The price of gold continues to rise, despite the persistent lack of interest shown by Western investors.

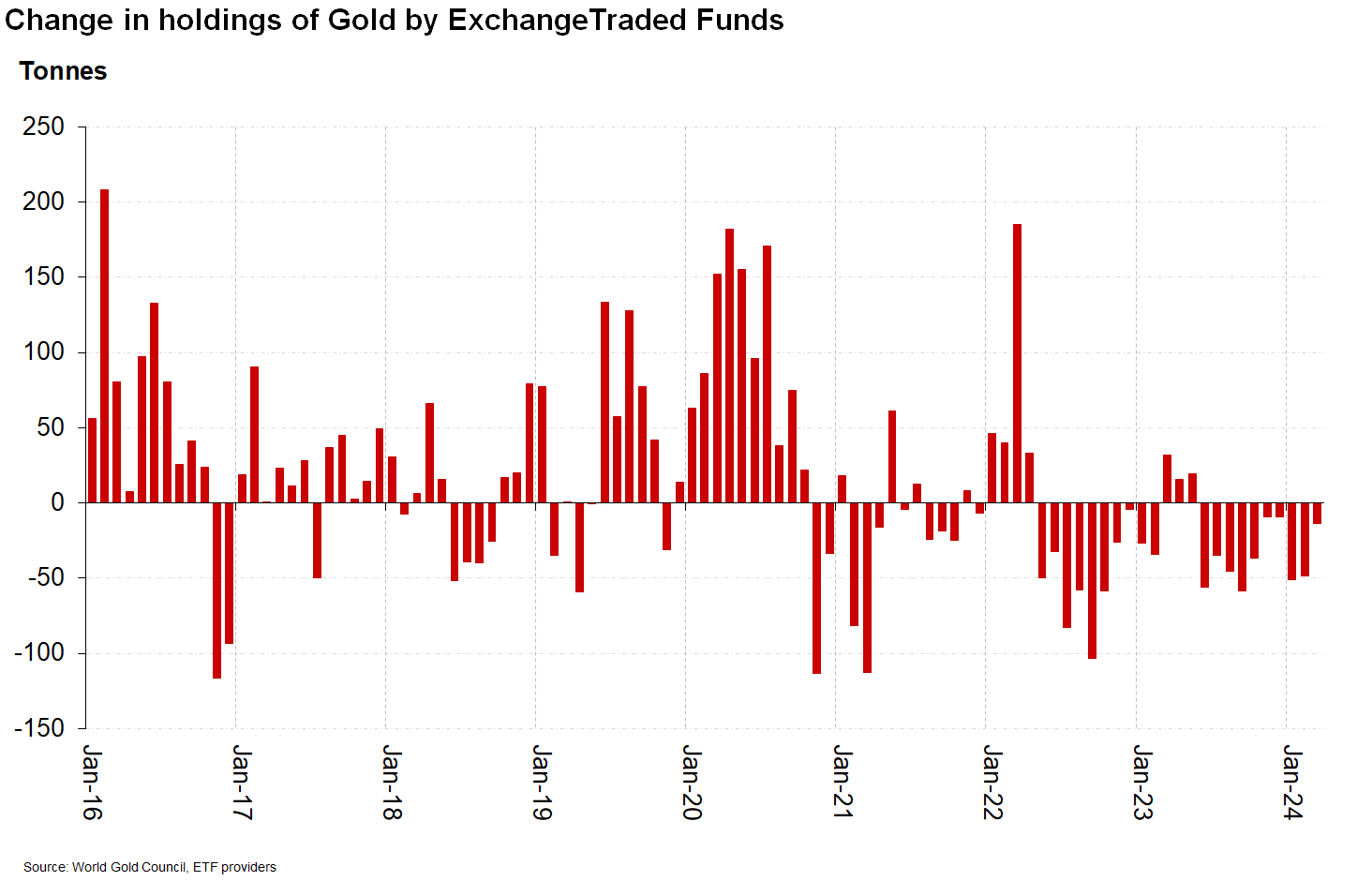

The decline in outstandings continued in March, albeit less pronounced than in previous months. Even so, this is the tenth consecutive month of outflows from gold-backed ETFs!

While outflows are intensifying in the West, the opposite is happening in China. Confirmation of gold's breakout has led to a 30% rise in ETF gold outstandings in just a few days:

In recent weeks, there has been a real rush to buy ETFs linked to Chinese mining stocks:

The rush on metal seen since the beginning of the year is now directed at mining companies.

It is now clear that the Chinese market plays a crucial role in determining gold prices. The premiums applied in Shanghai have acted as a powerful engine, propelling gold higher. Physical demand in China is so strong that Shanghai is gradually becoming the world's leading gold-pricing location. It's only logical that the market where most physical transactions take place should become the most important. The price is set where physical gold is traded.

The COMEX paper market is transforming itself into a source of supply for physical gold: sales by traders create arbitrage opportunities for Chinese physical demand. Whenever a contract is sold, it is logical to expect that the buyer of the futures contract will be tempted to take delivery of the discounted contract and resell the metal on the Chinese market.

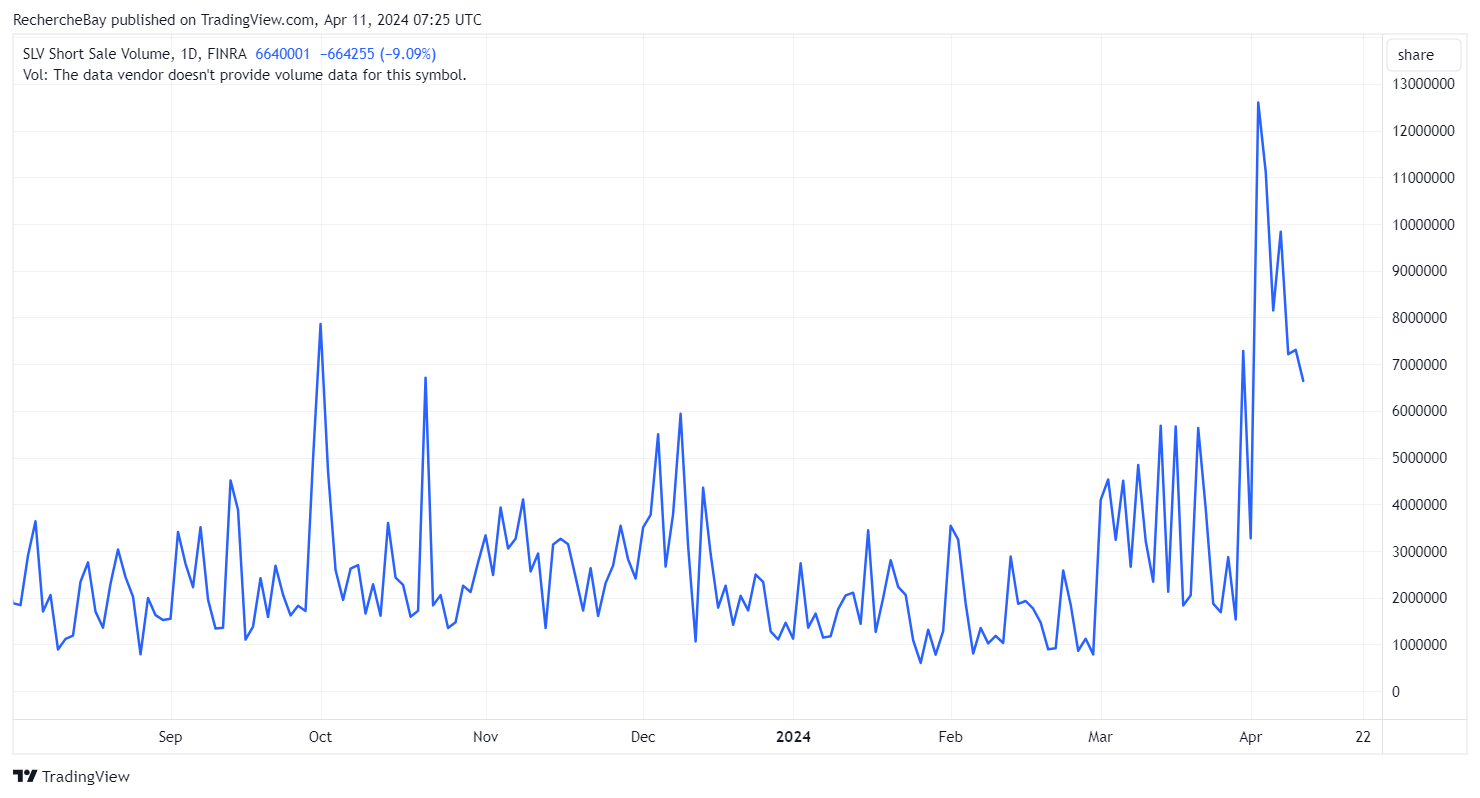

This arbitrage phenomenon could now be manifesting itself on the physical silver market. Last week, a considerable number of short positions were opened on the SLV ETF in anticipation of a 12% margin reduction on all futures contracts traded on the COMEX.

When these margin increases are triggered, long speculators are forced to pay extra cash to keep their positions open. Generally speaking, the constrained leverage on this futures market is such that margin increases "flush" most long speculators, sell orders on the COMEX follow, the spot price collapses and shorts can cover themselves in these panic sales by long speculators. This is probably what the shorts on the SLV ETF were hoping for last week.

To everyone's surprise, these margin hikes didn't have the expected effect: although there was a sharp drop on the futures market, the movement didn't last, and was even followed by a massive wave of buying at reduced prices.

The release of worse-than-expected CPI inflation figures in the United States should logically have pushed the price of silver lower. Instead, silver is back on the rise:

This rise was accompanied by a spectacular fall in short positions on the SLV ETF:

In other words, the rise in silver is taking place with a hedge of short positions on the SLV ETF. It’s a short squeeze!

Speculators who had bet on a decline in silver generated by the COMEX margin hike are buying back their positions. This time, they're up against players with "deep pockets", determined to maintain their long positions at all costs, presumably with the aim of taking delivery of their futures contracts.

The futures market becomes a means for these participants to source physical metal, and therein lies the problem. A paper market cannot serve as a price regulator if it is used as a physical delivery market. The COMEX was not created for the purpose of supplying metal! In fact, it is simply impossible to deliver all the contracts, as the leverage is far too high and COMEX stocks are insufficient to convert paper contracts into physical silver. If the silver market were to gradually transform into a market based on supply and demand for physical metal, the short squeeze phenomenon could intensify in the months ahead.

After all, the example of nickel last year highlights the consequences of a malfunctioning futures market. A short squeeze caused the metal's price to soar. In the case of nickel, where most contracts are traded over-the-counter, the surge in futures prices had no impact on the prices of traded contracts.

The case of silver is different. Silver concentrate prices are negotiated on the basis of spot prices. Consequently, any sudden rise in the price of silver would have an immediate impact on the profits of silver companies.

The surge in silver stocks reflects the recognition of this risk. Companies such as Coeur d'Alene, Fortuna Silver and Pan American Silver have almost doubled their market capitalization in the space of a few weeks, while the mining index has yet to confirm its breakout !

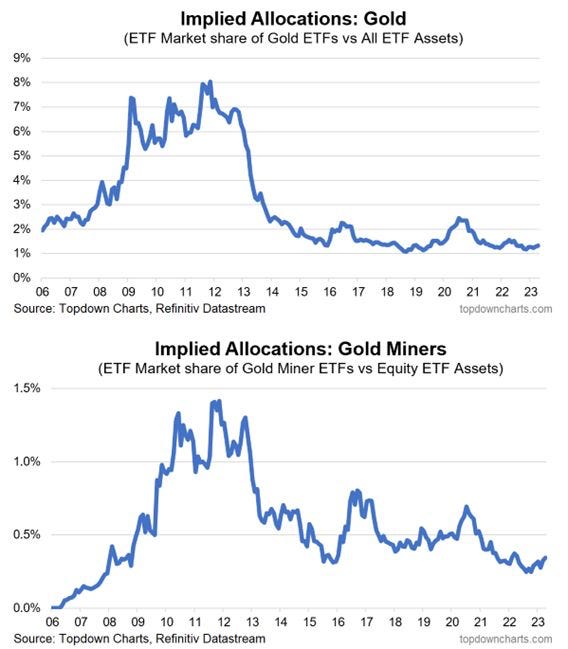

To date, there has been no sign of any change in asset allocation in Western countries.

The share of ETFs in the gold sector is still at an all-time low:

We're still a long way from a real craze for precious metals!

The rush to buy physical gold in China has led to a sharp rise in gold prices since the beginning of the year.

The rush on Chinese ETFs could spread to Western ETFs, with a significant impact on asset allocation.

We could then move from a wait-and-see phase to a pronounced enthusiasm for precious metals.

The change in sentiment in this sector is quite abrupt, as we've seen in the past, but this time Chinese demand seems to be the main driver, a historically unique situation. Even gold's most ardent supporters, the "Goldbugs", are caught off guard by this sudden spread.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.