In a context of a health crisis, geopolitical tensions, and weakening of American democracy, a risk has been added to Biden's mandate: inflation. In February, prices rose by 7.9% across the Atlantic. Long touted as transitory, this historic level calls into question the credibility of the US central bank. As inflation rises, the purchasing power of American households is sinking and the dollar is losing its value. For a social-democratic president with a protectionist policy, this is a debacle.

While Biden recently stated that his administration was using "every tool" necessary to fight rising prices, the Fed is continuing its quantitative easing (QE) policy with inflationary effects. While some present this strategy as a way to stimulate economic activity, it seems to reflect the Fed's inability to act in a sticky situation. A sign of a loss of control?

To guard against the risk of runaway inflation, and to see what strategy the U.S. central bank might adopt in the future, it is worth looking back.

In March 2020, in response to the health crisis, massive support was provided to the real economy. With an unprecedented $2 trillion plan, followed by a $900 billion increase, President Trump managed to save the country's businesses. A year later, shortly after his inauguration, Biden established a new stimulus package of $1.9 trillion for various social measures, including the distribution of a cheque for households. In total, in the space of one year, nearly $5 trillion was injected into the American economy.

How about monetary policy?

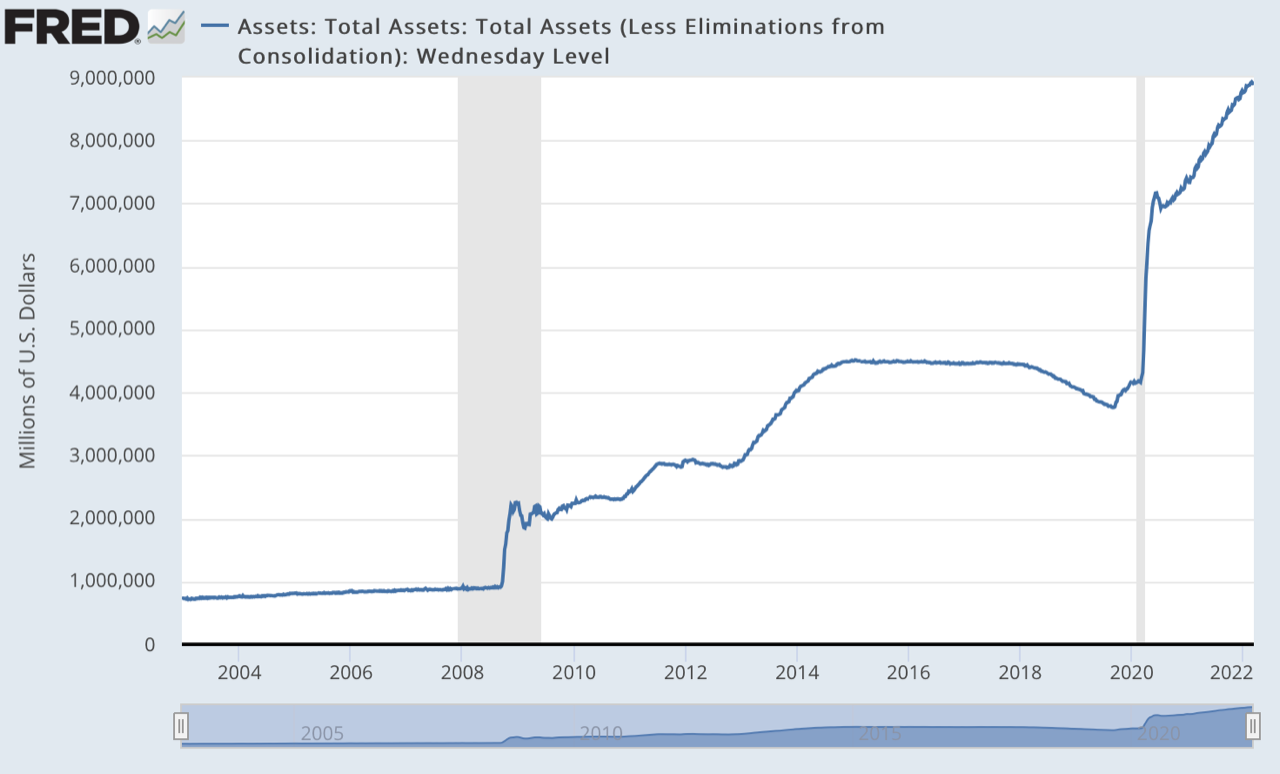

Fearing a repeat of the 2008 scenario, the Fed immediately lowered rates to between 0 and 0.25% and announced an emergency purchase of $700 billion of government and multinational debt to save the financial markets. A few months later, in June 2020, the US central bank expanded its quantitative easing program by deciding to buy $120 billion of debt on a monthly basis until further notice. The Fed's balance sheet exploded, and the results were immediate. After a 45% drop in one month, the S&P500 (the main US stock market index) recovered and reached its pre-crisis level in only five months (it had taken five years in 2008).

What are the effects on the gold and silver market?

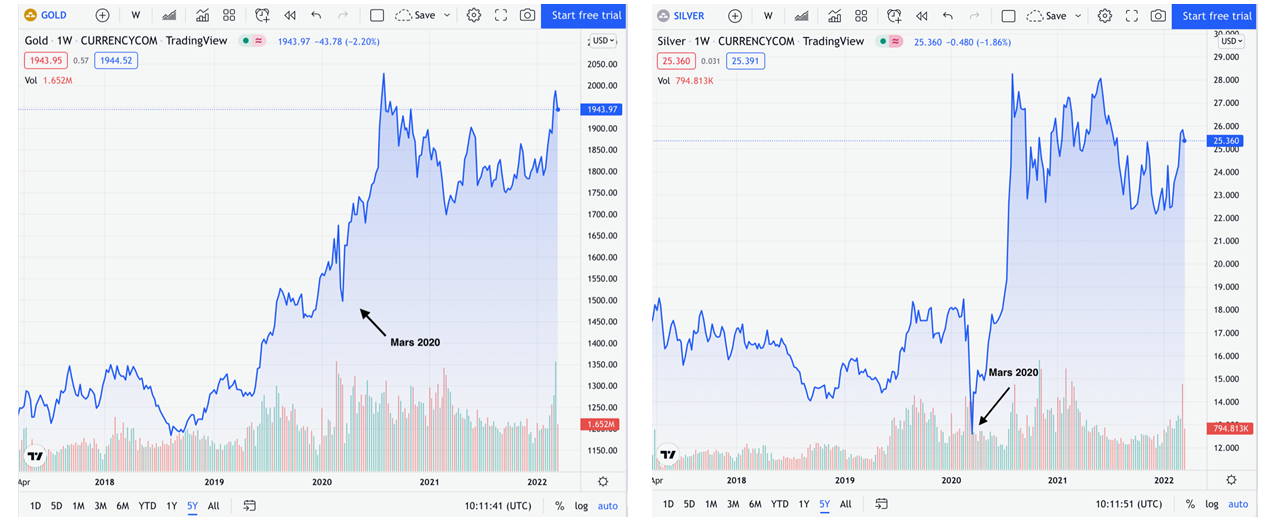

During the March 2020 correction, the price of gold lost only 10%. Then, supported by strong demand, it recovered its pre-crisis level within two weeks, before reaching a new high of $2,075 per ounce in the summer of 2020.

For silver, the fall was more significant. However, like gold, the recovery was swift and even more significant as the price soared to $28 per ounce in August 2020. This significant increase was driven by strong demand from investors (wishing to hedge against the risk of a crash), but also by the booming industrial demand for silver metal.

Price per ounce of gold Price per ounce of silver

The limitations of this policy

While the American policy mix (combination of fiscal and monetary policy) has proven effective, the perverse effects are quickly becoming apparent. Between 2020 and 2021, the US central bank has injected as many dollars as it has over the last ten years. Such action has a cost. Because of the unprecedented monetary injection, but also because of supply chain problems linked to the economic recovery, inflation is rising. At first, central bankers were reassuring, explaining that it was only "transitory". But very quickly, its level went into overdrive and the discourse changed. The risk of a "persistent" rise becomes possible.

Inflation has been rising steadily and is now at 7.9%, its highest level since 1982. The Fed is bound to act to protect the value of its currency and maintain household confidence. A rate hike and a reduction in the volume of liquidity are the two possible courses of action. Their objective is to slow down money creation, which would automatically lead to a drop in prices.

The Fed's choice

Although the governors of the U.S. central bank decided to end their debt-buying program on March 9 (after having injected $6 trillion in two years), a sharp rise in rates seems unthinkable. In the past, the Fed's key rates were more or less correlated to inflation. But since 2008, things have changed. By saving the banking system, including the most fragile banks, the confidence of economic agents has been shattered. Rates have been lowered continuously, without convincing results. Since then, a perpetual headlong rush has taken place.

The central bank keeps rates close to zero, and injects massive amounts of liquidity into the markets in case of a sharp drop.

But today, with inflation running amok, the Fed is caught between two chairs.

In fact, on Wednesday, March 16, at the Federal Open Market Committee meeting, the Federal Reserve decided to raise its key rates by 0.25%, bringing them to 0.5%.

What does this really mean?

To be honest, not much. Raising rates slightly and gradually - which seems to be the preferred course of action - will have no effect on inflation, and could, on the contrary, slow down the economy.

The question is: what can it really do?

The Fed is in a bind. It is no longer possible to act, for several reasons.

The risks of taking action

The first is excessive private and public sector debt. Last year, with extremely low interest rates, the US government paid $562 billion in interest on its debt. This is more than was spent on education ($263.1 billion), transportation ($154.8 billion), agriculture ($49.5 billion), international affairs ($46.9 billion), and the environment ($42.1 billion). With $30 trillion in debt - the ceiling of which was raised in December 2021 - higher rates would cause the cost of debt to spiral out of control.

Moreover, this pressure is not limited to Uncle Sam. Many emerging countries are indebted in dollars, and are experiencing significant inflationary pressures. A rise in US interest rates would have major consequences in Turkey, Argentina and Nigeria. These countries would suffer from excessive capital flight and a sharp depreciation of the exchange rate.

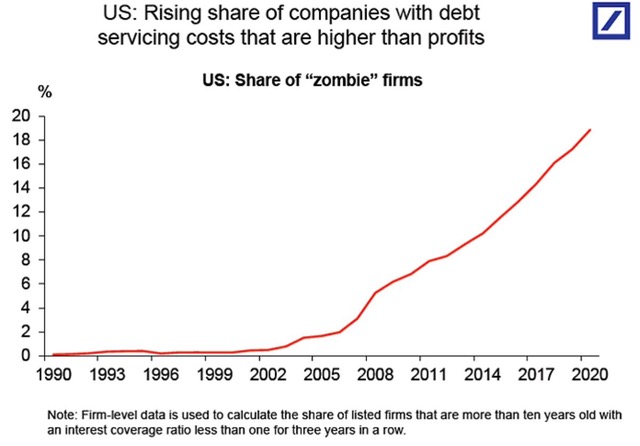

The private sector is equally concerned. In the United States, 20% of companies are considered as "zombies": the cost of their debt is higher than their profits. A monetary tightening would create numerous bankruptcies in the country, but also for certain foreign companies whose debt is partly denominated in US currency.

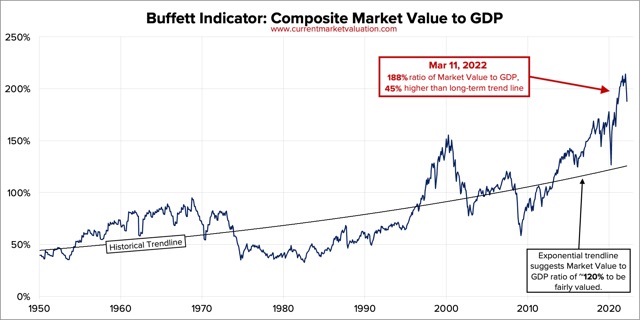

Another risk is that the US financial markets are extremely fragile. According to the Buffet Index, the market capitalization of all US stocks represents 188% of US GDP. As an indication, during the Internet bubble, it was 150%. In 2008, it was 120%. In order to artificially maintain the markets, the US central bank is forced to provide significant and permanent financial support by keeping interest rates at an extremely low level. In the event of a credit crunch, a financial crisis cannot be ruled out.

The Fed has to choose between galloping inflation and a financial crisis.

While it is complicated to make any predictions, the Fed's inaction leads us to believe that inflation will persist. But the purchasing power of American households is at stake. Pulling too hard on the rope could end up creating social chaos, and potentially the collapse of American democracy, which is already under strain.

This risk is all the more dangerous because things are accelerating. With the outbreak of war in Ukraine, and China choosing to confine part of its population once again, the rise in prices is intensifying. The increase in the price of oil and energy testifies to this. The Fed's dilemma is getting closer.

Although it is still too early to talk about the end of the dollar's hegemony, certain indicators such as the internationalization of the yuan, the increase in gold purchases by central banks, or the de-dollarization of certain countries, show us that we are progressively moving into a new monetary order. The Americans are anxious to protect their monetary supremacy, and this situation may not please them.

The Seeds Of A New International Monetary System Based On Gold? (@philippeherlin)

— GoldBroker (@Goldbroker_com) March 18, 2022

➤ https://t.co/G4WX1kijku#gold #money #dollar #ruble #RussiaUkraineWar #China pic.twitter.com/9uAP4ksSYH

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.