After exploding upwards at the end of February 2022, oil prices have gradually returned to a trading range between $60 and $80 since the start of the war in Ukraine:

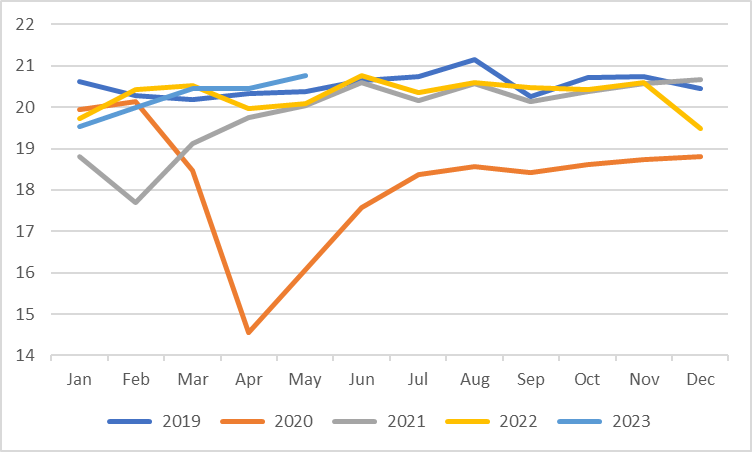

In recent months, demand for oil in the United States has remained very high. It reached a record 20.776 million barrels/day in May, up 3.4% from last year:

Even though consumer spending figures are declining overall, Americans still devote a significant proportion of their spending to travel.

More than 2.8 million travelers passed through TSA checkpoints in the United States on June 30. This was the busiest day ever for U.S. airports. Delta, United and American Airlines posted record revenues in the last quarter.

Americans are traveling more than ever at the start of summer...

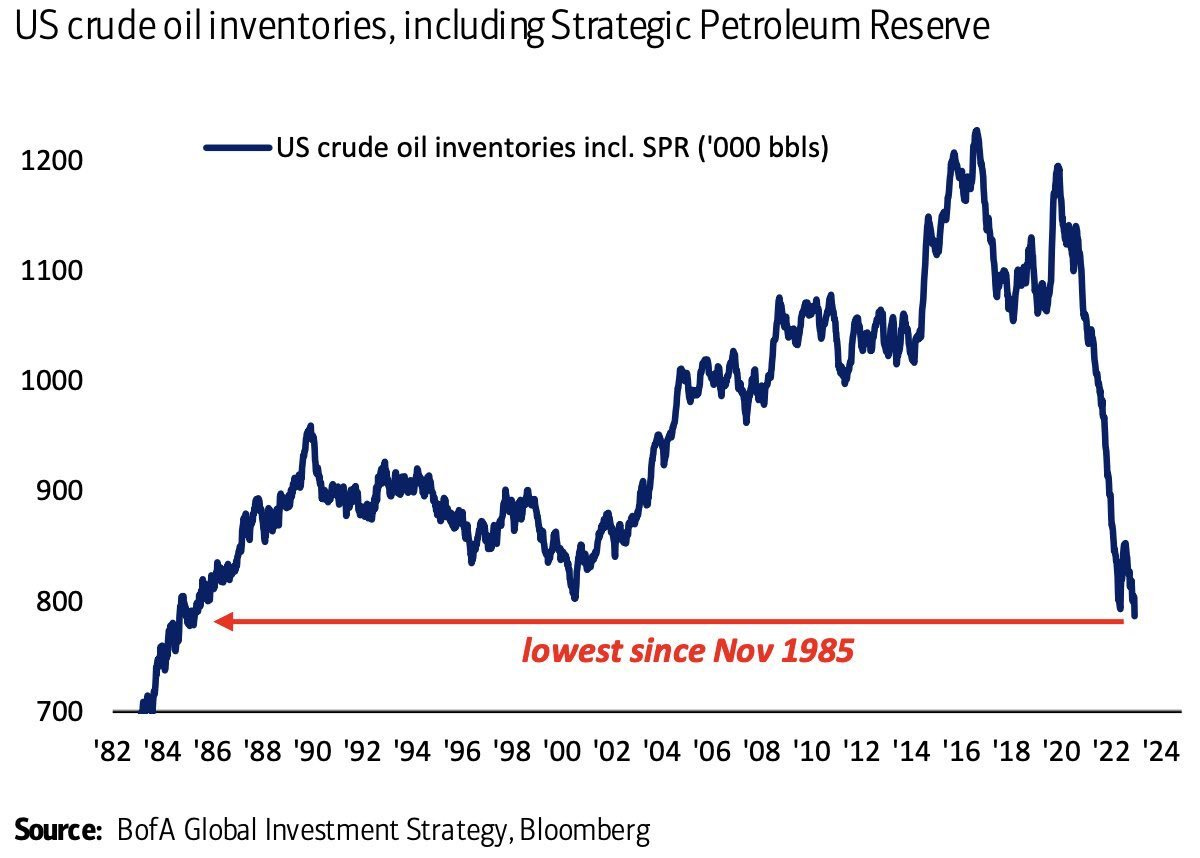

To reduce global demand for oil and fuel a further rise in prices, the country preferred to draw on its strategic reserves.

But demand has been so strong that inventories have shrunk in the space of a few months.

Strong demand in recent months has plunged US strategic oil reserves to their lowest level since 1985:

This artificial fall in oil demand is the main reason for the downturn in inflation seen in recent months. But many observers believe that the drop in oil prices has reached its limits.

The price rebound seen over the past few days is already having an impact on inflation recovery.

In Japan, the average price of gasoline has just reached its highest level in fifteen years. This upturn in inflation is complicating matters in the land of the rising sun.

The higher the cost of oil imports, the higher the price of gasoline for consumers, the higher the inflation figure, and the more the Japanese central bank has to raise rates, as it decided last month.

Rising oil prices are likely to further complicate the task of the BoJ, which is already struggling to cope with the reawakening of inflation in Japan.

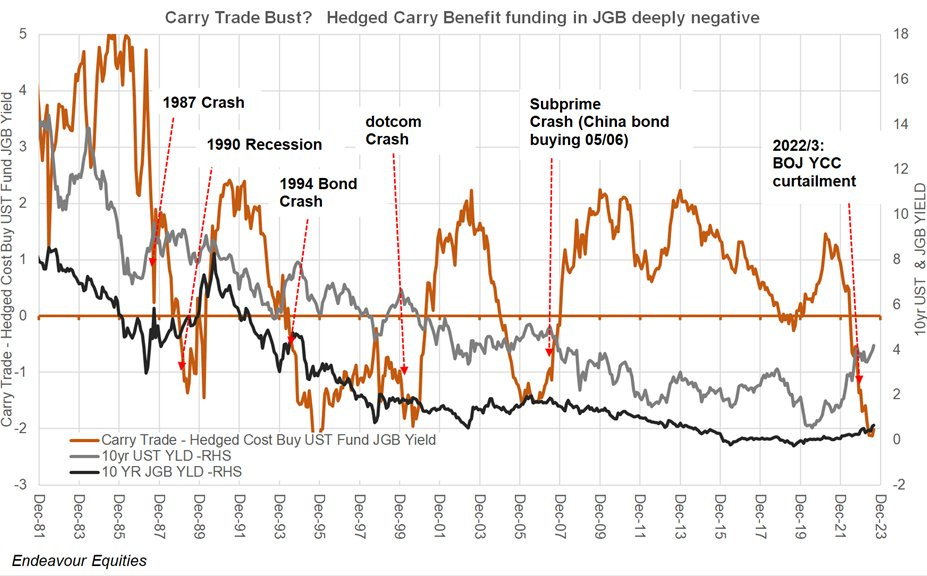

The rise in Japanese interest rates is profoundly altering the yen Carry Trade. As the value of Japanese bonds falls, yen borrowers are starting to lose money. And since they borrowed with very high leverage at a time when rates were negative, they are now forced to sell bonds and equities on the international markets.

The Carry Trade was a formidable tool for driving up the markets, acting as a liquidity pump very favorable to them.

Faced with the risks associated with the end of this mechanism, the pump is acting in the opposite direction, withdrawing liquidity from the financial system.

This week, analysis firm Endeavour Equities published a chart measuring the Carry Trade:

The Carry Trade pump is now working in reverse, just as it did on the eve of the last financial crisis in 2008.

To combat inflation, central banks have begun to reduce their balance sheets, thereby withdrawing liquidity from the financial system.

The sudden halt to Carry Trade yen has added to the pressure on available market liquidity.

Global liquidity is logically declining, and at a very rapid pace, which poses a threat to further market gains.

Against this already tense liquidity backdrop, a new banking stress story emerged this week.

Moody's has downgraded ten US banks and placed six banking giants, including Bank of New York Mellon, US Bancorp, State Street and Trust Financial, under review for possible downgrade. The agency also changed its outlook for eleven major US lenders, including Capital One, to "negative". Their exposure to losses in the commercial real estate sector was the reason for this new positioning by the rating agency.

In Europe, there was another blow for the banking sector. In a move that took investors and political observers by surprise, Italian Prime Minister Giorgia Meloni announced her intention to impose an exceptional 40% tax on bank profits. The shock was so great that the government had to correct its course a few hours later to calm the markets. Within hours, the collapse of the banks threatened to take the entire Italian stock market with it.

The threat of a credit event linked to tensions over global liquidity and the banking sector made a comeback in just two weeks.

The most liquid stocks, which had ignored this threat, are the first to suffer from this new context. Apple's share price has just abruptly ended its uninterrupted rise since the beginning of the year:

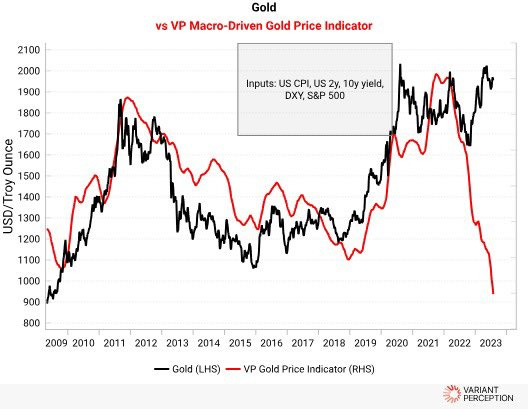

The price of gold, meanwhile, remains on its 2023 uptrend:

As I wrote in my monthly newsletter for GoldBroker.com clients, gold's resilience in the face of rising interest rates has been remarkable since the start of the year.

If we look at gold's behaviour since 2008, the sudden rise in interest rates that began in 2022 should have caused the yellow metal to plunge much lower. What we've seen since January differs from what's been happening in this market for the past fifteen years:

It is now demand for physical gold that is sustaining prices at high levels.

The threat of a credit event is likely to support this physical demand in the short term.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.