Most law graduates share a capacity to argue two-sides of any case, regardless of their own primary conviction.

When it comes to gold, my verdict as to its ultimate price direction (upwards) and its historical role (wealth preservation) have never wavered.

This, however, has not made me blind to sober counter-arguments to my own (and other’s) fundamental case for owning physical gold.

Below, therefore, I’ll consider the cases made by both the prosecution and defense when it comes to gold, as well as shed needed light on the current Bitcoin mania and possible Bitcoin trap.

Although not here to mock Bitcoin or those who defend it, I am here to splash some cold water on the face of those who compare Bitcoin to gold, or even worse, of those who feel BTC is the “new gold.”

Big mistake.

That said, there are gold headwinds worth considering, especially for those who don’t invest in gold for the long-term and are easily spooked by near-term headlines and price moves.

As someone who sees gold as longer-term fire insurance for global currencies already burning to the ground, such price volatility matters very little, as the longer-term wealth preservation role of gold remains without equal in the courts of history.

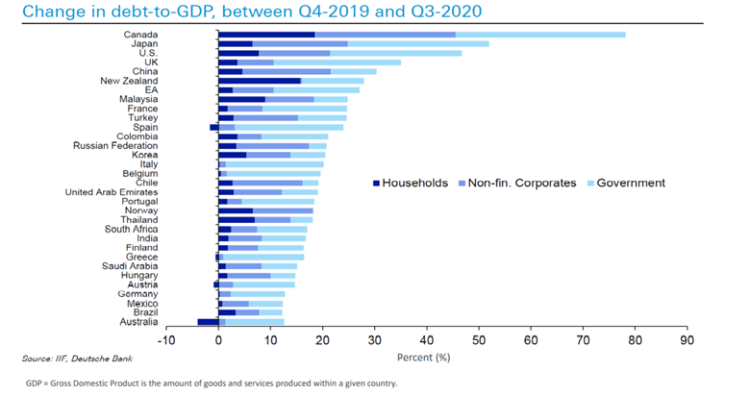

As dramatic changes in global debt to GDP expand nation-by-nation, there’s no mathematical way to grow out of the debt canyons dug by our esteemed central bankers.

This means we can expect more borrowing, printing and spending ahead—and thus an historically unmatched set-up for precious metals as global fiat money supply goes from stupid (manslaughter) to just plain insane (1st degree murder).

Let’s therefore examine the big picture, including gold’s headwinds and tailwinds, and leave you to draw your own verdict, already knowing mine.

Gold & Silver Ratios in a New Abnormal

In the 50 years since Nixon removed (i.e. welched on) the U.S. gold standard, a patterned waltz between the price of gold and silver has been in play, the choreography of which most are familiar.

Specifically, the dance involves silver lagging gold, then moving much faster, after which, at least since 1971, both metals often decline in price simultaneously.

In post-Nixon era, we’ve seen the gold-silver ratio gyrate from 47 (1973) to 19 (1974) to 40 (1978) to 65 (2016) to as high as 123 and then recently back to 70.

Does this dance today mean another bear market for both metals tomorrow?

The simple answer is no, and for bears who feel otherwise, I’d argue that you’re missing the macros. But more on that case below.

Declining Central Bank Demand—More Headwinds for Precious Metals?

Precious metal prosecutors will also argue that central banks have slowed their gold purchasing. This is a valid argument.

In 2020, central banks bought a record 660 tonnes of gold, ending a ten-year binge of over 5000 tonnes collectively.

But that buying has slowed, as has the gold price surge of 2020—for now.

The prosecution will further argue that the gold sold by central banks has not been re-purchased with similar gusto.

Russia’s central bank, for example, recently announced a suspension of additional gold purchases—due more to the cash-crunch it’s suffering from tanking oil prices and COVID pains than a loss of longer-term faith in the metal.

Turkey, which was a big gold buyer in early 2020, is equally likely to curb buying as their financial conditions deteriorate in 2021.

And as for China, having surpassed India as the world’s largest gold buyer in the last two decades, it is now evidencing less demand, as the premiums it has traditionally charged above the global gold price have been declining rather than increasing, and are in fact now trading at discounts.

The Bitcoin Alternative?

Needless to say, Bitcoin has also been taking headlines, as well as market share, away from the gold market (and gold “buzz”) as well.

Precious metal prosecutors will remind the court of public opinion that over $2B in outflows from gold ETF’s alongside $7B of in-flows into Bitcoin can’t be ignored, as digital currency bulls equate blockchain to the “new gold.”

Hmmm.

Bitcoin is not the new gold…But what is it?

A Cash Payment System?

Originally designed as a digital cash system, Bitcoin’s noble vision as an electronic wallet for non-dilutable “coins” in fiat world gone mad was soon usurped by its use on the Silk Road, an online mecca for illegal drug sales et al.

Such shady uses are less discussed today as BTC makes greater inroads into the main stream consciousness.

That said, BTC is not alone, nor even supreme, as a payment tool.

Over the last decade, payment tools like Cash App, Zelle, Apple Cash and Venmo have emerged allowing transfers to take place in seconds for reasonable fees.

BTC fees are around $10 per transaction, but almost no one is buying BTC for such transactions, as other tools are superior.

The simple truth is Bitcoin holders are getting rich by just watching its value rise in their Coinbase wallets, not because they believe BTC is (or will be) the next medium for grocery or car purchases.

For BTC holders, the only thing on their minds and e-wallets other than instant wealth has been the cost of electricity needed to mine more of these magical coins as concerns rise about straining, or even killing, the electronic grid where coins are “mined.”

Bitcoin Beware

But, again: What really is Bitcoin? Is it an online cash system?

Is it a truly safe, un-seizable “digital gold” that will protect holders from debased fiat currencies and the inevitable yet ignored inflation risks ahead?

In short, will BTC send gold into the history books and gold prices to the basement?

The short answer is hell no.

Gold’s Golden Days Are Still Ahead

Why?

Although it’s normal to expect a correction phase within a larger bull market for both silver and gold, the price retracements of late signal a buy opportunity for precious metal investors, not grounds for a bearish panic—unless you’re a gold trader blind to technical buy/sell signals.

The broader bull market in gold today is much different than the bull markets of 1971 to 1978, or 2010, which saw very little interest/demand from western buyers.

Demand going forward will in fact be driven more by western than eastern buyers, though current investors can’t ignore declining demand from China, Russia or India.

That said, the gold-silver dance described above will be very different going forward as both assets rally in synch rather than two steps up, one step back.

Most importantly, the larger world (i.e. fully insane macro’s) in which gold and silver trade today is infinitely different than the world it rose and fell in during the immediate post-Nixon era and the cycles described above.

A Whole New Ab-Normal

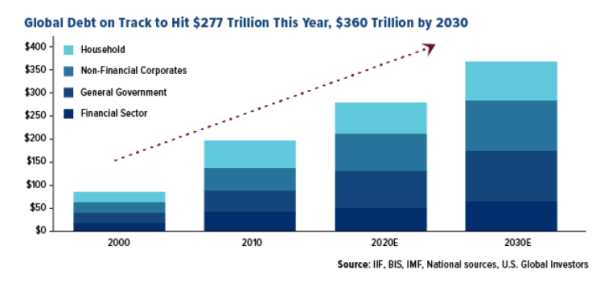

Unlike prior bull and bear cycles, the global economy today, unlike say 1973, 1979 or 2011, is flat-out broke, with global debt limping toward $280T and global GDP 1/3 of that horrific number.

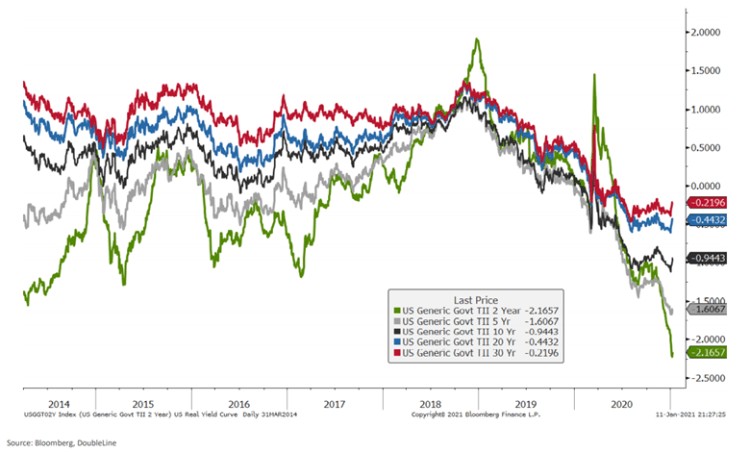

To pay for that debt, central banks like the Fed have all but gutted return in the Treasury market, whose real bond yields are all negative across the board, and thus technically in default.

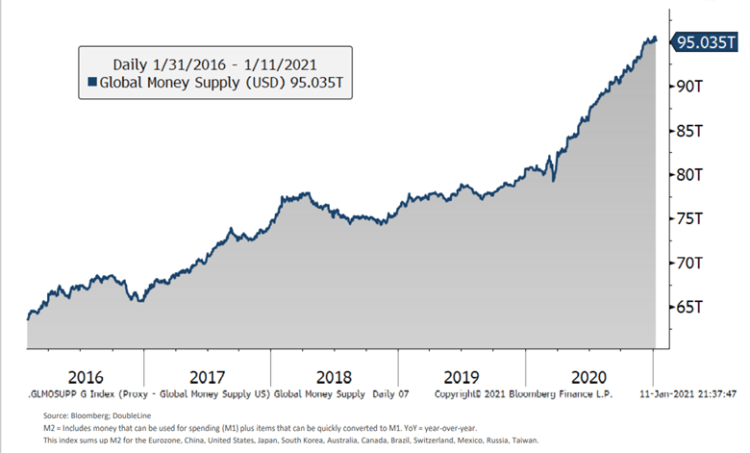

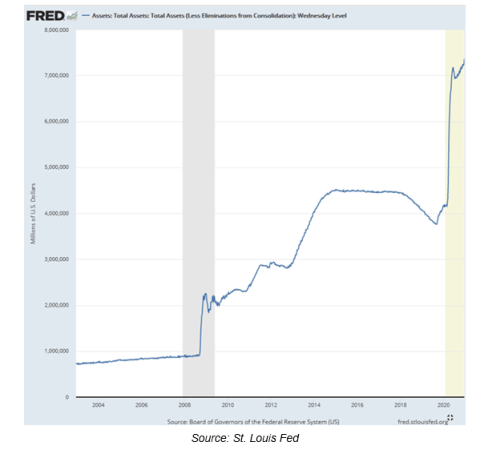

With this much debt off our bow, the only way to pay for it has been with printed dollars, yen and euros. Lots and lots of them. Just look at the Fed’s recent printing spree…

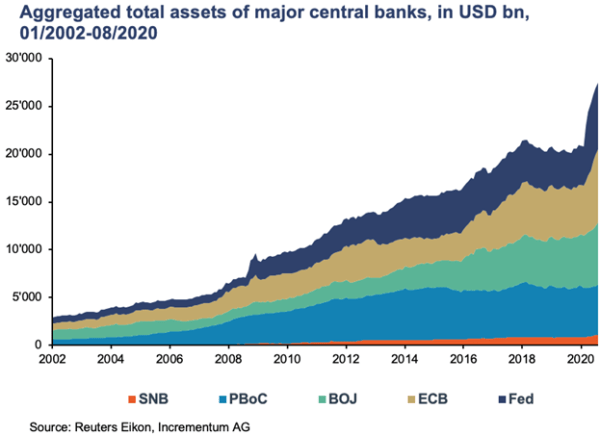

Central bank balance sheets (i.e. the levels of unfathomable amounts of printed currencies) are unlike anything seen before in the history of capital markets.

At greater than $30T and counting, the level of fiat (i.e. fake) money has never been this high, which means the amounts of increasingly worthless paper money has never been this grotesquely inflated nor the purchasing power behind them so profoundly debased.

Of course, this also means that the need for a genuine real store of value to legitimize now openly discredited fiat currencies has never been greater.

Never. Not ever.

But is Bitcoin the answer to this fiat currency disaster?

Nope.

Bitcoin Is Not the New Gold

Bitcoin, as a store of value so necessary to the inevitable recalibration (or re-setting) of the current debt and currency markets, is simply not the answer.

That is, Bitcoin may be many things, but it is not a currency stabilizer.

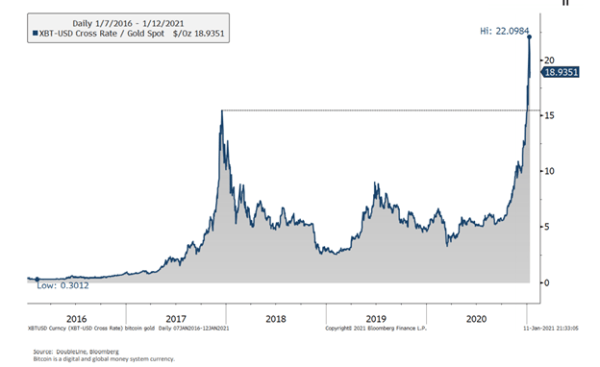

As an instrument of speculation, of course, Bitcoin is (for now) an absolute dream asset, with far, far, far greater speculative and price power punch than gold, as the following Bitcoin to Gold Ratio confirms:

The 5X annual price moves, the 10% daily gains (and losses) and the overnight millionaires made by Bitcoin are beyond compare, even to the speculative success recently enjoyed by gold.

But therein lies a key point (and problem) for BTC.

Although gold can and will see price surges (and losses), the kind of surges (and losses) made by BTC are far too volatile, up or down, to be considered as a credible store of value.

In short, Bitcoin will not be the Fed’s next balance sheet asset nor the IMF’s next SDR/currency solution.

The extreme price fluctuations in Bitcoin invalidate its claims as a store of value. Full stop.

As to being unseizable, Bitcoin in fact, is quite the opposite. There have been many instances of government confiscation of this digital asset from illicit enterprises.

Furthermore, and unknown to most, Bitcoin’s source code (and the complex inclusion of a “segregated witness” modification by Bitcoin miners) means that Bitcoin is no longer a digital cash system to be used as medium of exchange by other massive platforms, like…say Amazon.

Instead, Bitcoin is now being seen and held as the new gold—a fixed-supply asset to serve as an alternative to fiat currencies.

Hmmmm.

But how will Bitcoin serve a global population buying and selling goods by the second when it can only handle about 350,000 transaction per day?

Again, and whatever your or my opinion of the global “experts” —BTC is not going to be their new currency, but merely the new tool of a massive mania making many investors undeniably wealthy—for now.

Bitcoin Manipulation-the Tether Effect

Of course, like any new toy in the markets, room for abuse and fraud is equally possible, if not tempting.

There is growing evidence, rather than mere theory, for example, that Bitcoin’s astronomical rise has been artificially manipulated, in part, through one or more stablecoins, including Tether (USDT).

Without getting too complex, Tether was a coin allegedly promising a one-to-one USD backing.

There is concern, as well as growing evidence, that USDT agents were minting Tether coins out of thin air (much like the Fed creates dollars out of thin air), and then using those magically created USDT coins to buy Bitcoin on exchanges like Bitfinex.

Bitcoin defenders, of course, have been very busy of late downplaying the Tether story, but the potential for fraudulent BTC price manipulation now and going forward simply can’t be ignored.

Such concerns would make Bitcoin more than just a mania bubble—but something far worse: An artificial asset driven by artificial demand from other artificial coins. A veritable castle in the sky, of which the digital world will see many more.

In short, digital currencies are hardly beyond massive levels of risk as well as manipulation—and hence destruction.

Again: All Conversations Return to Gold…

Of course, gold finds its stability and source from the periodic table of the elements, science and the physical world, not a software miner, hacker or digital trader in a software world.

BTC generates no cash flows, has no industrial or consumer use other than as something to sell to someone else, who may be the next greater fool rather than millionaire.

Just saying: Be careful.

When the world one day faces the facts that fiat currencies (themselves no store of value) need a chaperone rather than just another technical imposter to contain otherwise open currency debasement and distortions, some re-pegging to gold is not only essential, but inevitable.

Anything less would be a charade, and all of us, of course, are growing tired of financial charades.

Closing Arguments

For each of the foregoing reasons, gold is entering a new era as well as a new bull market, though not one free of price volatility or even manipulation.

The recent 1.4 million oz. sell order of gold in a single illiquid market trade, for example, was additional evidence of the open secret on Wall Street that gold prices can and will be manipulated by bullion banks dumping gold in massive volumes to cover prior short exposures.

Overall, however, natural commodities, like natural market forces, get the last and final laugh over artificial markets, artificial currencies and even artificial “gold” like Bitcoin. For those looking to hedge against these un-natural and distortive forces, as well as the inflation and debased currencies here and to come, natural gold will preserve your wealth; fabricated Bitcoin will not.

Original source: Goldswitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.