The economic situation in Germany is deteriorating at an alarming rate. Factory orders were 3.7% down on the previous month and 7.3% down on last year.

This downward trend in factory orders has persisted almost uninterruptedly for the past 20 months:

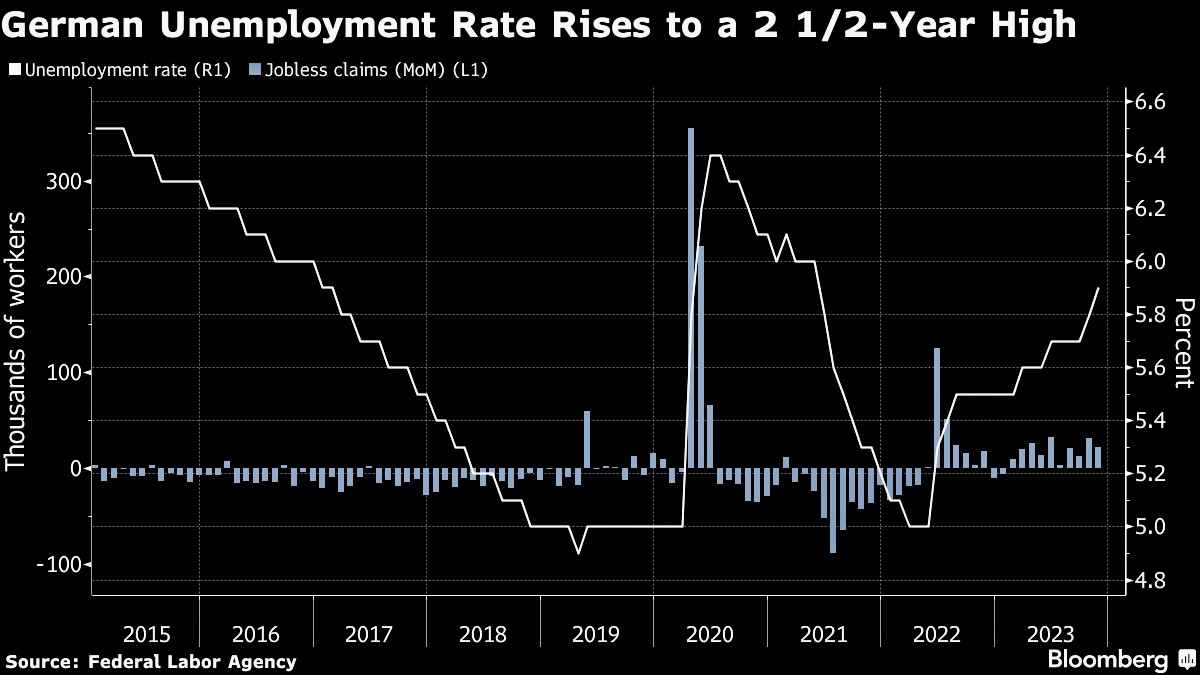

The unemployment rate rose again last month and is now close to the 6% mark:

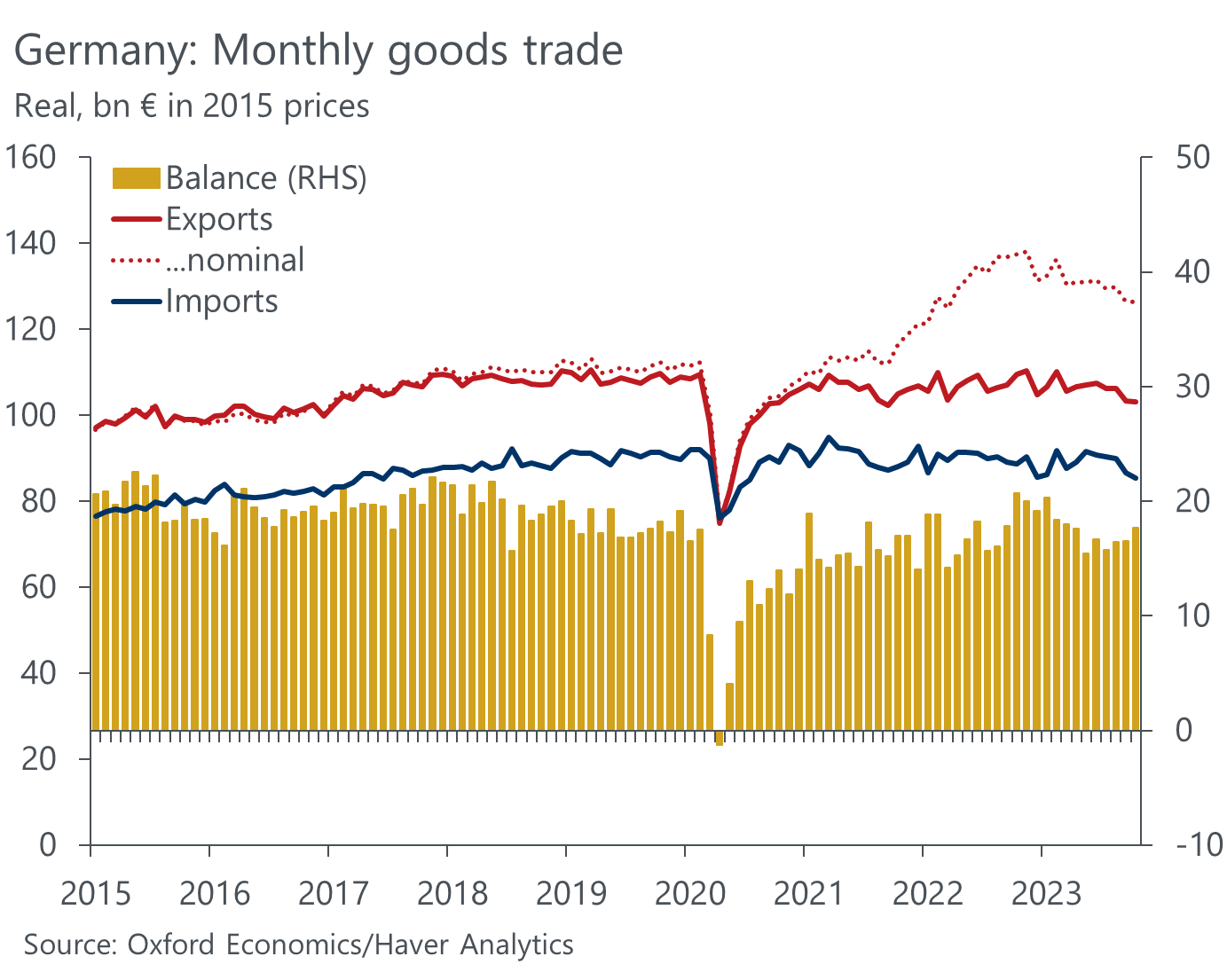

German imports and exports down again in October:

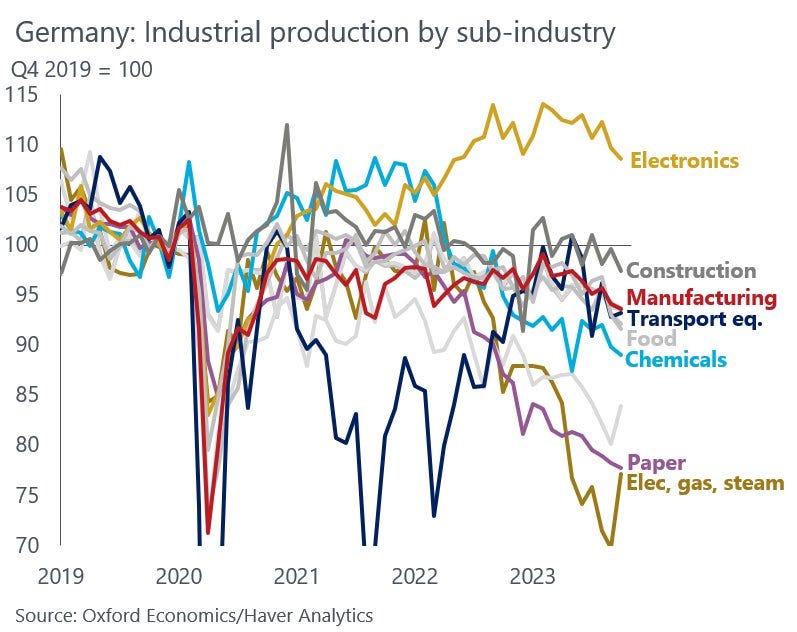

German industry is in decline in all sectors, not just the automotive sector:

Yet these disappointing results were not reflected in the stock markets. At the beginning of December, the DAX hit an all-time high:

However, when we look at the German small-cap segment, the situation is quite different. The SDAX index has not followed the DAX's rise and, on the contrary, appears to be drawing a head-and-shoulders reversal pattern on a monthly variation:

Small and medium-sized businesses seem to be the most vulnerable to the stagflation shock currently hitting Germany.

Europe pays for rising energy costs. EU payments for imported gas have risen by €185 billion since the imposition of sanctions against Russia. And, logically, it is SMEs that are most vulnerable to these rising energy costs.

Meanwhile, large caps are benefiting from reindustrialization efforts in the US, as they find it easier to move their production centers to regions where energy is cheaper. As a result, large-cap companies are following the positive trend of other large-cap companies on world stock markets.

It's also plausible that the DAX is anticipating the expected rate cut in Europe in 2024. The more severe the recession, the faster the ECB will adjust its monetary policy. Large companies will logically be the ones to benefit from this rate cut, while German SMEs will probably continue to suffer the effects of stagflation for many months to come. This is due to the significant economic slowdown brought about by persistent inflation, particularly due to persistently high energy costs.

German yields began to fall in response to these disappointing indicators. The German 10-year yield, which was close to 3% in October, has already fallen back to around 2%:

French yields are also falling, with the French 10-year falling back below 3%:

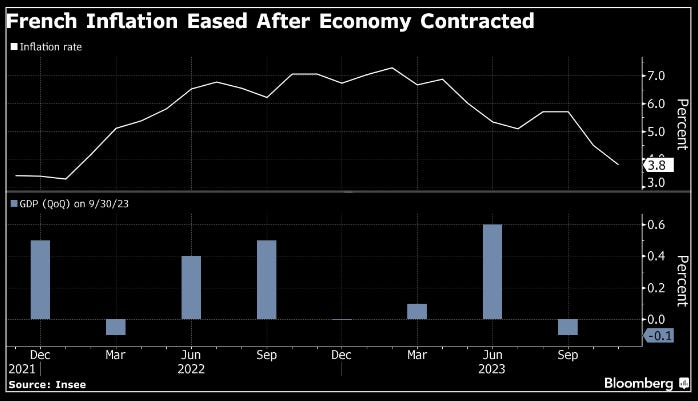

French economic indicators are showing a deterioration, characterized by a sharp contraction in activity in the last quarter. An official entry into recession can be expected by the next quarter.

The situation in France is potentially more worrying than in Germany, as a sharp economic slowdown would have greater social repercussions. The French government has less room for maneuver than its German counterpart to support activity, mainly because interest rates are still too high, limiting the scope for stimulus measures. What's more, France's very high debt-to-GDP ratio puts it in a delicate position in the event of a recession, complicating the management of the economic and financial situation.

Against this backdrop, we can anticipate increased pressure from European governments on the ECB to alter its monetary policy. France, in particular, may find it difficult to cope with a prolonged period of high rates if the economic slowdown worsens over the next quarter.

It is therefore logical to see a downward trend in real rates in Europe in anticipation of this inflexion by the ECB.

In this context, gold in euros seems to be taking advantage of this situation by attempting another breakout from the consolidation flag it has been flying since 2022, reaching a new all-time high at the beginning of this month, close to €2,000 per ounce!

The breakout took place on Sunday night and has already been retested a few hours later. Gold volatility reached a 50-year high at the start of the week.

As reported in the monthly bulletin reserved for GoldBroker.com clients, the remarkable rise recorded on December 4, propelling gold to an all-time high, was followed by a massive sell-off within two hours of this new record. Over 400 tonnes of paper gold were sold on the futures markets, representing around one seventh of annual mine production!

In this monthly bulletin, I ask what caused such a massive sell-off. Who took the decision to sell so much paper gold in such a short space of time?

While speculation about paper gold continues, fuelling volatility in gold prices, the physical market is gaining momentum.

Renewed interest in physical gold among private investors continues, but for the time being it is mainly among Asian savers. In the West, gold's recent record highs have not been widely publicized, nor have they provoked any particular movement.

As long as these gold purchases have not really begun in Western countries, there is no reason not to maintain an optimistic outlook on gold prices in euros!

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.