Last week, gold in dollars set a new all-time closing record, also surpassing its previous all-time high during the session:

Will gold finally break away from its major consolidation phase?

Is the bullish cup/handle pattern seen since 2013 paving the way for a new leg up in dollars?

If so, we could be on the verge of a gold rally similar to that seen between 2003 and 2011. During that period, the price of gold multiplied by six!

Gold is breaking records in dollars, but also in euros:

The value of the European single currency has collapsed by 80% against gold since its introduction.

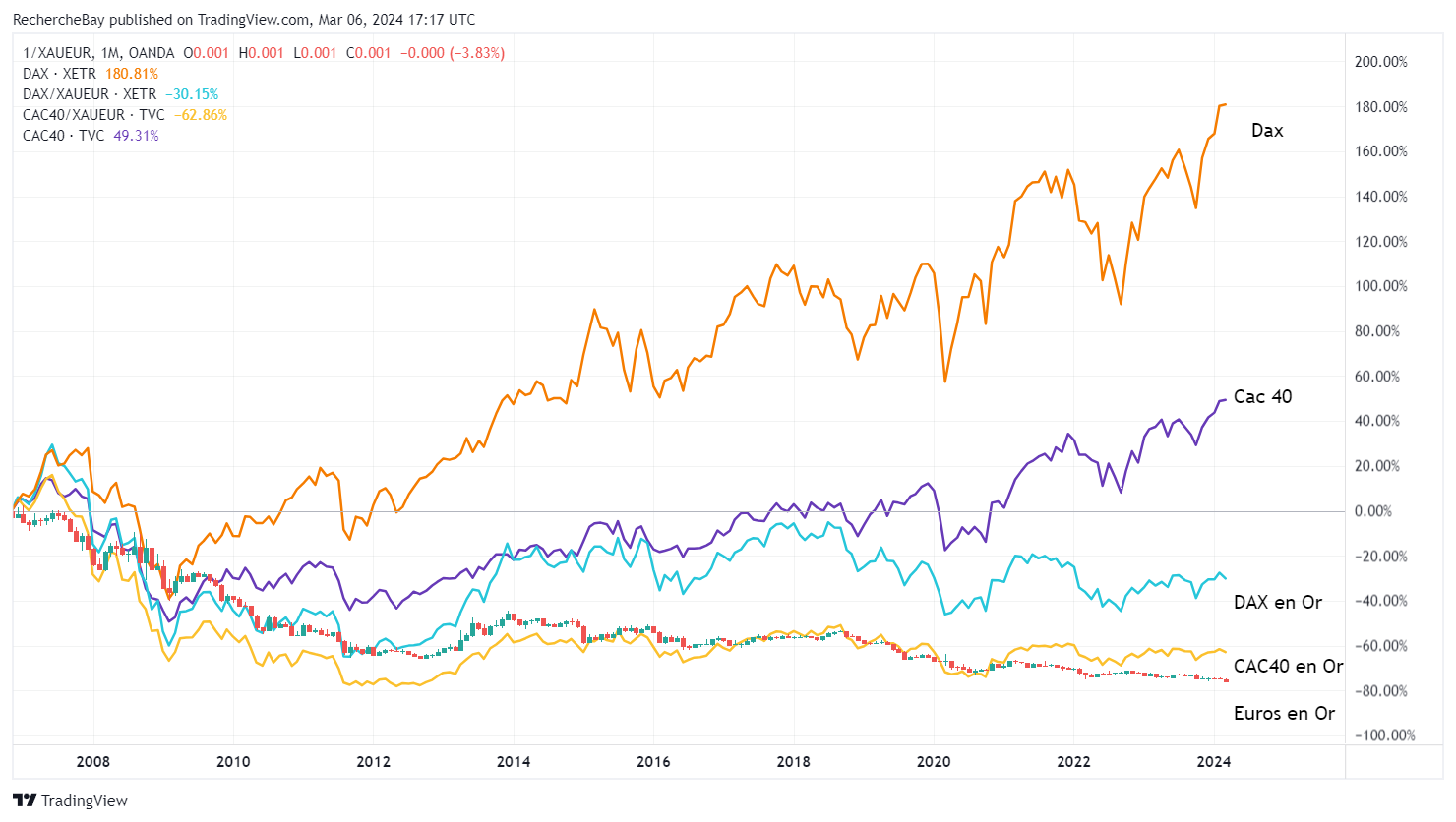

In recent weeks, the press has hailed the performance of European stock markets. However, a comparison with gold's performance over the past decade reveals a different picture: the CAC 40, measured in gold, has been languishing at -60% since 2008, while the DAX is also in the red when measured in gold.

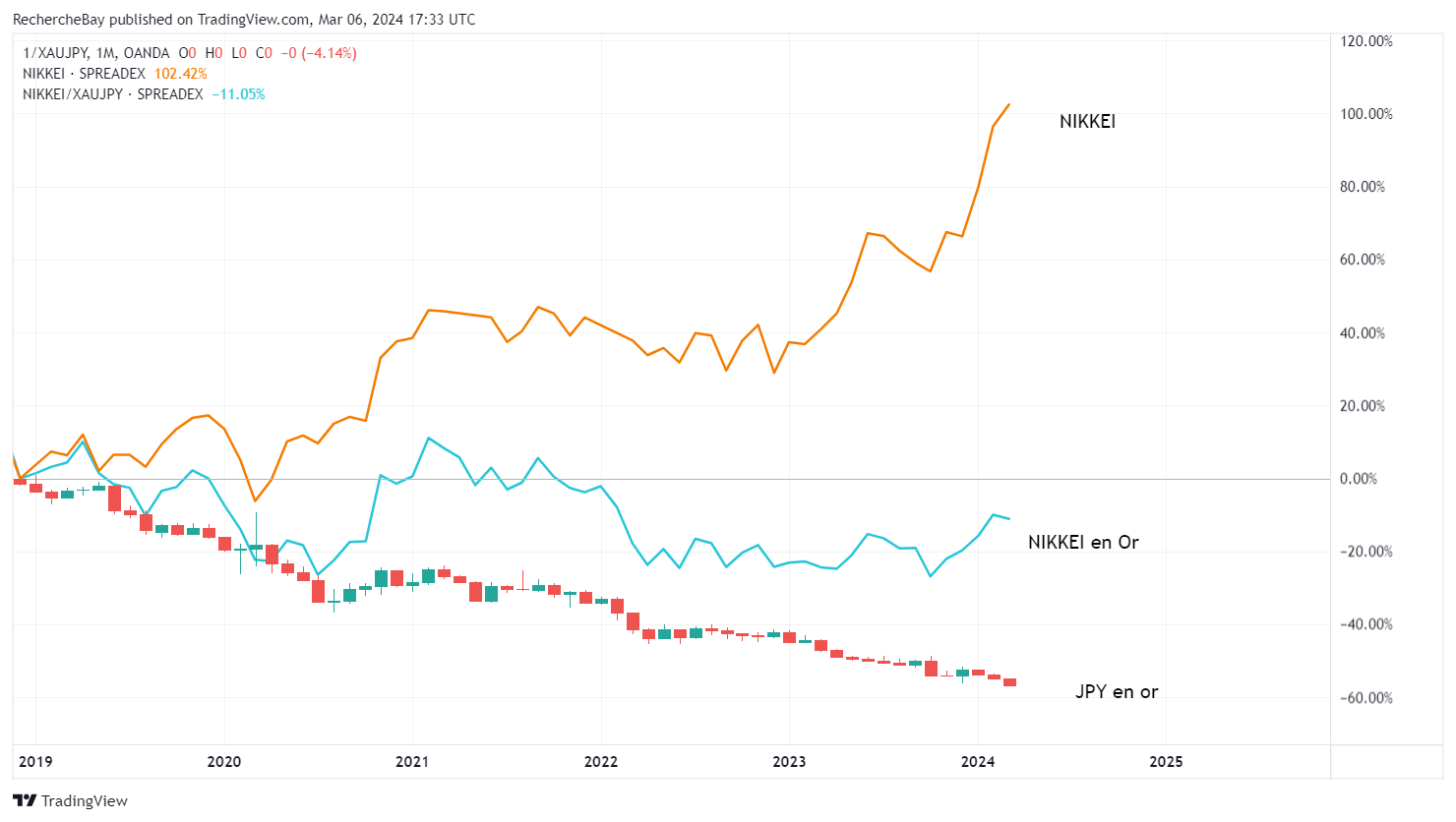

In Japan, gold is reaching dizzying heights: the depreciation of the currency is even more pronounced in the land of the rising sun. In just five years, the yen has lost 60% of its value against gold. Over the same period, the Japanese stock market has doubled in value... however, measured in gold, Japanese equities have fallen by 10% against the new world monetary standard:

This depreciation of the Japanese currency should have prompted the Bank of Japan (BoJ) to raise rates to prevent a marked return to inflation. However, this is not the case. BoJ Governor Kazuo Ueda has just warned the markets that a 1% increase in interest rates could lead to a 40 billion yen loss in value of Japanese government debt securities. In other words, to avoid further insolvency, the BoJ has no choice but to let its currency continue to plummet against gold.

Market performances are hailed in the press, while gold breaks records in the midst of general indifference.

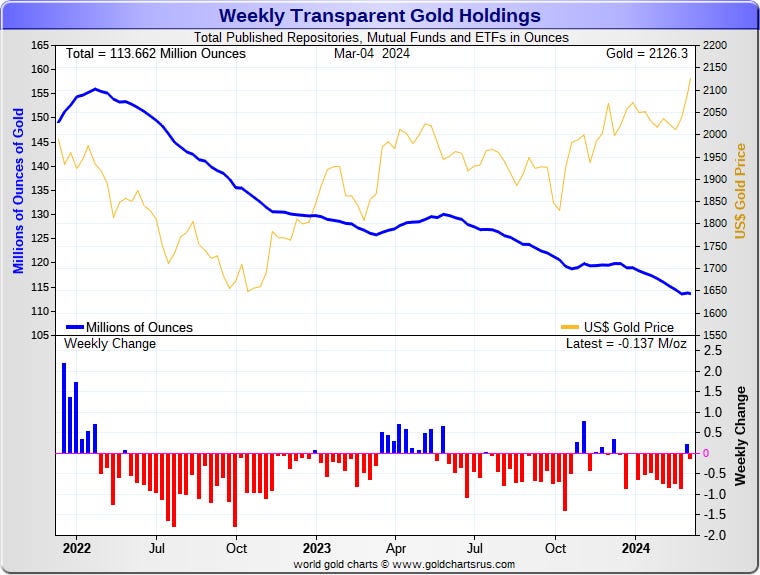

Even more remarkable is the fact that, at the same time as gold is setting new records, sentiment towards the yellow metal continues to deteriorate among investors. Outstandings in the ETF GLD continue to plummet. Since its peak in 2022, GLD has lost a third of its reserves!

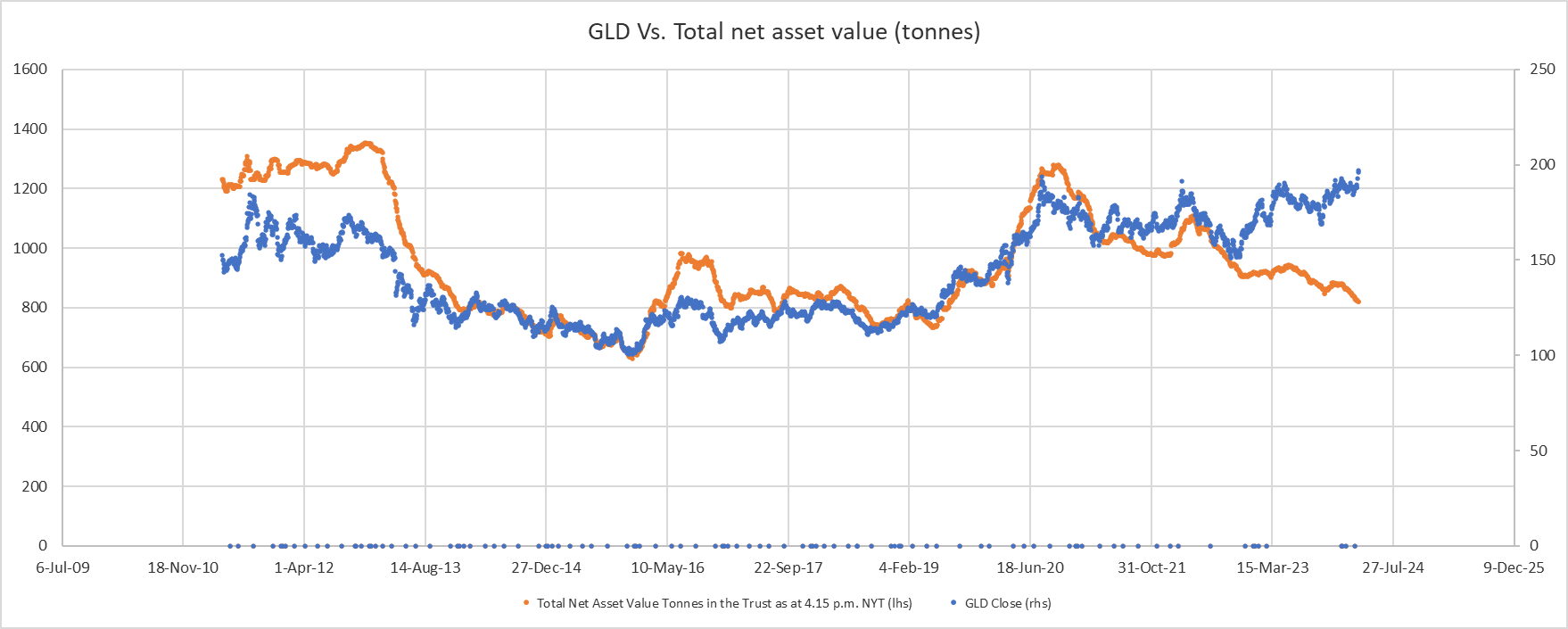

Previously, the level of assets under management in the ETF GLD was linked to the ETF price: a rise in the price of gold produced an increase in assets under management, while a fall caused the opposite movement.

But since 2023, this correlation has disappeared:

Whenever Western investors sell their exposure to gold through paper ETF contracts, central banks and the Chinese take the opportunity to buy back physical metal. As these physical purchases outstrip Western investors' sales of paper gold, gold prices continue to rise. Gold's next leg up may well come when these Western investors suddenly change their minds and start investing in gold again.

This renewed investment in gold will be driven by the realization that the current period of high inflation is here to stay. The Fed can't raise rates without triggering a recession, especially as inflation has yet to return to an acceptable level. This is the kind of situation in which gold appreciates greatly.

Indeed, traders are anticipating much higher inflation in the United States in the years to come. Equilibrium yields on 2-year bonds are currently at 2.75%, their highest level for almost a year:

As far as 1-year rates are concerned, the trend is even more pronounced. The 1-year break-even rates are over 4%, even returning to their 2022 peak:

Looking at derivative indicators, such as one-year inflation swaps, it's clear that the battle against inflation is still not won: markets are anticipating a recovery in the CPI indicator, which is likely to exceed 3% again over the next few quarters.

How can we justify cutting rates in this context? We would even have to consider raising them... a scenario that Jerome Powell has just ruled out. So, gold has certainly not finished rising...

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.