The US economy continues to send out very mixed signals.

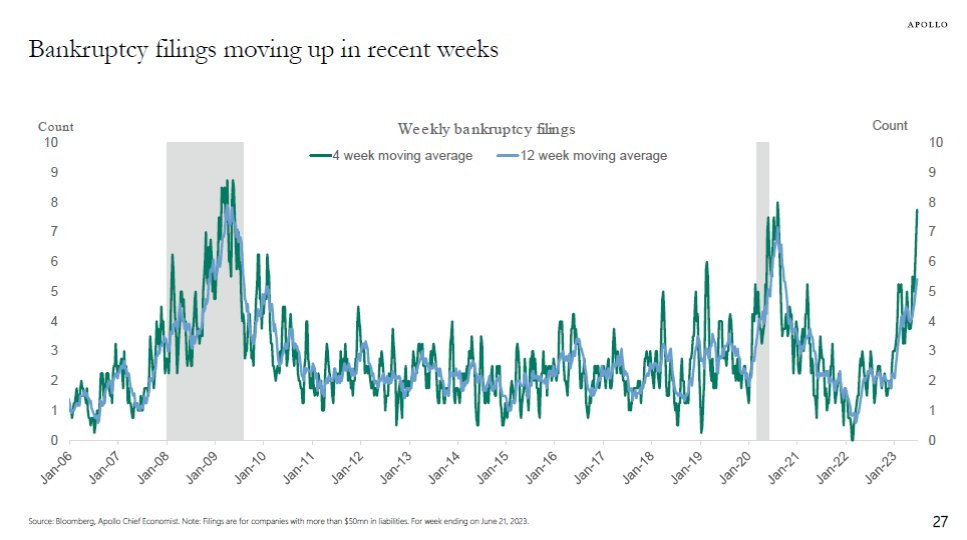

The number of bankruptcies in the United States has risen sharply in recent weeks:

This confirms that more and more companies are beginning to suffer from rising interest rates, which are making refinancing more difficult.

Nevertheless, some economic sectors remain euphoric.

This is particularly true for cruises, a key sector of the tourism industry.

Carnival posted record figures this quarter. The sector leader has seen its share price double since March:

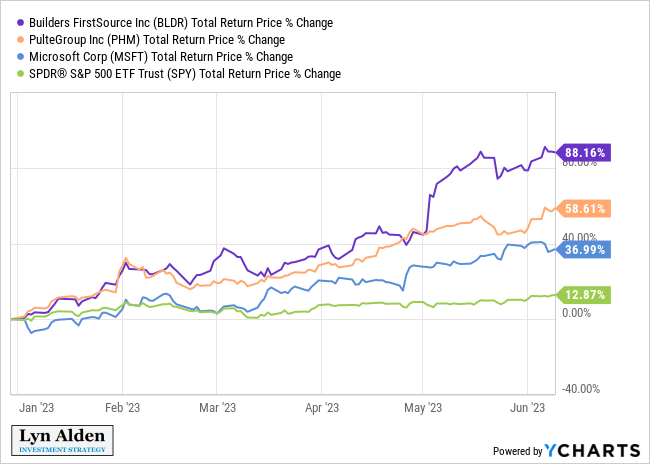

American new home builders are also among the big winners in the latest market boom. Builder stocks are even outperforming technology stars:

Manufacturers benefit from two windfall effects:

- Raw material prices have plummeted in recent weeks, boosting margins. In this respect, the situation is nothing like last year.

- Sales of older homes have collapsed, and as this is the main competitive market, demand is moving exclusively to new homes.

The market for older homes has collapsed for a very simple reason: homeowners bought at fixed rates that were much lower than current rates, and since rates have risen sharply, there is now no incentive for these homeowners to move. According to the Redfin Institute, 82.4% of homeowners have a mortgage rate of less than 5%, and 62% have a rate of less than 4%. 23.5% of homeowners even have a mortgage rate below 3%! The Fed's rate hike has broken the market for older homes, and is the main factor supporting the market for new homes.

The real estate situation is different in other countries.

In the UK, 800,000 homeowners will see their fixed rates expire by the end of the year, then 1.6 million by the end of 2024. Their repayments will literally explode with the new mortgage rates. The supply of older homes is also likely to increase. The same is true in Canada, where variable-rate financing is far more important than in the United States.

In Australia, over the next six months, no fewer than 880,000 homeowners will have to switch from a fixed rate to a variable rate. Next year, a further 450,000 loans will expire. At current rates, a household with a $1 million loan will have to pay an extra $2,000 a month, or $24,000 a year, to meet repayments with its bank.

This time, the real estate situation is much more fragile in the rest of the world than in the United States.

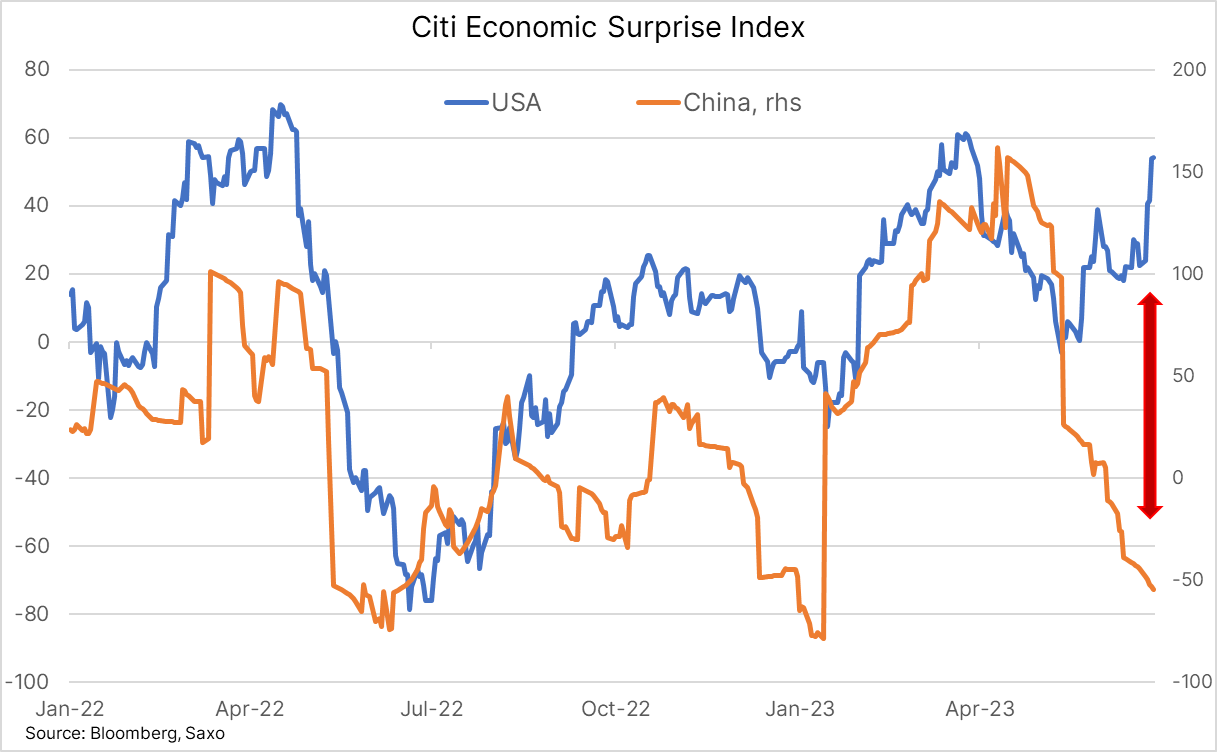

Overall, the US economy is currently outperforming the rest of the world. China, in particular, has been underperforming since April, with economic surprise indices down significantly, while these indicators are on the rise again in the United States:

This is clearly reflected in the performance of US technology stocks relative to Chinese stocks:

The drop in Chinese activity is due in part to Japan becoming much more competitive thanks to the fall in the Japanese currency.

Since 2019, the yen has collapsed by 50% against the dollar:

Since 2020, the Japanese currency has lost 30% of its value against the yuan:

The rise in the price of gold in yen terms since 2020 has been spectacular. The price of the fine metal has doubled in just 3 years...

The rapid collapse of the Japanese currency poses a short-term risk of yuan devaluation. Indeed, the Chinese authorities are unlikely to stand idly by and watch the rise of Japanese competition in export markets vital to their country.

A devaluation of the yuan would have consequences for commodity prices.

For the moment, copper is refusing to confirm the downward break of its bearish flag. On the contrary, China's economic slowdown is likely to accentuate the metal's decline:

Historically low copper inventories and the risk of Chinese devaluation are currently underpinning copper prices, which are likely to fall back much more violently as a result of the threat of recession.

Gold prices should have fallen further with weakening Chinese demand and the dollar's Olympic form. The dollar's further strengthening against the yen should maintain downward pressure on gold in the short term. But here too, demand for physical gold is there to support prices in this consolidation phase.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.