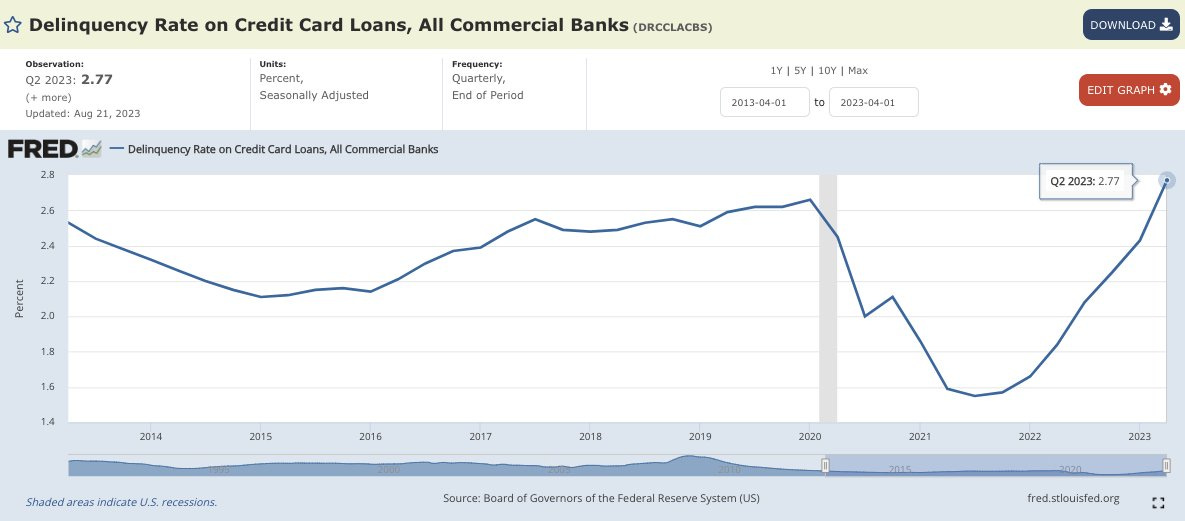

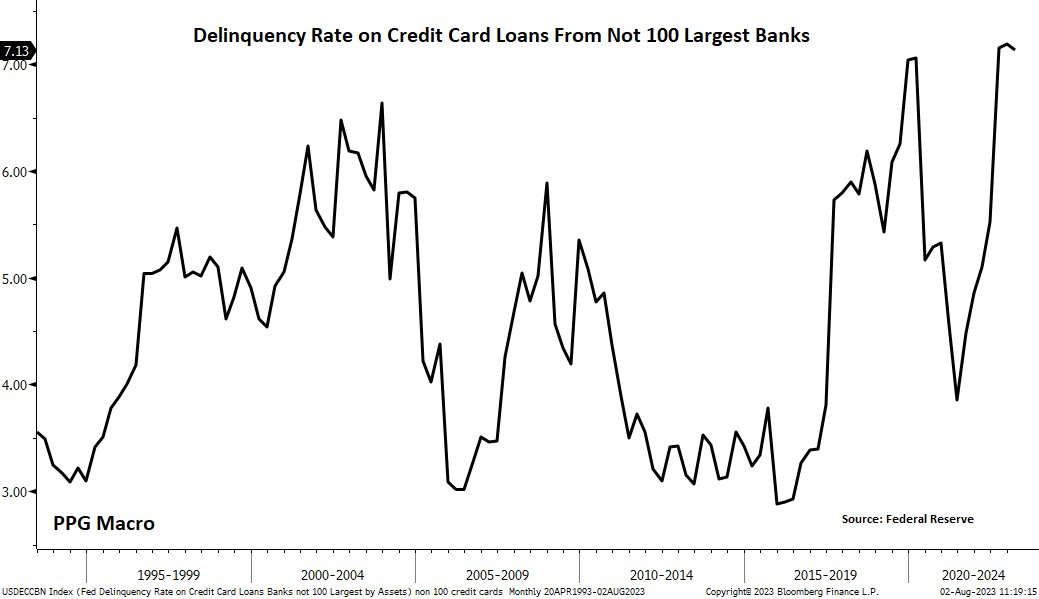

But it is in the consumer credit sector that the situation has deteriorated the most. The delinquency rate has just broken an all-time record:

The credit card delinquency rate is particularly closely scrutinized, as it determines the risk weighing on the banking sector.

The delinquency rate on credit cards issued by regional banks has just reached an all-time high of 7.1%:

Falling demand for corporate and real estate loans, sharply rising delinquency rates on car loans and credit cards... the risk of a credit crunch is on the rise again as summer 2023 draws to a close.

Logically, banks are the most exposed to this credit risk.

The BKX index, which measures the state of the banking sector, is in the process of returning to the support it tested twice during the Covid crisis and the banking crisis of March 2023:

Same configuration for the KRE index of US regional banks:

If the risk of a credit crunch spreads over the next few weeks, the Treasury and the Fed may have to intervene once again to prop up these supports.

As is often the case when pressure on banks increases, silver metal takes advantage of the situation to return to a bullish configuration and once again attempts to break out of its two-year consolidation flag:

The fact that the metal is reacting to mounting banking stress may have something to do with the selling exposure of some banks in the silver futures market.

Silver's current rise is also linked to tension in physical stocks, which are at record lows in Shanghai and on the COMEX.

Add to this the closure of two major mines, Peñasquito in Mexico and now Lucky Friday in Idaho, demand outstripping supply in 2022, and a drop in production expected in 2023....

The pressure on silver stocks is not about to ease. Last month, shorts were still hoping that the Chinese slowdown would have a negative impact on prices. It would seem that the reality of the physical market and the new banking risks are dashing their hopes.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.