The Fed unanimously decided to raise its key rates by 25 basis points, to their highest level since 2001.

The Fed indicates that its future decisions will depend on the economic situation. The outlook for the next meeting in September remains totally unclear. Will the Fed tighten monetary conditions further? Or will the economic slowdown that is beginning to emerge in the US be an argument for another pause in rate hikes?

The U.S. central bank seems very preoccupied with its fight against inflation, which it realizes it started too late and too softly.

Even if it can claim an initial victory with the disinflation of several components of the consumer price index (CPI), recent weeks have shown a resurgence of inflation in certain sectors of the economy.

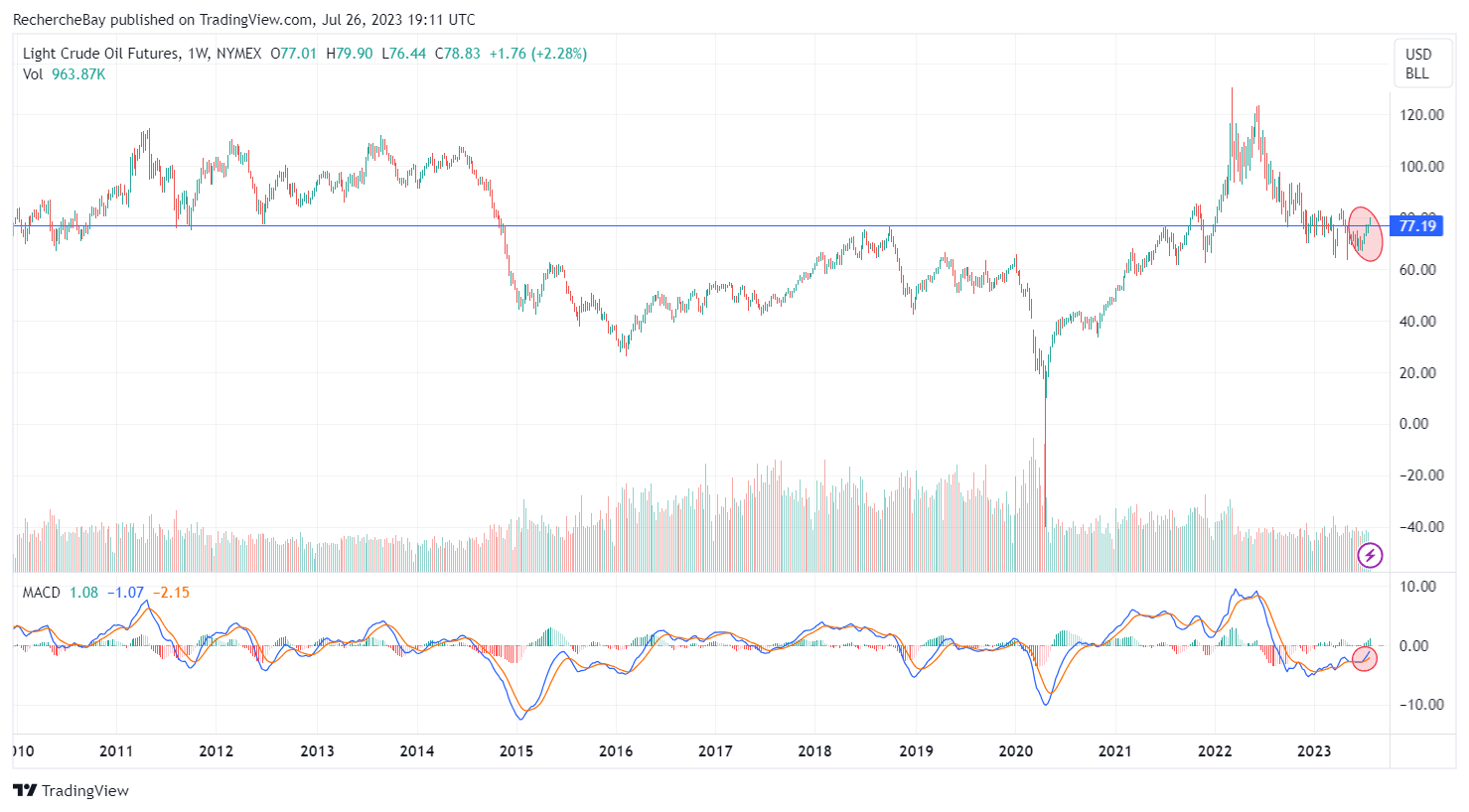

Oil prices have not fallen for four weeks:

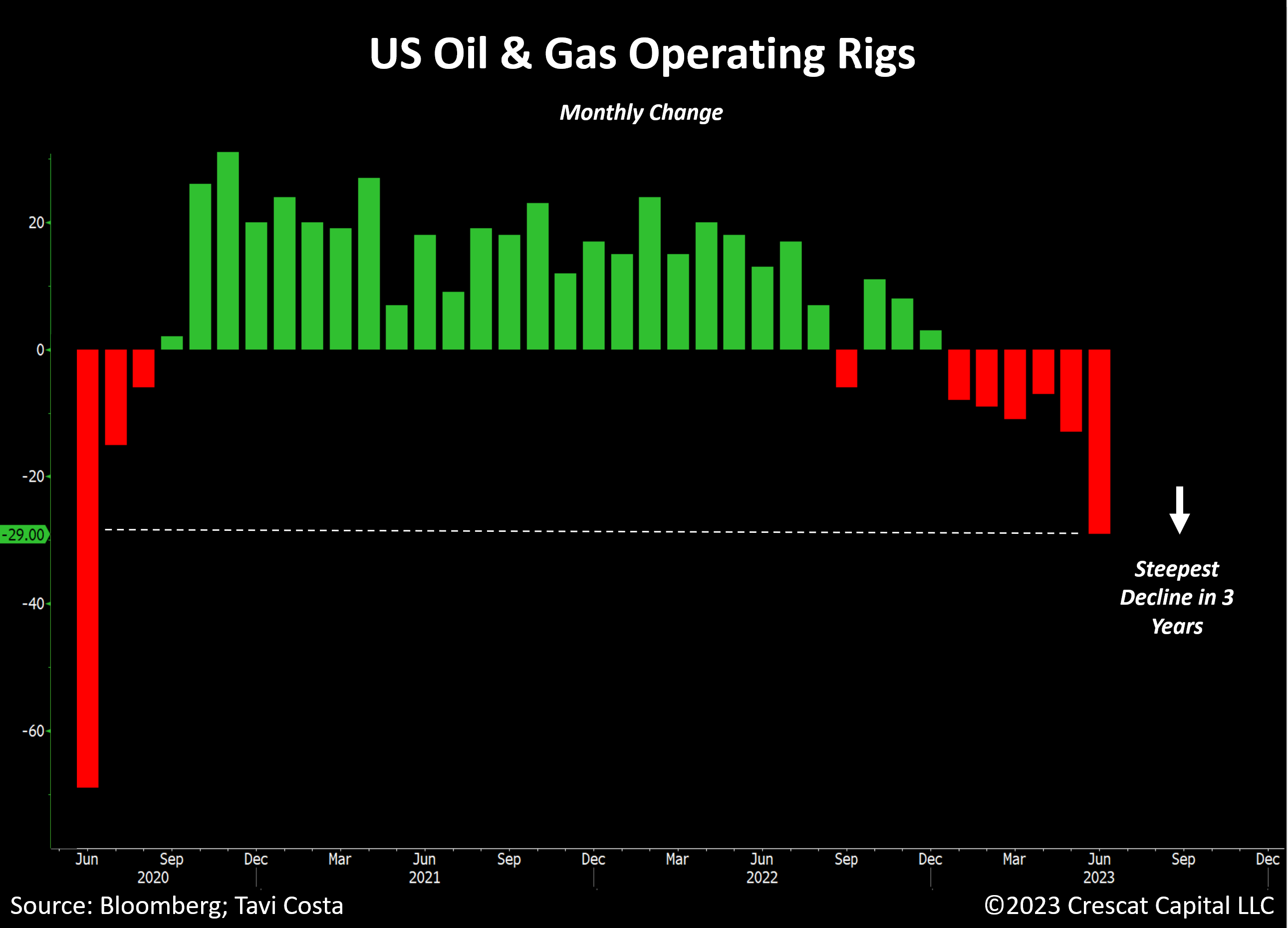

Analyst Otavio Costa warns that U.S. oil and gas rigs are experiencing a very sharp drop in operations, beginning to resemble that recorded at the start of the Covid crisis. Under-investment in the sector is beginning to affect the country's production capacities, which bodes ill in the current climate of tension with Russia and other oil-producing countries.

Falling oil prices are one of the main reasons behind the recent downturn in US inflation. Any upturn in oil prices would have a negative impact on future CPI figures.

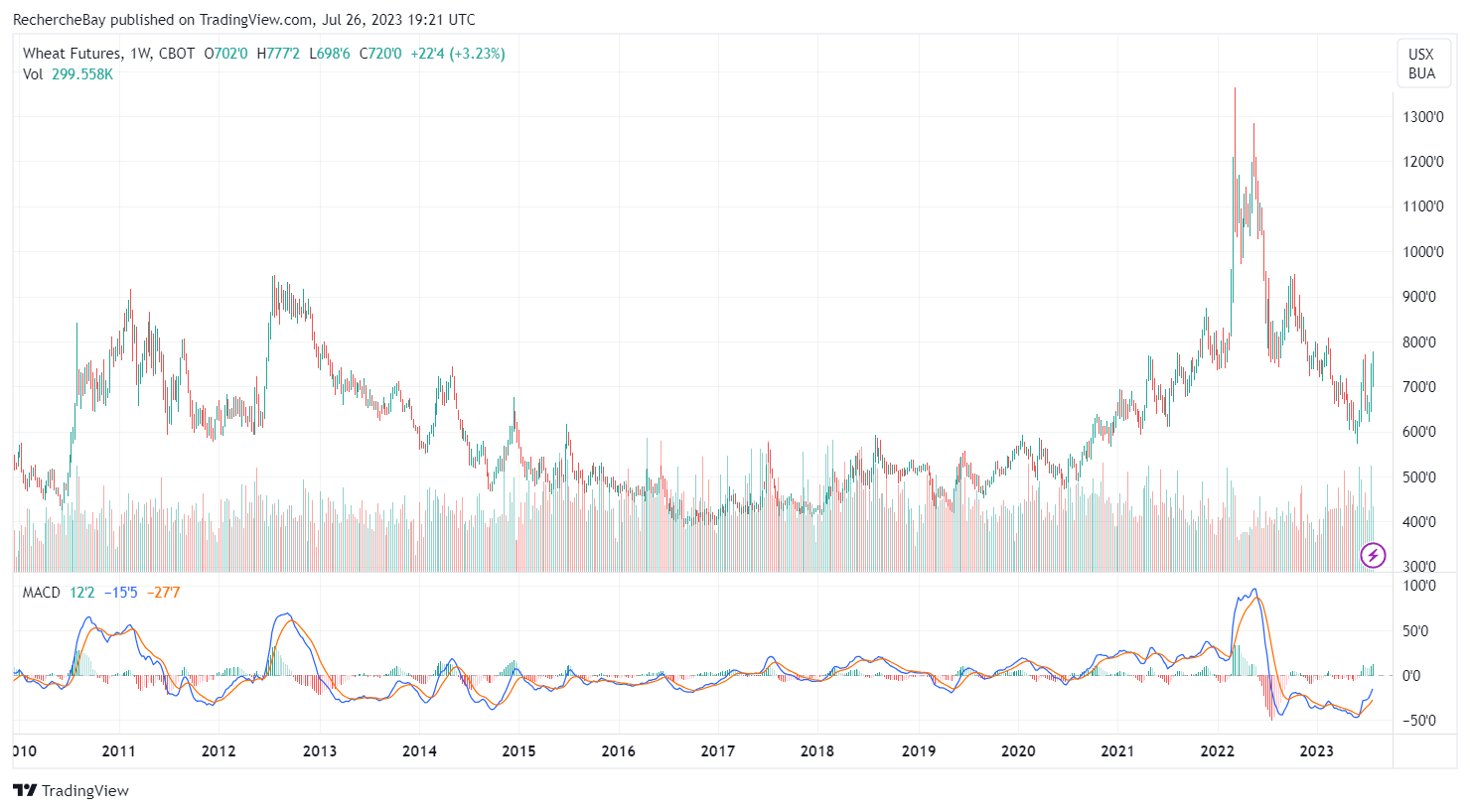

Oil is not the only commodity to have rebounded in recent weeks.

Flour futures prices have also been rebounding since the beginning of July:

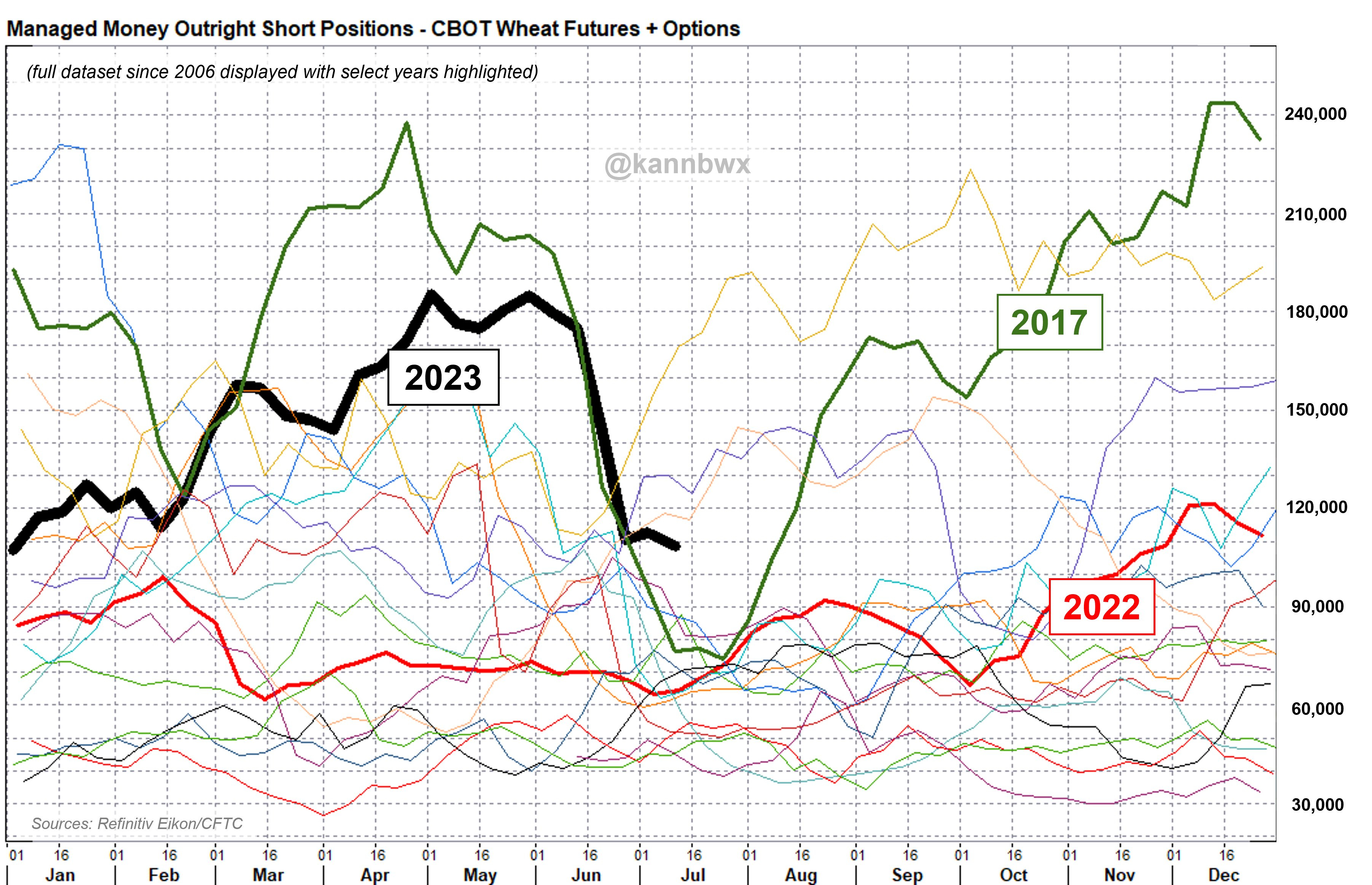

On the wheat market, funds had covered a large part of their short positions by mid-June, although they were still relatively exposed as of July 11. Open interest in wheat is at an 18-year low, down -10% since last year. This configuration on futures points to a probable continuation of the rebound observed in wheat prices.

The loss of the dollar's bullish support in June encourages a rebound in commodities. The greenback is still unable to bounce back strongly, despite the Fed's continued rate hikes. The loss of the 100 support level for the DXY would be a significant event, with consequences for commodity prices... and would herald a premature return to inflation.

The threat of a further rise in commodity prices is probably prompting Jerome Powell to postpone his battle against inflation until 2025.

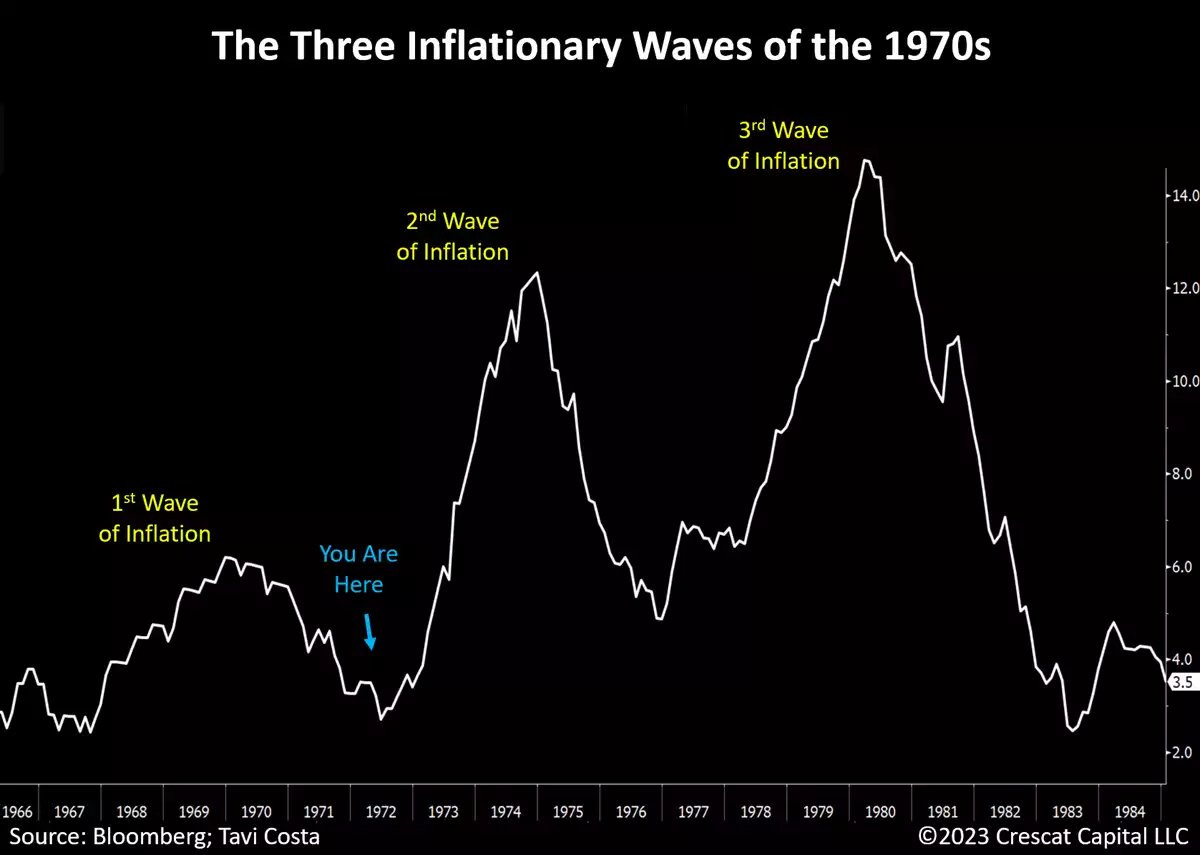

Otavio Costa, again, even believes that we are entering the second wave of the inflationary upsurge, as in the previous cycle of the 1970s:

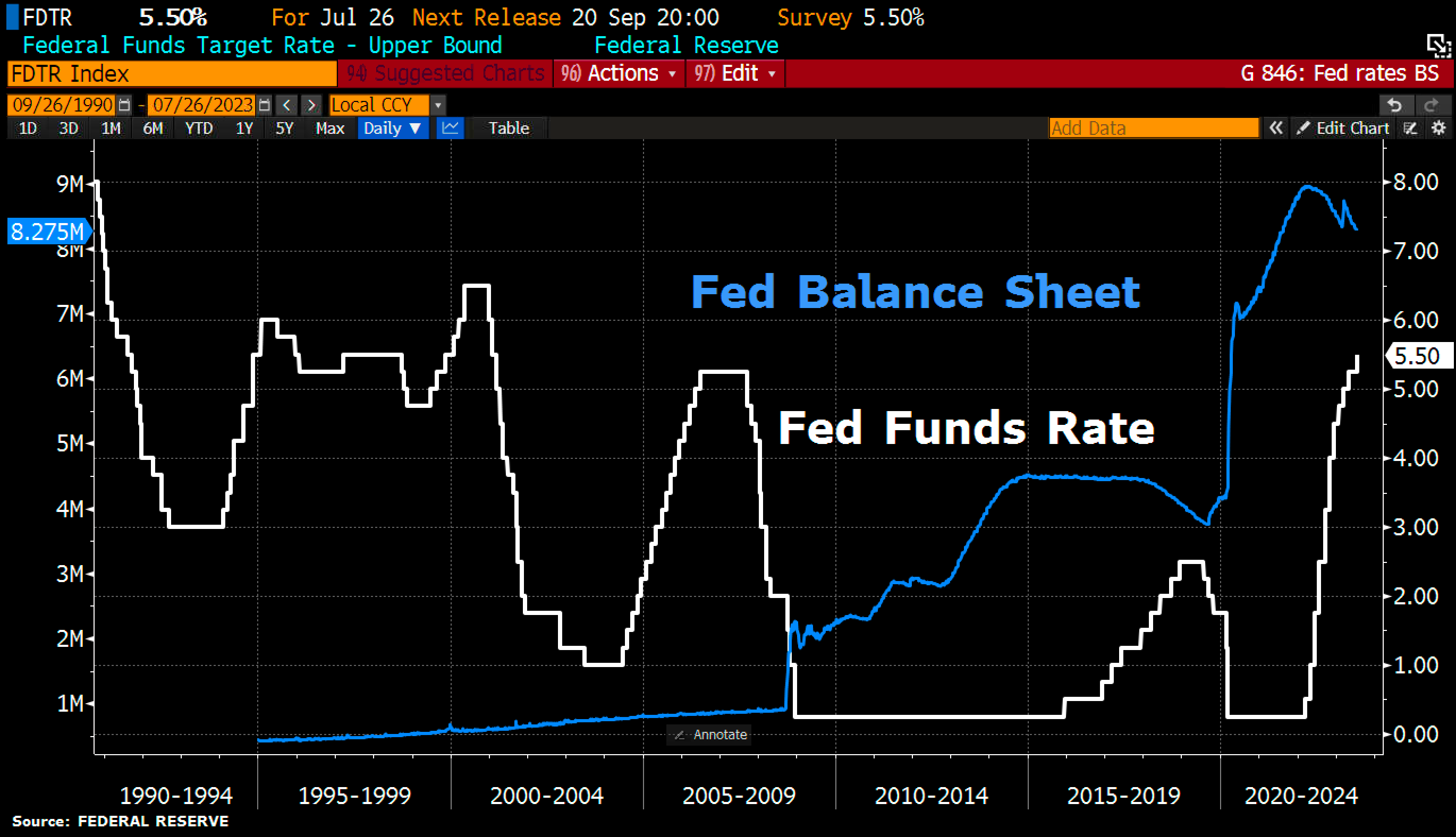

In any case, the Fed Chairman announced that he could continue to reduce the US central bank's balance sheet even without raising rates, admitting in passing that it is above all, excess liquidity that is keeping inflation too high.

Fed balance sheet reduction has just begun...

This prospect has the markets worried.

Will the US economy be able to withstand this restrictive policy for much longer? Can the US banking system withstand the shock if the Fed's monetary policy continues as it is? Could the prolonged battle against inflation trigger a new credit crisis in the USA? If so, this fight would quickly turn into a monetary policy error.

The price of gold has rallied in recent days. Not only is the battle against inflation far from won, but the risk of a monetary policy error is also increasing.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.