In 2013, mines called “Pure Silver” mainly exploited veins of silver.

Thus, First Majestic's revenues came 85% from silver and 4% from gold. For Fortuna Silver, silver represented 71% of its revenue and gold 16%. For Pan American, it was 65% silver vs. 31% gold.

In 2023, the proportions have reversed. For First Majestic, silver's share increased to 44%, while gold's share increased to 56%. For Fortuna, 16% silver vs. 75% gold. For Pan America, 20% silver vs. 73% gold.

According to my sources, the Panasquito mine, one of the three largest silver mines in the world, has been temporarily closed last year by Newmont because of wage demands by Mexican unions.

Fortuna Silver plans to close its main Mexican mine at the end of 2024, due to significant cost increments, of which the main drivers are:

- Mexican Peso appreciation (representing approximately 35% of cost increment).

- Higher contractor costs for transportation, distribution, shotcrete, maintenance, and mining services (representing approximately 16% of cost increment).

- Higher labor costs and new labor reform mandates, which took effect on January 1, 2024 (representing approximately 21% of cost increment).

- Change from owner’s mining fleet to contractor for mine development (representing approximately 6% of cost increment).

- Higher costs in fuel, energy, materials, and consumables related to 2023 inflation (representing approximately 5% of cost increment).

All of this has pushed the company to accelerate the closure of its mine, which is no longer profitable at current silver prices.

In his first video of the year on Live From The Vault, Andrew Maguire argues that trading on wholesale markets is not done at the COMEX paper-silver price or the LBMA fixing, but at a significantly higher price.

Is there any silver left in Mexico?

Since around 1600, Mexico has been the world's leading producer of silver. It was thanks to the continuous flow of silver from Mexico that the monetary system was able to function for the next 3 centuries.

According to the USGS, there were 37,000 tons of silver reserves in Mexico in 2007. In 2023, this figure remained unchanged. But if we add up the quantities of silver produced in Mexico since 2006, unless I'm mistaken, we arrive at 83,350 tons...

Silver lease rates are soaring

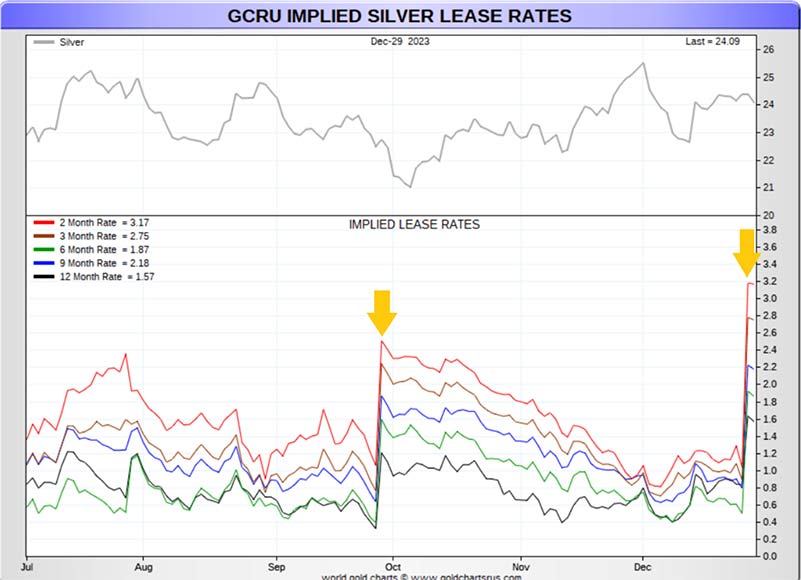

On January 3, 2024, Paul Franke (SeekingAlpha) wrote: The spike in 2-month lease rates to 3% annualized over the last few trading sessions marks the highest nominal number since the end of 2008. Plus, the rest of the duration curve, 1-year and under, has risen dramatically over just a couple of days. The situation is very similar to the lease rate pattern outlined months ago in September, marked with gold arrows below. While silver continued a downtrend in price for two more weeks into early October, silver did rally +20% from the ultimate quote bottom (and +13% from the initial lease rate spike) into the beginning of December 2023."

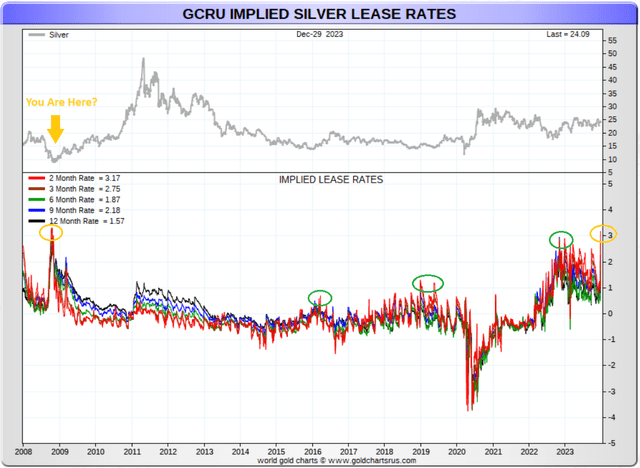

“Before late December 2023, "multi-year" highs in lease rates alongside an inverted yield position have taken place four times since 2008. Each was highly correlated with bottoming silver prices. The 2016, 2019, and 2022 setups proved to be very opportunistic trading signals (circled in green below). Perhaps the most relevant situation to compare with today's 3% annual rate for 2-month premiums was the late 2008 buy signal (circled in gold). This period also witnessed an oversized rise to rates above 3%. Within weeks, silver quotes started to climb. Over the next two and a half years, spot silver rose from under $10 an ounce to nearly $50."

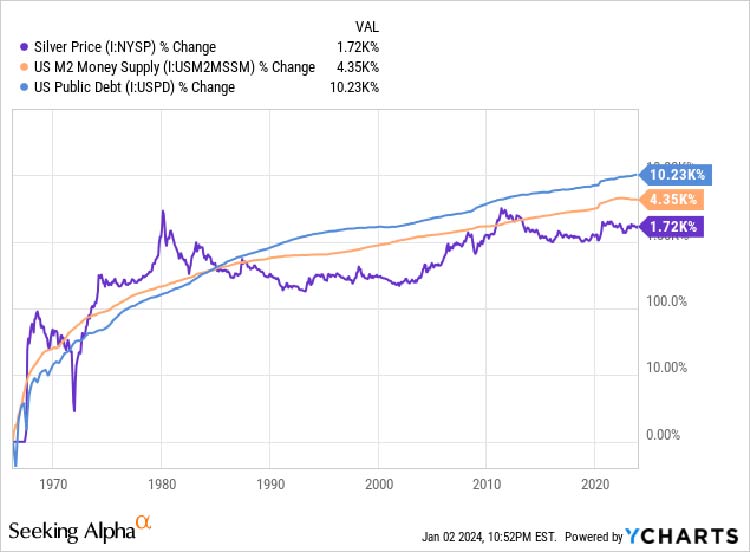

"Silver is incredibly cheap relative to other assets. My top valuation-focused silver buy argument is that M2 money supply and Treasury debt growth in America have outstripped the price gains in this critical monetary metal since the 1960s. Using relative valuation averages since 1965, I can argue silver's underlying long-term worth is closer to $40-50 an ounce today. To reach the all-time adjusted highs of early 1980 vs. our money supply trackers, silver would have to trade to $300 or even $400+ per ounce (depending on which data point you are referencing)."

Chinese silver stocks falling sharply

At the start of 2021, the Shanghai Futures Exchange's silver inventories stood at over 3,000 tonnes.

On Friday January 19, 2024, they fell to 945 tonnes:

There is of course the industrial demand for new energies which is very significant, but the fragility of the Chinese economy probably makes investors fear a new wave of QE from the People Bank of China, but also from the American Federal Reserve, which will have to both save the American banking system and finance the debts of the American Treasury. This reeks of money creation.

In this scenario, it's best to protect yourself by investing your savings in precious metals. The Chinese seem to have understood this before the Westerners.

Chinese are Embracing Gold as a Safe-Haven Investment: Will Europeans Soon Follow? (@LaurentMaurel_)

— GoldBroker (@Goldbroker_com) December 22, 2023

➡ https://t.co/67kyI9uxj3#China #gold #savings #investing pic.twitter.com/fDwclUHjRK

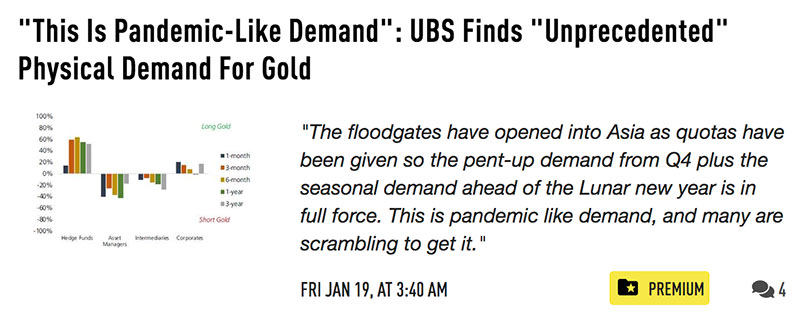

There was an article on Zerohedge on Friday the 19th reserved for “premium” subscribers, entitled "This Is Pandemic-Like Demand: UBS Finds Unprecedented Physical Demand For Gold".

"The floodgates have opened into Asia as quotas have been given so the pent-up demand from Q4 plus the seasonal demand ahead of the Lunar New Year is in full force.

This is a pandemic-like demand, and many are scrambling to get it."

In my opinion, the Fed's monetary policy will soon lead to a historic rise in gold and silver prices. The months of May, June and July 2024 will bring a first revaluation of precious metals and very probably oil, given the geopolitical situation in the Middle East. This increase will resume at the end of the year, after about three months of horizontal consolidation.

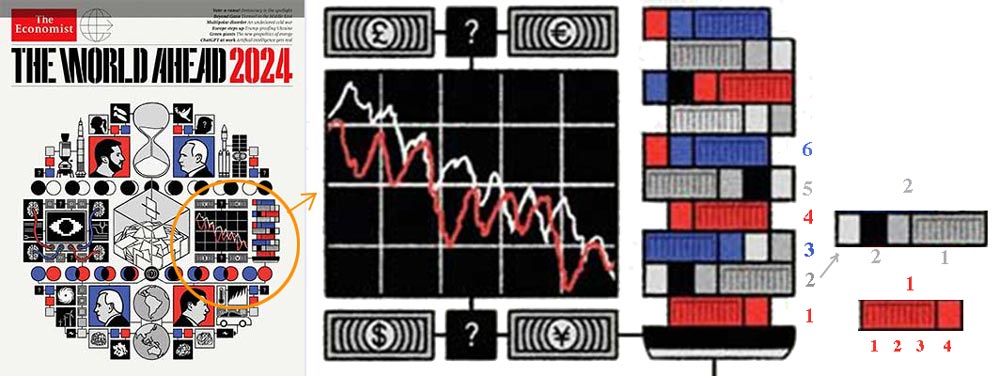

Remember the cover of "The Economist" magazine revealing its forecasts for 2024. It shows all the major fiat currencies devaluing in concert against real goods, represented by a container ship. We might wonder whether each of these containers provides a more precise indication of the loss of purchasing power or of future rises.

Once again, don't play in the markets!

The only way to position yourself for the revaluation of precious metals and commodities is to take advantage of sales over the next three months to buy physical assets actually held outside the banking system

You are now informed. It's up to you to take the necessary steps to cope with the monetary shock that's looming.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.