The new wave of inflation that we have been deciphering in our articles over the past few weeks has not been accompanied this time by a marked improvement in the US economy.

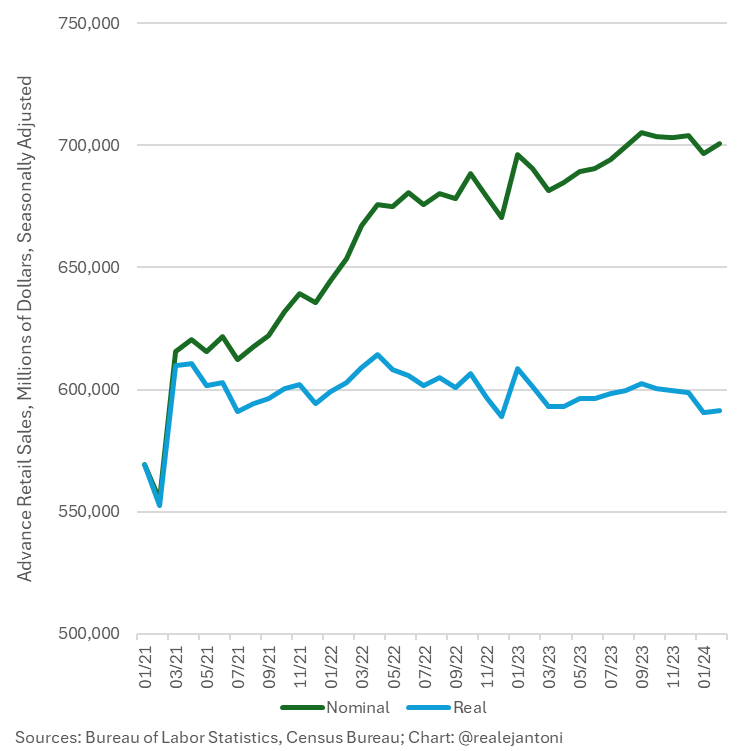

The latest retail sales figures are disappointing. Whereas the first wave of inflation was accompanied by a surge in retail sales, the current figures are flat or even down.

Once the figures are adjusted for inflation, retail sales in real terms have fallen significantly since the start of the year. Since March 2021, inflation-adjusted retail sales have been falling. In real terms, they have fallen by 3.2% since then. Even though Americans have 12.9% more dollars to spend than they did three years ago, they are buying fewer products.

In other words, the increase in sales figures is entirely due to higher prices. In fact, this new wave of inflation is even leading to a decline in retail sales in the United States:

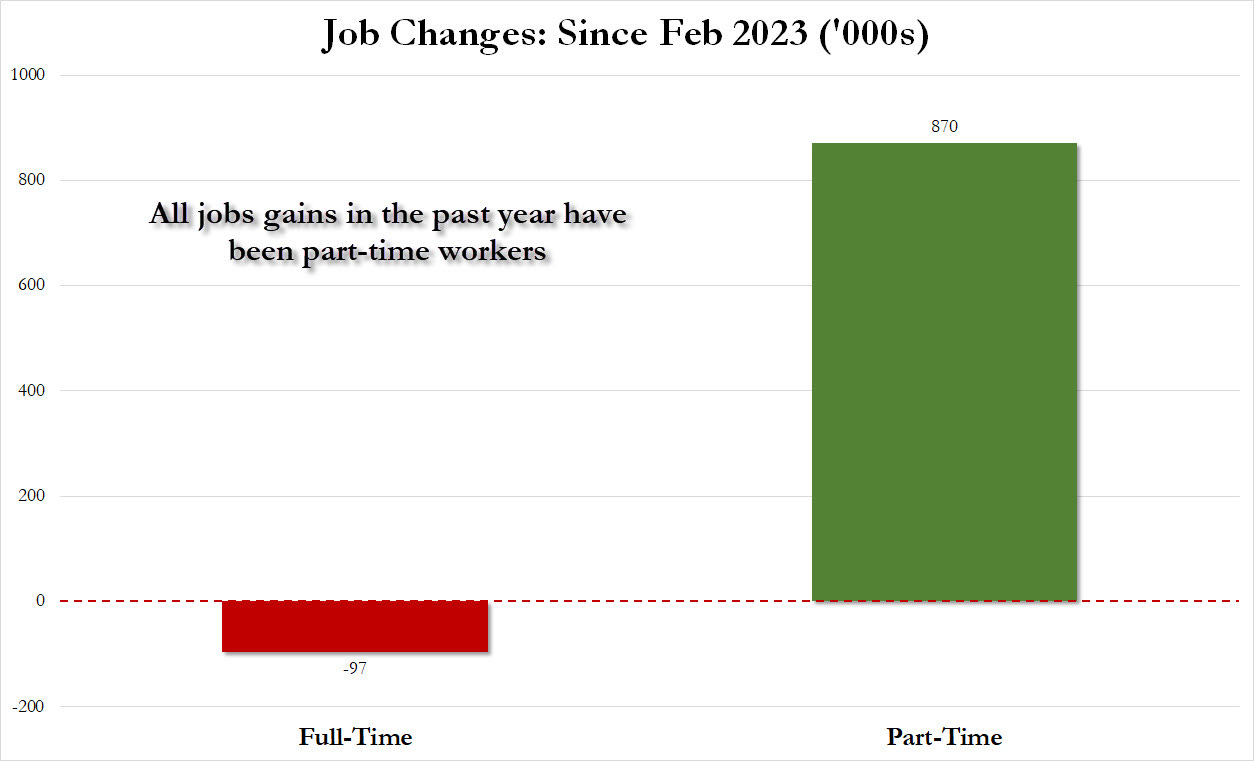

On the employment front, things are also different from the first wave of inflation.

Over the past year, job creation in the US has been mainly concentrated in the part-time sector:

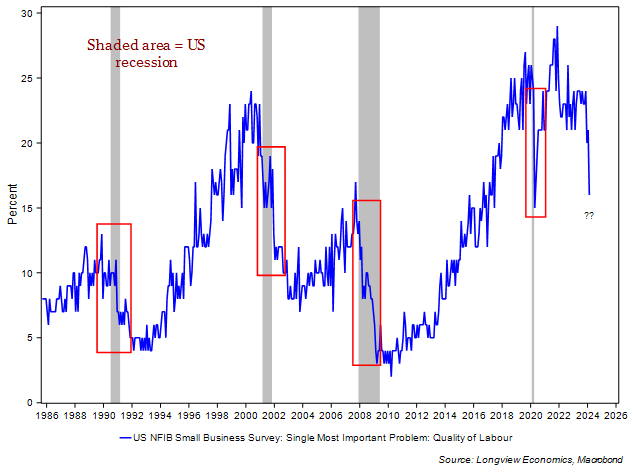

The latest NFIB Small Business survey sends the most worrying message: finding a high-quality workforce is no longer a challenge in the USA.

In contrast to the 2022-2023 period, an increase in the supply of skilled labor is underway, as the survey figures report:

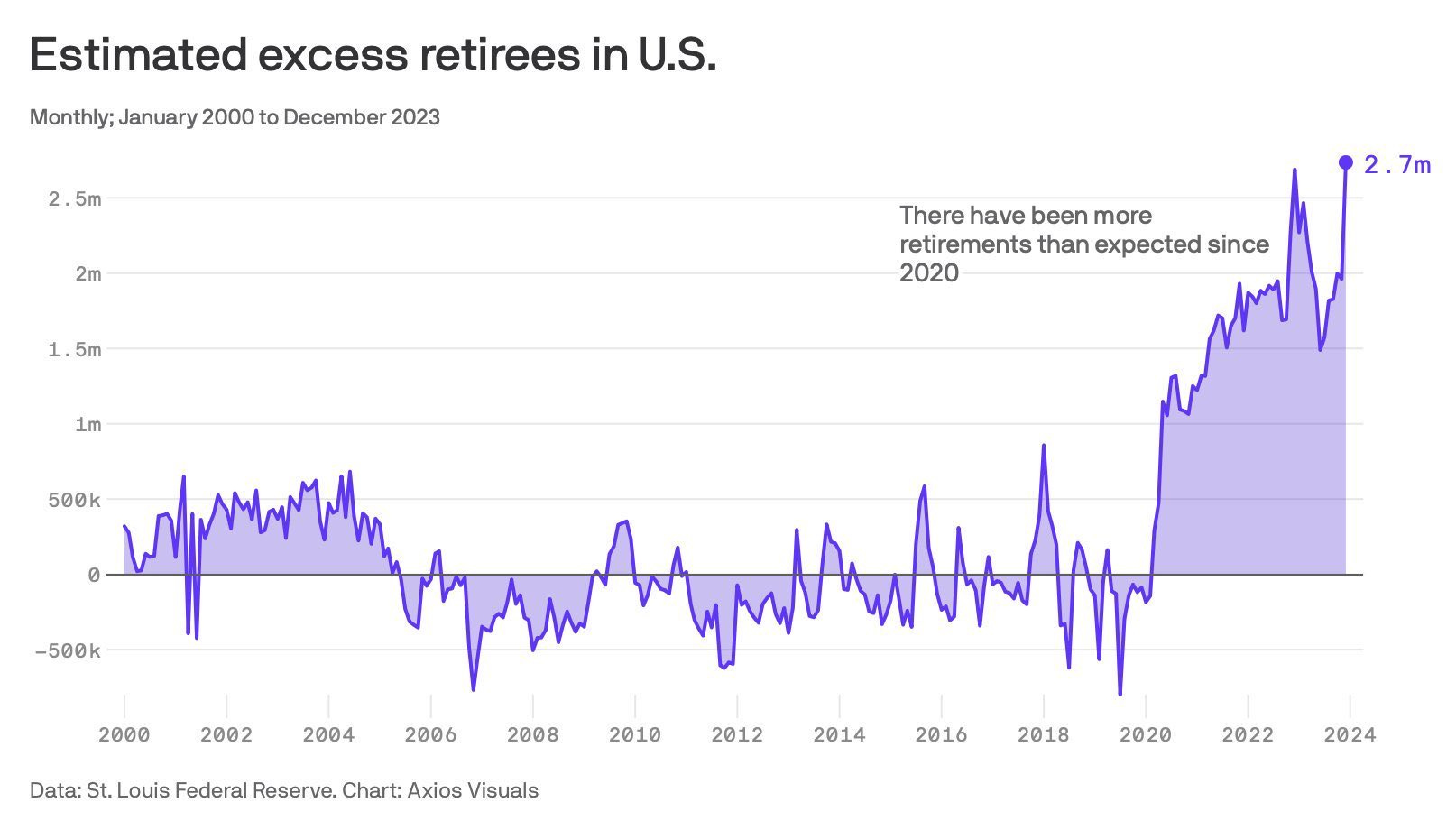

These data are all the more significant in a context where Americans are planning to retire in far greater numbers than previously expected:

Seniors are leaving the job market, which would normally increase pressure on the availability of skilled jobs. In the USA, however, the opposite is true: according to the NFIB survey, skilled jobs are no longer in short supply.

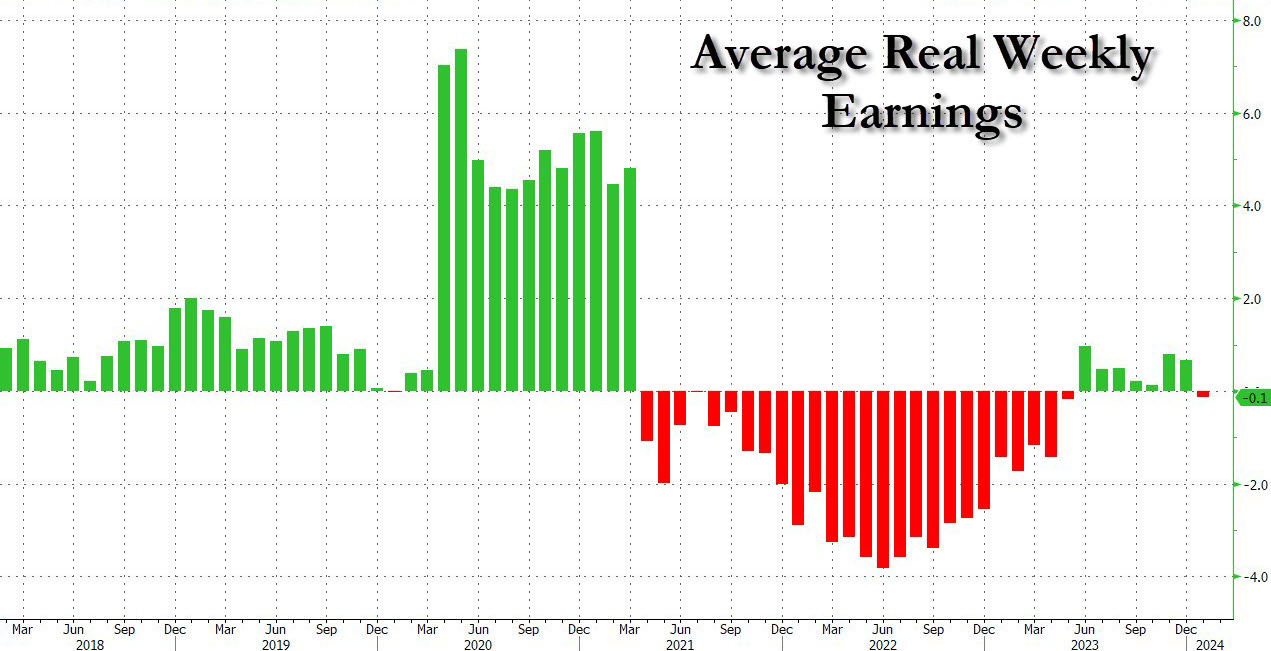

This explains why pressure on wages is lower than during the first wave of inflation. Wages are no longer keeping pace with rising inflation, and real wage levels are starting to fall again:

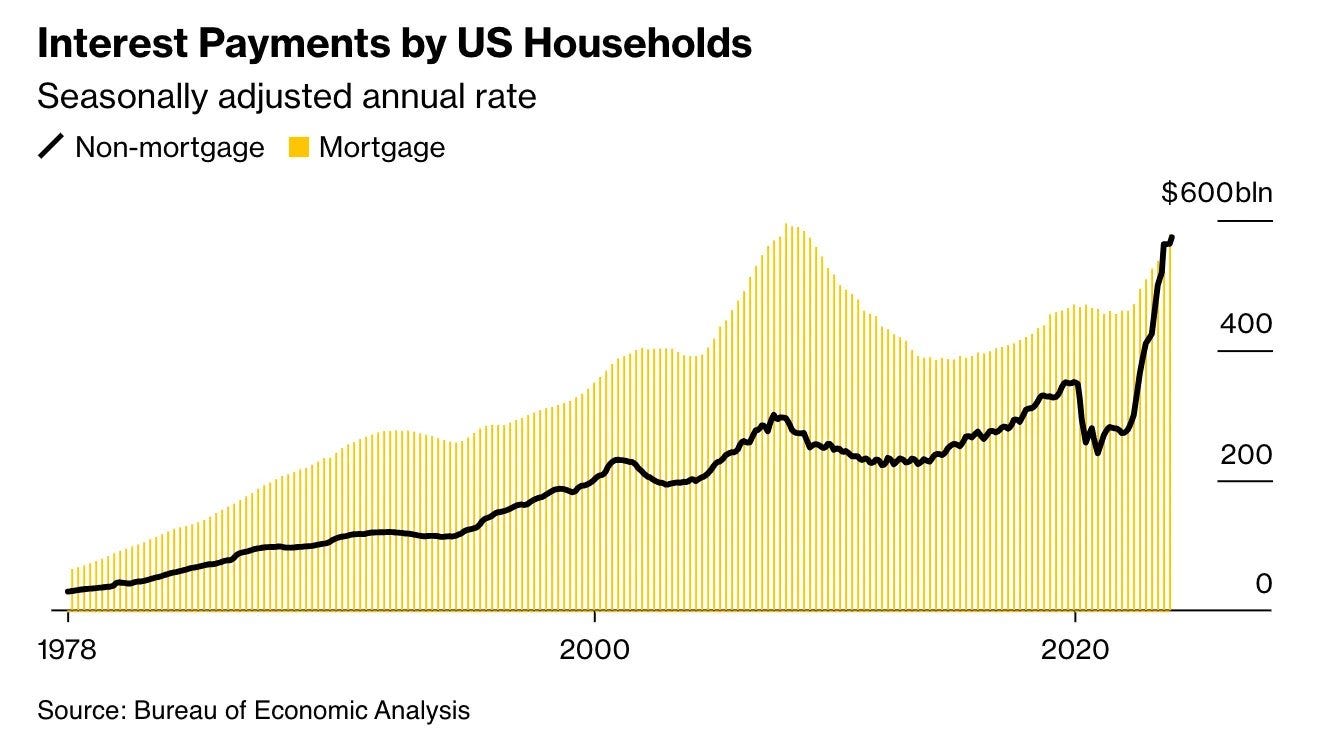

Rising inflation and deteriorating employment figures form a toxic cocktail that is unfolding at record levels of household debt.

Debt levels are returning to their 2008 peak.

But unlike the 2008 crisis, this indebtedness is concentrated more on consumer credit and less on mortgages. Although household mortgage indebtedness is not as high as in 2008, consumer credit indebtedness has risen considerably. Overall, household indebtedness is at an all-time high:

The resurgence of inflation, combined with the deterioration of the job market, is affecting households faced with a situation of over-indebtedness of historic proportions. This situation is now likely to put a brutal stop on consumption, which is the driving force behind the US economy.

This new trend is revealed by the decline in retail sales: the US economic engine is showing signs of weakness, even though inflation has already started to rise again.

Inflation remains at a worrying level, prompting the Fed not to cut rates immediately. Despite this, the Fed has decided to keep rates unchanged at 5.50%, a level considered too high by many economists who fear the risk of a credit crunch if this period of high rates continues. Jerome Powell seems determined to fight against inflation for longer than anticipated, which is proving to be more resilient than expected.

In short, the United States is entering a period of stagflation, a scenario that is enabling gold to set a new all-time record, confirming last week's breakout.

Gold always rises during stagflation.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.